2025 Israeli Defense Tech Landscape Map

Defense Tech

Israel’s defense tech ecosystem is built for urgency. Innovation here is not theoretical or long-term. It is tested in real time, shaped by operational feedback, and focused on solving immediate and evolving threats. This approach has positioned Israel as a growing force in the global defense landscape.

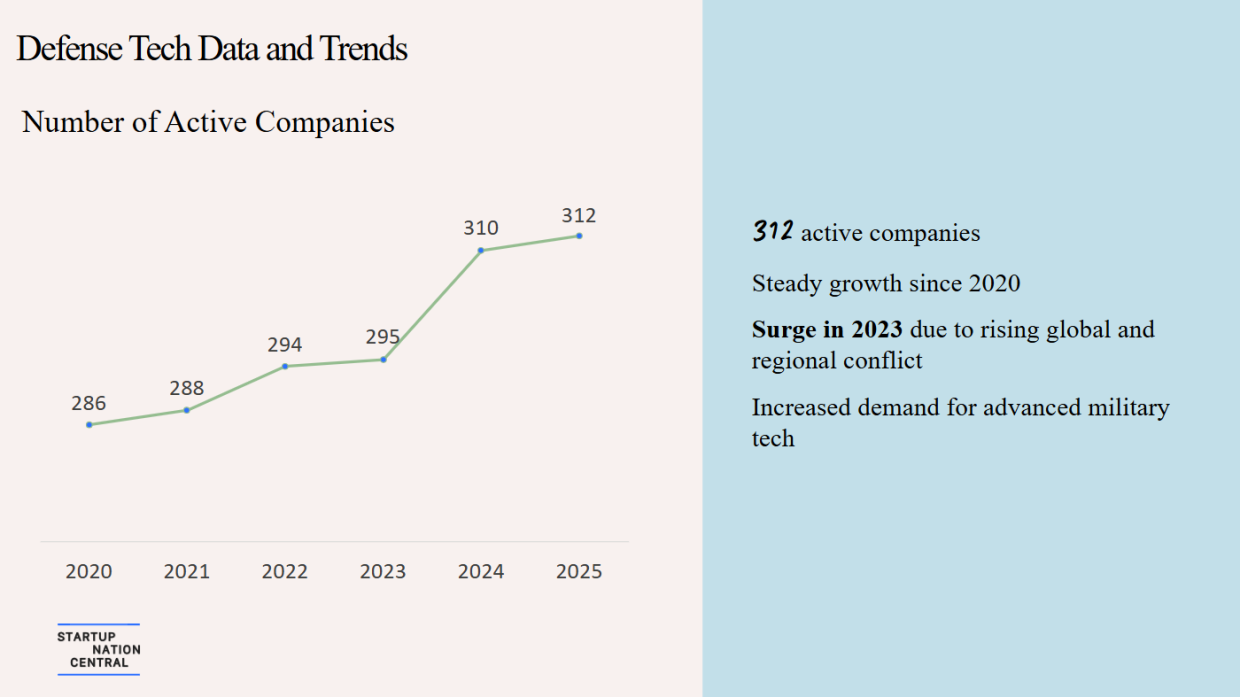

The 2025 Aerospace, Defense & HLS Landscape Map from Finder offers a comprehensive view of the companies, trends, and technologies shaping this space. With 312 active companies across critical defense categories, the map provides a clear guide to understanding where innovation is accelerating and where strategic opportunities are forming.

A Sector Defined by Real-World Readiness

In 2025, Israeli defense tech reflects the country’s broader innovation culture. Solutions are built with input from field units and deployed early to refine performance under pressure. This constant loop of iteration and execution makes Israeli defense-tech highly adaptable and market-ready.

Companies featured in the landscape are creating tools across a wide range of technologies: from autonomous systems and secure communication to advanced simulations and space platforms. These are interlinked innovations, built for integrated use in both military and civilian environments.

Defense Tech Key Focus Areas

The map breaks down the sector into distinct verticals:

- Aircraft & Avionics

Technologies supporting aerial targeting, surveillance, self-defense, and aircraft modernization.

- Combat Equipment & Systems

Advanced gear and systems for military and law enforcement, including tactical vehicles, protective armor, and mobile communications.

- C4I & Defense Electronics

Secure networks, sensors, and optics that support situational awareness, intelligence gathering, and real-time decision-making.

- Unmanned Systems

Autonomous air, ground, and maritime systems powered by AI, satellite tech, and advanced control modules.

- Security & Surveillance (HLS)

Centralized monitoring and infrastructure protection systems used for smart cities, public safety, and national security.

- Simulations & Training

AI-driven training platforms using virtual reality and sensors to simulate missions and improve preparedness.

- Space Tech

Innovations in satellite systems, suborbital platforms, and in-orbit manufacturing are expanding space access and capabilities.

Sector Composition and Growth

The ecosystem has grown steadily since 2020, with significant expansion starting in 2023 due to increased global defense demand. As of early 2025, Israeli defense tech companies in this landscape reflect a balanced mix of stages:

- 42% are early stage

- 39% are mature

- 3% are early growth

- 9% have been acquired

- 7% have gone public

This structure supports both long-term resilience and a steady pipeline of new solutions entering the market.

Investment Trends

The sector has experienced notable shifts in private investment:

- In 2021, it peaked at $429 million

- By 2023, investment dropped to $69 million

- In 2024, the sector recovered to $172 million

This rebound reflects the ecosystem’s ability to respond to changing geopolitical dynamics, especially as interest in dual-use and national security innovation continues to rise.

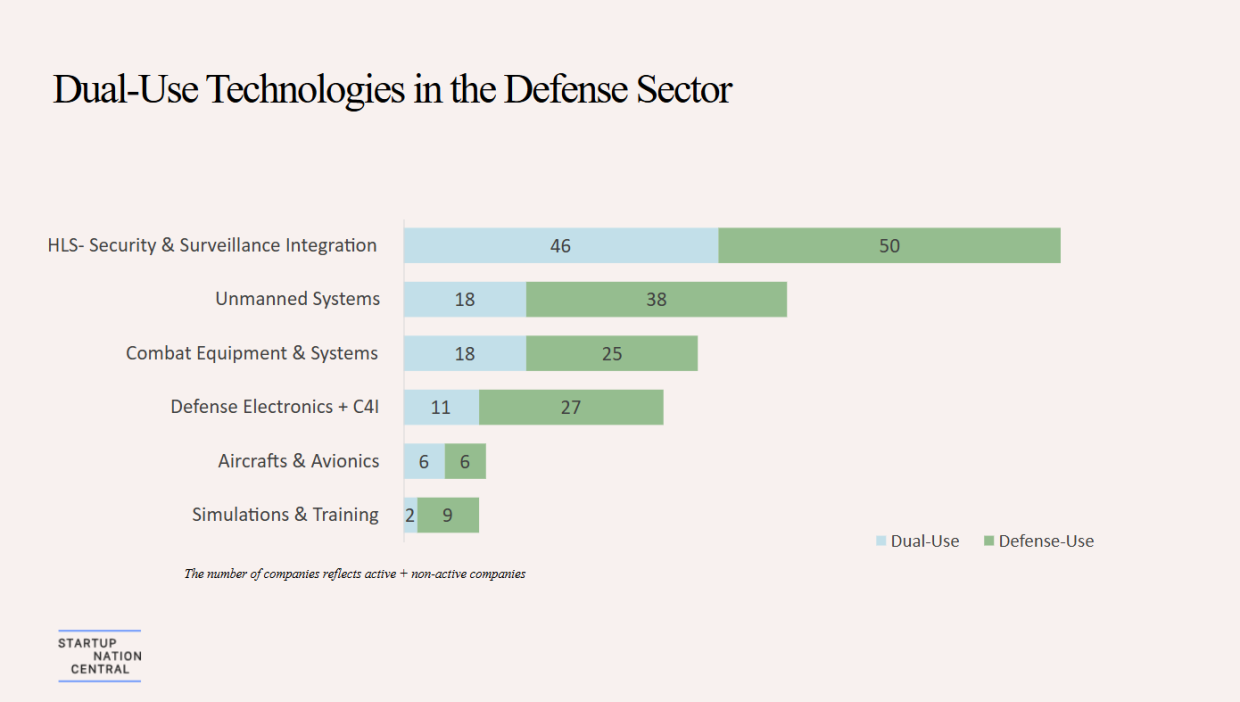

Dual-Use Innovation Expands Impact

A defining characteristic of the Israeli defense tech sector is its focus on dual-use capabilities. Many technologies built for defense applications are also serving critical civilian needs.

These technologies support applications in emergency response, border security, infrastructure protection, and more. This cross-sector relevance makes Israeli defense innovation attractive to both governments and global corporations.

Why This Map Matters

The 2025 Aerospace, Defense & HLS Landscape Map is a strategic tool for anyone looking to understand or engage with Israel’s defense tech ecosystem. It highlights where activity is clustering, where capital is flowing, and which companies are positioned to lead the next wave of security innovation.

Each company is selected based on recent milestones, funding activity, and relevance to key market challenges.

Whether you are a business executive, investor, or policymaker, this resource provides clarity and access in a fast-moving space.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle