Israel’s Health Tech Ecosystem

Health Tech

Since its inception in 2013, Startup Nation Central has strategically focused on sectors that can meet the needs of emerging industries and global challenges. Our current focus areas, where we believe Israel enjoys a leading edge and can supply fertile ground for commercial growth, are Health Tech, Climate Tech, and Agritech.

Over the past few decades, Israel has established itself as one of the most technologically advanced countries in the world for digital health and health technology. With ranking first in the world for R&D expenditure as a share of GDP, the highest number of startups per capita, and advanced technological capabilities across a vast range of sectors including Artificial Intelligence, Big Data, Machine Learning, Computer Vision, 3D printing, and more.

All of these have applications in health care and as a result, Israel is home to a vibrant and flourishing Health Tech sector.

Why Israeli Health Tech?

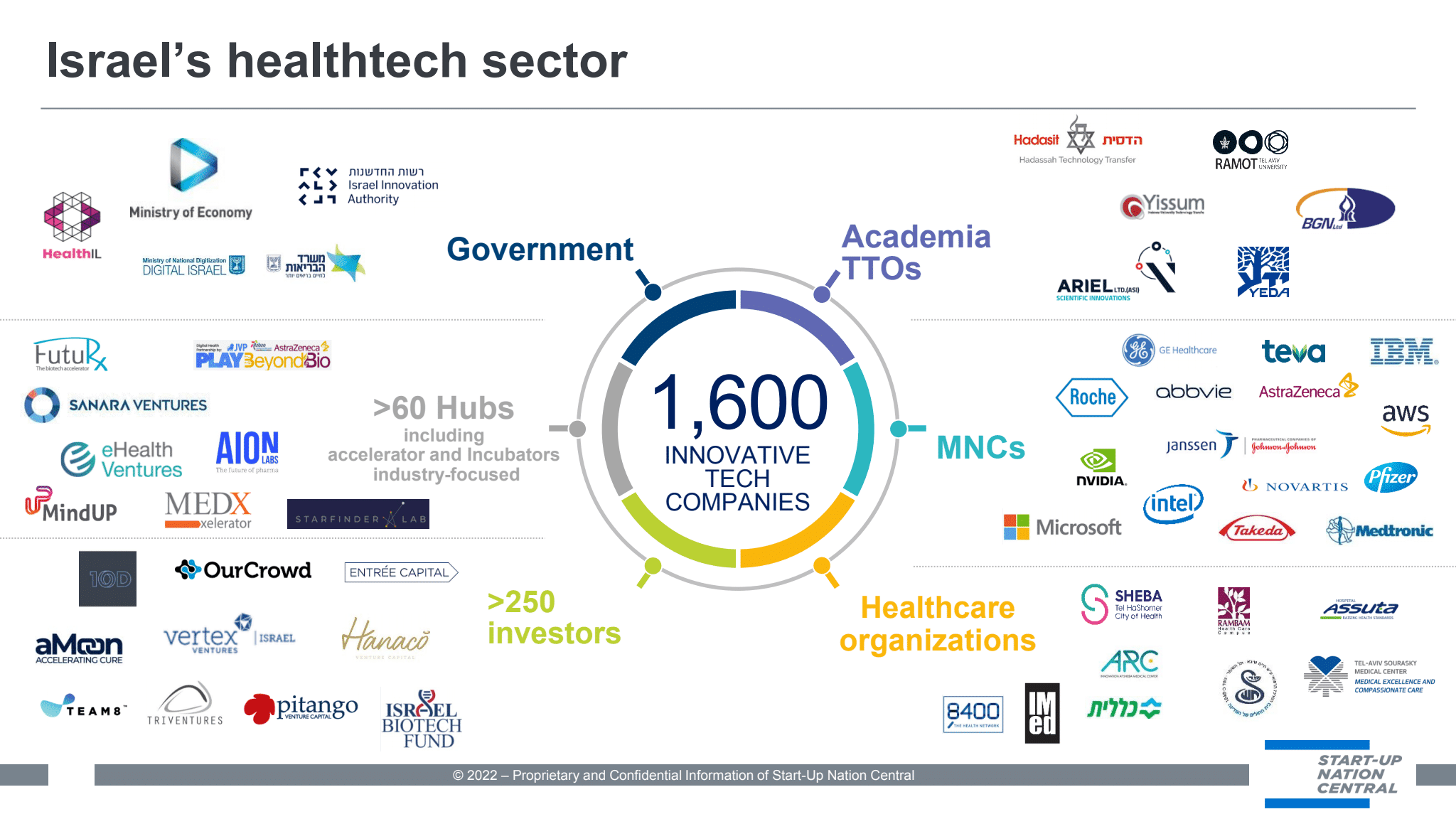

With roughly 1600 innovative Health Tech companies, as well as over 70 innovation hubs, dozens of R&D centers for multinational corporations and global tech companies, over 250 active VCs, and government support programs, the Israeli Health Tech ecosystem is a powerhouse of innovation.

Healthcare is currently the largest sector in the Israeli startup ecosystem, representing about 20% of all technology companies. In 2022, health startups raised USD 2 billion – a relatively modest decline of 27% compared to 2021. Health tech is ranked number 4th in the amount invested by sector.

Israel has a centralized, high-quality, community-based healthcare system. Over 98% of the population is covered by full health insurance and a majority has remained with the same linked electronic medical records (EMR) system for at least a decade. Israel’s four HMOs have been accumulating medical data for the last 25 years, nearly all of which is digitized, making Israel an ideal validation site for startups developing data-driven solutions.

An advanced public health system, entrepreneurial culture, human capital, a strong technological background, and a commitment to global partnerships to scale and grow the innovation economy make Israel attractive for health tech.

From Microsoft, IBM, AWS, and Google, to global pharma and health companies like Pfizer, AstraZeneca GE Healthcare, and Medtronic, many global health market leaders have already established a significant presence in Israel.

Mapping the Israeli Health Tech Ecosystem

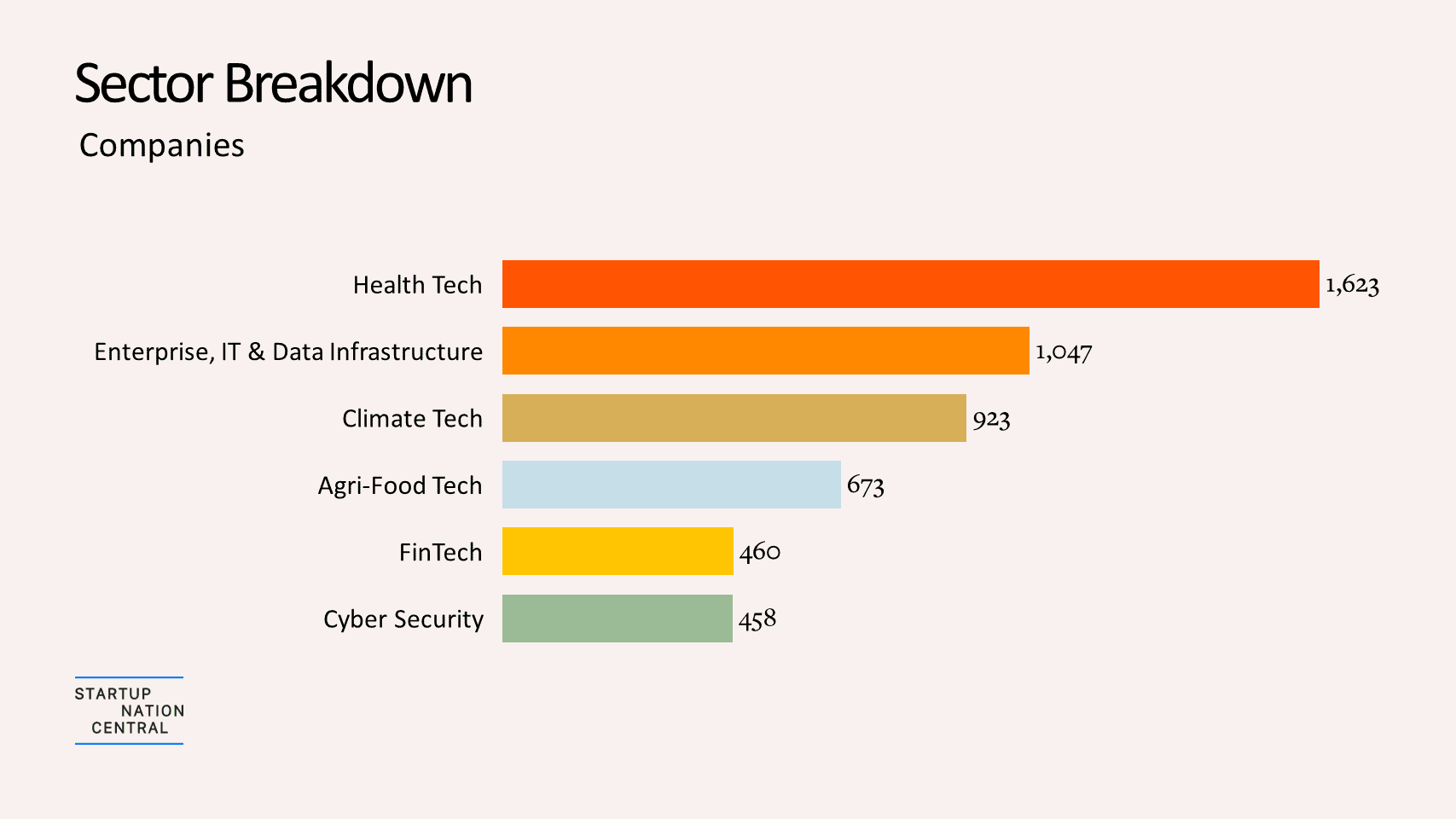

There are currently over 7300+ technology companies in Israel, according to our Finder Innovation Business Platform. Startups are the lifeblood of the innovation ecosystem, but to grow into the Startup Nation, additional stakeholders play an integral role. This is equally true for the booming health tech ecosystem.

There are over 1600 companies in the Life Sciences and HealthTech sector as of 2022. These companies are divided into three main sub-sectors (some of the companies belong to more than one sub-sector):

- Digital health (mainly software-based services and health service platforms) – 700 companies

- Development and manufacture of medical devices – 606 companies

- Pharma and biomedicine – 451 companies

Collaboration and Connection: The Key to Israel’s Health Tech Ecosystem

Israel’s health tech ecosystem thrives thanks to the collaborative efforts of various institutions, each contributing uniquely to its success. Venture Capital funds, innovation programs, multinational corporations, government initiatives, and academia, including Technology Transfer Offices, collectively create a robust infrastructure for innovation.

These components not only provide financial support and strategic guidance but also facilitate research commercialization, global market access, and technological validation. This multifaceted support network positions Israel as a global leader in health tech innovation, setting a solid foundation for startups to flourish and scale.

Venture Capital funds

In Israel, there are over 500 active VC funds in various tech sectors. These include both global and Israeli investors who recognize the tremendous potential and invest at various stages. In 2022, Israeli startups raised over USD 15B.

There are 250 active VCs in healthcare in Israel. The largest investors in this sector in 2022 are OurCrowd, which is invested in 20 startups, and eHealth Ventures, which is active in seven startups. They are followed by the Israeli fund aMoon and the American VC Insight Partners, invested in six startups respectively.

Innovation programs

Israel has one of the world’s most extensive incubator and accelerator networks for technology startups. There are over 150 incubators and accelerator programs, including over 70 healthcare-focused programs backed by global healthcare, pharmaceutical, and medical device companies all leveraging Israel’s unique health ecosystem.

Additionally, many incubators and accelerators are directly supported by government programs promoting early-stage entrepreneurship (such as Aion Labs, see case study below).

Multinational corporations

Over 500 MNCs including Google, Apple, Facebook, and Microsoft have established over 350 R&D Centers in Israel. This is the highest density of R&D centers outside Silicon Valley. From the perspective of the startups, MNCs in Israel have three important roles: access to global markets, a platform to validate their technologies, and educating the startup on trends, corporate challenges, and pain points.

MNCs active in the health sector are mainly from global pharma, and medical device companies, and include leading global corporations.

For example, the Health & Life Sciences groups at the Microsoft Israel R&D Center are building AI technologies and solutions for the healthcare domain, including language services, natural language processing technologies, conversational intelligence, and personal health assistants. They have recently developed a tool that helps doctors read unstructured text with Text Analytics for Health (TAFH), an Azure Cognitive Services application that uses artificial intelligence to translate medical data.

Another example is Google which launched a Verily Life Sciences (formerly Google Life Sciences) development center in Israel in 2021. Verily’s multidisciplinary teams have access to advanced research tools, large-scale computing power, and unique technical expertise focused on applying artificial intelligence techniques to important biomedical problems. The center advances early research conducted by Google Health and Jerusalem’s Shaare Zedek Medical Center, and is overseen by Shaare Zedek Scientific and the hospital’s Innovation Center.

Government

The Israeli government allocates significant resources and regulatory processes to support and encourage innovation. For example, “Yozma” was a venture capital initiative that leveraged public money to attract private investment, transforming the country into a global research and development hub.

Between 1993 and 1998, the government offered to match 40% of the money offered by private investors in combined funds, supporting more than 40 companies. The value of Yozma increased from $100 million in 1993 to $250 million by 1996, and the project is regarded as an example of government venture capital success.

In the health tech sphere, Israel has selected 19 programs for a new digital health initiative that will allow health organizations, such as HMOs, hospitals, and institutes, to build the digital infrastructure required for anonymized data-sharing and R&D collaborations with healthcare startups. Funding totaling NIS 100 million (about $30 million) for the three-year initiative is drawn from the National Digital Health Plan budget, currently under the purview of the Economy Ministry, as well as from the Health Ministry and the Israel Innovation Authority.

Academia and TTO (technology-transfer offices)

The ability to bring innovation from the lab to the commercial market is vital. Israeli TTOs have a remarkable track record, generating more revenue from IP sales than any other country except the United States. For example, Mobileye came out of research from Hebrew University in Jerusalem and was acquired by Intel in 2017 for $15.3 billion.

In the Israeli health tech sector, every hospital, HMO, and the university has a Tech Transfer Office (TTO) that helps bring innovation from academia to the market. The TTOs are a significant player in bringing outstanding solutions from the most advanced research institutions to the healthcare industry, connecting knowledge and research to scalable productization.

Health Tech Case Study: AION Labs

A powerful example of the unique character of the Israeli health tech sector is AION Labs. An alliance of pharma and health leaders from AstraZeneca, Merck, Pfizer, Teva, the Israel Biotech Fund, and Amazon Web Services (AWS), the goal of AION Labs is to create and adopt new AI technologies that will transform the process of drug discovery and development, contributing to the health and wellbeing of people worldwide. The consortium is additionally supported by the Israel Innovation Authority, and located within the Israeli biotech hotspot in Rehovot adjacent to Weizmann Institute for Sciences

This is a paradigm of the Israeli health tech ecosystem: four global pharma companies, an investment fund, and a huge tech multinational corporation, supported by the government and in collaborating with the academy, all working together to tackle one of the biggest global challenges in pharma with the help of AI.

As Mati Gill, AION Labs CEO, explains:

“As the Biotech industry places more emphasis on the ‘tech’ part of the equation, and artificial intelligence, machine learning, and computational technologies are increasingly integrated into the processes of development and discovery of drugs, that’s where Israel can be competitive at a global scale and that is what helped to attract our amazing group of partners to come together and establish AION Labs in Israel.”

Creating connections, creating opportunities

At Startup Nation Central we know how difficult it is to implement open innovation in big corporations – we are here to help find the right solutions to specific challenges. Our team has held upwards of 500 corporate engagements, which have led to scores of business outcomes, including investments, joint ventures, technology pilots, POCs, commercial agreements, and the establishment of local R&D and innovation centers – and we’ve only just begun.

Sharon Gour Arie

Global Partnerships Manager @Start-Up Nation Central

Sharon guides MNCs, NGOs, and worldwide organizations in defining pressing problems and growth challenges, finding the technologies to match those pain points, and creating/maintaining the best relationships in the Israeli innovation ecosystem.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers