H1 2024 Israel Tech Ecosystem: Growth Amidst Challenges

Finder

Despite significant risks, the H1 2024 Israel tech investment landscape remains robust and dynamic. While some investors exhibit caution, many are drawn by high-quality companies and appealing valuations, leading to increased investments. Rising stars in the startup ecosystem continue to secure funding, especially in popular sectors.

Recent investment activity, the rebound of the Finder Nasdaq Index, and M&A activity highlight the resilience and uniqueness of Israeli tech, showcasing groundbreaking solutions and continued global relevance. Innovative technologies, attractive valuations, and global consolidation in the cyber sector contribute to maintaining Israel’s status as a global innovation hub.

Rebound in Private Funding Driven by Mega Rounds

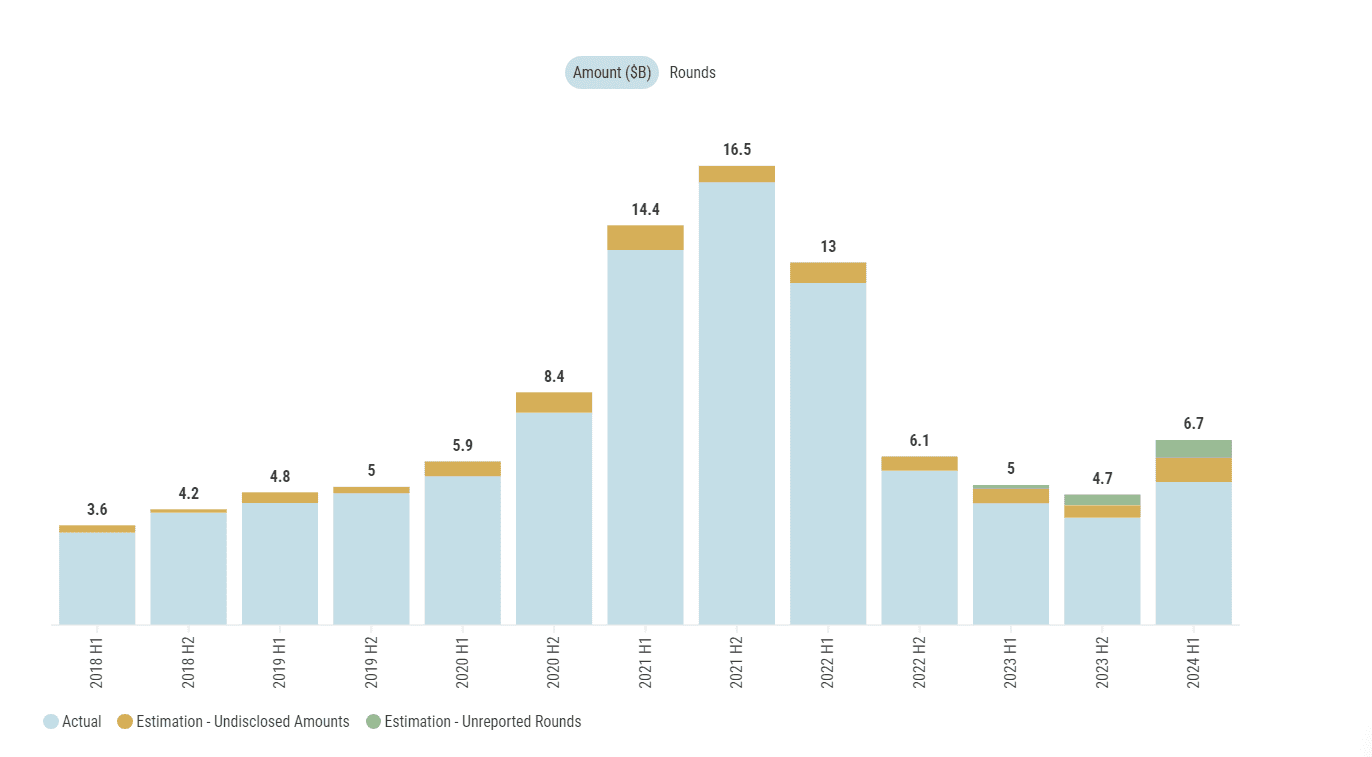

Private funding in H1 2024 increased 31% compared to H2 2023, amounting to $5.1 billion raised across 322 rounds. This figure could reach $6.7 billion when accounting for unreported rounds and undisclosed amounts. Q2 was particularly strong, with funding rising from $1.8 billion in Q1 to $3.3 billion in Q2.

Fourteen mega-rounds (above $100 million) contributed $2.8 billion, representing 56% of total private funding, overshadowing weaker sectors and providing much-needed capital for many early and mid-stage companies. This is an increase from 8 mega rounds in H2 2023. This surge was driven by a strong Q2, with reported funding rising from $1.8B in Q1 2024 to $3.3 billion, the highest since Q2 2022. The estimated number of rounds also increased to 362, up from 345 in H2 2023.

Wiz stands out with a $1 billion round, representing 20% of all private funding. Notably, 8 of these mega-rounds were in the cybersecurity sector.

H1 2024 will be remembered for the crazy times we live in. As Israel fights on literally all fronts, its startups are experiencing a positive period, where the cyber-security sector, which I focus on as an investor and an active board member, is topping the charts, in both exits and funding rounds.

The seed arena was only quiet on the surface; behind the stealthiness, things got very busy – it felt like 2021 all over again. The VC supply keeps increasing with new players like Picture Capital, together with new mega funds raised by Team8, and supported by the renewed interest of tier-1 global VCs setting up local presence. H2 will be dominated by AI security stories across funding, dream teams forming, and the first cyber-AI blue and white exits.

Zohar Alon, Cybersecurity Entrepreneur and Investor

Cybersecurity’s Increasing Dominance

The Cybersecurity sector played a crucial role in the Israeli tech ecosystem, representing 52% of private funding in H1 2024. This prominence was highlighted by Wiz’s record $1 billion round and significant M&A exits totaling $1.5 billion across nine deals. Cybersecurity funding in Israel surged to over 50%, underscoring the sector’s critical importance and attractiveness to investors.

However, this growth must be viewed in a global context. The consolidation of solutions worldwide has led to an acquisition spree by companies like Palo Alto Networks and CrowdStrike. Notably, Cisco’s $28 billion takeover of Splunk and discussions about Google potentially acquiring Wiz highlight this trend. This global competition is felt strongly in Israel due to its relative advantage in cybersecurity. However, an overreliance on this sector risks missing out on other significant trends and opportunities.

Global Funding Comparison

Israel’s 31% private funding growth in H1 2024 outpaced other regions. The US saw a 28% increase, while Europe and Asia experienced declines of 6% and 18%, respectively. Israel’s significant Q2 surge was notably higher than the more gradual trends observed in the US, Europe, and Asia.

Despite the incredibly difficult challenges our country is facing, the Israeli tech ecosystem has shown tremendous resilience in 2024, with investment volumes on par or even slightly topping the capital contributed during the first six months of last year. The amazing people of Israel have helped keep the ecosystem intact, uniting during this tragic period. We’ve seen strength and resilience with players worldwide reestablishing or opening offices in Israel.

Local and foreign investors have been active in early and late-stage opportunities, and this momentum is expected to continue into the second half of the year. High-profile M&As and large funding rounds have continued, with new investors entering the Israeli market. We will see a continued focus on cybersecurity and defense tech, and we should prioritize AI talent and know-how, ensuring Israel leads in AI innovation.

Irit Kahan, Managing Director Goldman Sachs Growth Equity

Boost in M&A Exit Activity Despite Low Number of Deals

M&A exits in H1 2024 surged to $4.1 billion despite fewer deals, a 70% increase from H2 2023. Aside from H2 2021, this marks the highest value since 2018 and continues the upward trend from H1 2023. Notable deals included two acquisitions exceeding $1 billion each. Total transactions reached $7.1 billion, matching the previous half. The number of M&A rounds rose from 25 in H2 2023.

Global Investor Participation is Pivotal

The Israeli tech investment landscape featured 217 active investors in 2024 H1, 54% of whom are Israeli. Deals typically involve multiple investors, prompting our unique analysis, categorizing rounds into Israeli-only, global-only, and mixed investments. Over the past year, the share of funding from investments solely by Israeli investors has declined, with the median round size rising to $5 million in H1 2024. In contrast, rounds involving Israeli and global investors have significantly higher median sizes, rising to $20.5 million. Global investors’ investments also show substantial rounds, with a median of $5.5 million. These investors participated in rounds accounting for 93% of all funding, a seven-year peak. Leading global investors like Insight Partners and NFX Capital each conducted seven rounds, while Sequoia and Greylock reopened local offices.

Finder Nasdaq Index Signals Rebound in Private Funding

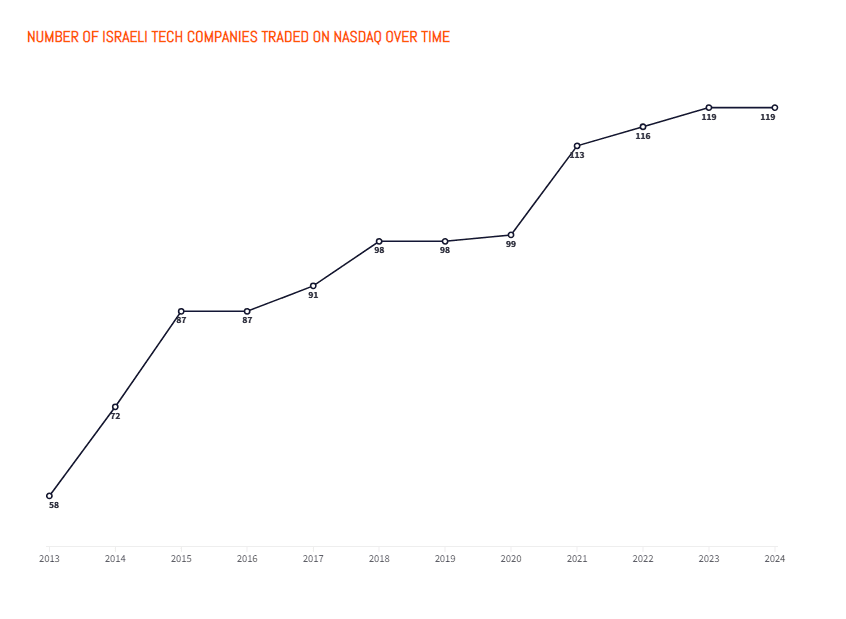

The new Finder Equal-Weight (EW) Index, based on Israeli tech companies traded on NASDAQ, revealed significant trends correlating with Israel’s tech ecosystem private funding. The index may be a forward-looking indicator for Israel’s private funding approximately 6-12 months in advance. Changes in the index revealed significant divergence coinciding with the government’s introduction of Judicial Reform and the outbreak of war in October 2023. However, despite these challenges, the index rebounded by March 2024.

Public Companies and PIPEs

PIPE (Private Investment in Public Equity) funding increased by 90% to $359 million, maintaining its status as a primary source of investment for public companies amidst a dry IPO market.

In H1 2024, Israel’s reported private funding growth of 31% stood out globally. The US saw a notable rise of 28%, maintaining its dominant position in the market. Europe experienced a slight decline of 6%, while Asia continued to decline by 18%. Israel’s funding surge, especially in Q2, marked its highest quarterly increase since Q2 2022, contrasting with more gradual trends in other regions.

H1 2024 Israeli Ecosystem Top Rounds

The Israeli tech landscape in H1 2024 showed vigorous activity, with 7,158 active companies and 217 active investors. Private funding rose for the first time since H2 2021, reaching $5.1 billion across 322 rounds, driven by Q2’s $3.3 billion surge, the highest since Q2 2022. Public funding remained relatively stable at $825 million.

Despite a slight decline in active startups, the ecosystem’s overall robust performance highlights enduring confidence in Israel’s tech innovation despite the complexities posed by the war and geopolitical challenges.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers