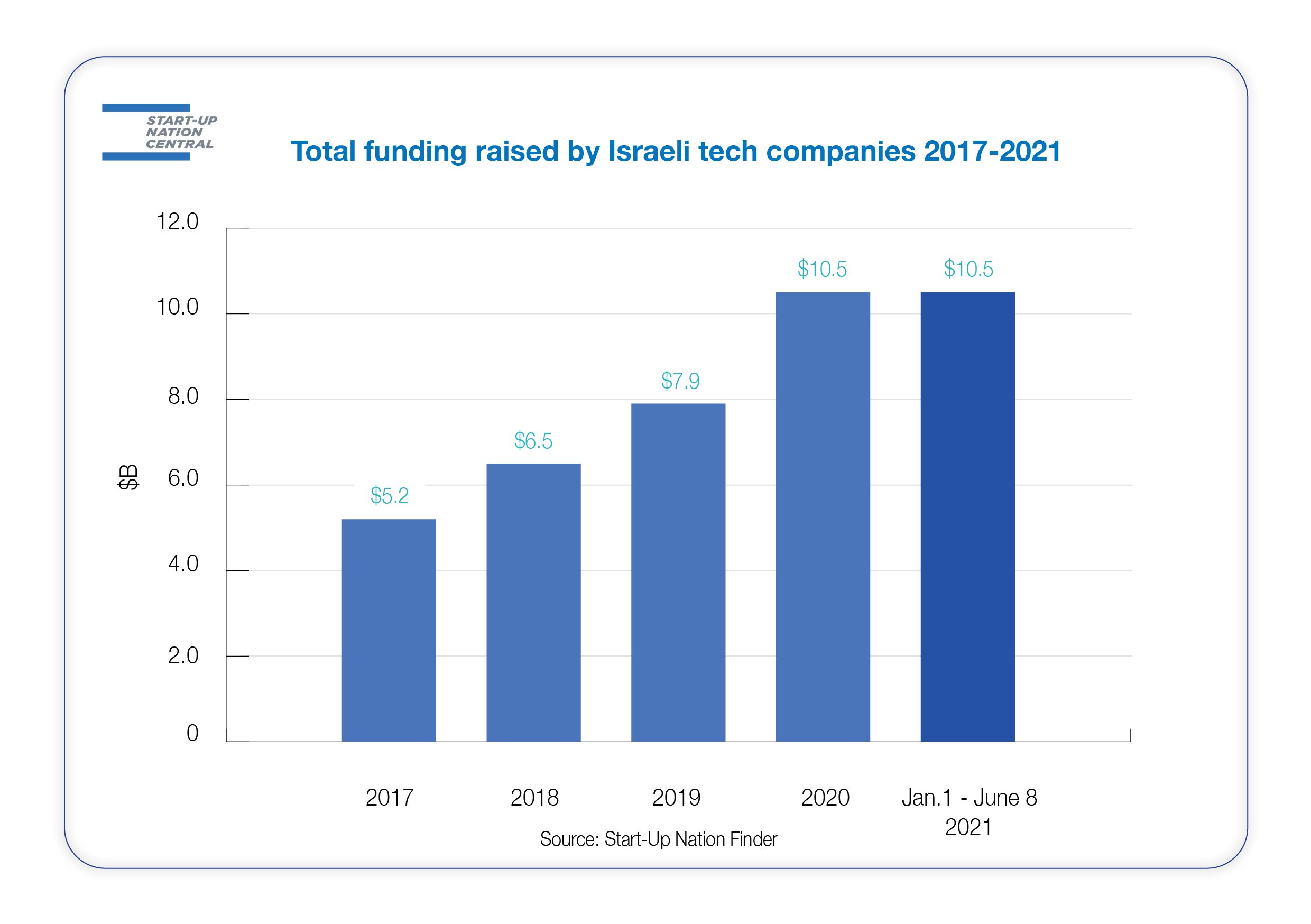

New Record: Investment in Israeli Technology Companies Hits $10.5 Billion, Shattering 2020 Record in Under 6 Months

Finder

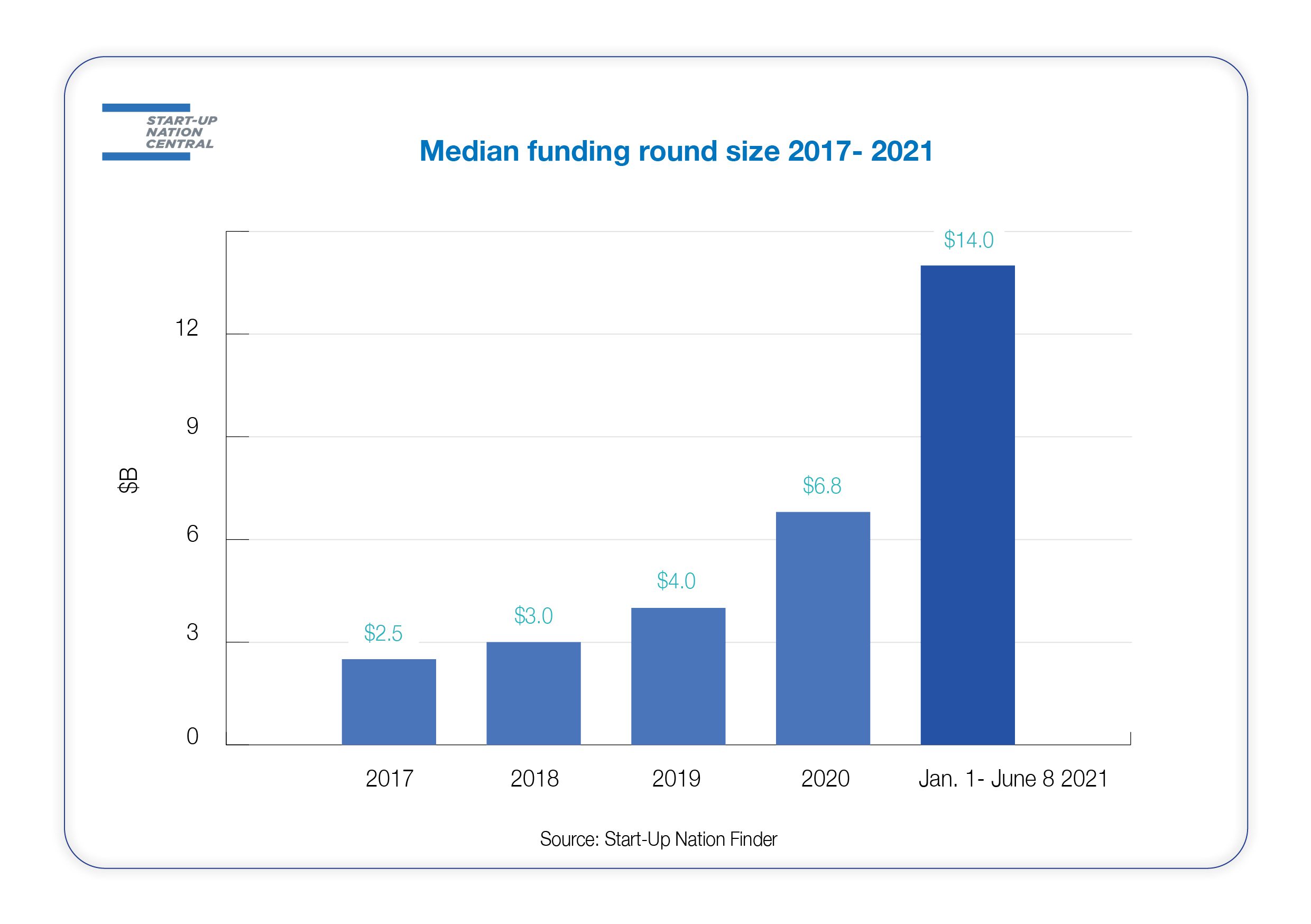

Size of median funding round more than doubled y-o-y from $6 million in 2020 to $14 million in 2021, indicating a maturing ecosystem; Israel also leads the world in funding growth with a 137% y-o-y increase in the first five months of the year

Israel’s innovation technology sector broke a new capital funding record this week, reaching a total of $10.5 billion raised since the start of the year, according to Start-Up Nation Finder. In doing so it matched the total raised throughout the whole of 2020, which was itself a record year. The amazing thing is that it was able to reach the milestone figure in less than half the time. Since historically the second half of the year has seen even better investment performance, the sector has the potential to more than double the amount by year’s end, a scenario Uri Gabai, the incoming CEO of Start-Up Nation Central’s new Research and Policy Institute, called “plausible in a conversation with Bloomberg.

Investments in Israel exceed global trends

The marked increase in investments in Israeli technology companies (most of which originate from foreign investors) is even more pronounced when compared to investment performance worldwide. While Start-Up Nation Finder figures revealed that Israel recorded a 137% increase in funds raised during the first five months of 2021 compared to the first five months of 2020, the global increase over the same period was only 89%. Europe recorded an increase of 123%, the US saw an increase of 91%, and Asia saw an increase of 69%, according to PitchBook data*.

“The record funding in 2021 indicates that the growth in 2020 was not a short-term Covid-related boost but reflects top investors’ increasing trust in the Israeli innovation ecosystem. The significant increase in median deal size reflects a maturing ecosystem that is able to maintain its competitive edge as a global hub of technological innovation and offering problem-solving solutions,” said Uri Gabai, the incoming CEO of Start-Up Nation Central’s new Research and Policy Institute. “We hope a new budget by the expected incoming government will focus on growth-oriented policies such as enhancing the innovation ecosystem’s economic impact and tackling the chronic shortage of tech-oriented human capital.”

Gabai elaborated on the human capital challenge in a radio interview with Israel’s public broadcaster (Hebrew), stating that the solution rested in increased inclusion of previously underrepresented populations, namely women, Arab-Israelis, and members of the ultra-Orthodox community. “Arabs, for example, make up three percent of the high-tech workforce, even though we all know they make up 20 or 21 percent of the general population. That’s where the problem lies, but that’s also where the solution is. The solution is tapping into the potential human capital that has not been utilized yet,” he said.

Bulk of investments go to later-stage companies

The overall increase in funding was mainly a reflection of the size of the funding rounds, with the median amount more than doubling year-over-year from $6.8 million in 2020 to $14 million by the beginning of June 2021. In terms of growth rounds (round B or higher), the median round size rose from $26 million in 2020 to $46 million in 2021. Early-stage companies experienced a similar boost in median funding from $4 million to $8 million.

The significant rise in investments in Israeli high-tech and innovation since the beginning of the year focused on companies that are at more advanced stages, with most of the capital (64%) invested in rounds C or later.

2021 has also shattered the record for the number of mega-rounds (investments of over $100 million) raised, with 30 having been completed so far compared to 21 mega-rounds throughout all of 2020. These rounds represent 53% of all capital raised, and for the first time account for more than half of the total capital that was invested.

The biggest round so far this year was completed by image recognition company Trax, which raised $640 million in a series E funding round in April led by SoftBank Vision Fund 2 and BlackRock. Other standout companies in early 2021 include FinTech company Rapyd, which raised $300 million in January, cyber company Snyk, which raised a similar amount in March, and fraud-prevention platform Forter, which repeated the feat in May.

Bulk of funding goes to Cybersecurity, FinTech, and Enterprise Solutions companies

The top three sectors drew an accumulated $6.2 billion or 60% of all investments. These sectors are all software-related, strongly B2B oriented, and saw huge increases in demand for their solutions over the last year as work practices changed.

*Data based on Start-Up Nation Central’s query submitted to PitchBook on June 8, 2021, full access requires a subscription.

Follow us on LinkedIn and Twitter to keep up to date with the latest from Start-Up Nation Central and the Israeli innovation technology ecosystem

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers