2021 Tech Trends: Israel becomes a unicorn factory

Finder

2021 was a standout year for capital investments in the Israeli tech ecosystem, with companies raising a record-breaking $26.6 billion — more than double the amount raised in 2020. But 2021 will probably be remembered as the year that Israel became a unicorn factory.

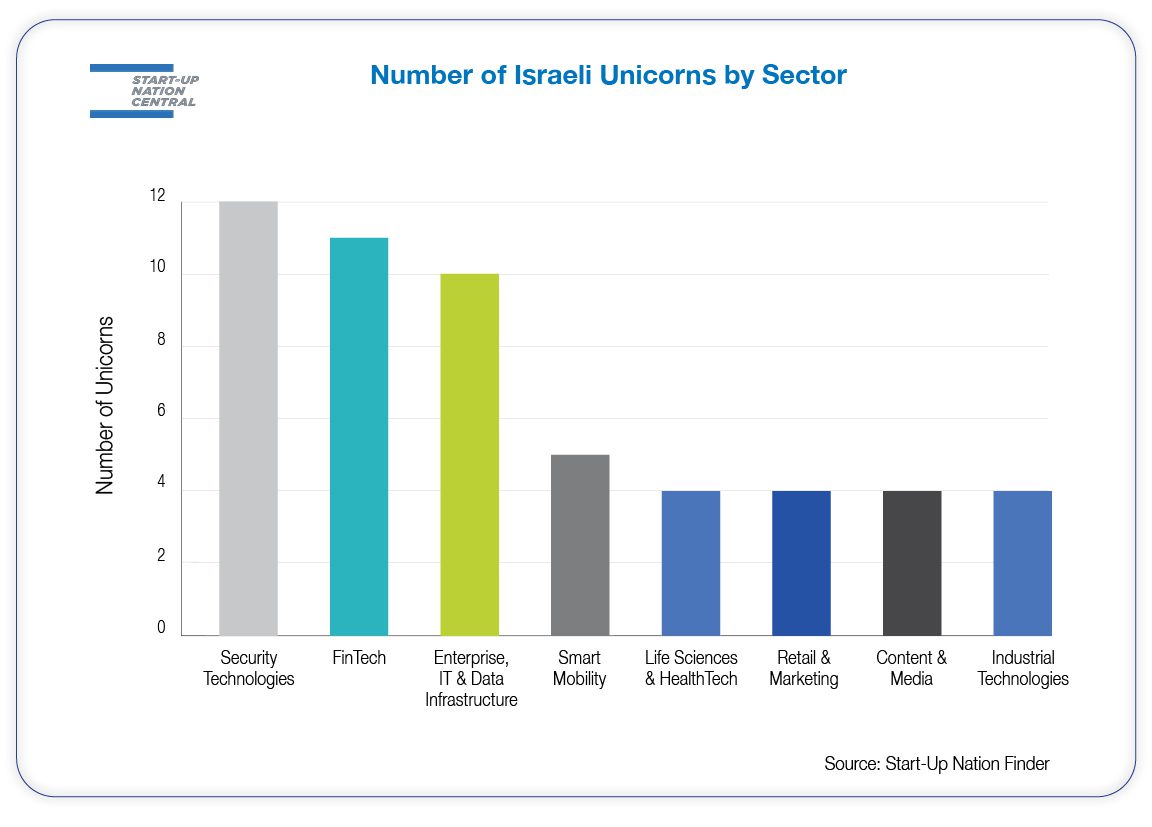

No fewer than 33 companies were valued above $1 billion (some even five times that amount) following major investment rounds this year, bringing the total number of blue-and-white unicorns to 54, according to Start-Up Nation Finder. Eight other companies went public afterward and therefore dropped from our reckoning.

These unicorns together raised nearly half of the total capital this year and helped pull up the median investment round size from $6 million to $14 million. The sectors that birthed the largest number of unicorns were FinTech, Security Technologies, and Enterprise IT & Data Infrastructure, absorbing 70% of the capital that went to unicorn companies last year. The characteristics the three sectors share and the reason they proved to be so attractive to investors is that they are comprised primarily of pure software companies capable of delivering rapid solutions to challenges that were in high demand during the COVID-19 pandemic.

2021 Tech Trends – Leading Tech Sectors

2021 Tech Trends – Dominant Investors

2021 Tech Trends – Record Exits

2021 Tech Trends – A Global Comparison

The trend of building larger companies reflects a shift in founders’ strategy that has gained in popularity. In the past, later-stage companies that wanted to scale up would have to go public or be acquired by larger, and often foreign-based, buyers in order to finance growth. The current market offers them the chance to continue growing while remaining more independent and more resistant to stock market volatility.

The increase in the number of large tech companies is seen as a benefit to the entire ecosystem as they provide inspiration for their smaller counterparts and give investors a tangible example of Israeli companies’ ability to scale and the profits they can earn from investing in them. It also diversifies the talent pool employed by the tech sector, expanding beyond R&D roles to other, complementary positions in sales, marketing, finance, HR, operations, and more.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers