How Does Israel’s Innovation Ecosystem Compare to 9 Global Tech Hubs?

Tech Innovation

The Israeli startup ecosystem is often compared to other ecosystems, particularly California’s Silicon Valley in terms of entrepreneurial culture and historical similarities, but the two ecosystems are even more alike than commonly thought due to their composition of startups in relation to other ecosystems

Background

Academic research and media reporting often focus on common social and historical characteristics when comparing startup ecosystems. Tech innovation ecosystems, including the Israeli ecosystem and California’s Silicon Valley, are often compared due to similarities in factors such as academic influence and involvement, entrepreneurship culture, presence and impact of venture capital funds, and other shared characteristics that had an influence on the crystallization of the ecosystems1.

Sectorial Composition of Companies – A Comparative View

In this post, we will put aside the factors that may or may not have had an influence over the development of these ecosystems and focus on the current characteristics of nine different ecosystems in terms of the different sectors to which the startups operating within them belong. The ecosystems we examined are the Israeli ecosystem, the Bay Area (San Francisco and Silicon Valley), New York, France, London, Ireland, Sweden, Singapore, and Germany. We took Pitchbook’s unified classification system for all nine ecosystems and adopted their Primary Industry Sector and their Primary Industry Group systems, which place each company in mutually exclusive categories according to industries. We analyzed over 38,000

VC, angel, accelerator, and incubator-backed companies and examined what percentage of companies were founded in each sector between 2011-2020 in each of the ecosystems.

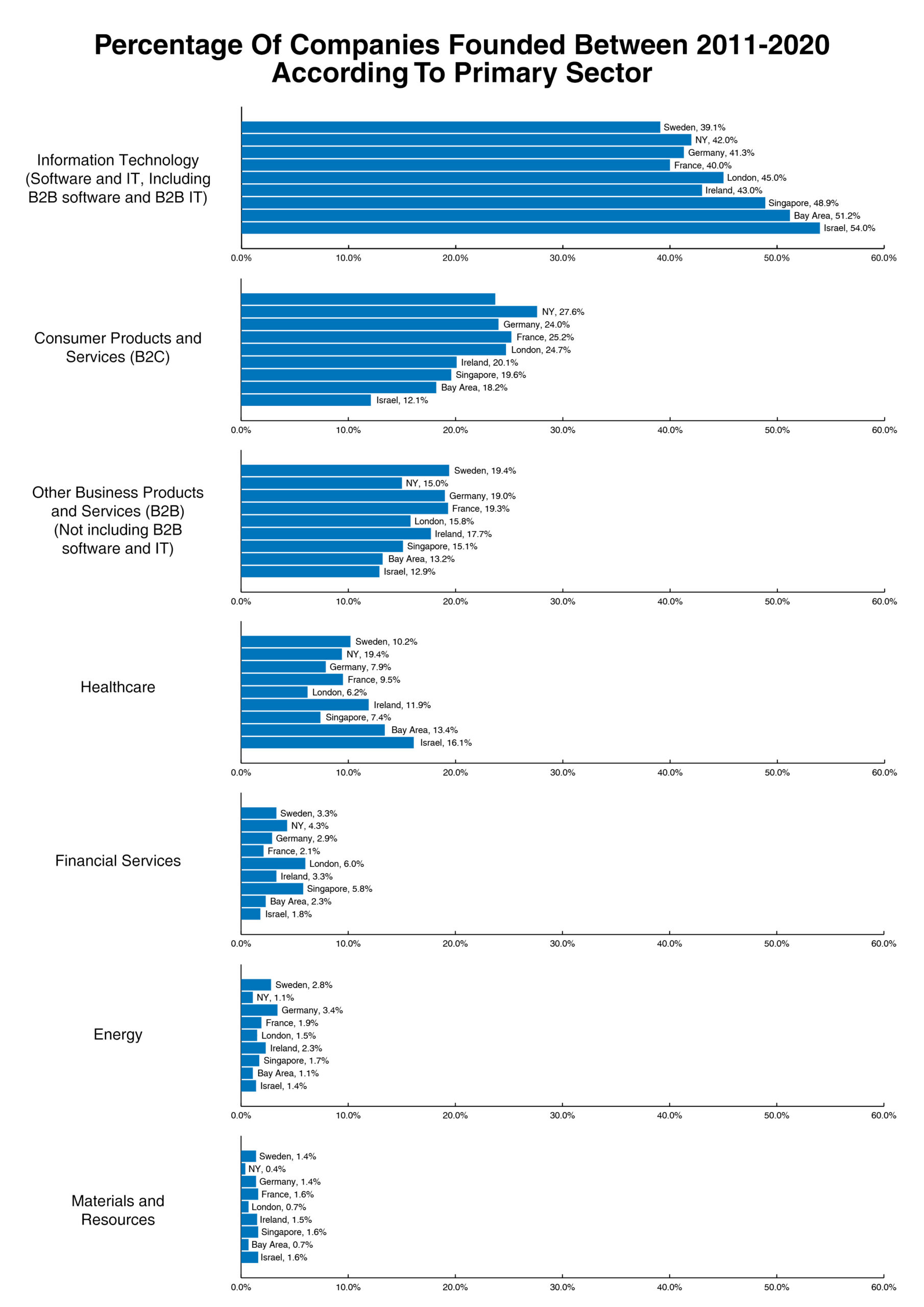

Pitchbook’s Primary Industry Sector provides a breakdown according to seven high-level economy sectors that the company operates in. A breakdown by percentage of companies active in each Primary Industry Sector in each ecosystem reveals differences and similarities. For instance, the Israeli and Bay Area ecosystems have the highest percentage of companies founded in both the Information Technology and Healthcare sectors while both have the lowest share of B2C and B2B sectors2.

Although the classification is not “clear cut” it strongly demonstrates the Israeli and Bay Area ecosystems’ orientation toward the software and healthcare sectors relative to other ecosystems.

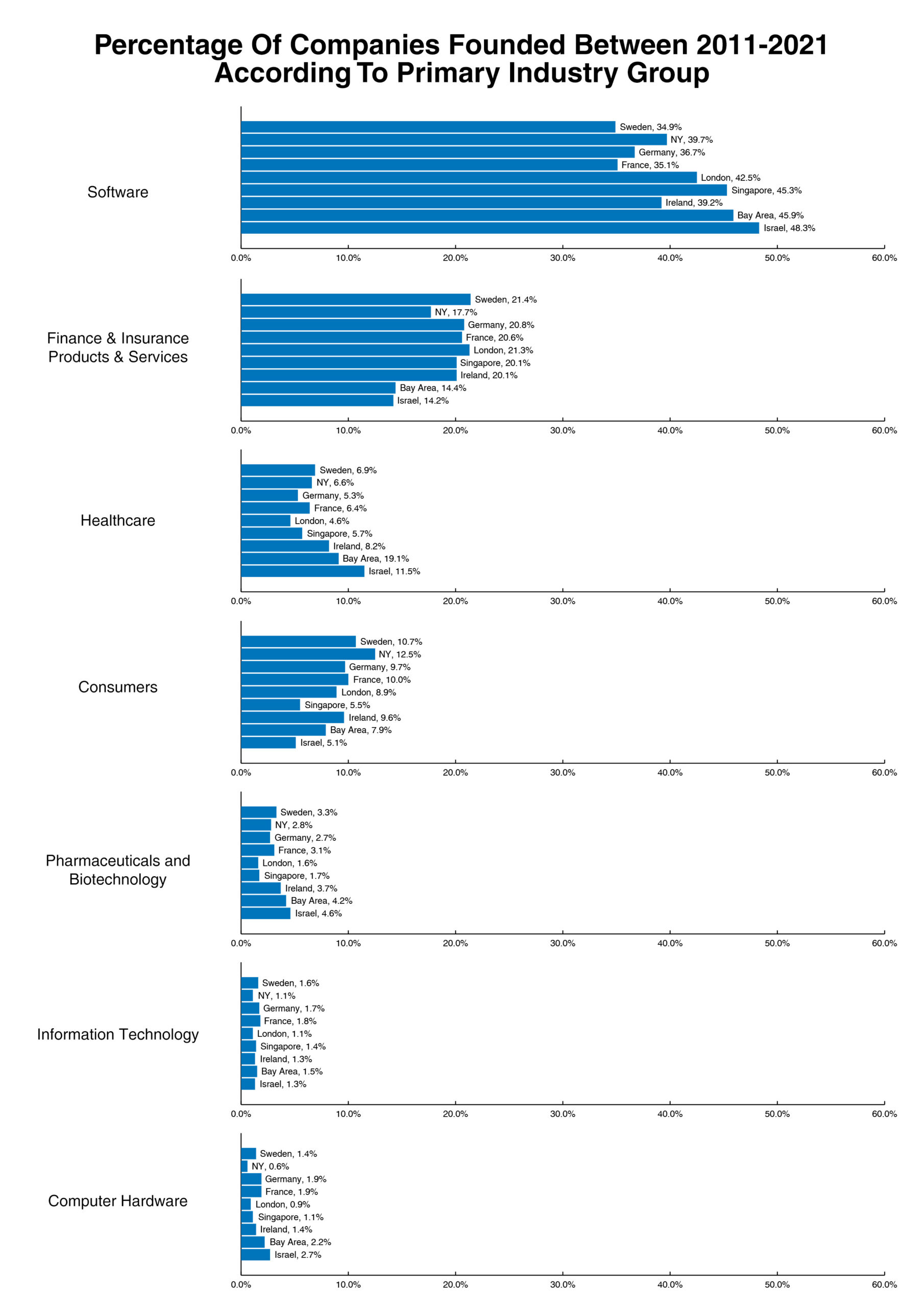

Pitchbook offers a further drilldown – the Primary Industry Groups, which has multiple categories and enables a more distilled breakdown, that remains mutually exclusive. A breakdown by Primary Industry Group also reveals similarities between the Israeli and Bay Area ecosystem. Both have the highest percentage of companies in the Software, Pharma & Biotechnology, Healthcare, and Computer Hardware groups, with the lowest percentage of companies in the Retail, and Finance & Insurance sectors. The Israeli ecosystem is the lowest in the Consumers group and the Bay Area is also relatively low in the group3.

In this instance too, the classification is not absolute, and one may find many software-oriented companies in other Industry Groups (such as healthcare and finance); however, the Israeli and Bay Area orientation toward non-software-oriented industry groups such as pharma and biotechnology is an indication for its strong position in the entire “LS&H” Industry.

It is noteworthy that the two ecosystems are oriented toward two sectors that have some opposite characteristics: The Healthcare, Pharma, and Life Sciences sectors usually demand sectorial specialization, longer time-to-market periods, and heavy regulation (even for software-oriented companies in this sector), but also shows a relative inelasticity of demand. The Software sector, on the other hand, allows a great deal of flexibility across verticals and markets, but also demands companies to constantly adopt emerging technologies and be attentive to dynamic market trends and demand.

Which Foreign Ecosystems Most Resemble the Israeli Ecosystem?

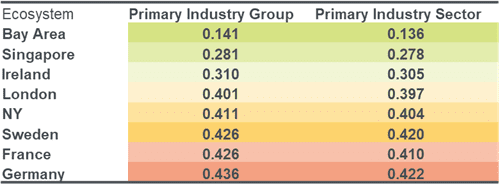

To understand the overall picture across all sectors, we further calculated the absolute value of deviation from the proportion of companies in the Israeli ecosystem for each ecosystem (for instance, Israel’s percentage in the Energy Sector is 1.4%, so both the Bay Area – 1.1% and Singapore – 1.7% get a value of 0.3 as the distance away from Israel’s percentage). The sum of deviation reveals that the Bay Area is by far the closest to the Israeli Ecosystem in both the Primary Industry Sector and the Primary Industry Group. Ireland and Singapore are in the 2nd and 3rd places, far away from the Bay Area.

The German and French ecosystems, which are relatively low in Software, Pharma, and Healthcare, and relatively high in Retail, Finance, and Consumer Startups, are the most dissimilar to the Israeli company composition.

Sum of deviation from the Israeli Ecosystem Composition of Sectors and Industry Groups

Discussion

Startup ecosystems vary one from another not only in soft characteristics such business culture, but also in the sectorial and technological orientation.

The figures presented in this post show that both Israel and the Bay Area Ecosystems are the ones most oriented toward Software, IT, Healthcare, Pharma, and Life Sciences, while being least oriented toward Consumer, Retail, and Finance, at least in terms of number of startups.

This short analysis does not provide the reasons for the similarities between the ecosystem; however, a partial explanation may be the longtime relationship between the two ecosystems. For example, Intel’s presence in Israel since 1974 and the 80 multinational corporation headquartered in Bay Area that currently have innovation operation in Israel.

For further insights into the strong connections between the Israeli and Bay Area technological ecosystems, we refer you to a report issued recently by the Bay Area Council Economic Institute – Silicon Valley to Silicon Wadi: California’s Economic Ties with Israel, which Start-Up Nation Contributed to and which discusses the distinctive roots of Israel’s innovation economy, California’s economic footprint in Israel, Israel’s economic presence in California, key technologies where that activity is focused, and future opportunities for collaboration.

1See for example:

Academic Research

Cukier, Daniel; Kon, Fabio (2018) : A maturity model for software startup ecosystems, Journal of Innovation and Entrepreneurship, ISSN 2192-5372, Springer, Heidelberg, Vol. 7, Iss. 14, pp. 1-32, http://dx.doi.org/10.1186/s13731-018-0091-6

Klaus-Heiner Röhl (2019) Entrepreneurship: a comparative study of the interplay of culture and personality from a regional perspective, Journal of Small Business & Entrepreneurship, 31:2, 119-139, DOI: 10.1080/08276331.2018.1462621

BARROS, J. G. D. ., & Paixão, A. E. A. . (2020). Comparative Study of Innovation Ecosystems Inducing Success of Startups in The World (Cutting 2000-2017). International Journal for Innovation Education and Research, 8(8), 647–658. https://doi.org/10.31686/ijier.vol8.iss8.2573

Media

Meir Valman. The Shared Tech Roots Of Silicon Valley and Israel’s Startup Nation. Forbes.

2It is important to mention that Pitchbook’s IT Primary Industry Sector includes many pure software companies, while Business Products and Services category excludes most of the enterprise software and IT companies that are under the Information Technology sector. Another important note is that the B2C category does not refer to the business model, but the end-users of the product.

3It should be noted that in some cased we merged several Industry Groups Under one category, for instance: Healthcare Devices and Supplies, Healthcare Services, Healthcare Technology Systems were united under one “Healthcare” category. All consumer categories were merged under one category.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers