Decision Support, Diagnostics, and Clinical Workflow Management Dominate Israeli Digital Health Company Funding in Early 2021

Health Tech

With approximately $700 million raised in 31 funding rounds completed between January and April, including mega-rounds the likes of which the local industry has yet to see, 2021 is well on course to surpass 2020’s total of $813 million raised, firmly positioning the Startup Nation in the post-pandemic global healthcare landscape.

New research published by Start-Up Nation Central reveals that Israeli companies in the Digital Health sector have managed to raise approximately $700 million during the first four months of 2021, nearly matching the $813 million total for 2020. As the investment world and the healthcare industry begin to look beyond the COVID-19 pandemic, they have their sights set on the “Start-Up Nation” and the incredible innovation taking place in the local healthtech scene, particularly in the fields of deep tech and AI that are game-changers when it comes to Decision Support, Diagnostics, and Clinical Workflow Management.

Research conducted by Lena Rogovin, Senior Research Analyst and Sector Lead, Digital Health & Life Sciences at Start-Up Nation Central found that the main reason for the uptick in the total amounts invested, constituting an 85% increase, is an increase in later-stage funding rounds. Out of the 31 funding rounds that were completed since January, 17 were round B or later, compared to a total of only 21 later-stage rounds in 2020. The median amount raised in 2021 nearly tripled that of the previous year, climbing from $6 million to an astounding $14 million, a sign that the ecosystem is maturing and investors are recognizing the opportunities in growth companies. For an in-depth analysis of 2020 Digital Health funding figures and investment trends, check out Start-Up Nation Central’s 2020 Digital Health Report.

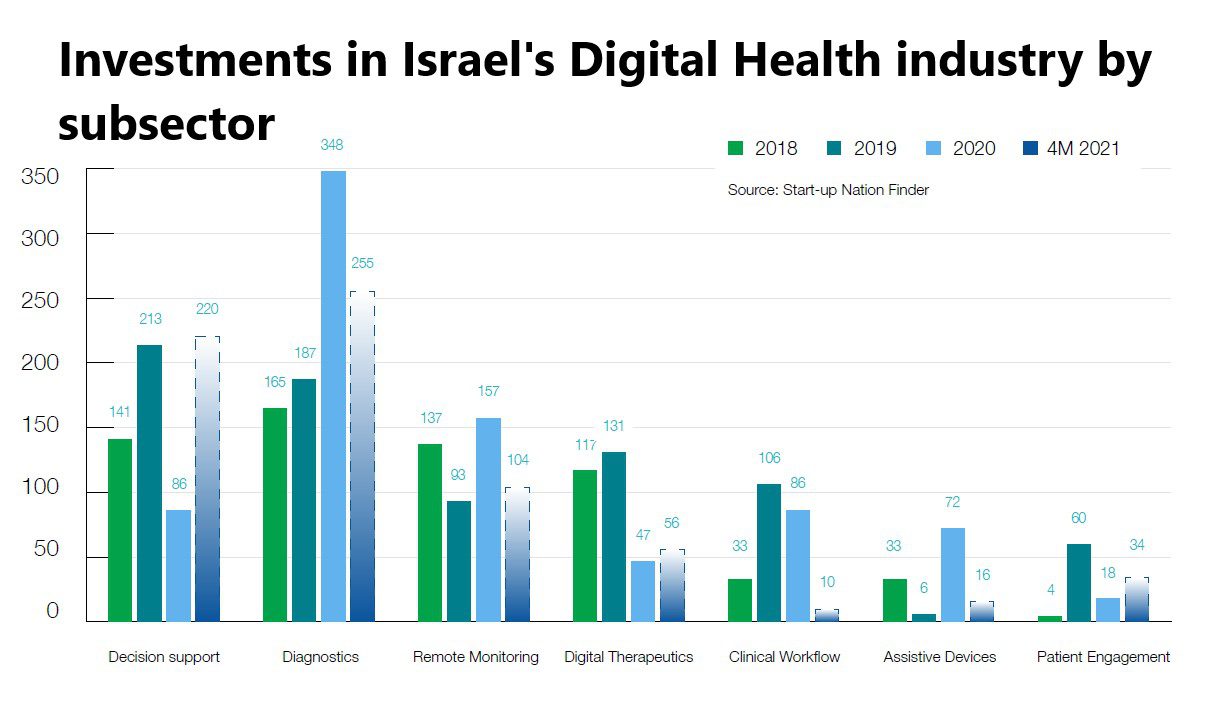

A breakdown of the completed funding rounds according to subsectors indicates that investments increased across the board, with a slight advantage for companies active in the Diagnostics, Decision Support, and Remote Monitoring fields. The figures suggest that investors are looking past the COVID-19 pandemic that dominated the landscape in 2021 with an eye towards companies with the promise of longer-term growth as innovation leaders.

“The strong start to 2021 shows that Israel has a lot to offer both in terms of the post-Corona reality and for other areas of Digital Health which were less of a focus for investors in 2020, but remain essential for global healthcare industry transformation in the longer term. As the healthcare situation returns to normal, interest is starting to shift back to other parts of the sector that were a lower priority during the height of the pandemic,” Lena Rogovin, the report’s author noted.

“There is no question that the sector is maturing as evident in the shift to later-stage funding. The companies that are receiving the most attention are those associated with Deep-Tech and Artificial Intelligence and we anticipate that they will remain the core technologies going forward in 2021 with an emphasis on Decision Support and Clinical Workflow Management,” she added.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers