Finder Spotlight: 2024 Israeli Robotics Tech Companies

Tech Innovation

According to Jensen Huang, CEO of Nvidia, robotics could be “the next wave of AI.” Speaking at a conference in Taiwan, he highlighted humanoid robots and self-driving cars as the next frontier of AI.

Huang’s view is widely shared. A recent article in Nature proclaimed, “The AI revolution is coming to robots,” noting that nearly every major tech firm with AI expertise is now focused on applying versatile learning algorithms, known as foundation models, to robotics.

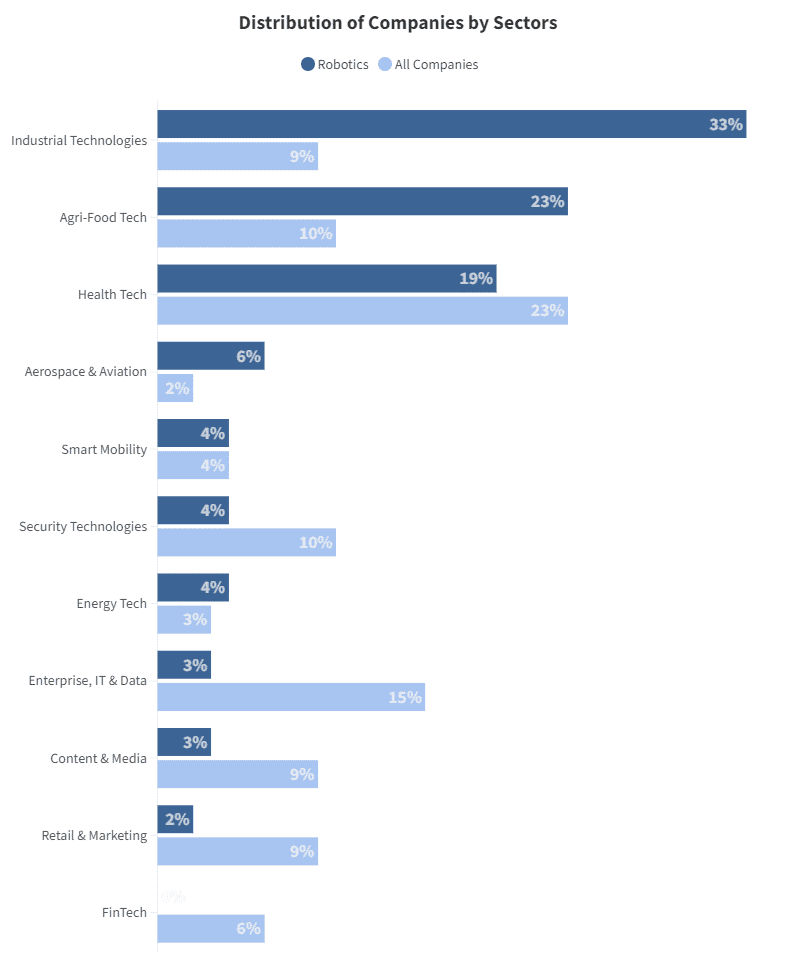

Sector Distribution

Israel is a hub for robotics tech companies, boasting 170 pioneering companies across diverse sectors: 33% of these companies focus on Industrial Technologies, 23% on Agrifood Tech, 19% on Health Tech, and 9% on Aerospace and Defense.

While the use of robotics in Industrial and Health Technology is common worldwide, Israel’s unique contribution to Agrifood Technology is rooted in its long-standing tradition of agricultural innovation.

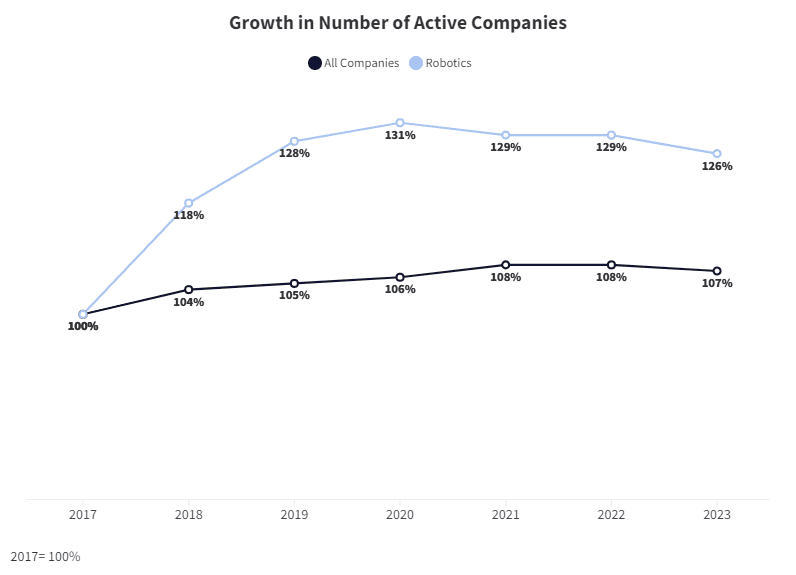

Robotics Tech Companies

Robotics tech is a hotbed of innovation in Israel, with a rapid growth rate outpacing overall company formation. Since 2017, the number of robotics tech companies has grown by 126%, compared to a 107% increase for all companies.

Recent highlights in Israeli robotics include:

- Unlimited Robotics: Raised $5M in seed funding to develop service robots for hospitals, performing tasks like delivering meals and supplies.

- Finally: Emerged from stealth to develop robots for piece picking in online grocery orders.

- XTEND: Raised $40M for its operating system for drones and robots used by IDF soldiers for navigating drones in narrow tunnels.

Other notable companies include:

- Intuition Robotics: Creates AI-driven robotic companions like ElliQ for eldercare, assisting with daily tasks and providing companionship.

- ReWalk Robotics: Specializes in wearable robotic exoskeletons for individuals with spinal cord injuries, with FDA clearance and NASDAQ trading since 2014.

- RGo Robotics: Develops artificial perception technology, enabling mobile robots to understand complex surroundings and operate autonomously.

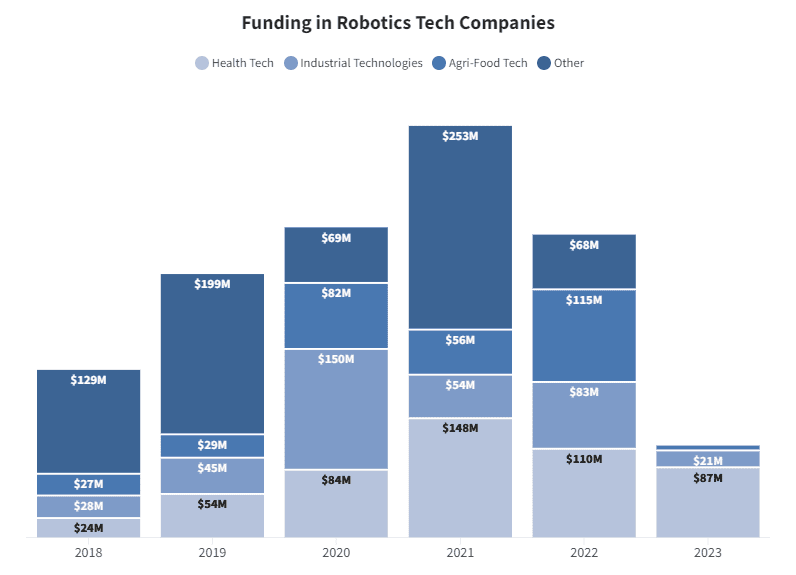

Private Funding in Robotics

Private Funding by Sectors

Robotics tech companies experienced a funding surge in 2021, with over $500M raised. This dropped to $376M in 2022 and about $100M in 2023. Health Tech and Industrial Technologies received the most funding, although other subcategories also saw investment activity.

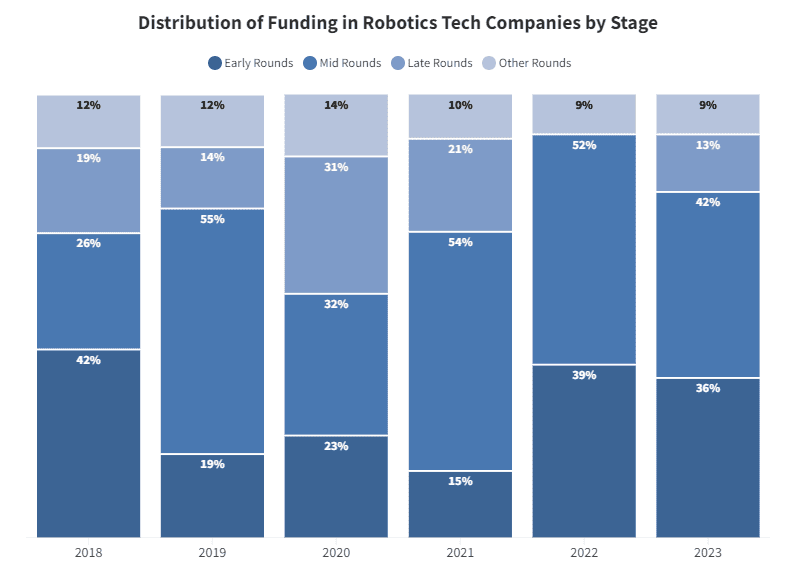

Private Funding by Stage

Israeli robotics tech companies are typically in early development stages. About half of the funding recently went to mid-rounds, with 35-40% allocated to early rounds.

Top Funded Companies

The top-funded robotics tech companies in Israel showcase the sector’s diversity:

- Fabric: Raised $310M for fulfillment robots for autonomous warehouses in the retail market.

- Intuitive: Secured $153M for developing robot sensing, mapping, and navigation capabilities.

- Momentis Surgical: Raised $96M for a surgical robot for hysterectomy.

- Airobotics: Secured $83M for autonomous drones.

- Powermat Technologies: Raised $80M for wireless charging of robots.

- Beewise: Secured $80M for autonomous beehives to improve pollination.

For more details, see the Robotics Top-Funded Watchlist.

Main Exits

Most exits in the robotics tech sector have been in Health Tech. Notable exits include:

- Equashield: Merged with Nordic Capital in a $300M deal in 2022 for its automated drug-compounding technology.

- Ecoppia: Listed on TASE in 2020, raising $82M for its robotic solar panel cleaning solutions.

What’s Next

Israel’s robotics tech sector is diverse, with innovations spanning industrial robots, retail and commerce robotics, health and surgical robots, agri-robots, defense tech robots, and home robots for daily tasks. The sector includes robot development and core component innovation, such as software, sensing, and power solutions. A more detailed taxonomy and maturity analysis of this market is needed.

For more information, check out the articles from MSN and Nature.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers