Investment in Israeli Digital Health Companies Crosses the $1B Mark for the First Time

Finder

More capital was raised in the first six months of 2021 than in all of 2020. The average round size grew by more than 50% compared to last year, reaching $30M for later-stage rounds and $5M for early-stage rounds

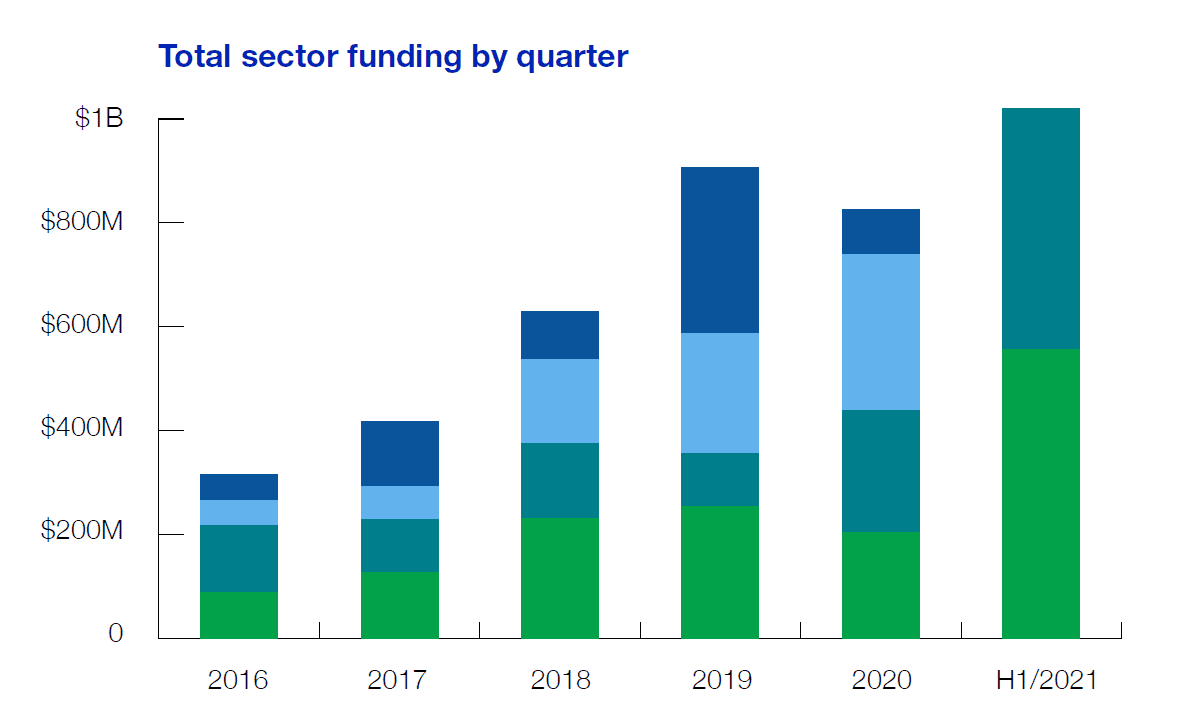

Start-Up Nation Central revealed in a new report that investments in companies operating in the Israeli Digital Health Sector crossed the $1B mark for the first time ever in the first half of 2021. Having raised a total of $1.021B in H1/2021, the sector has more than doubled (114%) the $438M raised in H1/2020 and already surpassed the full-year total of 2020 and also of 2019, which was the previous record year.

Data compiled on the Start-Up Nation Finder Innovation Business Platform found that the median round size of Israeli Digital Health Companies more than doubled from $4M in FY/2020 to $10.3 in H1/2021. The average amount raised in early-stage rounds stood at $5M in H1/2021 (compared to $3M in 2020) and in later-stage rounds, the average was $30M in H1/2021 (compared to $20M in 2020.)

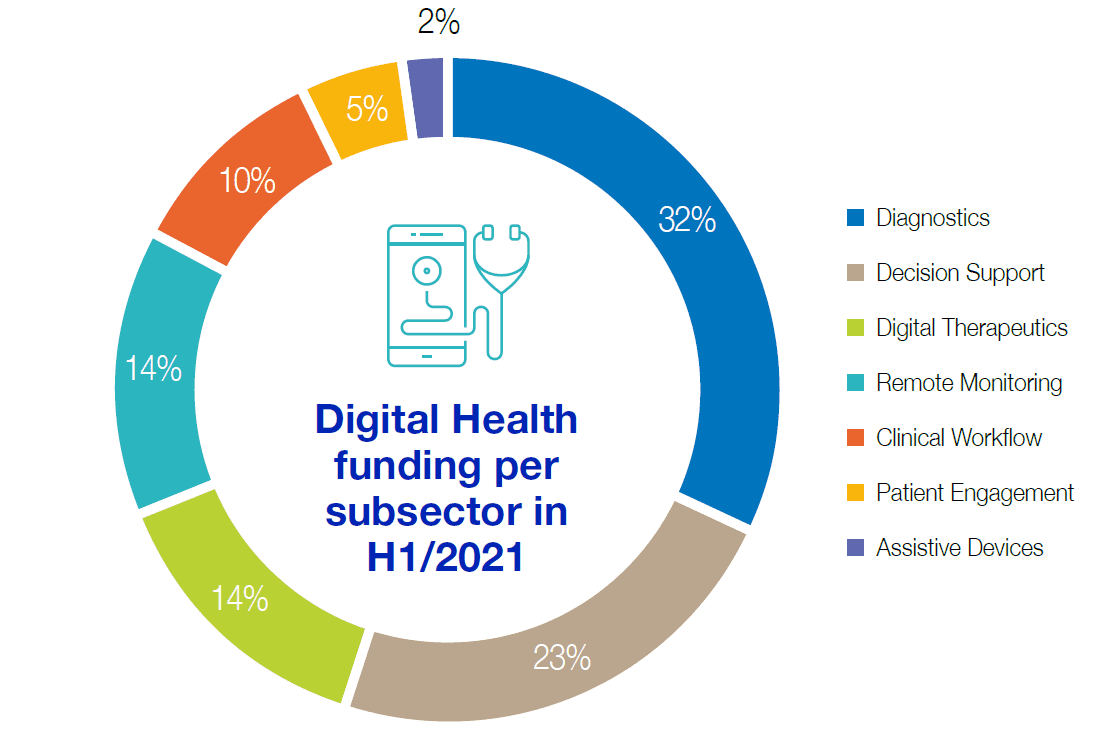

2021 sees far more diversification in investments in the Digital Health Industry

The first half of 2021 saw investment capital spread out much more evenly among the various Digital Health subsectors. The Big 3 subsectors (Remote Monitoring, Decision Support, Diagnostics) accounted for only 53% of the total amount raised compared to the historical 80%. The Digital Therapeutics subsector exhibited the largest growth, raising $147M, which triples the total amount raised by the subsector in 2020. The investment spree has made it the third most funded subsector after Diagnostics and Decision Support, overtaking Remote Monitoring, which had received a boost of investment in 2020 as a response to the COVID-19 pandemic.

2021 also saw a greater diversity in the sources of capital, with many new investors, both Israeli and foreign, Investing in the sector. These include local financial institutions like Poalim Capital Markets, VCs that haven’t focused on the Israeli Digital Health sector in the past, such as Hanaco Ventures, as well as large global VCs like IVP.

Start-Up Nation Central Digital Health Analyst Lena Rogovin: “The Israeli Digital Health sector broke the funding record on the back of record global investments, increased maturity of the sector, and reduced focus on COVID-19 solution alongside a greater emphasis on consumer health, as we forecast in our previous reports. We expect this trend to continue in the second half of the year driven by investors’ greater attention to previously overlooked subsectors and an improved understanding of the market needs as a result of recent global exits and large strategic partnerships that provide a benchmark for the entire market, including the Israeli ecosystem.”

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers