The number of startups in the Israeli ecosystem may have peaked. Does it matter?

Tech Innovation

The stagnation in the number of active startups in the ecosystem and their rising average age does not necessarily mean that the ecosystem is becoming weaker and having less positive impact on the Israeli economy. Perhaps their positive qualitative features will offset the quantitative contraction.

Recap

In previous posts we discussed Israeli startup openings, closings, and average age figures, based on SNC’s Finder data and the time lag correction methodology. We saw that the annual number of startup closings is closer than ever to the annual number of openings, and the average age of the companies in the ecosystem is growing. In this post, we will drill down to some characteristics of the companies that were closed and opened in the past few years.

A Stagnation in Number of Startups in the Ecosystem – Is it Necessarily a Bad Sign?

Based on current trends, we may soon for the first time see a decline in the total number of active startups. Although the number of startups is an important indicator of the ecosystem’s strength, it is not the only factor. Some exploratory data points that this post will further present regarding size, equity financing, survivability, and shifts in sector mixture suggest that the characteristics of the startups in the ecosystem may compensate for the expected stagnation and even for a possible decline in number of active startups.

Size and Stage of Startups Closed

By breaking down startup closures based on size, we can see that 89% of the companies that closed over the past three years were small startups with no more than 10 employees, while their proportion out of the general ecosystem is 58%. The proportion of larger startups that closed is far smaller than their share of the general population. Since smaller startups tend to have less economic impact, the total effect on the economy and the workforce is not very substantial.

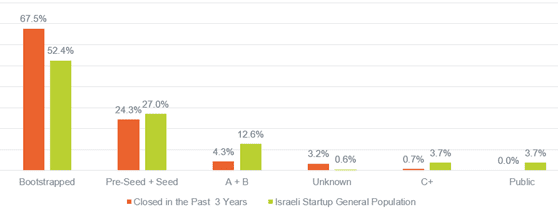

Startups that close down are not only smaller, but also in earlier stages of financing. The proportion of closed companies that are in stages C+ is negligible, while the proportion of A+B round stage groups is only around a third of the A+B group in the general ecosystem. We can say that most of the startups that closed were bootstrapped companies that did not raise equity funding at all or reached only very early stages – pre-seed and seed. This means that in terms of value destruction for investors, the impact is less severe than it might seem at first glance.

Sectors

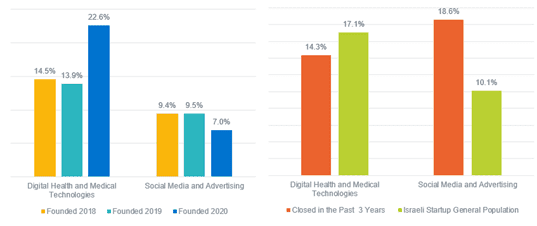

We do see some trends in startup openings and closures across different sectors. A thorough analysis of trends across all different sectors is beyond the scope of this blog, but will be the subject of a future post; however, we do wish to highlight two prominent trends:

- A rise in startup openings and a decline in startup closures in the Digital Health and Medical Devices sector – A sector that is expected to grow dramatically following the COVID-19 pandemic.

- A decline in startup openings and a surge in startup closures in the social media and AdTech sector.

While the reasons and consequences of the latter are unclear yet, trends in the Digital Health and Medical Devices sector are apparently a consequence of the global COVID-19 pandemic and help the Israeli ecosystem adjust to a new expected shift in global market needs.

Survivorship

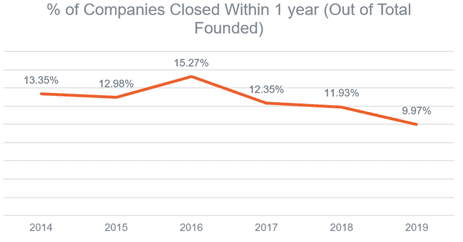

When examining startups founded in recent years, we also observe a rather significant rise in short term startup survivorship. Out of the 1074 companies founded in 2016, more than 15% had been dissolved by the end of 2017; while for companies founded in 2019, fewer than 10% were closed. These figures partially explain the rise in the average age of companies in the ecosystem shown in the previous post.

Of course, the time lag discussed in the previous posts may play a role here and these figures are not final, but it is necessary to mention that while we expect the nominal number of startups closed during 2020 to rise, we also expect the nominal number of startups opened to rise as well.

This maybe an indication that a smaller number of “low quality startups” is being created each year in the Israeli ecosystem.

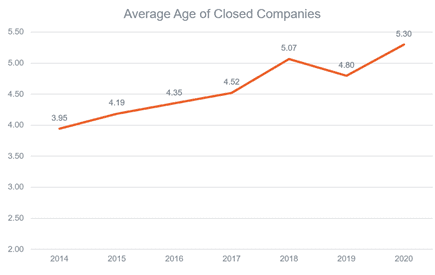

Yet how is it that the 1-year survivability rate is rising substantially, while more and more startups are closing each year? If we look at the average age of companies when they close, it reveals that it is rising substantially.

These figures indicate that while closed companies are smaller, and rarely receive substantial equity funding, many of them had been in existence for quite a few years without substantial business activity and economic impact, especially those that were closed in the last couple of years.

The reason for these phenomena (higher 1 year survivability rate and a rise in average age of companies closed) is unclear yet, but possible explanations may include qualitative characteristics such as a higher number of more experienced entrepreneurs in the ecosystem, greater involvement of strategic & value-added investors, or external reasons such as more access to equity funding.

Conclusion

Despite indications that the total number of startups may no longer be growing, we presented some indications that at least a part of the trend may be attributed to the ecosystem shedding off smaller and weaker startups, that did not raise substantial amounts of equity. Most of them did not manage to scale up, even though some of them had been in existence for years before they closed down. Therefore, the impact of the increased number of closures on the ecosystem is not as dramatic as it might seem.

Moreover, the smaller number of startups that were opened in the last couple of years, may have better chances of surviving, growing, and having a greater impact on the Israeli economy.

The rising average age of tech companies in the ecosystem is partially explained by a higher short-term survivability rate, so not all the factors that contribute to the ecosystem aging are negative. This is especially true for companies that can survive long enough to raise later-stage funding rounds and scale-up.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers