Israeli startups capture the global spotlight as insurance companies become top drivers of climate tech.

Climate Tech

Insurers are rapidly becoming one of the most active climate advocates. Keep reading to find out why – and learn about Israeli innovators offering climate tech solutions to this industry.

-

Drones can capture images of weather-related challenges to help forecast extreme climate events.

The climate tech opportunity generated by insurers

Climate change is on everyone’s minds these days: we live through it, we see it on TV, and we may even dream about it – unless it keeps us up at night! But when we think about taking action to solve the challenge, we tend to look to governments or consumer brands to make reforms. Not many people think of insurance companies as a driving force of change, but here’s the thing: they are.

“The Israeli government’s strong involvement in innovation activity not only supports the Israeli ecosystem but also is key for spreading Israeli technology abroad. It results in outstanding technologies.”

-Norio Okubo, Manager, Mitsui Sumitomo Insurance Co., Ltd

Insurance companies as climate advocates

Insurance companies are becoming climate advocates because they understand that existing and future climate and carbon regulations will require their clients to adapt quickly; otherwise, their clients are likely to be ‘uninsurable’ in the not-so-distant future. Without insurable clients, insurers will be out of business, so they are turning to innovation to find ways to help their clients meet climate-related regulations and challenges.

Norio Okubo, Manager at Mitsui Sumitomo Insurance Co., Ltd, explains that “Mitsui Sumitomo aims to solve social issues that are of high importance to both our stakeholders and our company, by working on three priority issues: coexistence with the global environment, safe and secure society, and the well-being of diverse people.”

In 2021 alone, there was an estimated USD $130 billion in insured losses worldwide due to extreme weather events (statista.com, Feb 8, 2022) – the second-most costly year on record.

Innovation that insurance companies can consider to address climate challenges

Global insurance leaders are actively exploring how they can make themselves relevant to climate change. Many often ask, “How are other insurers tackling climate change? What innovative solutions are relevant for this? What new business opportunities can we as insurance companies develop as we integrate climate tech innovation?”

Here are some ways that insurance companies can benefit from adopting innovative technology:

Improving underwriting by predicting extreme weather events

Insurance companies are looking for new forward-looking tools and platforms to forecast extreme weather events. The data is critical to improving underwriting, risk selection, and pricing.

Israeli innovators, leveraging their strengths in data capturing and analysis, are leading various companies with advanced solutions in this space, from unicorns like Tomorrow.io to much younger yet still promising startups such as Emnotion, which has the ability to provide forecasts and alerts at a hyper-local scale. Terra Space Lab (TSL) and Weather It Is also come to mind, both of which are developing monitoring and early-warning systems to detect a wide variety of local environmental events with high economic consequences, such as wildfires and flooding.

Supporting risk mitigation via innovation

Risk mitigation means preventing bad things from happening. We are seeing more insurance companies exploring if they should broaden the relevance of the industry beyond just pricing and transferring risk but actually changing outcomes. That means increasing the resilience of their customers’ infrastructure, facilities, or supply chains.

Prisma Photonics’ sensorless system could help utility clients monitor their critical infrastructure and provide alerts in case of natural disasters.

Another approach to risk mitigation would be helping clients incorporate more sustainable practices into their business operations. For example, crop insurance companies are utilizing PlanetWatchers’ satellite-based monitoring system to track the farming practices of their clients and reward them for adopting more sustainable approaches that combat soil erosion and strengthen the farmers’ resilience against climate change.

Supporting investment decisions with ESG data collection and measurement systems

In addition to incorporating innovation to improve underwriting practices, insurers are reconsidering their investment practices – the asset side of the balance sheet. In this context, similarly to other industries, they are embedding ESG considerations. Also here, innovation plays a role with ESG data systems, such as ESGgo, assisting investors in measuring and benchmarking their own ESG progress, as well as that of their potential investees.

Expanding into new (climate) markets

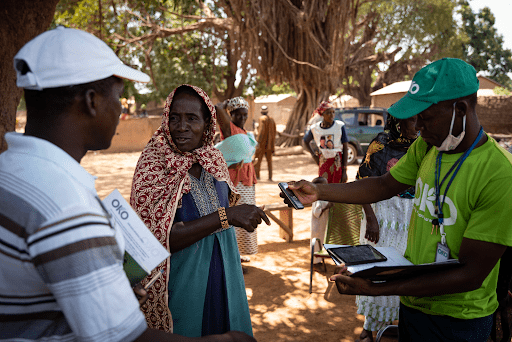

Insurance companies are always looking to expand their pool of clients. Climate change may present some unusual opportunities to do so. Take smallholder farmers, for example; targeting this population that is highly vulnerable to climate change, OKO has developed a platform that uses satellite and mobile technology to bring affordable and simple crop insurance to smallholder farmers in developing countries.

“Climate change is becoming more urgent and has highlighted the transformation that needs to happen in this space for the long term. Insurance solutions are a huge part of this.”

-Simon Schwall, CEO, OKO

Start-Up Nation Central is a non-profit organization that strengthens Israel’s innovation ecosystem and connects it to global challenges and stakeholders.

ClimateTech is a key area of focus for our work, as more clients from all industries approach us to source solutions to meet this global challenge. To assist our clients in the insurance industry, we created this smartlist of Israeli climate-tech companies with relevant solutions. We hope you find it valuable.

As climate change progresses globally and insurance companies increase their engagement with climate-tech startups, we expect many new companies to emerge in the nexus of climate and insurance.

Amy Woolf is a climate-tech consultant at Start-Up Nation Central, a non-profit organization that strengthens Israel’s innovation ecosystem and connects it to global challenges and stakeholders.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers