2021 Tech Trends: Israel is winning the global race for tech funding

Finder

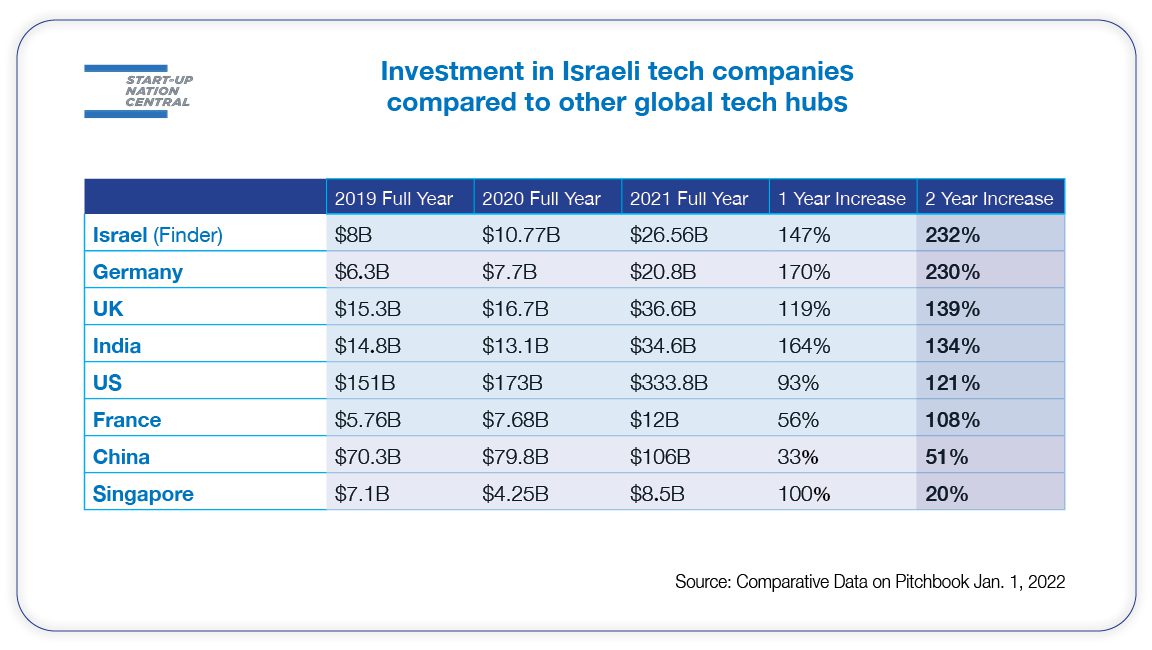

Israeli tech companies raised a staggering $26.6 billion in 2021, more than doubling the amount raised in 2020, which was itself a record year. According to Start-Up Nation Finder, Israel registered a 147% increase in capital raised by technology companies over 2020 – placing it among the world leaders in terms of investment growth – even in a year that saw the global industry take off in a dramatic fashion.

When compared to growth rates of other countries based on comparative data compiled from PitchBook on January 1st, 2022, Israel’s 147% found itself at the top of the rankings, beating out traditional tech hubs like the US (93%), the UK (119%), Singapore (100%), Sweden (144%), Ireland (108%), and France (56%). The only countries that saw higher growth in tech investments were Germany (170%) and India (164%).

When compiling data from the past two years, Israel is the outright winner with 232% growth. While some countries stagnated or fell in 2020 due to the COVID-19 pandemic, Israel grew faster than average due to its handling of the crisis and its ability to adapt to changing conditions.

2021 Tech Trends – Leading Tech Sectors

2021 Tech Trends – Dominant Investors

2021 Tech Trends – Record Exits

2021 Tech Trends – A Unicorn Assembly Line

One of the characteristics of the Israeli ecosystem that allowed it to flourish over the past year is the focus on developing software solutions. This made it more immune to problems during the pandemic and also quickly offered solutions that arose because of it – remote working required new levels of cybersecurity, enterprise software, and payments solutions (FinTech).

Another unique characteristic of the Israeli ecosystem is the concentration of many later-stage companies. The Israeli tech sector has been around for a relatively long time, meaning its companies have been able to demonstrate multiple increases in revenue due to unprecedented increases in demand. This led to the raising of many mega-rounds in 2022 that went to companies that wanted to move to the scale-up phase

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers