Israeli Innovation in War: A Year of Resilience

Finder

Since the outbreak of the war on October 7th, 2023, Israel’s tech sector has been tested by unprecedented challenges. Despite disruptions ranging from workforce reductions to funding uncertainties, the ecosystem has shown resilience and adaptability. Israeli innovation has persevered over the past year, providing insights into key trends, achievements, and the obstacles that lie ahead.

Israel’s tech sector is a critical component of its economy, accounting for 18% of the GDP and nearly half of its exports. The events of October 2023 created immediate challenges, with approximately 15-20% of the tech workforce drafted for military duty. Despite these disruptions, Israel’s high-tech sector, long known for its agility, responded by reorganizing resources, ensuring continuity in global operations, and maintaining investor confidence.

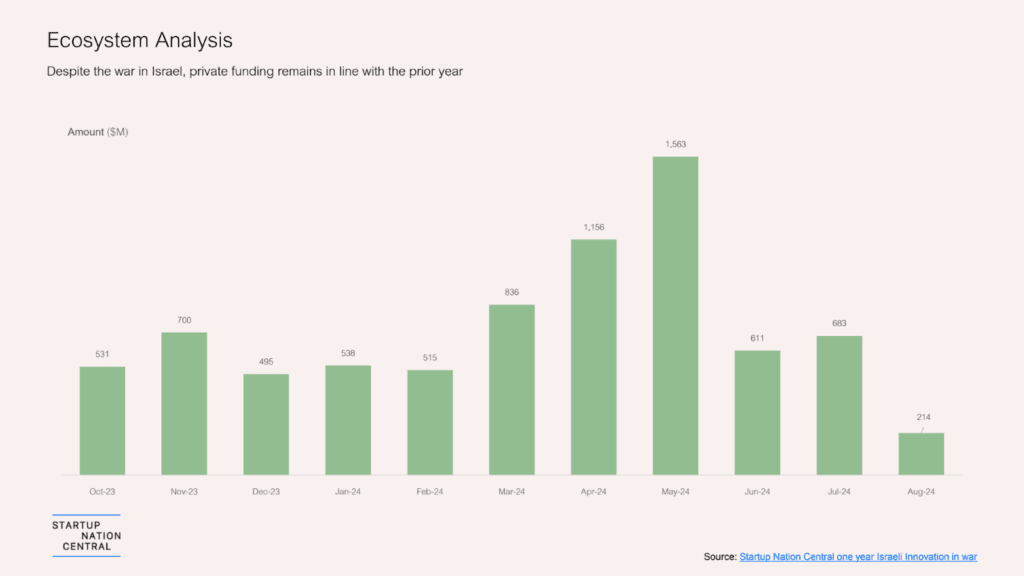

Private Funding: Staying Strong

One of the most notable indicators of the tech sector’s resilience is private funding. In the months following the outbreak of war, Israeli companies raised $7.8 billion across 577 rounds. Though this represents a 4% drop from the previous year, it highlights sustained investor confidence despite a broader global decline in tech funding. This funding included several mega rounds exceeding $100 million, a testament to the maturity and continued appeal of Israel’s tech industry, particularly in cybersecurity.

Mergers and Acquisitions: A Rebounding Market

M&A activity similarly reflects the ecosystem’s strength, with $9.6 billion in deals completed across 73 events. Though slightly down from $10.6 billion the previous year, the numbers reveal a quick recovery from the immediate impact of the conflict. Sectors such as cybersecurity and health tech led the way, with notable exits like Talon Cyber Security and CartiHeal bringing confidence to global investors.

Regional Disparities and Relocation

While the overall picture for Israeli tech remains positive, the war has created significant disparities across different regions of the country. Tech companies in northern Israel have faced greater challenges, with nearly 40% of businesses in the region considering relocation due to heightened security risks. Funding for northern startups has become harder to secure, with 69% of companies in the region expressing concern about future investment prospects.

Sector-Specific Insights: Cybersecurity, Health Tech, and More

Israel’s cybersecurity sector continues to shine, attracting significant attention from investors both at home and abroad. Companies like Wiz, which raised nearly $1 billion in one round, exemplify the sector’s strength. Cybersecurity has become a core pillar of the Israeli innovation ecosystem, with nine mega-rounds in this sector alone.

In health tech, despite workforce shortages and logistical disruptions, companies have continued to innovate and attract capital. Israel’s health tech sector remains robust, with 47 private rounds in the last year. Digital health technologies, medical devices, and AI-driven diagnostics continue to push the sector forward, positioning Israel as a global leader in life sciences innovation.

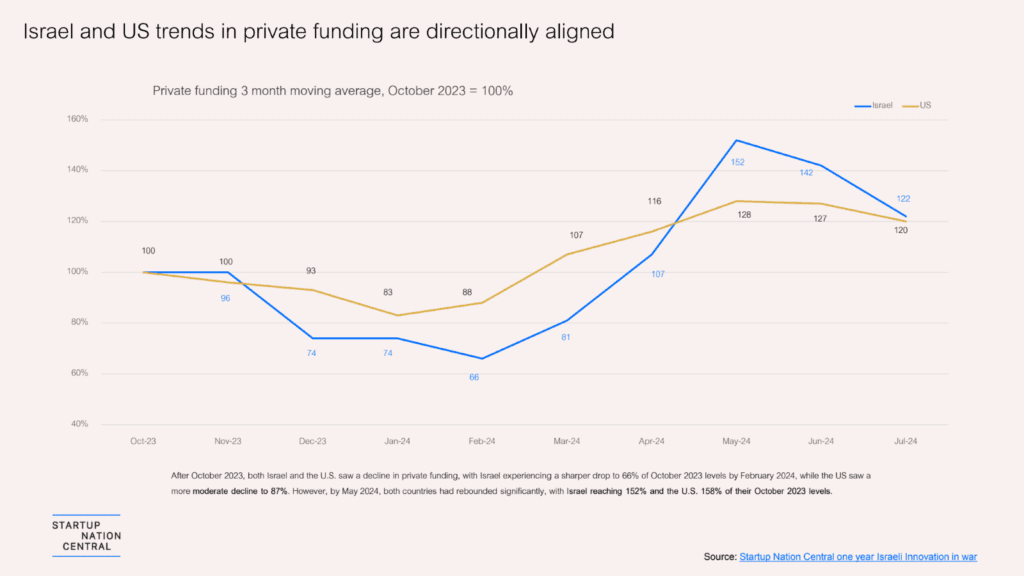

U.S. and Israeli Tech Funding Trends Stay Aligned

One notable observation from the past year is that private funding trends in Israel closely mirrored those in the U.S., despite the regional geopolitical challenges. Both ecosystems experienced declines in investment following the conflict, but their recovery patterns were in sync. For example, by February 2024, Israel’s private funding dropped to 66% of October 2023 levels, while the U.S. experienced a more moderate decline to 88%. However, by May 2024, both countries rebounded, with Israel reaching 152% of October 2023 levels and the U.S. climbing to 128%. This alignment demonstrates that, despite the unique challenges Israel faces, its tech ecosystem continues to perform on par, reinforcing its global competitiveness.

Challenges Ahead: Uncertainty in Government Support

Despite the positive developments, there remains significant concern about the Israeli government’s role in the sector’s future growth. An ecosystem survey we conducted in mid-2024 revealed that over 80% of companies doubt the government’s ability to lead the recovery. The absence of a long-term strategy for academic research, budget planning, and innovation infrastructure exacerbates this uncertainty, potentially threatening the sector’s future.

Nevertheless, the Israeli tech ecosystem remains optimistic: 54% of companies are confident about their ability to expand in the coming year. Additionally, 56% of companies believe in the ecosystem’s resilience, with most investors sharing this optimism. The war has also spurred new forms of innovation, particularly in areas directly impacted by the conflict. From defense technologies to remote work solutions, Israeli startups are pivoting quickly to address both immediate and future challenges.

As Israeli tech companies navigate these challenges, the world will continue to look to its innovators for bold, impactful solutions.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers