2023 Israeli Tech Annual Report

Tech Innovation

Despite the proposed judicial reform turmoil and the Oct 7 war, in 2023, Israeli tech remained robust with private funding expected to reach nearly $10 billion.

Main Takeaways: 2023 Israeli Tech Annual Report

- Private Funding Resilience: Despite economic uncertainties, 2023 Israeli tech private funding in the ecosystem nears $10 billion, with disclosed funding at $7.9 billion, showing stability at 2019 levels but with fewer rounds.

- Seed Stage Tenacity: Seed stage funding shows minimal impact from the broader funding decline, indicating strong investor interest in early-stage technologies.

- Public Funding Steadfastness: Public funding remains strong at $1.9 billion, with Health Tech’s public funding doubling, reflecting sustained investor confidence.

- Foreign Investor Confidence: Increased participation of foreign investors in funding rounds highlights their confidence in Israel’s tech sector’s long-term prospects.

- M&A Activity – Signs of Rebound: M&A value declined by 25% from last year, but a $1 billion Q4 rebound and Cybersecurity’s $2.8 billion in exits indicate sector growth potential.

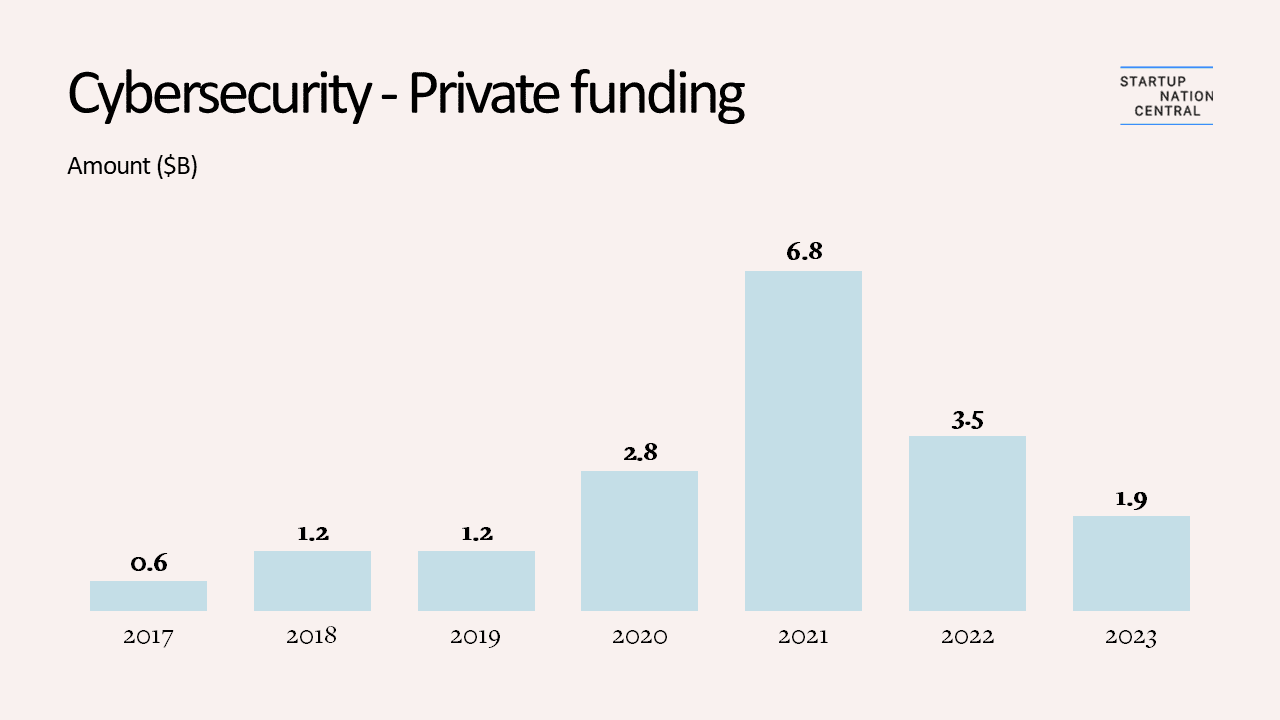

- Cybersecurity: With $1.9 billion in private funding and stable since Q3 2022, the sector sees a smaller decline than the broader ecosystem and notable mega rounds by Wiz and Cato Networks.

- Health Tech: Experiencing a 53% decrease in private investments to $1.4 billion, Health Tech remains resilient, with Medical Devices stable and significant funding in Pharma and Biomedicine.

- Climate Tech and Agrifood Tech: Despite a 60% decrease in private funding, these sectors show stability and promise, with Israel leading in sustainable water solutions, alternative proteins, and renewable energies.

Background

In 2023, the Israeli high-tech sector navigated significant challenges but showed remarkable resilience.

With the proposed judicial reform mid-year causing domestic tension, the attack on October 7, and the ensuing war against Hamas – all against a background of global macroeconomic contraction – there have been obvious declines in venture capital investments.

Despite this, Israeli tech companies have maintained business continuity and have shown characteristic agility and creativity in overcoming setbacks. Historically, Israel’s bold and determined approach to tech innovation has enabled the ecosystem not just to overcome challenges, but to thrive.

At Startup Nation Central, we call this Impatient Innovation.

2023 Israeli Tech Sector Insights

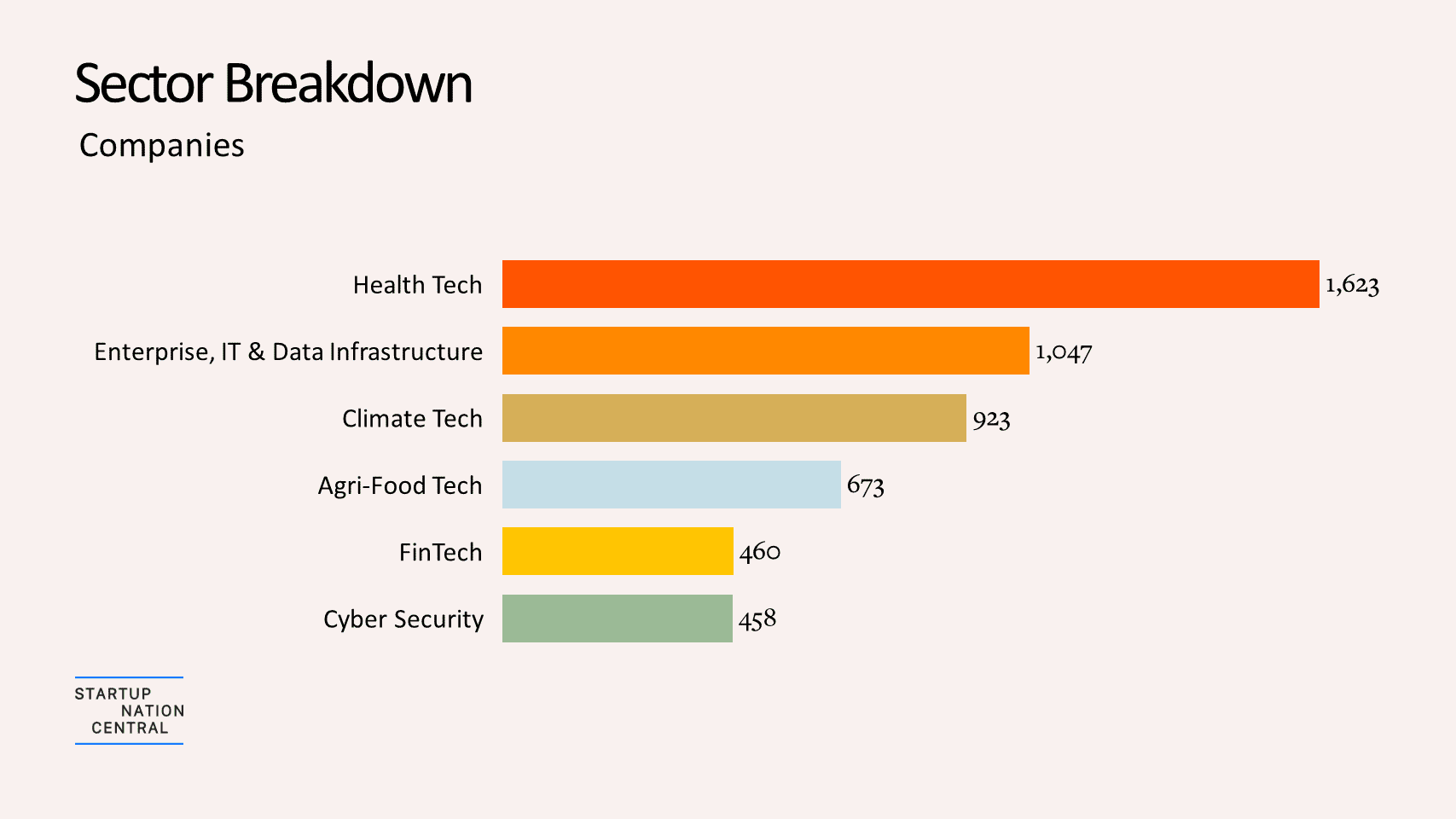

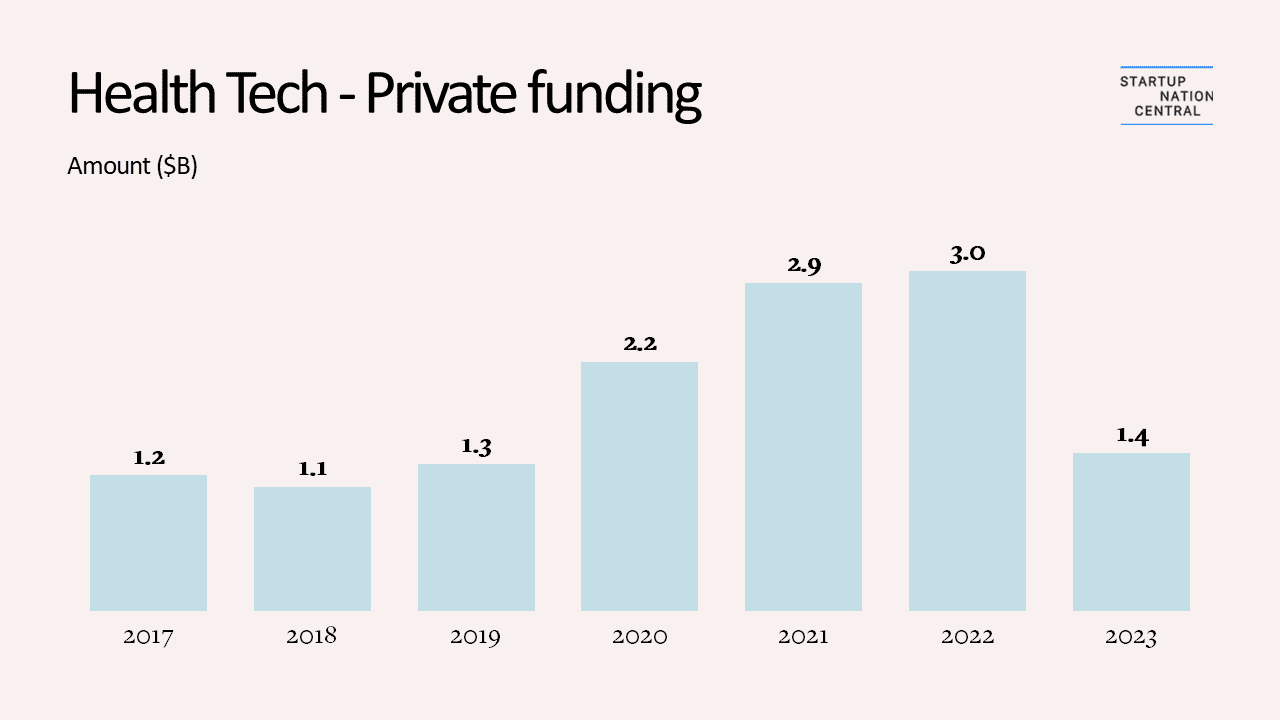

Health Tech

The Health Tech sector continues to lead the Israeli ecosystem in terms of company count – over 1600 companies, representing 22% of the ecosystem. Private investments in Health Tech decreased 53% from the previous year, amounting to $1.4 billion, slightly lower than the 55% decline observed in the broader ecosystem. The Health Tech sector demonstrated relative resilience in the first 3 quarters of 2023 compared to H2 2022 with around $0.4 billion in private funding per quarter, but there was a drop in Q4.

Medical Devices is the only subsector in which private funding did not drop and remained stable compared to last year ($447 million). The Pharma and Biomed subsector had the top Health Tech mega-round of the year – Upstream Bio raised $200 million in round B. Mental Health and Rehabilitation ecosystem efforts were impressive, with ~150 startups and growing, and immense collaboration with health organizations agile initiatives.

58% of the rounds and 52% of the funding came solely from foreign investors (and there were additional rounds/funding in which both foreign and Israeli investors took part). Notably, no Angels were involved in funding this year.

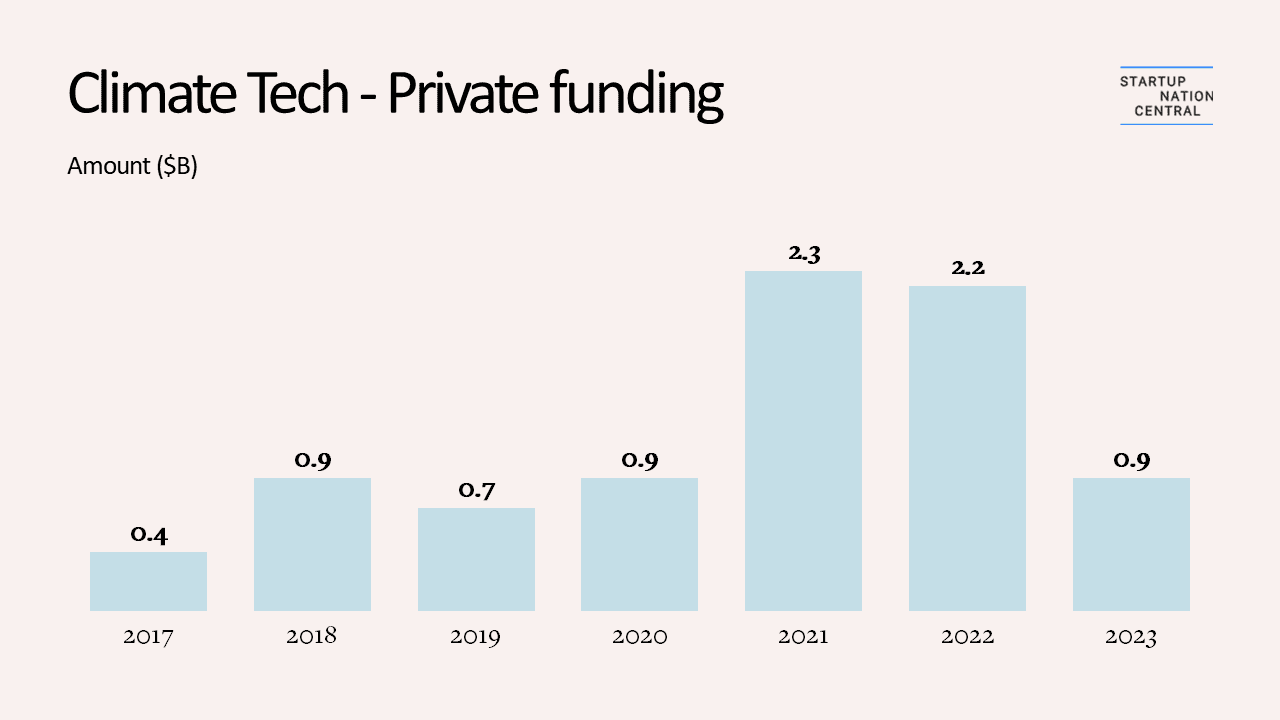

Climate Tech

In 2023, Israel’s Climate Tech sector showed notable resilience and adaptability, focusing on carbon tech and energy transition reflecting global climate change mitigation efforts. Although the sector didn’t match early 2022’s peak in deals, it remained poised for growth. The number of companies slightly increased, with total funding at $0.9 billion, across 127 funding rounds. As opposed to the general downward trend, funding in the Carbon Tech sub-sector increased this year by 55% to $190 million.

This period saw the sector expand with new accelerators, innovation centers, and incubators, indicating the local entrepreneurial and VC community’s confidence in climate tech’s long-term prospects. Amidst increasing urgency for climate solutions and regulatory shifts towards decarbonization, Israel’s tech ecosystem continues to drive forward with innovative impactful climate tech solutions.

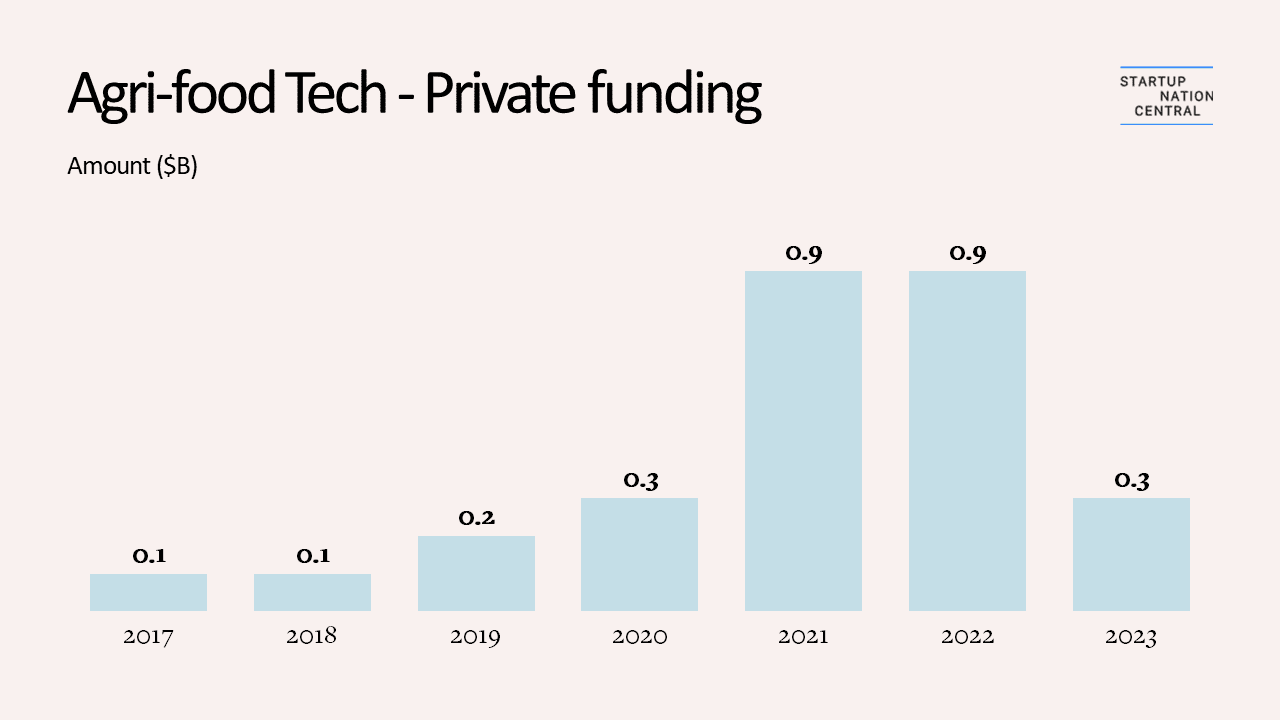

AgriFood Tech

In 2023, Israel’s Agriculture & Food Tech sector showcased resilience amidst global economic and local challenges, with an increased focus on cellular agriculture, automation, and alternative proteins. This shift mirrors global trends in consumer preferences and food supply needs.

The sector maintained a stable number of companies, but funding rounds decreased to 76 from 97 in 2022. Despite the overall decline in total funding, funding of Water and Irrigation companies nearly tripled and reached $138 million, accounting for 40% of the sector’s private funding.

Many of the Israeli startups are now transitioning to growth phases, concentrating on commercialization and market expansion, setting the foundation for future substantial growth. The integration of advanced agricultural technologies, along with Israel’s entrepreneurial ecosystem, poises the Agriculture & Food Tech sector for ongoing success and innovative breakthroughs.

Cybersecurity

The Cybersecurity industry in Israel continues to be the strongest with the highest amount of private funding this year ($1.9 billion) as well as the highest average amount per round ($27 million).

The decrease in the total amount in 2023 compared to 2022 is lower than the general ecosystem (45% in Cybersecurity vs. 55% overall). When comparing H2 this year to H2 last year, it went down by only 12.5% and the average amount per round did not change. Overall, the sector has been quite stable since Q3 2022.

A Cybersecurity company raised the top round this year in the Israeli ecosystem – Wiz – which raised $300 million at the beginning of the year in round D. Another notable round by a Cybersecurity company was Cato Networks round G amounting to $238 million.

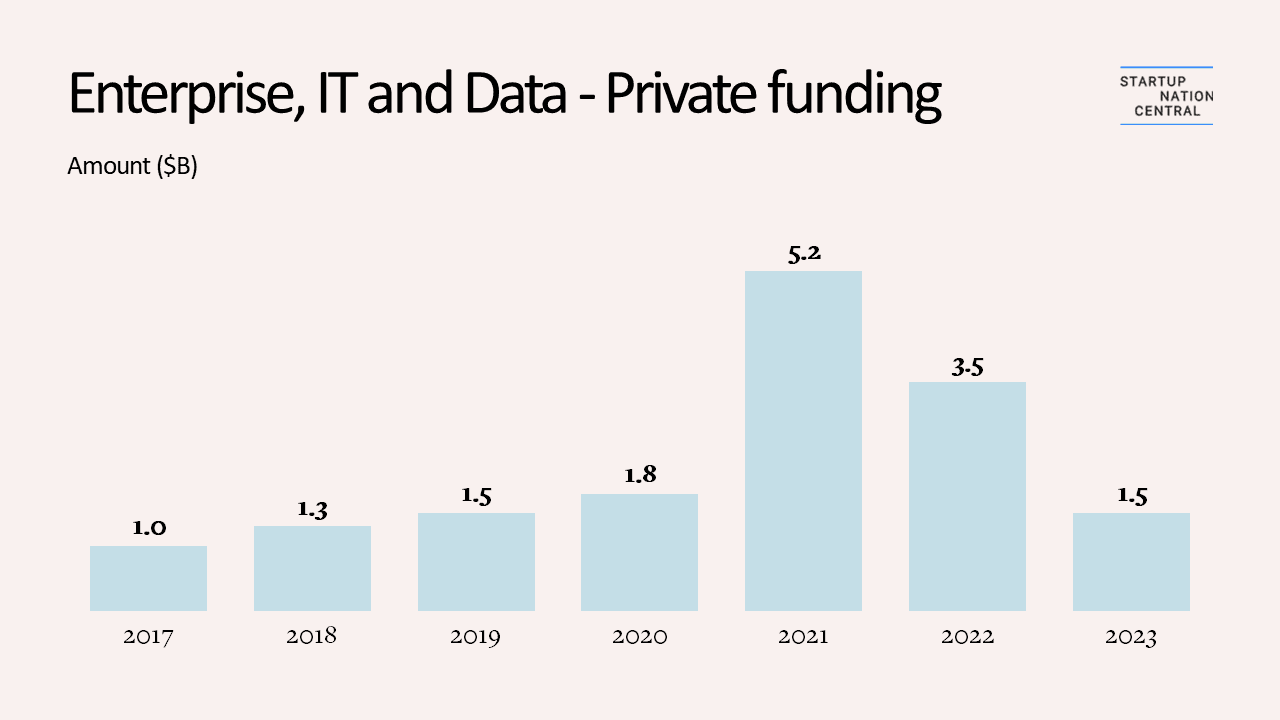

Enterprise, IT and Data

In the Enterprise IT and Data sector, there was a 58% decrease in the private funding amount invested between 2022 and 2023. However, the decrease between H2 2022 and H2 2023 was only 14% and Q4 was higher this year than last year by 17% ($404 million compared to $346 million). The average amount per round also grew in the second half of 2023 to $28 million, which is 36% higher than the second half of 2022.

4 companies in the sector had mega rounds this year in advanced funding stages: AI21 raised in total of $208 million in round C, HiBob raised $150 million in round D, VAST Data raised $118 million in round E, and Tomorrow.io raised $109 million in round E.

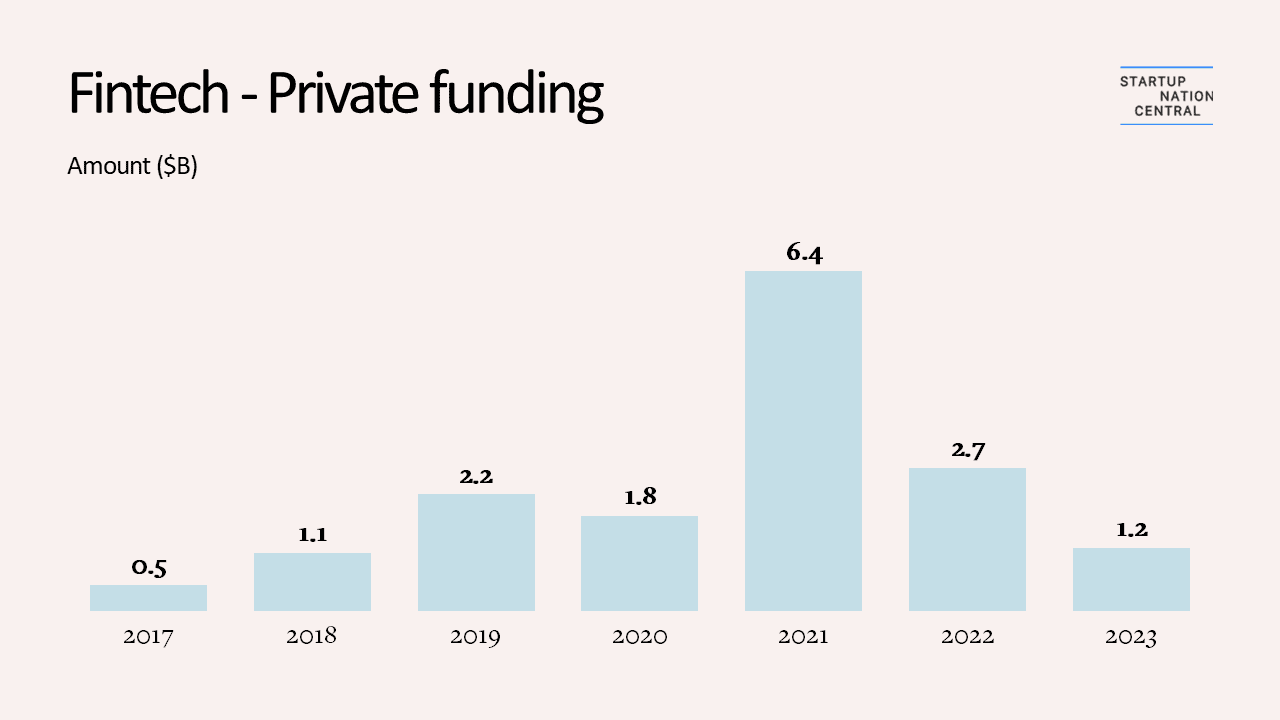

Fintech

The Fintech sector experienced a 57% decrease in private funding this year compared to the previous year, which aligns with the overall ecosystem trend. Despite the war, Q4 was relatively quite strong in Fintech with nearly $0.4 billion in private funding accounting for a third of the entire private funding this year and only 7% down compared to Q4 2022. A big portion of Q4 funding is attributed to Next Insurance which raised $265 million in an F round. Another notable investment round was in Q1, in which eToro raised $250 million.

76% of the rounds (in which the type was disclosed) in 2023 were early rounds (up to A) and only 8% of the rounds were mid-stage rounds (B or C). In 66% of the rounds, foreign investors were involved compared to last year, which was 55%.

2024 Israeli Tech Economic Outlook

We surveyed investment firms and corporate leaders active in the Israeli tech ecosystem to understand the industry’s expectations for the future, following a very turbulent year. It covered topics related to resiliency, recovery, investment and exit trends, and other activities in Israel. The survey was conducted at the end of November 2023 and was completed by 123 professionals.

Overall, respondents were optimistic about Israel’s resilience and ability to overcome challenges and expect the startup nation’s tech economy to remain stable or grow in 2024. Tech sector trends predict that AI and Cybersecurity will continue to lead this year, with Defense Tech gaining traction. For impact sectors such as Agrifood, Health, and Climate Tech, Israel is expected to continue leading global efforts to meet shared challenges with scalable tech solutions.

Heading into 2024, the Israeli tech ecosystem faces significant challenges, but the ecosystem’s bedrock of innovation, global partnership, and proven resilience will steer it through uncertainties and toward a continued growth trajectory; Israel remains an innovation hub and an ecosystem with significant investment opportunities.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers