Opportunities for Investments through Innovation Diplomacy

As global supply chains fragment and geopolitical competition sharpens, a new generation of policy frameworks is shaping how regions cooperate, invest, and innovate. Three initiatives stand out for their strategic relevance to technology, infrastructure, and regional alignment: IMEC, I2U2, and Pax Silica. Each reflects a different approach to economic cooperation, yet all create concrete opportunities for private investment and cross-border collaboration, advancing innovation diplomacy through joint development, shared problem-solving, and mutually reinforcing regional interests.

“Going into 2026, we are entering a new period in the Middle East. There is the potential for an increase in trade, in economic connectivity, and in shared infrastructure. Historically in the middle east that number has been less than 10%, whereas in Europe, about 40% of trade happens with nearby countries. International frameworks like IMEC and I2U2, coupled with the geopolitical shifts open the way for more countries in the region to participate in connected economic growth.

Matan Friedman, Managing Partner at One Horizon Capital, a US based investment firm

The economies of countries in the GCC region are rapidly evolving, diversifying away from oil and gas, decentralizing away from state owned enterprises, developing towards a local and regional economic engine. Fueling this growth of private enterprise, is an element of innovation and a layer of private capital. GDP growth for the three largest economies in the Middle East is expected at 4-5%, which is twice the growth rate in the US and three times that in Europe. There is a massive opportunity for innovation and capital to participate and facilitate the economic growth of the region.

Food Systems is an area that is ripe for transformation. Countries in the GCC region currently import ~85% of their annual food consumption. Through innovation, investment and collaboration there is an opportunity to provide healthy, fresh, sustainable, regionally grown food, at lower cost than imports.

As the countries in the GCC continue to diversify their economies away from oil and gas, towards other segments of the economy, there is natural room for collaboration. Israeli companies can collaborate with other companies in the region, advancing topics ranging from food security to healthcare to data centers and infrastructure. Early moving investors and companies will be well positioned to benefit from this growth as it accelerates over the next decade.

– Matan Friedman, Managing Partner at One Horizon Capital, a US based investment firm

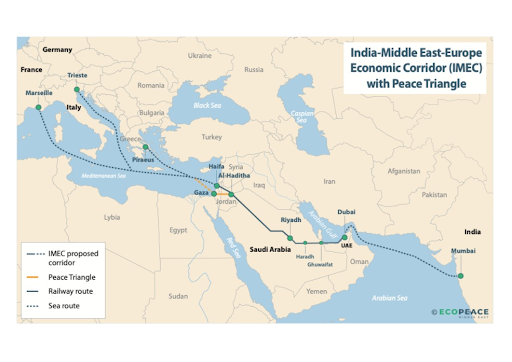

IMEC: Building the Physical Backbone of a Connected Region

The India–Middle East–Europe Economic Corridor, IMEC, is designed to rewire trade and logistics across three regions through an integrated network of ports, rail, energy, and digital infrastructure. The corridor links India to the Gulf, Israel, and Europe, aiming to reduce transit times, strengthen supply chain resilience, and anchor long-term economic cooperation.

Examples of projects include

- Port modernization and smart logistics hubs in India, the UAE, and the Eastern Mediterranean

- Rail connectivity linking Gulf ports to Israel and onward to Europe

- Energy infrastructure, including hydrogen-ready pipelines and power transmission

- Subsea and terrestrial digital cables supporting data flows and cloud infrastructure

IMEC relies heavily on private capital to complement public commitments. Infrastructure funds, sovereign co-investors, logistics operators, and energy developers all have entry points across construction, operations, and digital enablement. Technology plays a critical role, from AI-driven logistics optimization to cybersecurity for cross-border transport systems. Beyond trade, IMEC enables joint standards, interoperable digital systems, and shared innovation in climate-resilient infrastructure, water management, and energy transition.

Source: EcoPeace

I2U2: From Diplomacy to Deal Flow

I2U2 brings together India, Israel, the UAE, and the United States around targeted economic and technological cooperation. Unlike broad trade agreements, I2U2 focuses on catalytic projects in food security, energy, health, and advanced technologies, with an explicit role for the private sector.

Examples of projects- Deep Dive on Sectors

- Joint agri-food initiatives combining Indian scale, Israeli agtech, and Gulf capital

- Renewable energy and storage projects aligned with regional decarbonization goals

- Health innovation platforms connecting Israeli digital health with Indian manufacturing and U.S. market access

- Advanced manufacturing pilots in food, water, and climate technologies

I2U2 is structured to crowd in private capital. Venture funds, strategic corporates, family offices, and development finance institutions can participate through co-investments, pilot programs, and commercialization partnerships. The framework reduces early risk by aligning government priorities with market demand, accelerating time to scale. In addition, I2U2 strengthens trust-based collaboration across very different economies. It enables shared R&D, joint ventures, and talent mobility, while anchoring innovation-driven growth in real economic needs.

“We are witnessing a shift from security-driven alliances to frameworks built on infrastructure, investment, and connectivity. Initiatives like I2U2 and IMEC are more than trade corridors- they are shaping the next model of regional cooperation, where supply chains, energy networks, and digital links become sources of influence and stability.

For Israel, the key is a holistic approach: linking traditional economic engines – trade, logistics, and industrial flows ; with its strength in technology and innovation. Integrating tech into physical and commercial infrastructure creates a force multiplier, positioning Israel as a strategic value creator within”.

– Danielle Aviran, Regional cooperation and strategic cross-border consultant

Danielle Aviran, Regional cooperation and strategic cross-border consultant

Pax Silica: Securing the Semiconductor Supply Chain

Pax Silica is an emerging policy concept centered on cooperation among allied and like-minded countries to secure the global semiconductor value chain. Rather than full onshoring, it emphasizes distributed specialization across design, tools, materials, manufacturing, and advanced packaging.

Examples of projects

- Cross-border collaboration in chip design, EDA tools, and AI accelerators

- Investment in advanced materials, photonics, and power semiconductors

- Shared R&D platforms linking universities, startups, and multinational fabs

- Trusted supply chain initiatives for automotive, defense, and critical infrastructure chips

Semiconductors demand patient capital and deep expertise. Pax Silica opens opportunities for growth equity, strategic corporate investment, and infrastructure-style funding in areas such as design automation, testing, specialty fabs, and semiconductor equipment. Israel’s strength in chip design, AI hardware, and semiconductor software makes it a high-value node for investors seeking exposure without the capital intensity of fabs.

Pax Silica reinforces technological alignment between the U.S., Europe, Israel, and partners in Asia. It supports shared standards, IP protection, and talent development, while reducing dependence on fragile or politicized supply chains. Collaboration here is less about geography and more about trust and capability.

“Pax Silica is where geopolitics meets execution. Unlike earlier regional frameworks, it is not just about alignment between governments, but about supply chain, energy, semiconductors, AI and industrial resilience — areas where Israel has a disproportionate innovation advantage. In today’s ever-changing geopolitics, deep tech has become hard currency and the basis for national security, as well as global industrial players’ irreplaceable enabler for remaining competitive while they shorten their supply chains and onshore the critical parts of their manufacturing operations.

Yoni Heilbronn, Managing Partner , IL Ventures

From advanced materials and chips to physical, industrial AI and dual-use technologies, Israeli startups are already building the infrastructure layer that Pax Silica depends on. For investors, the opportunity is not abstract cooperation, but concrete platforms that connect Israeli innovation with regional and global manufacturing capacity, capital and markets. This is where policy becomes revenue, and diplomacy becomes scalable technology.”

-Yoni Heilbronn, Managing Partner , IL Ventures

The European Union: Anchor, Market, and Strategic Counterweight

The European Union plays a central role across all three frameworks, both as a destination and as a strategic anchor. For IMEC, Europe represents the terminal market that gives the corridor its global economic weight, linking Asian production and Middle Eastern logistics to European consumers and industry. Within I2U2, the EU functions as a standards setter and scale market, particularly in climate, health, and digital regulation, shaping how innovations are commercialized globally. In the context of Pax Silica, Europe is an essential partner in semiconductor resilience, contributing advanced research, manufacturing capabilities, and policy alignment around trusted supply chains. For all three initiatives, success depends on clear global positioning, aligning infrastructure, technology, and capital flows with Europe’s regulatory frameworks, sustainability priorities, and industrial strategies. This alignment enables participating countries to move beyond regional cooperation toward global relevance, ensuring that investments made today translate into long-term competitiveness in a rules based international system.

“IMEC, I2U2 and Pax Silica are examples of the shift towards minilateral, smaller groupings and alliances that can create practical mechanisms and help countries collaborate. While earlier technology minilaterals often focused primarily as “talking shops”, today this cooperation is often infrastructure-focused by design—with connectivity, supply chains, standards and strategic investment all on the table, aimed at delivering tangible projects and programmes.

Dr. Tanya Filer, Founder & CEO of StateUp, Editor-in-Chief of the Cambridge Forum on Technology and Global Affairs

In some cases, countries are seeking out these small group relationships to avoid being forced into binary choices amid US–China technology rivalry. The test for the emerging regional alliances is whether these initiatives can develop the institutional backbone and conditions of trust that ensures initial alignment converts into sustained execution. And because the foundations of today’s technological power depend on energy systems and secure critical infrastructure, the most credible cooperation models will be those that invest and plan strategically across these strategic domains, an approach we call the ‘triple transition’.

Israel has particular strengths in technology verticals and sectors critical to regional resilience. For example, the energy and agritech sectors have evolved in response to environmental challenges such as water scarcity, limited land, and high energy dependency. From pioneering agricultural innovation to low-carbon energy and sustainability technologies, Israel continues to develop and apply wide-ranging solutions critical to regional resilience and therefore to these tech alliances.”

– Dr. Tanya Filer, Founder & CEO of StateUp, Editor-in-Chief of the Cambridge Forum on Technology and Global Affairs

A Converging Opportunity

| Framework | Strategic Function | Innovation Focus | Investable Entry Points |

| IMEC | Physical connectivity and trade integration across regions | Ports, rail, energy networks, digital infrastructure | Infrastructure funds, logistics operators, energy developers, digital infrastructure platforms |

| I2U2 | Economic activation through targeted cooperation | Food systems, renewable energy, health innovation, advanced manufacturing | Venture capital, strategic corporates, family offices, pilot-to-scale partnerships |

| Pax Silica | Technological resilience and supply-chain security | Semiconductors, AI hardware, EDA tools, trusted manufacturing | Growth equity, strategic corporate investment, semiconductor equipment and design platforms |

IMEC builds the physical corridors, I2U2 activates targeted economic cooperation, and Pax Silica secures the digital and industrial core of modern economies. Together, they signal a shift toward structured, innovation-led regional collaboration.

For private investors and corporations, these frameworks offer more than policy alignment. They create investable pathways where infrastructure meets technology, and diplomacy translates into deal flow. Innovation moves fastest when capital, capability, and cooperation align across borders.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle