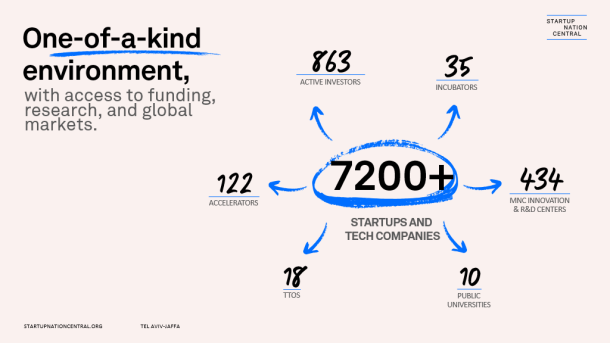

Israel is one of the world’s most concentrated hubs for innovation, shaped by a culture that values speed, collaboration, and global thinking. With more than 7,200 active technology companies and over 430 multinational R&D centers, founders entering the ecosystem gain immediate access to talent, expert networks, and commercialization pathways. These structural advantages make Israel an ideal environment for entrepreneurs navigating the landscape of Israel entrepreneurship.

Market trends through Q3 2025 highlight a selective and mature investment landscape. Capital is flowing into fewer companies, but the average deal size is larger. Cybersecurity, industrial technologies, fintech, and business software attract steady investor attention. Hiring trends show a shift toward product, QA, and data roles, reinforcing the ecosystem’s focus on scale-ready operations and customer value. For founders preparing to start a company in Israel, these dynamics influence legal setup, go-to-market strategies, regulatory considerations, and funding approaches.

This guide helps entrepreneurs understand how to incorporate a company, meet regulatory requirements, protect intellectual property, hire talent, raise investment, and find partners across Israel’s innovation ecosystem.

Understanding Israel’s Business and Startup Environment

Israel’s business environment is fast-paced and globally oriented, shaped by the country’s approach to problem solving and resourcefulness. Founders entering the ecosystem quickly encounter a culture that prioritizes rapid iteration, experimentation, and early customer validation. Proof of concept programs play a central role in helping startups demonstrate value and form partnerships.

Israel’s innovation strategy is reinforced by a mindset that blends technical expertise, cross-disciplinary collaboration, and practical execution. This combination drives strong outcomes across sectors, shapes the local venture environment, and affirms why multinational companies continue to invest in Israeli innovation.

Through Q3 2025, private funding data shows an ecosystem growing in maturity. Investors seek companies with product-market clarity, financial discipline, and potential for global scale. Cybersecurity, industrial tech, business software, and fintech remain strong categories, while talent shifts emphasize the importance of product management, data science, and QA functions. These features collectively define the environment for entrepreneurship in Israel.

Step 1: Choosing the Right Legal Structure for Your Startup

The legal structure of a startup shapes its ownership, governance, tax exposure, and fundraising capabilities. For technology companies operating in Israel, one structure is used more than any other due to its flexibility and alignment with investor expectations.

Most common structure for tech startups

Most Israeli tech startups incorporate as a Private Company Limited by Shares. This structure limits liability, supports preferred share mechanisms, and allows companies to issue stock options to employees. It also enables SAFEs and convertible instruments commonly used in early-stage financing. Investors in Israel and abroad are familiar with this structure, which helps streamline due diligence.

Legal liability considerations for founders and investors

Liability is limited to the amount invested, protecting founders and shareholders. Israeli corporate law requires directors to uphold fiduciary duties such as careful decision making, maintaining accurate records, and acting in the company’s best interest. Strong governance is important not only for compliance but also for investor confidence.

Recommended entity structure for venture-backed startups

Startups planning to raise venture capital often choose between:

- A single Israeli private limited company holding both operations and intellectual property

- A dual structure in which an Israeli subsidiary manages R&D and IP while a foreign parent entity handles commercial activities

The right approach depends on tax strategy, market priorities, and investor guidance. Early alignment helps avoid restructuring challenges during later fundraising rounds or exit planning.

Step 2: Register a Company in Israel

Registering a company in Israel is a structured process. When documents are prepared in advance, incorporation can be completed efficiently.

Registering with the Israeli Registrar of Companies

Founders must file Articles of Association, director declarations, shareholder identification documents, and the company’s registered address. A lawyer certifies the documentation before submission. Once registration is processed, the company receives legal recognition and can operate formally in Israel.

Required documentation and forms

Founders typically submit:

- Articles of Association

- Director appointment declarations

- Identification documents for shareholders

- Notarized or apostilled documents for foreign shareholders

- Lawyer certification of accuracy

These materials define the company’s management structure and ownership distribution.

Costs and timelines for company registration

Registration is usually completed within a few business days once documents are prepared. Foreign shareholders may require additional steps for identity verification, which can extend the timeline. Government filing fees and legal service fees apply.

Reserving your company name and language requirements

Company names must be unique and may be filed in Hebrew or English. Most technology companies choose English names to support consistency with international branding.

Opening a corporate bank account

A corporate bank account is required for tax registration and financial operations. Banks request incorporation documents, identification for shareholders and directors, proof of address, and other KYC materials. Foreign shareholders may experience longer review periods, particularly when cross-border investment structures are involved.

Common challenges for foreign founders during registration

Foreign founders often encounter additional notarization or apostille requirements, extended banking procedures, and delays in tax registration until the bank account is activated. These steps require planning but are manageable with experienced counsel.

Step 3: Getting Around Taxation and Financial Compliance in Israel

Once incorporated, startups must register with the Income Tax Authority, VAT Authority, and National Insurance Institute. Compliance obligations include maintaining accurate bookkeeping, submitting VAT reports, preparing annual tax returns, and managing payroll including pension contributions and withholding taxes.

Israel maintains several innovation-support programs designed to help companies conduct R&D, scale operations, and access global markets. These programs contributed to sustained ecosystem confidence during the year, especially in capital-intensive and regulated industries.

Founders often explore market opportunities and customer demand as part of their tax and financial planning processes.

Step 4: Licensing, Permits, and Sector-Specific Regulations

Different industries in Israel require different regulatory approvals. Understanding these requirements early helps founders avoid bottlenecks.

General business licenses

Digital-first and software-based startups often do not require municipal licenses. However, companies operating laboratories, production facilities, clinical environments, or physical retail or service locations may require local permits.

Industry-specific permits (biotech, defense tech, fintech)

Regulated industries include:

- Life sciences and health technologies, with approximately 1,600 companies working across medical devices, pharmaceuticals, and digital health

- Defense and homeland security technologies, which require export control approvals

- Fintech and insurtech companies, which must comply with AML, KYC, privacy, and cybersecurity requirements

Works involving sensitive data or regulated markets often require additional approvals from relevant ministries.

Collaborating with Israeli accelerators and innovation hubs

Accelerators, hubs, and innovation centers provide mentorship, pilot support, and commercialization pathways. The life sciences sector alone includes more than 75 hubs across Israel, offering startups access to laboratories, clinical partners, and research institutions. Israel also has more than 120 accelerators and dozens of multinational innovation centers to propel companies from early-stage ventures to scale-ready businesses within this environment.

Step 5: Get Intellectual Property Protection for Startups

Intellectual property strategy is essential to investment readiness and long-term competitiveness. Israeli law provides strong tools for managing IP rights.

Registering patents, trademarks, and copyrights in Israel

The Israel Patent Office handles patent applications, PCT national phase entries, and trademark filings. Copyright protection arises automatically upon creation but can be registered to strengthen enforcement.

The role of the Israel Patent Office

Founders rely on patent filings to secure rights and create defensible market positions. Formal registrations are especially important in deep tech, industrial technologies, and life sciences.

Protecting software, algorithms, and trade secrets

Software is usually protected by a combination of copyright, trade secret practices, internal security procedures, and contractual IP assignment agreements. Patent protection may apply to specific technical innovations.

IP ownership when founders or developers are overseas

Founders must ensure that employees and contractors assign IP rights to the company through written agreements. Investors verify IP ownership during funding rounds, so documentation must be clear and complete.

Step 6: Understand Employment and Labor Laws

Israeli labor laws create a structured framework that protects employees while supporting organizational flexibility. Startups must comply with requirements related to pension contributions, paid leave, notice periods, severance eligibility, and health and safety standards.

Shifts in talent demand further influence founder hiring decisions. By Q3 2025, R&D roles had declined while product, QA, and data positions increased significantly. These trends reflect a broader move toward commercialization and scale preparation across the ecosystem. Founders should plan hiring accordingly, prioritizing roles that support go-to-market and customer-facing functions.

Step 7: Understand Fundraising and Investment Regulations in Israel

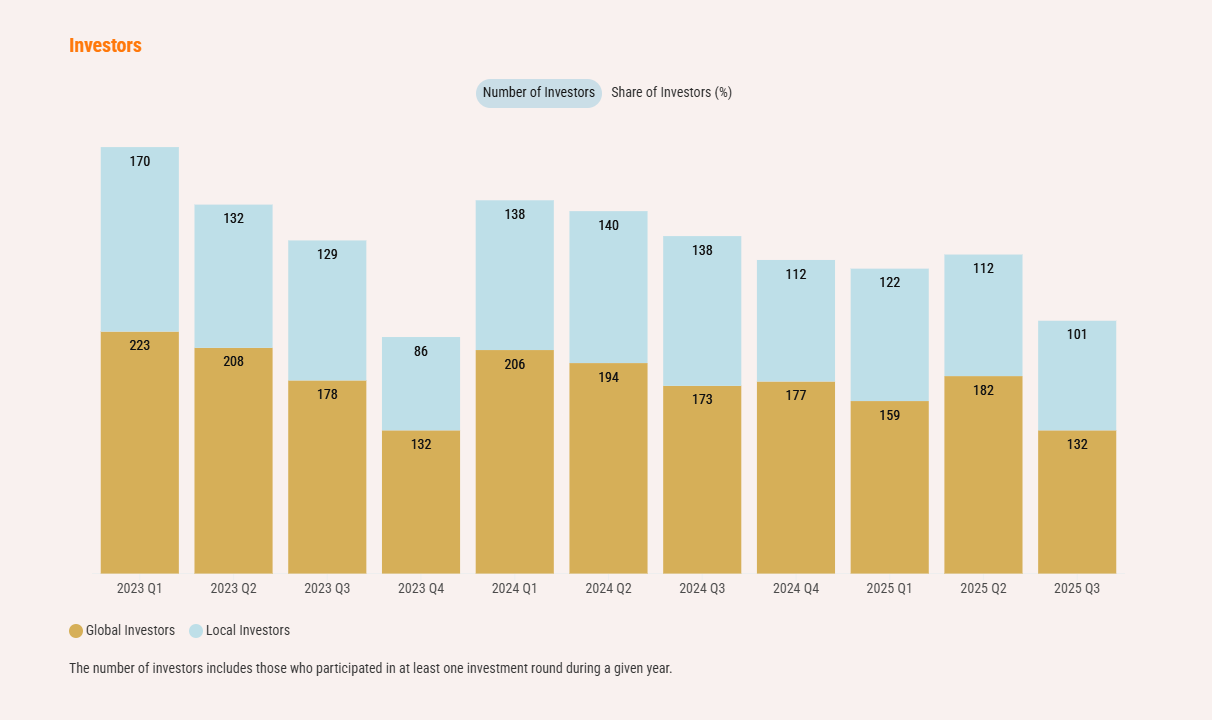

Israel’s investment market is sophisticated and globally connected. Through Q3 2025, private companies raised an estimated 11.9 billion dollars across the first three quarters. Although deal volume decreased, median round sizes increased, reflecting investor focus on companies with clear strategies and scalable technologies. Cybersecurity, industrial technologies, fintech, and business software remained strong sectors.

Investors look for evidence of:

- Product–market fit

- Efficient capital use

- Clear customer demand

- Strong governance and reporting

- Scalable systems and operations

Global investor participation also contributes to ecosystem strength. International partners continue to view Israel as a strategic innovation destination.

Practical Resources for Founders

Startup Nation Central’s Finder business engagement platform helps entrepreneurs understand the ecosystem and identify relevant partners. Finder provides real time insights into companies, investors, sectors, and opportunities across Israel’s innovation landscape.

Using Finder supports competitive research, customer identification, investor mapping, and partnership discovery, helping founders build stronger commercialization pathways.

Key Takeaways for Founders

- Israel entrepreneurship is defined by a dense and globally oriented innovation ecosystem.

- Investors prioritize clarity, operational discipline, and customer validation.

- Legal structure shapes governance, ownership, and fundraising options.

- Sector-specific regulations apply to life sciences, defense, fintech, and other specialized industries.

- Strong intellectual property management is essential for investment readiness.

- Israeli labor law requires compliance in payroll, pensions, leave, and equity administration.

- Startup Nation Central offers tools and insights to navigate the ecosystem effectively.

Founders FAQ

What is the most common legal structure for startups in Israel?

A Private Company Limited by Shares, which supports stock options, venture capital participation, and clear governance.

Can foreign founders start a business in Israel?

Yes, although foreign shareholders may require additional notarization and longer bank onboarding.

Do startups need a business license?

Digital-first companies often do not. Laboratories, manufacturing operations, and regulated services may require specific approvals.

How do I protect my intellectual property?

Through patents, trademarks, copyrights, trade secret practices, and written IP assignment agreements.

Which sectors in Israel attract the most interest?

Cybersecurity, industrial technologies, business software, and fintech continue to draw investor attention.

Where can I explore opportunities in the Israeli innovation ecosystem?

Startup Nation Central’s Finder platform provides real-time insights into companies, technologies, and investors.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle