Israeli institutional investors bursting onto the local VC scene

Tech Innovation

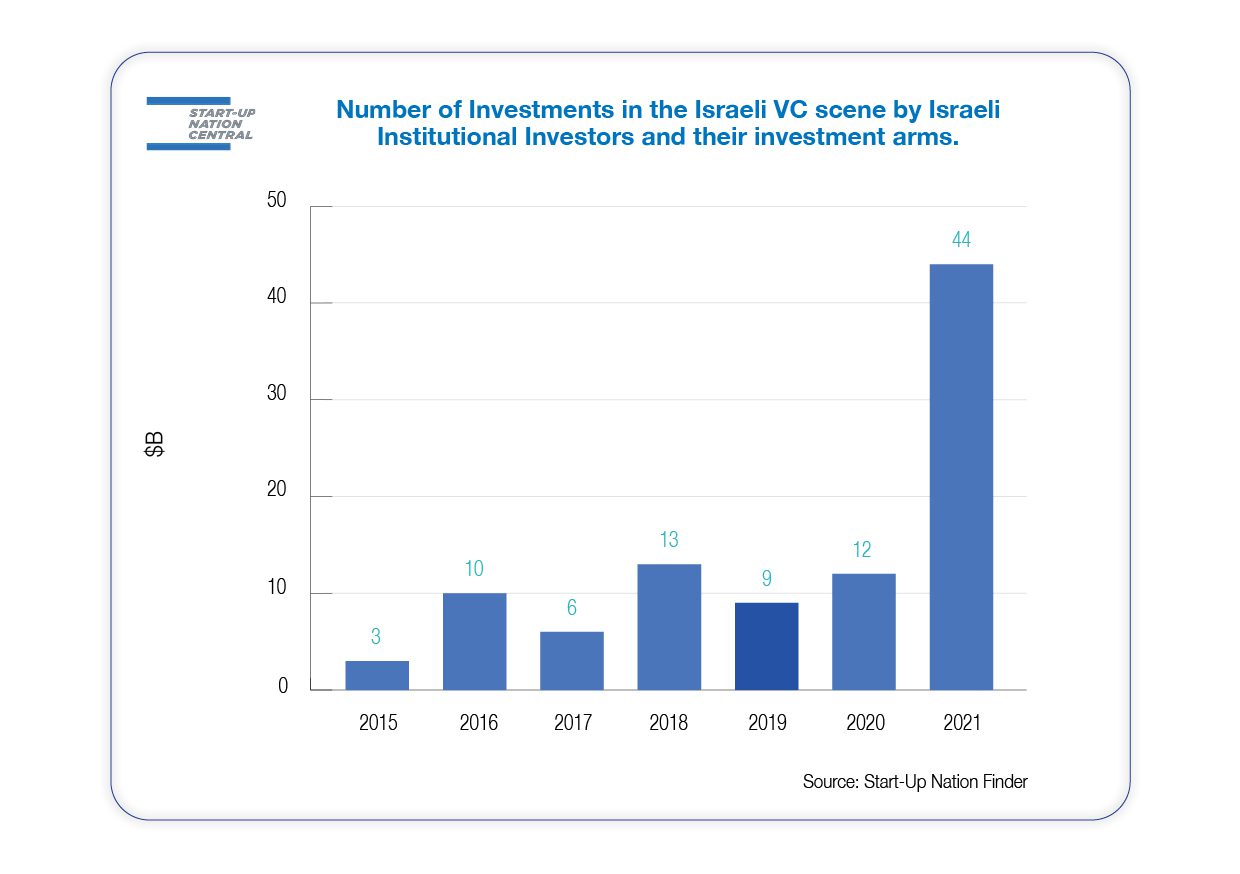

In 2021 the Israeli venture capital ecosystem witnessed a surge in the activity of local institutional bodies and their investment arms. According to Start-Up Nation Central records, the number of investments more than tripled YoY. Two prominent factors contributed to this increase: a new incentive program launched by the Israel Innovation Authority and a leap in valuations and round sizes.

Since 2021 the Israeli startup ecosystem has witnessed a surge in the number of investments made by local institutional players and their various investments arms. Data from Start-Up Nation Finder[1] reports that 44 such investments were recorded in 2021, up from an average of just 10 in the five previous years.

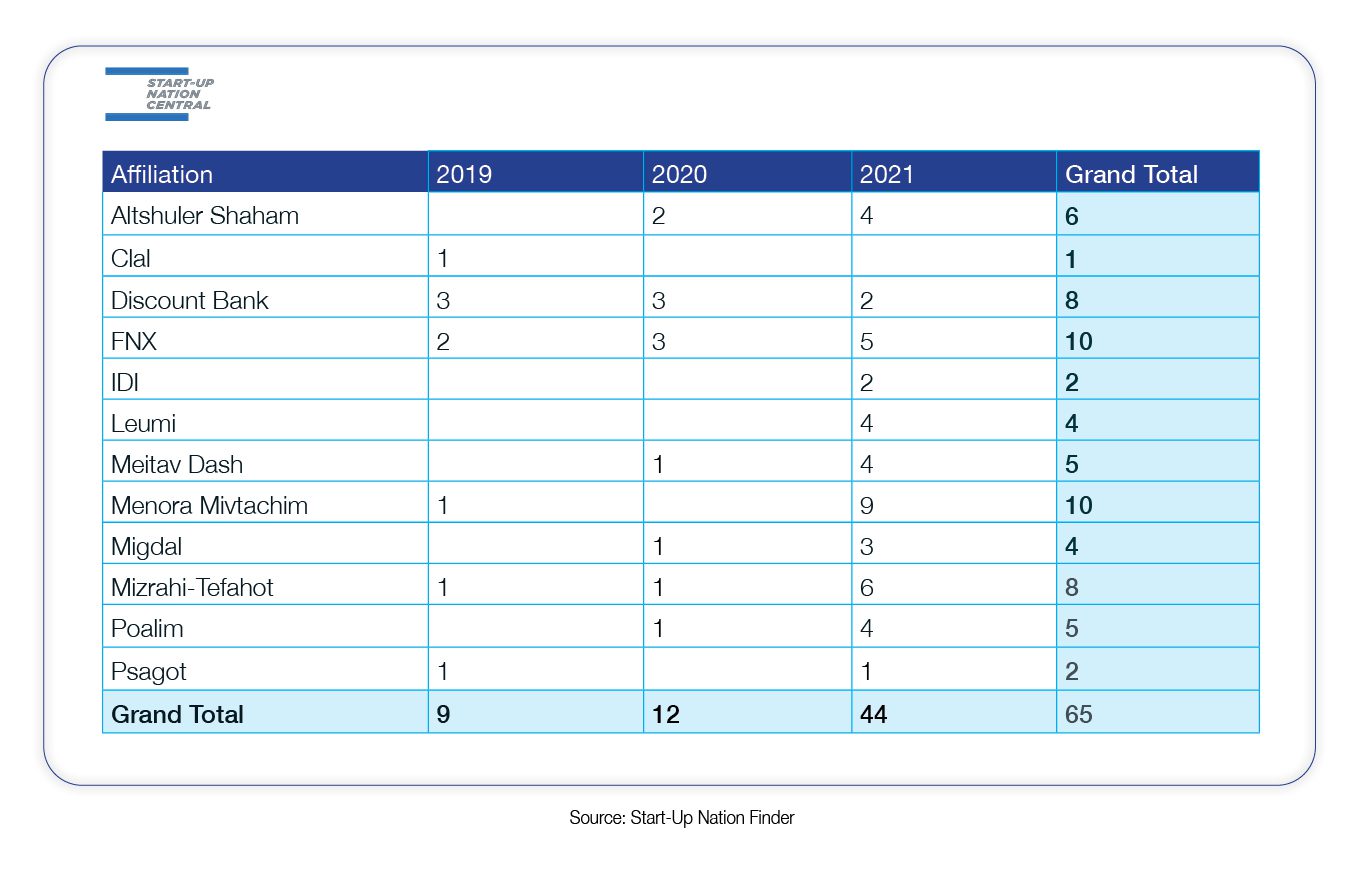

Who are the leading institutional bodies responsible for the surge?

A quick glance at the figures from 2019 to 2021 reveals that the player that increased its activity the most is Menora-Mivtachim, which holds the largest pensions fund in Israel and has several other insurance activities. Other organizations that exhibited a prominent increase in activity were Bank Leumi, Bank HaPoalim and Bank Mizrach-Tefahot (the 1st, 2nd, and 4th largest banks in Israel respectively) and Meitav-Dash investment house.

Leading Israeli institutional bodies by number of investments

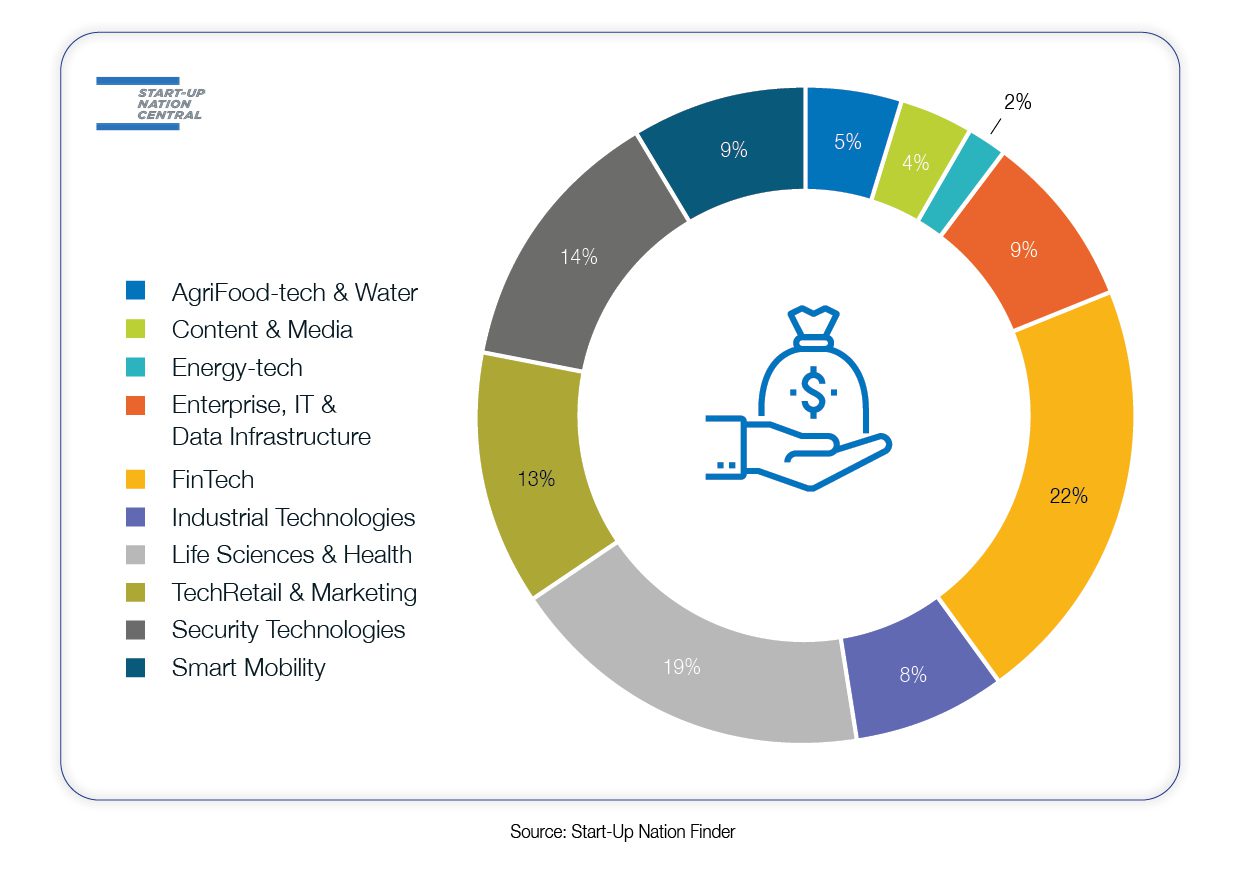

Home Court Advantage

The local institutional players prefer investments in sectors that are close to their core business, namely FinTech. While this sector was responsible for 9% of total investments in the ecosystem since 2014 (by number of investments), it makes up 22% of the investments made by local institutional bodies.

Local Institutional Investments Breakdown Across Sectors – 2014-2022 TD

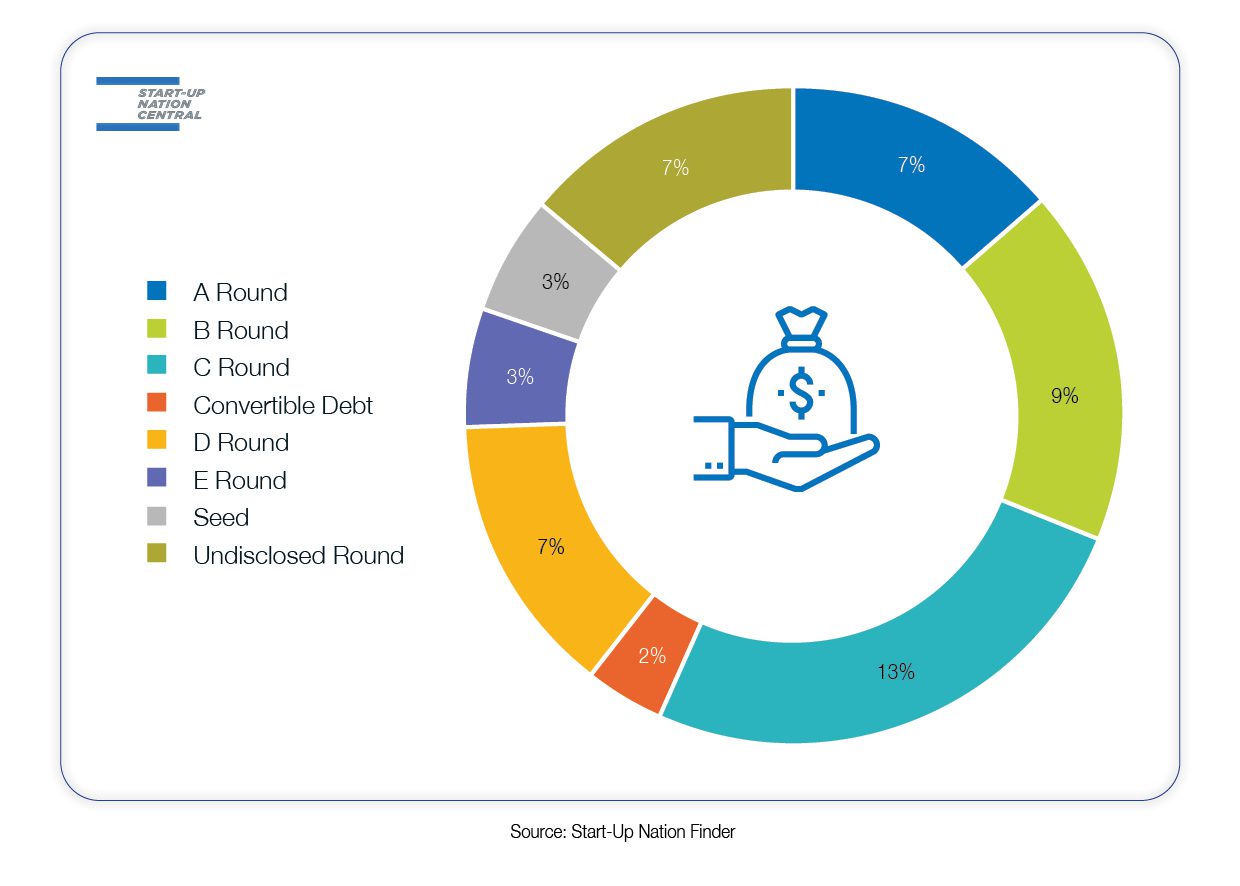

Preferring Later Stages

Another characteristic of the investment behavior of local institutional investors is a strong preference for later stage rounds. A possible explanation for this tendency is that many of the investments arms of these bodies mimic the investment behavior of private equity funds, which tend to make larger investments in more mature companies, unlike many other players in the ecosystem.

Local Institutional Investments Breakdown Across Funding Stages – 2021-2022 TD

Why Now?

Several possible factors may have contributed to the increased activity described above, among them:

- The Israel Innovation Authority’s incentive program that was launched in 2020 – The program offered nine institutional investors downside protection of up to 40% on nominal investments in local growth stages (B-C rounds) companies; however, this can’t be the only explanation, because several institutional firms such as Altshuler Shaham and Meitav-Dash (both operate as investment houses and pension funds), and IDI Insurance company did not participate in the program, but increased their activity in 2021.

- Larger and later rounds – In 2021 we witnessed an increase in the number of growth stage rounds as well in their size. This is due to several factors, among them: global trends in the venture capital scene and the increasing ecosystem maturity. This enables “heavier” players that act more like private equity funds rather than VCs, to participate in the game.

- Increased focus on technology – another reason for this increased interest from institutional investors: The overall rising attractiveness of technology and innovation investments in general, and in fintech solutions in particular. This trend comes along with establishing innovation departments in these “heavy” bodies. This aligns with the data itself that shows increased interest in fintech investments by these bodies vs the general population.

[1] For this analysis, we counted the number of investments i.e. each investment by each investor in each round is counted as an “investment”.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers