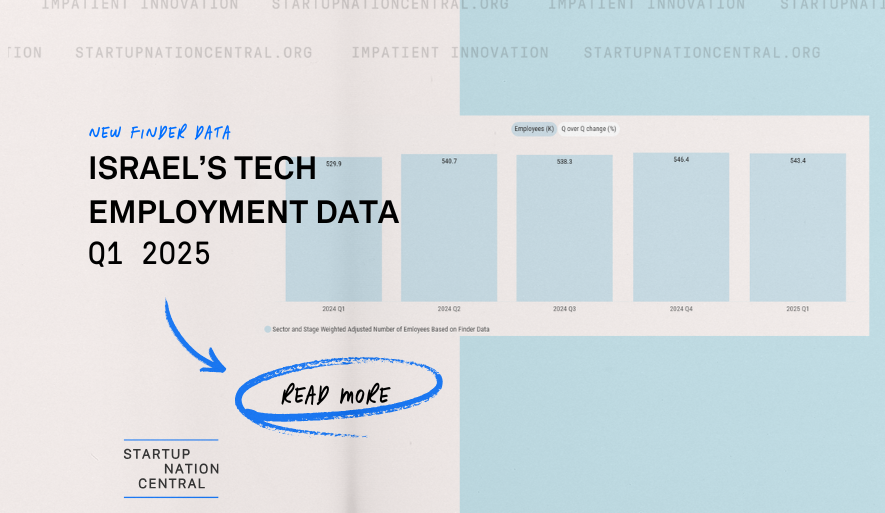

Employment trends in Israel’s tech sector provide a clear view of how the industry is adjusting to economic and geopolitical challenges. Finder’s Q1 2025 ecosystem report, in collaboration with the Aaron Institute for Economic Policy at Reichman University and using data from the Israeli Central Bureau of Statistics (CBS), shows that the sector is refining its workforce strategy, maintaining productivity, and strengthening its role in the national economy.

Israeli tech companies are reallocating talent to innovation-heavy roles, relying on global hiring to support operations, and producing greater economic output per employee. These patterns suggest a sector that is stabilizing and adapting rather than contracting.

Local Tech Employment Trends Reflect Strategic Shifts

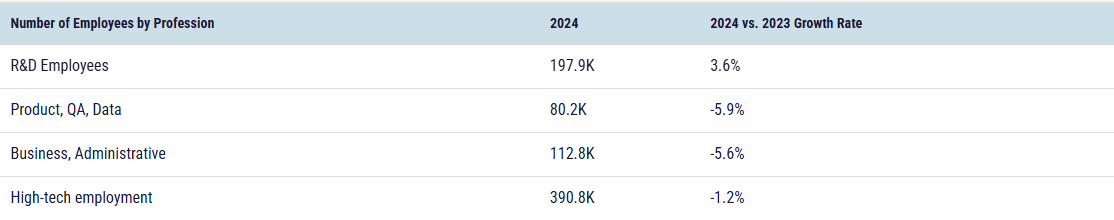

In Q1 2025, local high-tech employment declined by 1.2% year over year, reaching approximately 391,000 workers. This decline followed a period of workforce rebalancing that began in late 2023. While total employment dropped, the composition of the workforce changed in meaningful ways.

R&D positions grew by 3.6%, now totaling close to 198,000 employees. This contrasts with ongoing declines in non-R&D roles. Product, QA, and data roles fell by 5.9%, and business and administrative positions declined by 5.6%.

Companies are concentrating on roles that contribute directly to technology development. The hiring focus is moving toward core innovation functions, with fewer resources allocated to support and business operations.

Productivity and Output Are Increasing

Despite the dip in headcount, the sector contributed more to the economy in Q1. GDP per employee rose by 4%, reaching NIS 730,000. Exports per employee also rose by 4%, reaching NIS 726,000.

These gains reflect an increase in efficiency. Companies are creating more value per employee, which aligns with investor expectations for stronger fundamentals and disciplined growth strategies.

Global Tech Employment Remains Stable

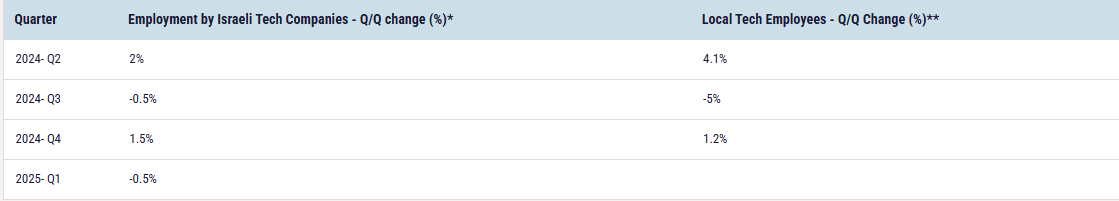

Startup Nation Central’s Global Employment Indicator offers additional insight into workforce trends. This metric aggregates employment data from over 5,000 Israeli tech companies using publicly available professional profiles.

In Q1, global headcount among Israeli tech companies declined by 0.5%. This is significantly smaller than the local employment decline reported by CBS. The data suggests that companies are managing workforce shifts by maintaining or expanding operations outside of Israel.

Companies are making strategic use of international hiring. This supports continuity in times of local disruption and reflects the increasing importance of global operations within Israeli tech.

Sector-Level Economic Contribution Is Growing

The high-tech sector now contributes 20% of Israel’s GDP and 53% of national exports. These figures indicate that the sector continues to deliver strong economic results.

The slight decline in local employment has not slowed output. Productivity is rising, and export capacity remains strong. These trends point to a sector that is adapting without losing momentum.

Innovation Roles Are Driving the Shift

The growth in R&D hiring is a key signal. Startups and scale-ups are allocating resources to engineers and technical staff. These roles are seen as central to product development, IP creation, and long-term value.

This trend reflects changes in funding dynamics. Late-stage and scale-up companies are securing larger rounds. Investors are prioritizing strong business models, clear product-market fit, and teams that can execute efficiently.

Hiring patterns are following this logic. The data shows that companies are concentrating on technical depth rather than headcount volume.

Global Strategy Is Shaping Workforce Models

The 0.5% decline in global employment supports the view that Israeli companies are spreading operations to ensure business continuity. Global hiring helps manage risk and ensures access to talent in uncertain conditions.

Some companies may be expanding overseas operations. Others may be adjusting the balance between local and global teams. Either approach points to a more flexible and globally aware business model.

This approach strengthens resilience. It also supports growth in markets where Israeli companies are building customer bases and strategic partnerships.

Tech Employment Data as an Early Signal

Changes in employment patterns often precede larger shifts in economic structure. The current data suggests that Israeli tech is entering a new phase of workforce development. The emphasis is on technical roles, distributed teams, and long-term efficiency.

Productivity is rising. Output per employee is higher. Global reach is supporting stability. These are indicators of a sector that is preparing for sustainable growth.

What to Watch Going Forward

Several questions will shape the employment landscape in the coming months. Will R&D hiring continue to grow? Will companies maintain global headcount while refining local operations? Can early-stage startups attract the talent they need in a competitive funding environment?

These trends will influence not only employment levels but also innovation capacity. Workforce data offers a reliable view of how companies are responding to broader economic signals.

2025 and Beyond

Israel’s tech employment data from Q1 2025 reflects a sector that is adjusting to new realities. The decline in total employment is balanced by higher productivity, a stronger focus on R&D, and increased use of global teams.

These shifts point to an ecosystem that remains economically strong. Companies are making deliberate choices to align workforce strategy with long-term value creation. As a result, Israeli tech is positioned to deliver consistent results even in a complex global environment.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle