Israel did not become a global tech hub by following a familiar script. There was no large domestic market to scale into, no abundance of natural resources, and little tolerance for slow experimentation. What emerged is an ecosystem shaped by constraint, speed, and a clear expectation that technology must solve real problems, quickly and at global scale. Israel’s tech hub status is driven by the interaction of policy, culture, talent formation, and institutional design, which together produce outcomes like high startup density, deep tech strength, and major exits.

This context matters. Israel’s technology success is often summarized through statistics, startups per capita, R&D intensity, or headline exits. Those metrics are meaningful, but they are outcomes, not the drivers. The deeper story sits at the intersection of policy, culture, talent formation, and institutional design, all reinforcing one another over decades. Because high tech is so deeply integrated into Israel’s economy, it contributes roughly 20% of GDP, over 50% of exports, and around 12% of total employment.

Today, Israeli technology is embedded across global infrastructure. From cybersecurity platforms and AI systems to semiconductors, digital health, energy technologies, and climate solutions, Israeli companies build foundational tools used worldwide. Multinational corporations rely on Israeli R&D for core products, global investors return across market cycles, and startups are designed from day one for international relevance.

Israel’s Global Tech Reputation

Israel’s standing in global technology is the result of long-term structural choices rather than short-term momentum. Its reputation has been shaped by consistent performance across innovation metrics, sustained global demand for its technologies, and the ability of its companies to integrate into international markets at scale.

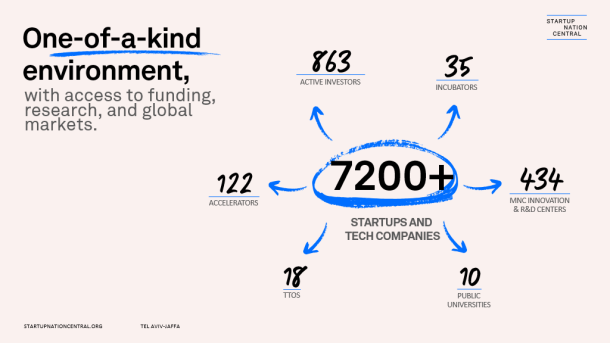

Israel is consistently recognized as one of the world’s most innovation-dense economies. With more than 7,000 active startups and tech companies, it ranks among the top countries globally for startups per capita and venture capital investment per capita. What differentiates Israel is not just volume, but integration. The ecosystem operates as a tightly connected network where founders, investors, researchers, policymakers, and multinational partners interact constantly. Geographic proximity shortens feedback loops, while cultural norms favor direct communication and rapid decision-making.

Israel’s reputation has also been shaped by its role as a technology supplier rather than a consumer market. Israeli companies often build infrastructure-level solutions that power global industries, embedding the ecosystem deeply into international value chains

What Makes Israel a Leading Technology Hub

Israel’s role as a technology hub rests on a combination of policy incentives, talent pipelines, a dense ecosystem, deep tech sectors, and sustained global demand. Dense networks, high research intensity, and early global orientation allow innovation to move quickly from concept to commercialization.

Global Ranking

Israel consistently ranks at or near the top of global innovation indices. It leads the world in R&D expenditure as a percentage of GDP, investing approximately 5% to 6% annually. It also ranks among the top countries for venture capital investment intensity and the number of companies listed on NASDAQ outside the United States.

Beyond rankings, Israel has built a reputation for reliability in complex technologies. Global corporations look to Israel for solutions in areas where failure is not an option, including cybersecurity, defense-related technologies, data infrastructure, and advanced computing. This trust has translated into long-term commitments from multinational companies, with nearly 450 innovation and R&D centers operating in Israel.

Startup Density and Innovation Output

Israel’s startup density is one of the highest in the world. The country’s compact size enables unusually fast ecosystem interactions. Founders can meet investors, academic experts, pilot customers, and regulators within a single day. This density shortens feedback loops between founders, investors, academia, regulators, and multinationals, reducing time to market and increasing the rate of successful exits.

Innovation output is visible across the company lifecycle. Israel produces a steady pipeline of early-stage startups alongside mature scale-ups capable of operating globally. Successful exits, whether through IPOs or acquisitions, recycle experienced talent and capital back into the ecosystem, reinforcing long-term sustainability.

Deep Tech Leadership in Israel

Deep tech is where Israel’s ecosystem shows its greatest differentiation. The country has built durable advantages in sectors that demand advanced engineering, long development timelines, and high technical risk, areas where trust, talent depth, and institutional support matter most. Israel’s strongest differentiation appears in deep tech sectors such as cybersecurity, AI infrastructure, semiconductors, and health tech, all of which depend on long-term R&D, data-intensive validation, and complex engineering capabilities.

Strength in AI, Cybersecurity, Semiconductors

Israel’s global standing is particularly strong in deep tech. Cybersecurity remains the most recognized sector, with Israeli companies protecting cloud infrastructure, enterprise systems, financial platforms, and critical assets worldwide. Many of these capabilities originate from elite military technology and intelligence units, where engineers gain early exposure to real-world threats and large-scale systems and later translate that experience into scalable cybersecurity and AI infrastructure companies.

Artificial intelligence has become a central growth engine across the ecosystem. Israeli AI companies focus heavily on infrastructure, data platforms, developer tools, and applied enterprise solutions. This emphasis aligns with global demand and positions Israeli firms as core technology providers, especially for organizations seeking robust AI infrastructure and mission-critical applications.

Semiconductors represent another strategic strength. Israel specializes in chip design, verification, AI accelerators, and advanced architectures, while fabrication largely happens abroad. Israeli teams design some of the world’s most sophisticated chips. Global leaders including Intel, NVIDIA, and Apple each operate major semiconductor R&D centers in Israel, alongside a growing cohort of local semiconductor startups.

Life Sciences and Health Tech Expansion

Life sciences is the largest sector in Israel’s tech ecosystem, accounting for roughly 20% of all tech companies. More than 1,600 companies operate across digital health, medical devices, pharmaceuticals, and biotech, with many positioned at the intersection of data, AI, and clinical practice.

Israel’s national healthcare system plays a critical role. Universal coverage, four integrated health maintenance organizations, and more than two decades of digitized medical records create an environment well suited for clinical validation and data-driven innovation. Collaboration between hospitals, academia, startups, and government agencies shortens the path from research to commercialization, supporting sustained growth in health tech.

Position Compared to Other Global Tech Hubs

Israel does not compete with major hubs like Silicon Valley or New York on scale. Instead, it differentiates through specialization, efficiency, and depth. Compared to hubs such as London, Berlin, or Singapore, Israel shows higher startup density and a stronger concentration in foundational technologies.

Israeli startups are built for global markets from inception. Limited domestic demand pushes founders to engage international customers early, shaping products that address universal enterprise needs rather than local preferences.

The Talent Engine Behind Israel’s Success

Talent formation in Israel is systemic. Education, military service, academia, and industry are closely linked, creating a continuous pipeline of technical expertise, leadership capability, and entrepreneurial readiness. The typical flow runs from education and universities → military technology units → industry R&D centers → startup formation and scale-ups, forming a repeatable path from training to venture creation.

Academic Excellence

Israel’s universities are central to its innovation engine. Institutions such as the Technion, Tel Aviv University, and Hebrew University rank among the world’s leading research centers in engineering, computer science, physics, and life sciences.

Technology transfer offices at universities such as the Technion, Tel Aviv University, and Hebrew University regularly spin out startups and license IP into industry. Close collaboration between academia and industry ensures that research addresses applied challenges, while students graduate with both theoretical knowledge and practical experience.

Cultural Drivers of Entrepreneurship

Cultural factors also play a decisive role in shaping Israel’s startup environment. Israeli society tends to value directness, debate, and questioning authority. Directness, debate, and tolerance for failure lead to flatter hierarchies, faster feedback, and more rapid iteration in startups.

Mandatory military service further contributes to leadership development and technical training at a young age. Mandatory service, particularly in elite technology and intelligence units, provides early hands-on experience with large-scale systems, which later translates into founders who build scalable cybersecurity and AI infrastructure companies. For Israelis, failure is generally viewed as a learning step rather than a stigma. This mindset lowers barriers to experimentation and encourages founders to tackle complex problems with confidence.

Major Tech Cities and Their Specializations

Innovation in Israel is geographically distributed rather than centralized in a single city. Each major tech hub has developed distinct sector strengths, shaped by academic institutions, military presence, and long-term industrial investment. Tel Aviv is most associated with startups and venture capital, Haifa with semiconductors and robotics, Jerusalem with life sciences, and Beersheba with cybersecurity and AI, creating a clear location-to-specialization map across the country.

Tel Aviv: Core Startup Hub

Tel Aviv is the center of Israel’s startup activity. It hosts the highest concentration of early-stage startups, venture capital firms, accelerators, and coworking spaces. The city’s international outlook and dense professional networks make it the primary gateway for global engagement.

Haifa: Chip Design and Engineering R&D

Haifa is Israel’s primary hub for semiconductor and chip design R&D, underpinned by the Technion and long-standing multinational centers from Intel and other global firms. Haifa anchors Israel’s hardware and deep engineering ecosystem. Supported by the Technion and multinational R&D centers, the city specializes in semiconductors, robotics, and advanced manufacturing technologies.

Jerusalem: Emerging Research and Tech Parks

Jerusalem combines academic research with a growing startup scene focused on life sciences, medtech, and applied research. Government-backed incubators and innovation districts support commercialization and scale, especially in health tech and research-intensive ventures.

Beersheba: AI and Cyber Innovation

Beersheba has emerged as a center for cybersecurity and AI, driven by the presence of military intelligence units and Ben-Gurion University. The city increasingly serves as a testing ground for advanced security technologies and data-driven infrastructure solutions.

Investment and Economic Impact

Capital flows reflect confidence in Israel’s ability to generate globally relevant technology. Venture investment, exits, and public market activity demonstrate how innovation translates into measurable economic contribution. Capital flows into Israeli tech convert into economic impact via new high-skilled jobs, export growth, and high-value exits that recycle capital back into the ecosystem.

Venture Capital

Israel consistently attracts significant venture capital relative to its size. Global investors participate in the majority of funding rounds, alongside a mature local venture ecosystem that supports companies from seed through growth stages.

In 2024, Israeli tech companies raised approximately $12B in private funding, signaling renewed momentum after a global slowdown. This places Israel among the leading tech ecosystems globally in funding intensity relative to population and GDP. Funding trends in 2025 continued to reflect strength, driven by late-stage rounds and increased global participation.

Major Exits

High-profile exits reinforce Israel’s reputation as a source of strategic technology. The $32B acquisition of Wiz by Google in 2025 highlighted the value of Israeli-built platforms in cybersecurity and cloud infrastructure. The Wiz acquisition illustrates how Israeli cybersecurity and cloud infrastructure companies can become strategic assets for global platforms.

Government and Institutional Support

Government policy plays a consistent enabling role. The Israel Innovation Authority provides grants, incubator programs, and R&D incentives designed to reduce early-stage risk while maintaining market discipline.

Organizations and Platforms Supporting Innovation

Israel’s ecosystem is supported by institutions designed to reduce friction between innovation and adoption. These organizations provide structure, data, and connectivity, enabling global partners to engage efficiently with Israeli technology. These institutions act as connective tissue, matching global demand with Israeli technology supply and helping solutions scale faster.

Israel Innovation Authority

The Israel Innovation Authority supports research, early-stage development, and international collaboration across sectors and stages. It operates as a central policy and funding instrument, helping transform early research and prototypes into investable companies.

Startup Nation Central

Startup Nation Central is a nonprofit organization that strengthens Israel’s economy by connecting global corporations, investors, governments, and solution seekers with Israeli innovation. Startup Nation Central is a nonprofit that connects global corporations, investors, governments, and solution seekers with Israeli tech companies through data, insights, and matchmaking. It provides impartial, data-driven access to the ecosystem and facilitates partnerships that translate innovation into impact.

Startup Nation Finder and Data Tools

Data platforms and ecosystem tools such as Startup Nation Finder give global stakeholders a structured view of Israeli startups, sectors, and trends. By turning ecosystem information into searchable, comparable data, they make it easier to identify relevant partners and opportunities.

Global Partnerships and Future Outlook

Israel’s innovation model is increasingly defined by international collaboration. As global challenges grow more complex, Israel’s ecosystem continues to evolve toward deeper partnerships, scalable platforms, and long-term technological relevance.

International Innovation Bridges

Bilateral R&D programs, multinational partnerships, and joint ventures connect Israeli startups with markets across North America, Europe, Asia, and the Middle East. These bridges accelerate scale and embed Israeli technology into global supply chains. These international bridges also diversify Israel’s markets and embed its technologies into global infrastructure, making the hub more resilient over time.

Trends in Deep Tech and AI Development

Future growth is expected to concentrate around deep tech, AI infrastructure, climate technologies, and digital health. Investment patterns increasingly favor scalable platforms and infrastructure, reflecting ecosystem maturity and global demand. Looking ahead, Israel’s growth is expected to concentrate further around scalable deep tech platforms, AI infrastructure, climate technologies, and digital health, driven by global demand and the ecosystem’s increasing specialization.

How the Pieces Fit Together

Israel’s tech hub emerges from an interconnected system: policy and the Israel Innovation Authority de-risk early R&D; universities and military technology units produce advanced talent; multinational R&D centers and venture capital supply capital and markets; and startups translate this into deep tech sectors like cybersecurity, AI infrastructure, semiconductors, and health tech. Together, these elements drive measurable outcomes in GDP, exports, high-value jobs, and global-scale exits, reinforcing Israel’s position as a long-term innovation partner.

Key Takeaways

- Israel’s position as a global tech hub is the result of long-term ecosystem design, not short-term trends. Policy, culture, talent, and capital have evolved together over decades.

- High tech is a core economic engine for Israel, contributing roughly 20% of GDP, over 50% of exports, and a significant share of employment.

- Israel’s strength lies in deep tech sectors such as cybersecurity, AI infrastructure, semiconductors, and health tech, where advanced engineering and real-world validation are critical.

- The startup ecosystem benefits from extreme density. Founders, investors, academia, government, and multinational corporations operate in close proximity, accelerating iteration and scale.

- Talent formation is systemic. Universities, military service, and industry collaboration create a continuous pipeline of technical expertise and leadership.

- Israeli startups are global from inception. Limited domestic market size drives early international engagement and product design for global customers.

- Universities, the Israel Innovation Authority, Startup Nation Central, and multinational R&D centers each play distinct but complementary roles in the tech hub, forming a coordinated network that links research, capital, and market access.

- Looking ahead, Israel’s growth is expected to concentrate further around scalable deep tech platforms, AI infrastructure, climate technologies, and digital health, driven by global demand and ecosystem maturity.

FAQs

Why is Israel a global tech hub?

Israel combines high R&D investment, dense startup activity, advanced engineering talent, and early global market orientation. These factors work together to produce globally relevant technology at scale.

How many startups are in Israel?

Israel has more than 7,000 active startups and tech companies across sectors such as cybersecurity, AI, health tech, semiconductors, climate tech, and enterprise software.

What industries is Israeli tech strongest in?

Israel is strongest in cybersecurity, AI infrastructure, semiconductors and chip design, digital health, medical devices, and enterprise software.

How does Israel support innovation?

Innovation is supported through targeted government R&D grants, strong academic research, military-driven technical training, and a mature venture capital ecosystem.

What is Startup Nation Central?

Startup Nation Central is a nonprofit organization that connects global corporations, investors, governments, and solution seekers with Israeli innovation through data, insights, and partnerships.

Are Israeli startups focused on global markets?

Yes. Due to a small domestic market, Israeli startups are built for international customers from day one and scale globally early.

Why do multinational companies invest in Israel?

Multinationals invest in Israel to access advanced R&D, deep tech expertise, and startups building foundational technologies for global platforms.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle