H1 2023 Tech Reports: Navigating Uncertainty in Israel’s Innovation Ecosystem

Tech Innovation

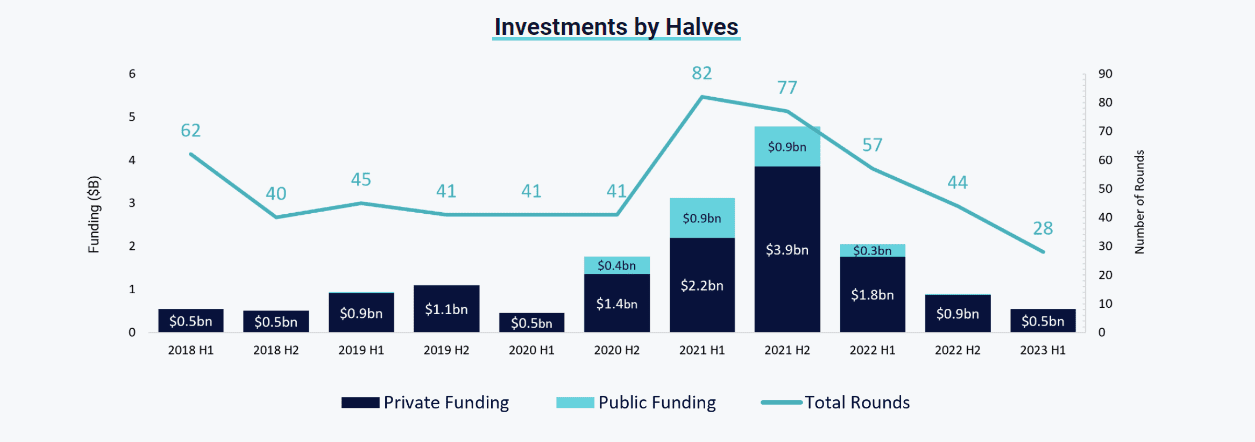

As we enter H2 2023, Israel’s tech ecosystem faces unprecedented challenges due to the recent judicial reform. The ripple effect is already evident with a 29% decrease in private funding compared to H2 2022, hitting a 5-year low at $3.9B. Investor participation in investment rounds nosedived by 53% in H1 2023 compared to H1 2022, reaching a 9-year low. However, amidst the economic turbulence, the cybersecurity and climate tech sectors have displayed resilience, maintaining consistent performance levels between H1 2023 and H2 2022.

Keep reading for an overview of our H1 2023 Tech Reports.

Private Funding Hits 5-Year Low

The first half of 2023 saw a substantial drop in private funding, plummeting to $3.9B. This is a 29% decrease from H2 2022, and a level not seen since 2018. Additionally, there was a quarter-on-quarter decrease of 10% from Q1 to Q2 2023. This stark downturn stands in contrast to the relatively stable private funding trends observed in the US, as presented by PitchBook data. Early-stage funding rounds, specifically those under $20m, declined significantly after an initially stable period during 2022.

The decline in private funding has raised concerns within the tech ecosystem, impacting startups’ growth and innovation prospects.

Investor Participation Plummets to a 9-Year Low

Investor participation in investment rounds nosedived to the lowest level in the past nine years in H1 2023, experiencing a 53% decrease compared to H1 2022 and a 24% decrease compared to H1 2022. Concurrently, a historic shift is underway, with foreign investors seizing the reins, directing more deals than their Israeli counterparts for the first time in a decade. Even in the face of an 11% dip in their participation from H2 2022, these international financiers led 70% more rounds than Israeli investors and initiated 17% more new investments, serving as a steadying force in these uncertain times.

The significant decrease in investor participation poses challenges for startups seeking funding and growth opportunities.

IPOs and M&As Reach New Lows

In the current landscape, the market for initial public offerings (IPOs) has dipped to its lowest since 2018, and mergers and acquisitions activity (M&As) is also at one of the lowest rates in the past decade. This decline indicates caution among investors and businesses in navigating economic uncertainties. The decrease in IPOs and M&As calls for a data-focused analysis of the factors driving this trend.

Two Sectors Exhibit Initial Resilience

Despite the economic turbulence, the cybersecurity and climate tech sectors have demonstrated resilience in private funding, maintaining consistent performance levels between H1 2023 and H2 2022.

The resilience of these two sectors provides valuable insights into their growth strategies and the key factors contributing to their stability.

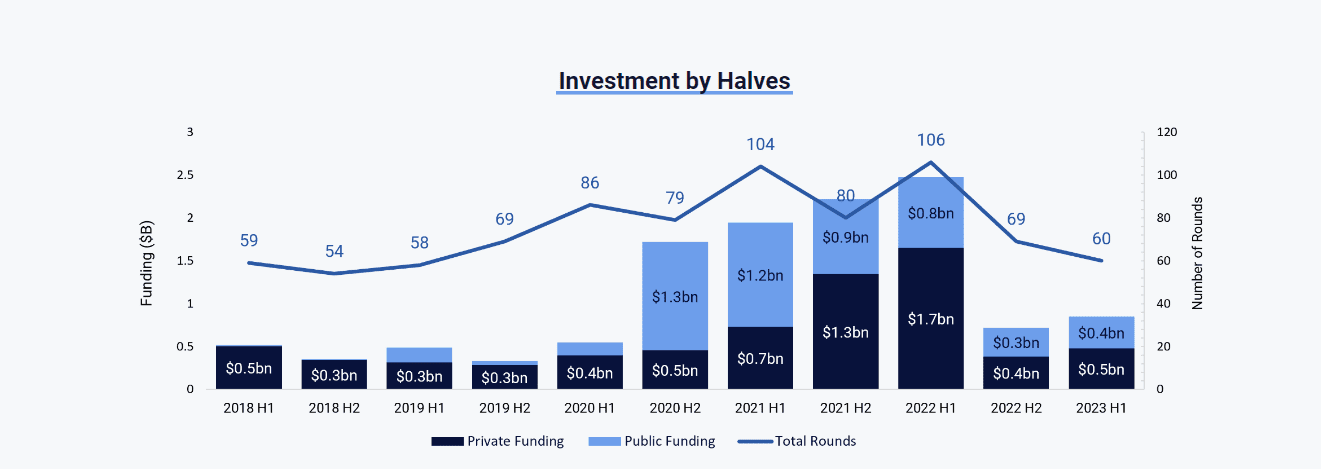

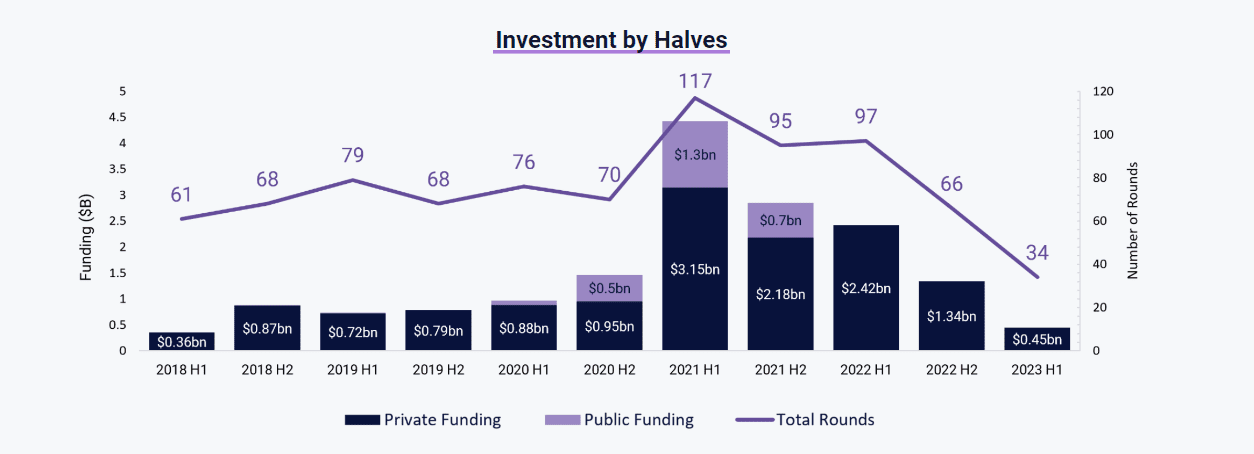

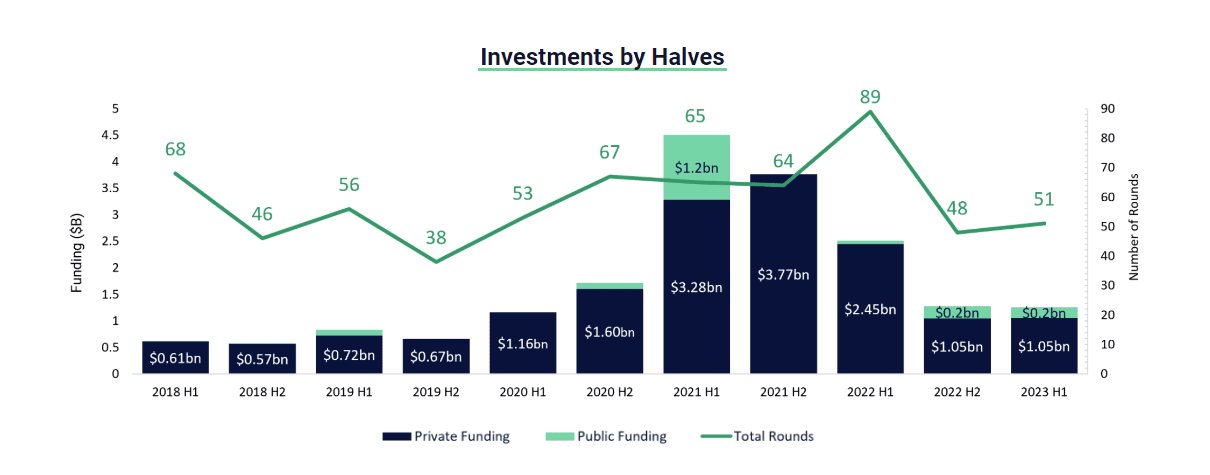

H1 2023 Fintech Sector Insights

The total investments in Israel’s fintech sector took a significant hit, plummeting by over 50% from $6 billion in 2021 to $2.6 billion in 2022. Unfortunately, the downward trend continues into 2023, with investments reaching only $545 million. However, amidst these challenges, the adoption of generative AI offers promising opportunities within financial services.

The integration of generative AI in fintech holds significant promise, particularly in task automation and data analysis. While the sector faces headwinds due to the macroeconomic slowdown, startups have the chance to collaborate with established financial players.

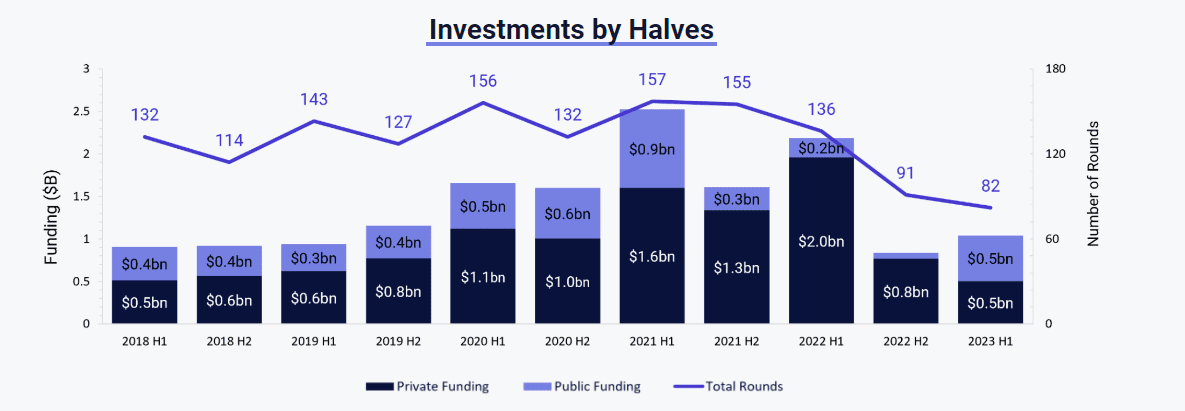

H1 2023 Climate Tech Sector Insights

The global climate tech sector has proven its resilience, with the Israeli climate tech sector experiencing funding growth in H1 2023 compared to the previous six months. The urgency for climate solutions and escalating regulatory and corporate commitments for decarbonization continue to drive innovation in this domain.

Israel’s recognition as a market leader in food & land use and sustainable water solutions, as well as in solar energy, geothermal energy, and alternative proteins, positions the country at the forefront of climate tech innovation. With the growing focus on climate innovation, more Israeli entrepreneurs are leveraging their skillset to make a significant impact in this sector.

The sector’s expansion is further supported by initiatives like Start-Up Nation Central’s Climate Solution Prize, empowering changemakers and awarding top researchers and innovative companies driving breakthrough climate tech solutions.

H1 2023 Health Tech Sector Insights

The health tech sector experienced a sharp decline, reaching the lowest level of private investments since 2018, with only $504 million in H1 2023—a staggering 74% decrease compared to H1 2022. However, despite these challenges, health tech startups continue to be a significant part of the Israeli tech ecosystem.

While the current economic environment poses obstacles, health tech remains a beacon of hope in addressing global health challenges. Early-stage companies represent a considerable portion of private funding rounds, indicating the potential for startups to make a positive impact in this sector.

With digital health leading the subsector, decision support systems and medical devices developing treatment & therapeutics are key areas of focus for health tech innovation.

H1 2023 Agriculture-Food Tech Sector Insights

Israel’s agrifood tech sector stands out as a leading force in innovation and sustainability, garnering global attention and significant investments. Collaboration between academia, industry, and government has played a vital role in the sector’s growth, fostering cutting-edge research and development.

The food tech domain has seen a surge in startups focusing on novel ingredients and alternative protein sources. Despite challenges in scaling up production, regulatory limitations are gradually easing, providing room for investor confidence to grow in the second half of 2023.

In the agriculture tech sector, advanced funding rounds have contributed to stability in Q2, with companies like N-Drip securing significant investments. The strategic attraction of agri-investors to the sector showcases the potential for startups to leverage collaborations with industry players to achieve sustainable growth.

H1 2023 Enterprise IT and Data Infrastructure Sector Insights

The enterprise IT and data infrastructure sector showed improvement in Q2 compared to Q1, with a significant rise in early-stage deal flow. Dozens of generative AI companies are actively fundraising, presenting promising opportunities within this domain.

Generative AI’s rising interest indicates a shift in companies’ data infrastructure strategies, aiming to implement Large Language Models (LLMs) within their organizations. The need for new data infrastructure tools to ensure LLM readiness is spurring innovation in compliance, privacy, and security.

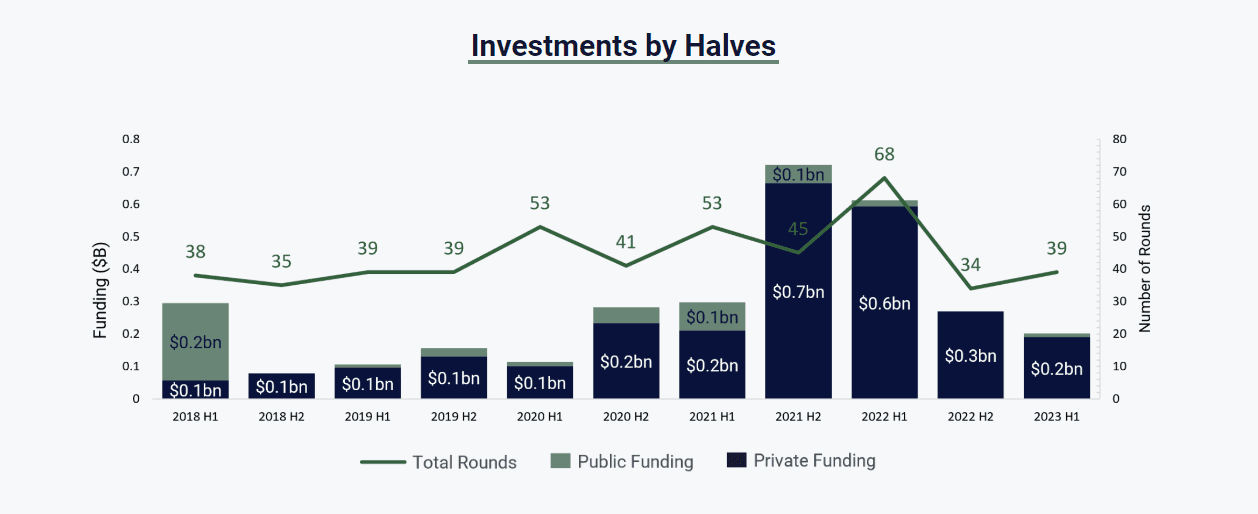

H1 2023 Cybertech Sector Insights

The cybersecurity sector has shown relative robustness, maintaining stability in both private and public investments, with M&A activities surpassing the previous half. However, data indicates a slight dip in investments in Q2 compared to Q1, warranting further exploration to understand the dynamics fully.

Over the past three years, the sector has faced growing challenges due to the sophistication of malicious actors and the emergence of new attack vectors. Cybersecurity remains a top priority for many enterprises, with operational efficiency driving spending and startups focused on ARR growth.

While certain subsectors may experience shifts in investor interest, opportunities lie in areas such as AI security, security automation, and security solution consolidation.

From Crisis to Opportunity

Israel’s tech ecosystem faced a challenging landscape in H1 2023, with notable declines in private funding and investor participation. However, sectors like cybersecurity and climate tech display resilience, providing potential growth opportunities. Fintech, health tech, agriculture-food tech, enterprise IT, and data infrastructure sectors also present various challenges and prospects for recovery.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers