Record Year For Israeli FinTech: Funds Raised More Than Doubled To Reach $1.8B, Share Of Global Investments Tripled

Finder

After 2019, Israeli FinTech capabilities do not need further global introduction. The growth experienced in recent years has positioned Israel among the world’s top FinTech hubs. In 2019, Israel was ranked fifth in terms of global investments; behind China, the US, the UK and India.

With six mega funding rounds of over $100 million in 2019 (compared to only three since 2014), Israel’s FinTech sector raised $1.8 billion in equity in 2019. This was an increase of over 100% since 2018 and represents 5.1% of the world’s total venture investments in FinTech, compared to 1.7% recorded in 2018.

The new record of equity raised in 2019 reflects the success of the sector in recent years, and is partially thanks to the growing interest of global corporations, which increased their presence and investment in Israel. One recent example is MasterCard’s announcement that it is going to open a cyber and FinTech innovation lab in Be’er Sheva.

The coronavirus crisis might push certain FinTech solutions forward

The COVID-19 crisis came on the heels of this phenomenal success, which begs the question: Will COVID-19 impact global interest in Israel?

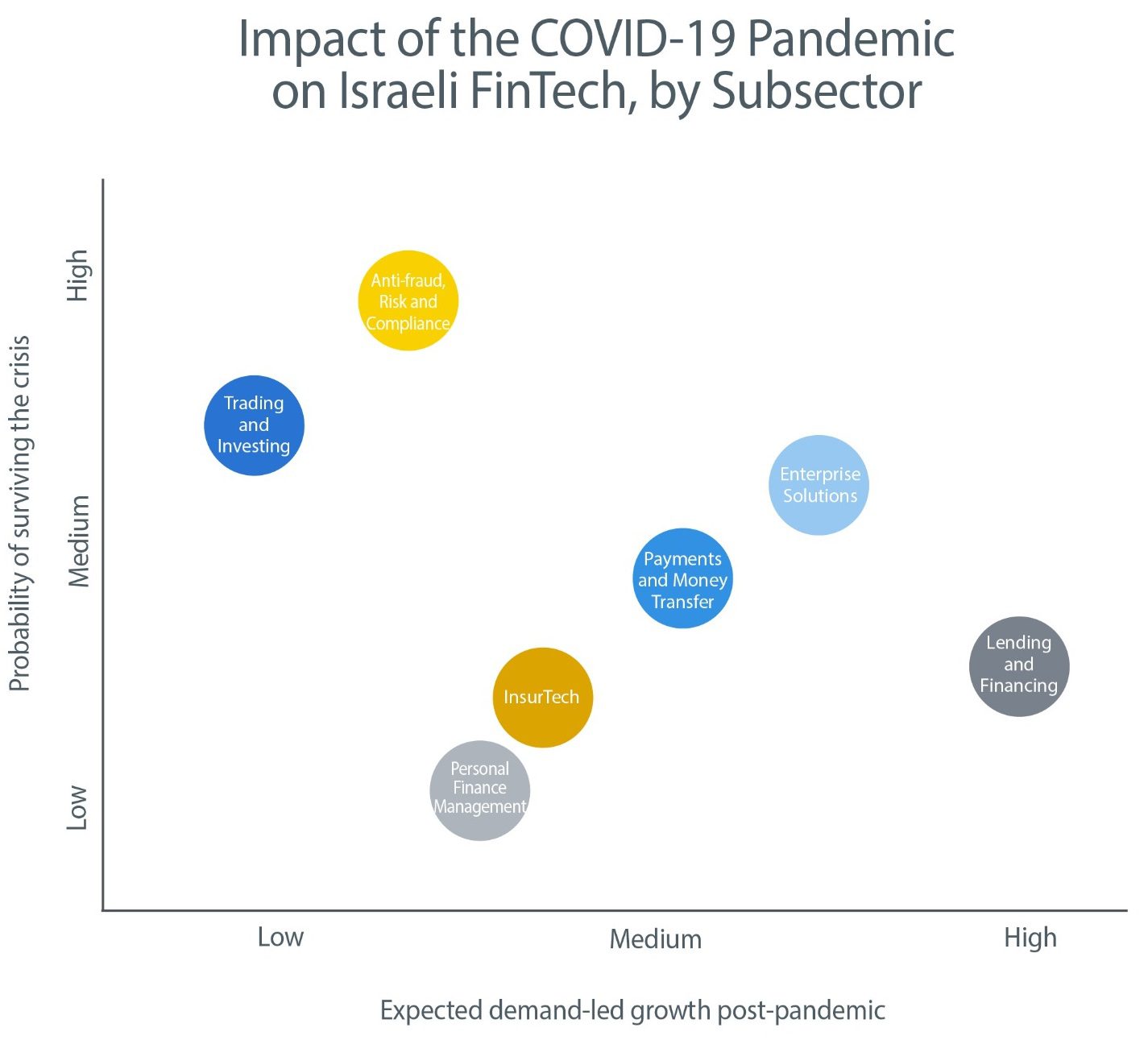

In the short-term, foreign investors and organizations might stay away due to the COVID-19 pandemic and its financial implications. Nevertheless, as the pandemic pushes forward the process of global digital transformation, certain types of FinTech solutions that Israel specializes in may see growing demand – artificial intelligence (AI) and Anti-fraud in particular.

Despite the challenging economic environment, its key characteristics still make Israeli FinTech attractive to foreign organizations looking for innovation. Here are three reasons why:

1. An empowering ecosystem

Unlike other global FinTech hubs, most Israeli FinTech startups offer solutions to financial institutions, corporations, or SMEs. Israeli startups aim to support and empower businesses (B2B model), instead of competing with them for the end user (B2C model). Therefore, global financial service providers that are looking for innovation should consider collaborating within an ecosystem where they are seen as potential partners rather than competitors.

In addition, as a B2B-oriented FinTech ecosystem, the risk of losing customers during the COVID-19 period is lower than in B2C ecosystems. B2B contracts are often signed for long periods, and it is more difficult for large organizations to change or eliminate their ongoing engagements. Startups offering solutions to individuals are expected to struggle more as unemployment remains high.

2. Diversification

Other countries with a large number of FinTech companies typically also have a huge potential local market (e.g. India or the US). While this is beneficial for startups as they can save costs and focus on their own country, their solutions may not be relevant for other countries. Since different challenges exist in each country, the sector will tend to be focused on solving only the main problems that exist in that country, and startups may be highly concentrated in a few subsectors.

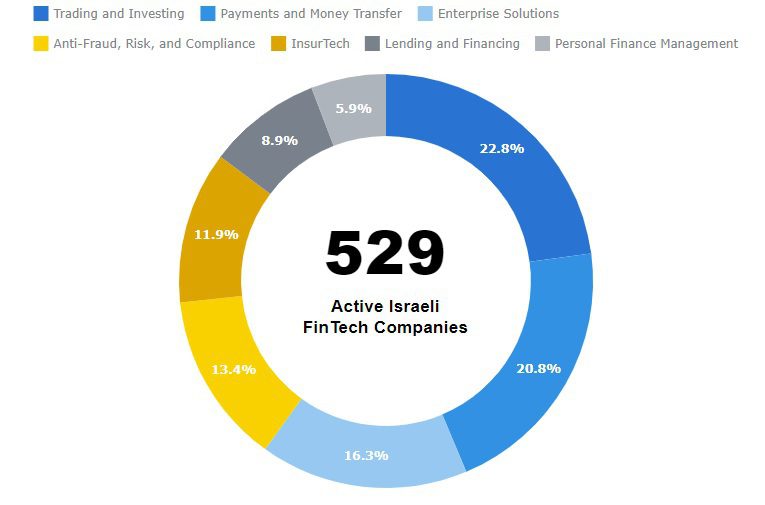

In Israel, the situation is different. Its small population forces companies to aim globally from day one. Trying to solve different global challenges has resulted in a very diverse ecosystem, where the largest subsector, Trading and Investing, accounts for only 22% of the active companies. For a large corporation searching for a wide spectrum of innovative solutions rather than a specific challenge, Israel should be considered as one of the leading options.

3. Artificial intelligence capabilities

As global digital transformation advances, the amount of available data is rapidly growing. Financial service providers are trying to use this data to become more proactive and efficient. This makes AI one of the most in-demand technologies for the global financial market.

With more than 1,500 tech companies using AI, Israel is certainly making a name for itself as a leader in the field. The Israeli FinTech sector is also capitalizing on local industry knowledge and experience. Almost 40% of the companies in the sector are using AI, and in 2019 Israeli FinTech startups using AI attracted close to $800 million.

Digital transformation continues

Regardless of how the pandemic situation plays out, global corporations still need to continue their long-term digital transformation and adaption to new market realities. As they search for solutions in many new areas, they will increasingly discover that many of them can be found within the Israeli FinTech ecosystem.

To read our full FinTech Report, click here.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers