Israel’s Energy Tech Ecosystem 2025

Finder

Israel’s energy tech ecosystem is growing fast. More than 350 active startups are now developing solutions across energy generation, storage, infrastructure, and decarbonization. These companies raised over $400 million in private capital in the past year, reflecting strong investor interest even during a period of global funding caution.

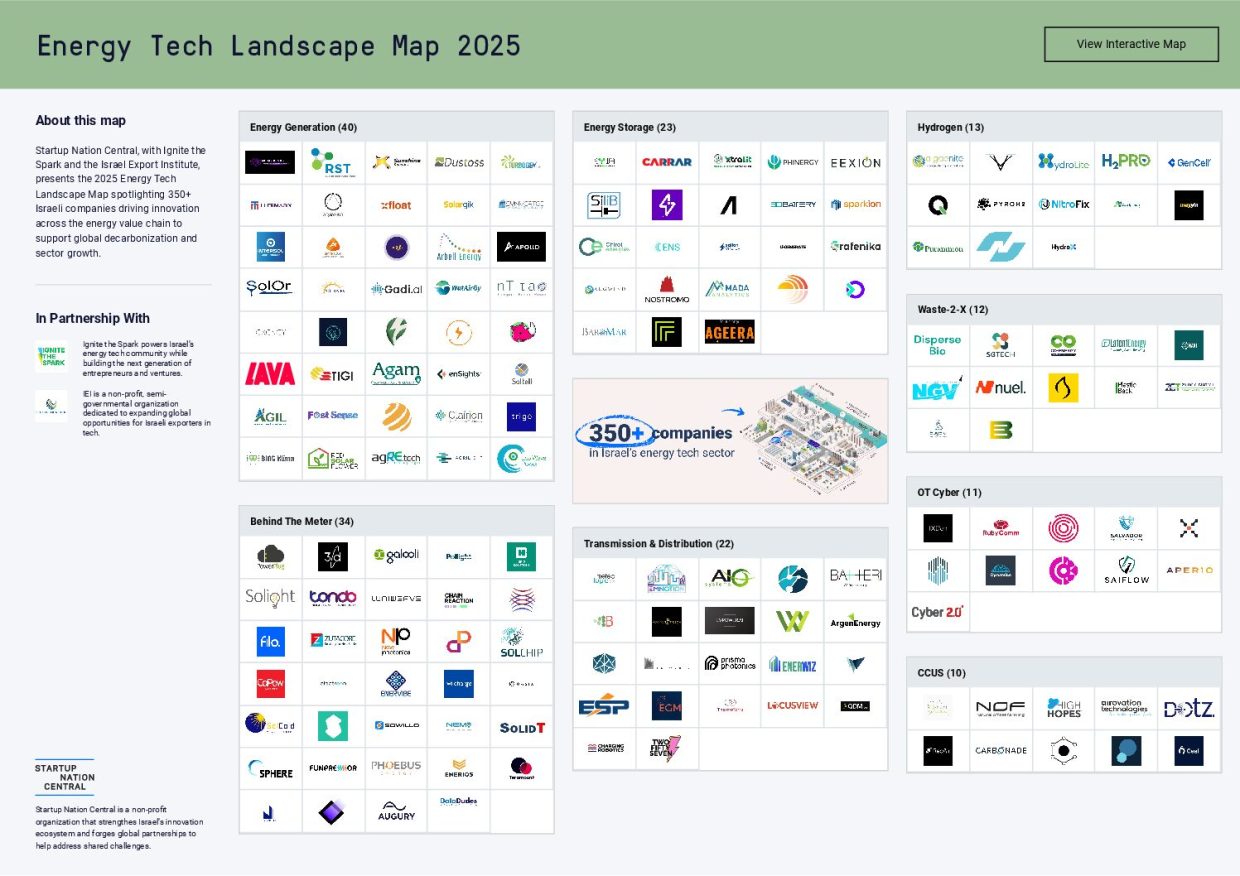

Published by Startup Nation Central in collaboration with Ignite the Spark and the Israel Export Institute, the 2025 Energy Tech Landscape Map categorizes innovation into eight subsectors: Energy Generation, Energy Storage, Behind-the-Meter, Grid Infrastructure, Hydrogen, Operational Technology (OT) Cybersecurity, Carbon Capture and Storage (CCUS), and Waste-to-X.

Global Energy Context: Urgency Meets Innovation

Clean energy capacity is expanding globally. Projects like the Xlinks Morocco–UK HVDC link aim to transmit 11.5 GW of solar and wind power across continents. In response to China’s dominance in renewables manufacturing, the U.S. and EU have enacted industrial policies such as the Inflation Reduction Act and the Net-Zero Industry Act to support domestic production.

In 2024, 205 GWh of battery capacity was installed worldwide, a 53% increase year-over-year. Systems exceeding 100 MWh are becoming common. Technologies beyond lithium-ion, such as metal-air batteries and thermal storage, are being tested for long-duration use.

AI is accelerating energy optimization. It enables real-time control of grids, predictive maintenance, and smarter energy management across sectors. Datacenters, which are major electricity consumers due to AI workloads, are shifting to co-located renewable power and advanced cooling systems to reduce their footprint.

Investment and Market Signals

Israel’s energy tech sector includes more than 350 companies, up nearly 60% over the past decade. Since January 2024, 26 new startups have been founded. About 35% of companies are in mature stages, including those that are public or acquired, while 65% remain in early or late growth phases.

Private capital shows resilience. From 2014 to 2023, energy tech consistently outperformed the broader Israeli tech sector in funding volume and stability. In 2024, funding briefly lagged behind ecosystem trends, but early 2025 data shows recovery, with new rounds approaching 50% of 2023 and 2024 levels in just six months.

Subsector Deep Dive

Energy Generation

Leading companies include SolarEdge (solar PV electronics), BrightSource (concentrated solar power), and Ormat (geothermal energy). Emerging players like Apollo Power (flexible solar films), Eco Wave Power (wave energy), and nT-Tao (compact fusion) are pushing boundaries in alternative energy.

Energy Storage

StoreDot is developing ultra-fast charging batteries for electric vehicles. Phinergy is advancing aluminum and zinc-air batteries. Brenmiller Energy offers high-temperature thermal storage for industrial use. Software solutions enhance real-time control and grid optimization.

Grid Infrastructure

mPrest applies Iron Dome military technology to manage smart grids. Prisma Photonics uses fiber-optic sensing and AI for real-time grid monitoring. Exodigo provides AI-based subsurface mapping. These companies address rising demands for grid resilience and bidirectional energy flows.

Behind-the-Meter

Electreon is testing wireless EV charging roads. Augury uses AI to monitor industrial machines. Oasix develops smart energy management systems. CaPow offers continuous wireless power for robotics.

Hydrogen

H2Pro’s E-TAC electrolysis provides a lower-energy method for hydrogen production. Nitrofix is developing electrochemical green ammonia. Hydrolite builds safe, portable hydrogen systems.

Carbon Capture

RepAir reduces CO₂ capture energy use by about 70% compared to traditional methods. CarbonBlue captures carbon from seawater. Other ventures are working on mineralization and utilization technologies.

Waste-to-X

HomeBiogas creates household-scale biodigesters. Co-Energy produces electricity, hydrogen, and biochar from mixed waste. SGTech boosts anaerobic digestion efficiency.

Cybersecurity

Claroty protects OT networks, while SaiFlow secures distributed energy resources and EV infrastructure. These tools support the increasing digitization of energy systems.

Deal Activity: Who’s Raising Capital?

In 2025, several Israeli energy tech startups completed notable rounds:

- Augury raised capital to expand its AI platform for industrial energy efficiency.

- Wi-Charge advanced its wireless infrared power delivery system, which operates over 30 feet.

- RepAir scaled its fully electric carbon capture system with significant energy savings.

Energy Tech 2025 Strategic Outlook

Energy economist Nick Butler believes the next decade will favor scalable, cost-effective technologies rather than high-risk moonshots. Solutions like compressed air storage, subsea cables, and rare-earth alternatives will attract long-term capital. Israeli startups are already moving in this direction by embedding technologies into large-scale systems and partnering early with global industry players.

Finder is a Platform for Global Collaboration

Israel’s energy tech ecosystem is maturing, with a balanced mix of early-stage momentum and late-stage validation. Over 165 companies are mapped in the 2025 Energy Tech Landscape Map, offering solutions across the entire energy value chain. Global partners looking to accelerate their energy transition strategies can find both proven technologies and emerging innovations in Israel’s dynamic landscape.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle