Israeli FinTech’s Explosive Q3

Finder

Companies raised $1.5B in the last quarter, surpassing the 2020 total in a three-month period

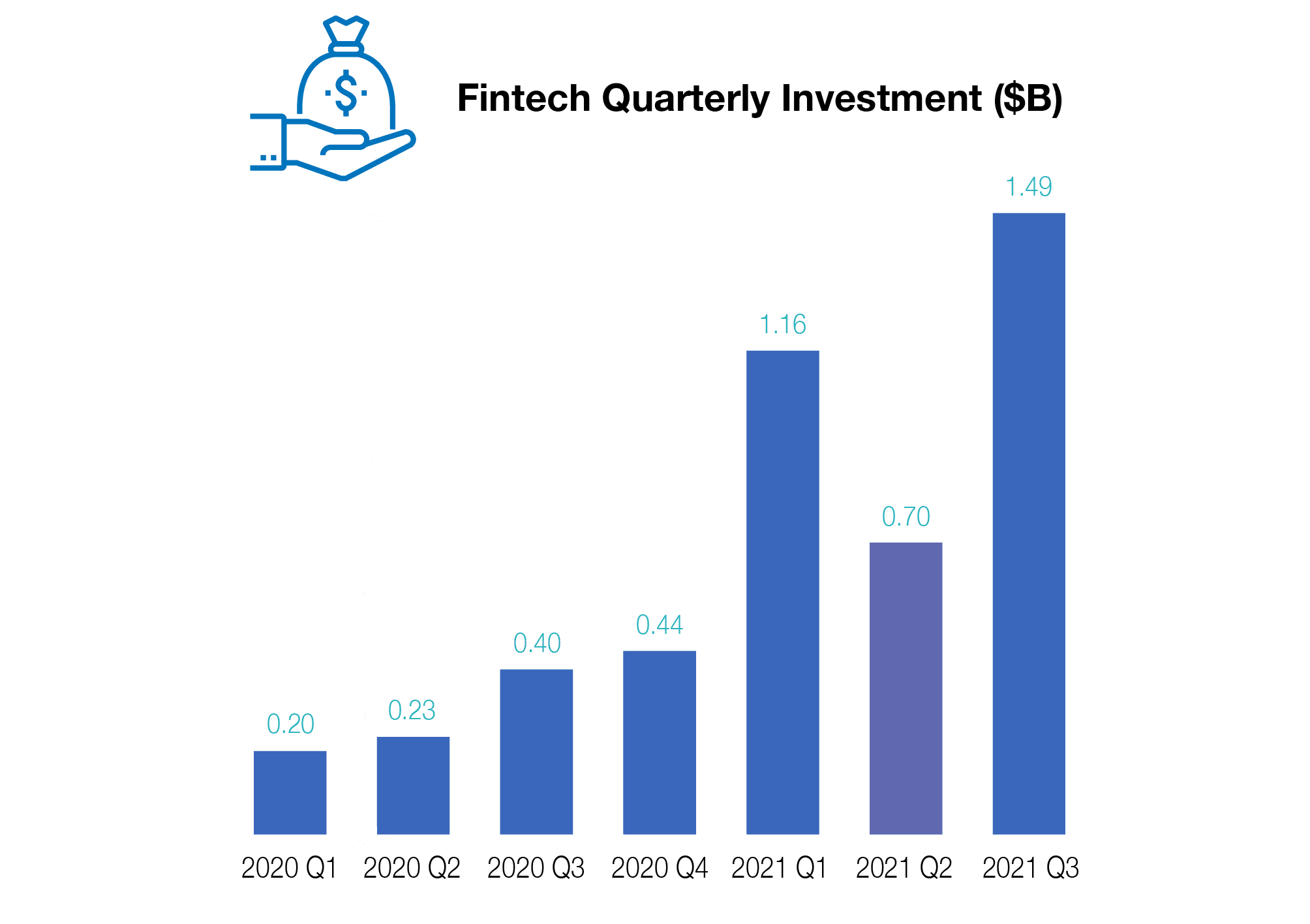

The Israeli FinTech sector had an incredible Q3 in terms of equity investments, with 25 rounds raising an accumulated $1.5 billion. This record-breaking quarter alone surpassed the $1.3 billion raised throughout all of 2020 and brings the YTD 2021 total to $3.4 billion — a 160% increase from last year, with nearly three months still left to go in the year.

The massive influx of investment has also entrenched FinTech as one of the leading sectors in the Israeli innovation ecosystem. Last year, investments in FinTech companies made up 12% of the total funding raised by Israeli companies; in Q3/2021, its share of the pie climbed to 18%. FinTech is currently the third largest sector in terms of investment share, following Security Technologies (25.2%), and Enterprise IT & Data Infrastructure (23.5%).

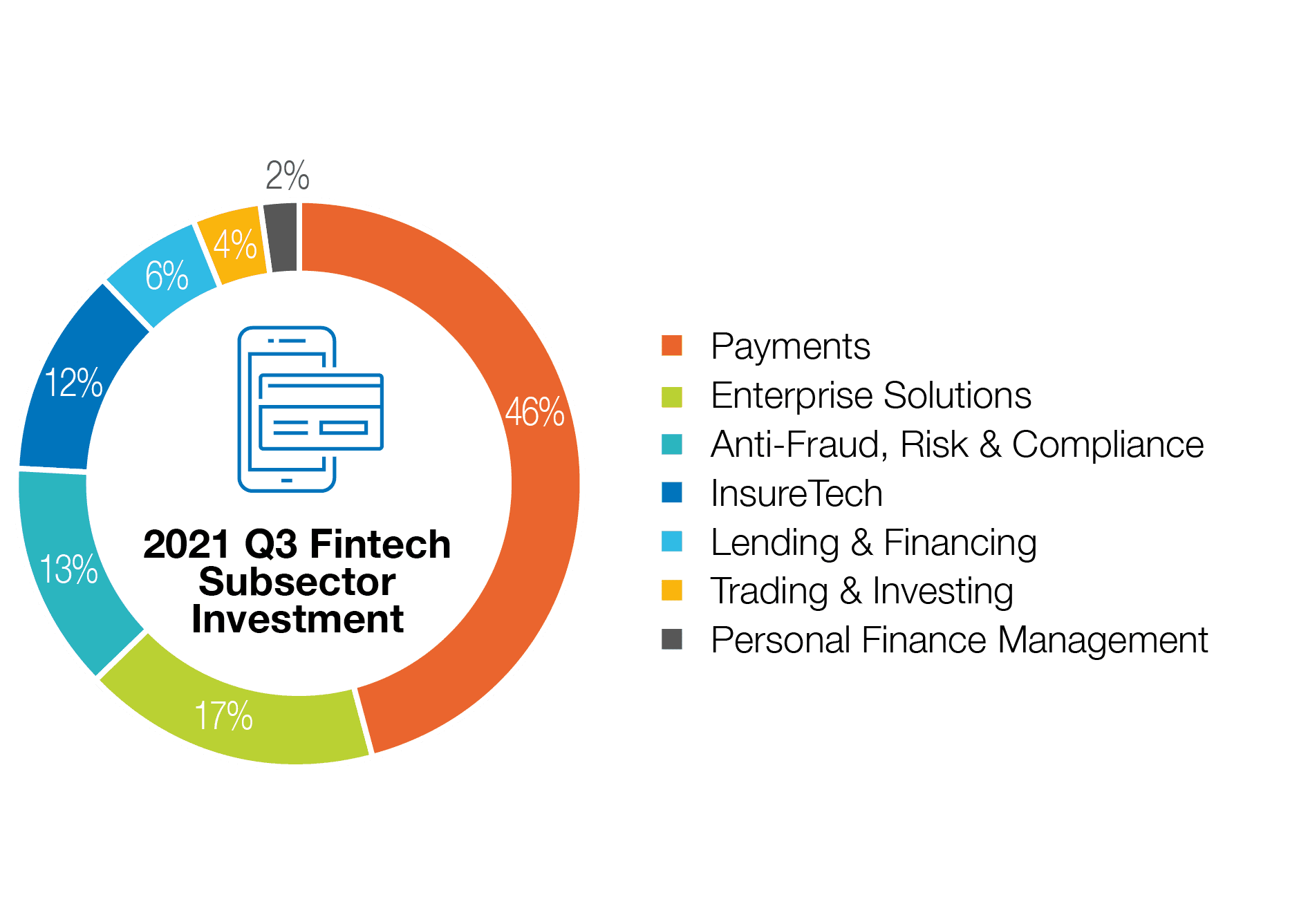

The subsector that’s powering this upsurge is Payments, which encompasses technologies such as APIs, AI, cryptography, and cyber to bring technological solutions to the world including cross-border networks, digital wallets, anti-fraud verification, and flexible payment options. This subsector already received more than triple the funding it did in 2020, an increase attributed primarily to the COVID-induced need for digital innovation and the impressive, relevant technological solutions these companies enable. A prime example is payments company Rapyd, which became Israel’s highest-valued private tech company, after raising a $300 million series E round at a valuation of $10 billion in August.

Rapyd is far from the only Israeli FinTech company to raise massive funding rounds last quarter. Q3/2021 alone saw five companies raise mega-rounds (over $100 million), pushing the number of mega-rounds so far this year to 12. Last quarter’s standout funding rounds were carried out by Behalf ($100M), At Bay ($185M), Melio ($250M), Rapyd ($300M), and Fireblocks ($310M). This is a substantial development as only five companies raised mega-rounds in all of 2020.

Funding so far this year has provided promising results for younger Israeli FinTech companies, with a 56% increase in early-stage rounds (pre-seed, seed, and series A) compared to last year. This suggests that there is an exciting pipeline of younger FinTech companies on their way.

With the local ecosystem showing no signs of cooling down, Israel is strengthening its position as a global FinTech powerhouse just at the time that the need for such solutions is at peak demand.

To learn more about the Israeli FinTech ecosystem visit our website and the Finder business innovation platform.

Nicole Krieger, Fintech Sector Lead at Start-Up Nation Central contributed to this report. you can reach out to her on LinkedIn

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers