Digital Health Alchemy – The Israeli Angle

Health Tech

Market conditions offer Israeli companies the opportunity to play a bigger role in the booming industry, as long as they get their formulas right.

It seems like the digital health industry, and nearly all the companies operating within it have reached a tipping point. The confluence of several strong forces will lead to the emergence of a few winners who will reap the fruits of the creation of new industry categories (similar to what happened in retail, marketing, etc.) alongside many more that will perish as unfulfilled promises while burning A LOT of money along the way.

The great potential of digital health, combined with multiple tailwinds (some due to COVID-19 but others that are unrelated, such as, favorable regulations, maturation of relevant technologies, attempts to stop the increase in healthcare expenditures, attempts to meet the influx of demand for care), have initiated what appears to be a tectonic shift. However, this emerging opportunity has also brought with it meaningful challenges:

- Growing competition as more digital health startups are now trying to reach the market (since more entrepreneurs are attracted to the digital health space given the sizeable opportunity combined with shorter development cycles compared to traditional devices).

- Companies are sitting on piles of dry powder due to highly accessible private and public capital, requiring them to scale fast and conquer more ground before their competitors do, in order to justify these large investments (and to the previous point, there’s an ever-increasing number of competitors).

- Saturated sales channels given that there are more sellers (points 1 and 2) coupled with the limited number of buyers (in part because of on-going consolidation in each category) and their limited bandwidth / capability to select the right offering (just try selling to the health benefit manager at a US self-insured employer).

- Many companies offer solutions that address only part of the buyer’s problem (a great example is the area of remote patient monitoring, where many companies are generating new data but not actionable insights or real alterations in clinical workflows. More color here). Part of the reason is that building solutions in healthcare nowadays takes time and significant resources. Buyers, on the other hand, are looking for broader (and not niche) solutions. It may sound trivial, but it’s worth keeping in mind that if you solve only part of the problem, the buyer remains stuck with a problem. Moreover, partnering with endless number of companies (following the self-insured employer’s example, chronic care solutions per each disease) is simply unsustainable.

The result? An arms race has begun.

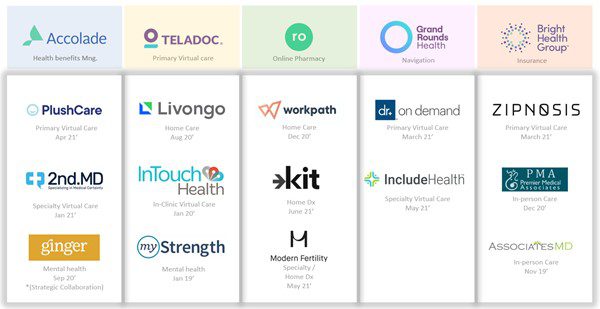

There is more than enough ammunition (private and public capital) and everyone is trying to secure more beachheads (value). The past few months have felt like the “digital health fantasy league” with a staggering rate of M&As. The graphic below showcases how (relatively) new industry entrants are acquiring their way to becoming broader, more comprehensive, and more compelling vendors.

It is worth noting that all of these transactions occurred only in the last two years, and there are many more examples for such platform attempts (e.g. GoodRx, Olive.ai, Hims & Hers Health, etc.)

This storm – which is only expected to increase – has some very interesting repercussions: the platform companies are starting to become more and more similar (again using the self-insured employer’s example – combining in-person and virtual care, navigation tools, health benefits management, etc.) while trying to expand from different directions (pick your color above). At the same time, offerings that not so long ago were unique and promising (such as general telemedicine) are now more of a me-too layer.

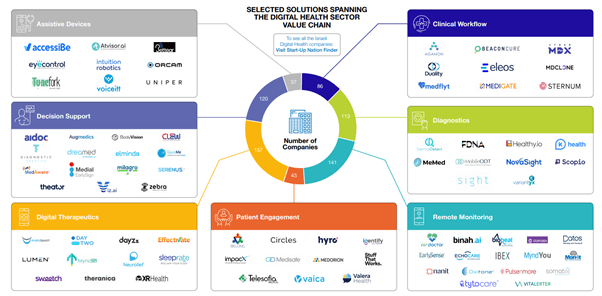

Within these repercussions, there is an opportunity for the Israeli industry. It’s safe to say there are many great and relevant technologies coming out of Israel, for example as Israel is ranked 1st in the world in AI-based startups per capita (see this report). One byproduct is the sheer number of active Israeli digital health startups – more than 600 active companies (see this report from Start-Up Nation Central for more color) meaning that in almost any sub-sector of the industry you can find prominent Israeli contenders.

While many of these companies may find it is very difficult to triumph on their own (accentuated by the previously-discussed challenges), there seems to be a large pool of companies that could either greatly augment – or even become the linchpin of – a (much) larger play. In that respect, it is also my hope that we will see more Israeli companies actually become the platform themselves.

The “digital health alchemy game” has begun. While this successful matchmaking of different technologies, business models and company cultures is far from trivial, especially given the rapid pace, whoever is able to think ahead, aim, and execute the right “combos” stands a chance to win big.

Dr. Nadav Shimoni leads the digital health sector at Arkin Holdings, the largest private Israeli healthcare investor, managing more than $1.5 billion in a diverse healthcare portfolio located both in Israel and globally across pharma, BioeTech, MedTech, and Digital Health.

More information is available at http://arkinholdings.com/ and via Arkin’s digital health blog, “Differential Diagnosis”

The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Start-Up Nation Central

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers