Who is Responsible for the Large Increase in Investment in Israeli High-Tech?

Finder

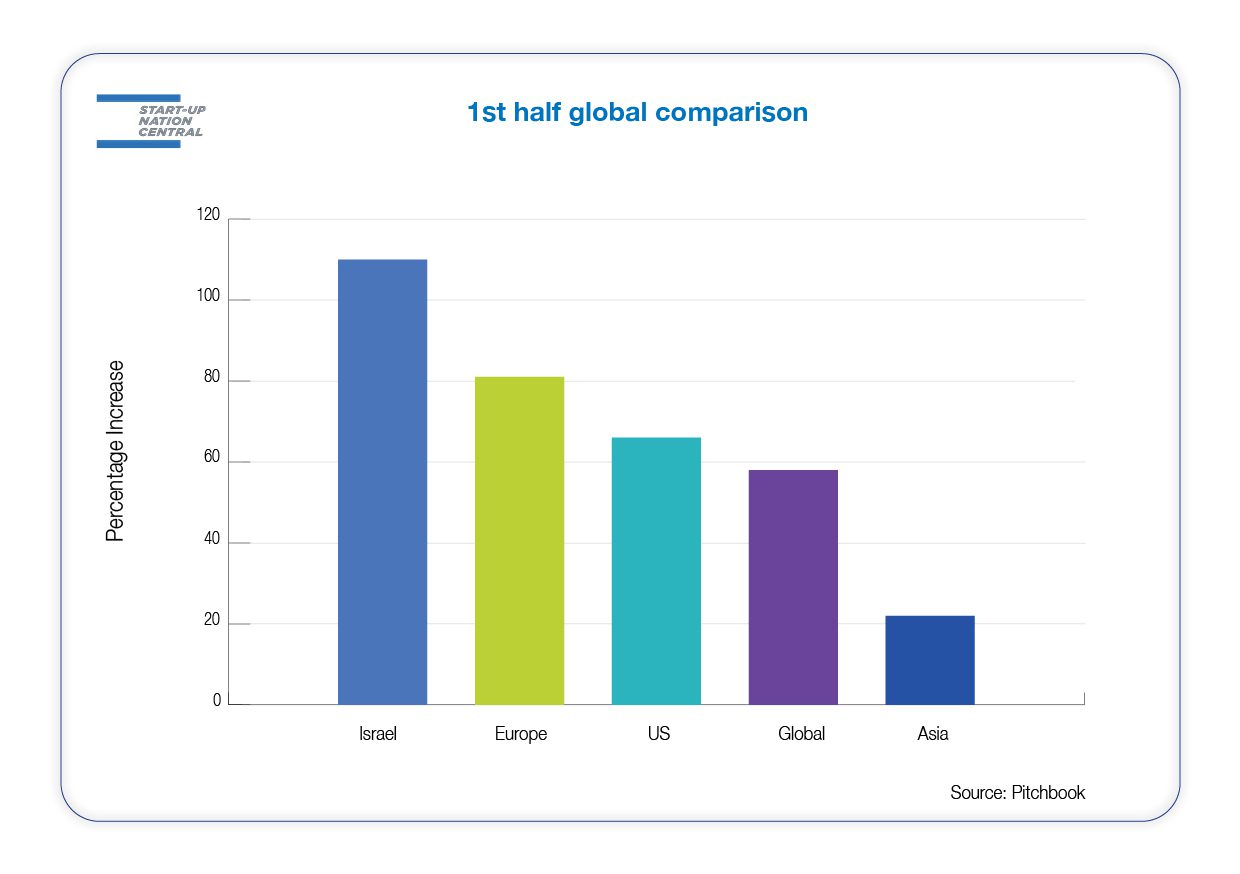

Israeli startups raised a total of $12.2B* in the first six months of 2021, making it the most successful H1 ever in terms of investment. This represents an increase of 110% from H2 2020, the highest among geographic regions, and 152% from H1 2020 (see table 1 in the appendix). This total for H1 was higher than the total amount raised throughout all of 2020.

This huge increase in H1 far exceeds the typical annual rate of increase over the past few years which has averaged 20-25%. This is impressive given that 2020 also saw an above-trend increase over 2019 at 33%. This accelerated pace of investments has commonly been attributed to the effects of the COVID-19 pandemic, which briefly caused investment to stall. As it became clear that the pandemic had actually accelerated the adoption of new technology that might otherwise have taken many years to occur and that the economy was not about to collapse, investment not only recovered but increased rapidly. However, investment has continued to rise at an even faster pace, long after the market has incorporated the widespread adoption of new technologies. Could there be a different explanation of what is driving the ecosystem forward?

Capital Flows to VC Have Exploded

The amount of capital allocated to the VC asset class has been growing strongly. US-based VC funds raised $81B in 2020, up from $42B in 2017, and 2021 is on track to be even stronger with $74B raised in H1 alone. VC investors were sitting on $238B in dry powder by the end of H1 2021, up from $123B at the end of 2019. These inflows began before the pandemic due to favorable market conditions for the asset class and have accelerated due to loose monetary conditions created by central banks.

As increased levels of capital flow into private investing, they are being disproportionately allocated to the largest investors. In H1 2021, 65% of all capital raised went into very large ($500M+) funds. As a result, capital is being concentrated amongst a few giant managers with 61% of all the available dry powder in the hands of just 50 of them. These managers invest across all sectors and are particularly looking out for large late-stage deals to be able to deploy massive sums.

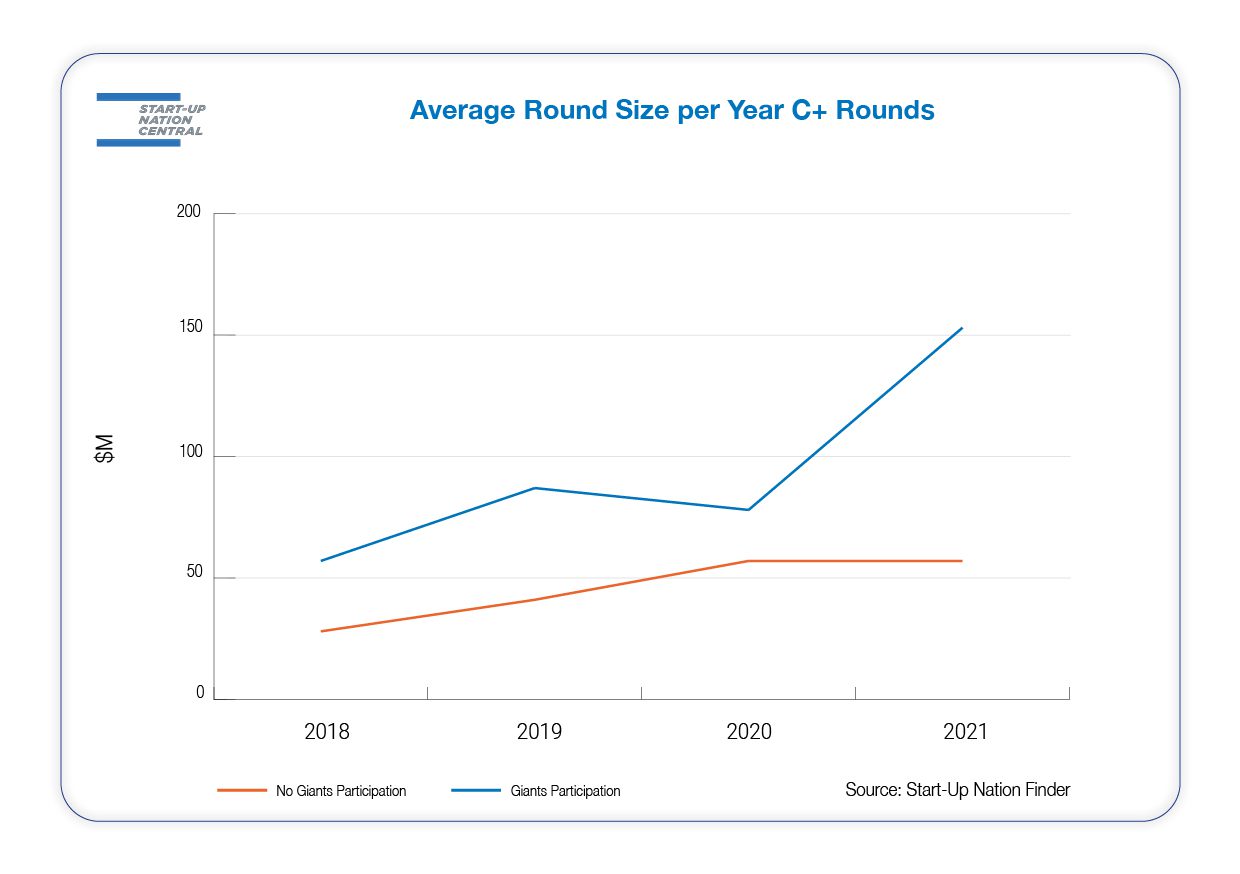

We have identified 10 managers (“Giants”) that hold at least $1B in dry powder and have invested at least 10 times in Israeli companies since 2015. While all members of this group have been investing in Israel since at least that time, their involvement grew substantially after 2018, with their participation rising from 4.5% of all deals in 2018 to almost 16% in 2021. This is very disproportionate given that the past few years have seen upwards of 1,000 unique investors every year. However, the Giants’ influence on total investment is far greater than just their share of investments because of their disproportionate contribution towards larger and later-stage rounds. In absolute terms, they have increased their participation from 9 C+ rounds in 2018 to 31 during the first half of 2021, over 40% of the total.

| The 10 Giants |

| Accel |

| Andreessen Horowitz |

| Battery Ventures |

| Bessemer Venture Partners |

| General Catalyst |

| Insight Partners |

| Lightspeed Venture Partners |

| Sequoia Capital |

| Softbank |

| Tiger Global Management |

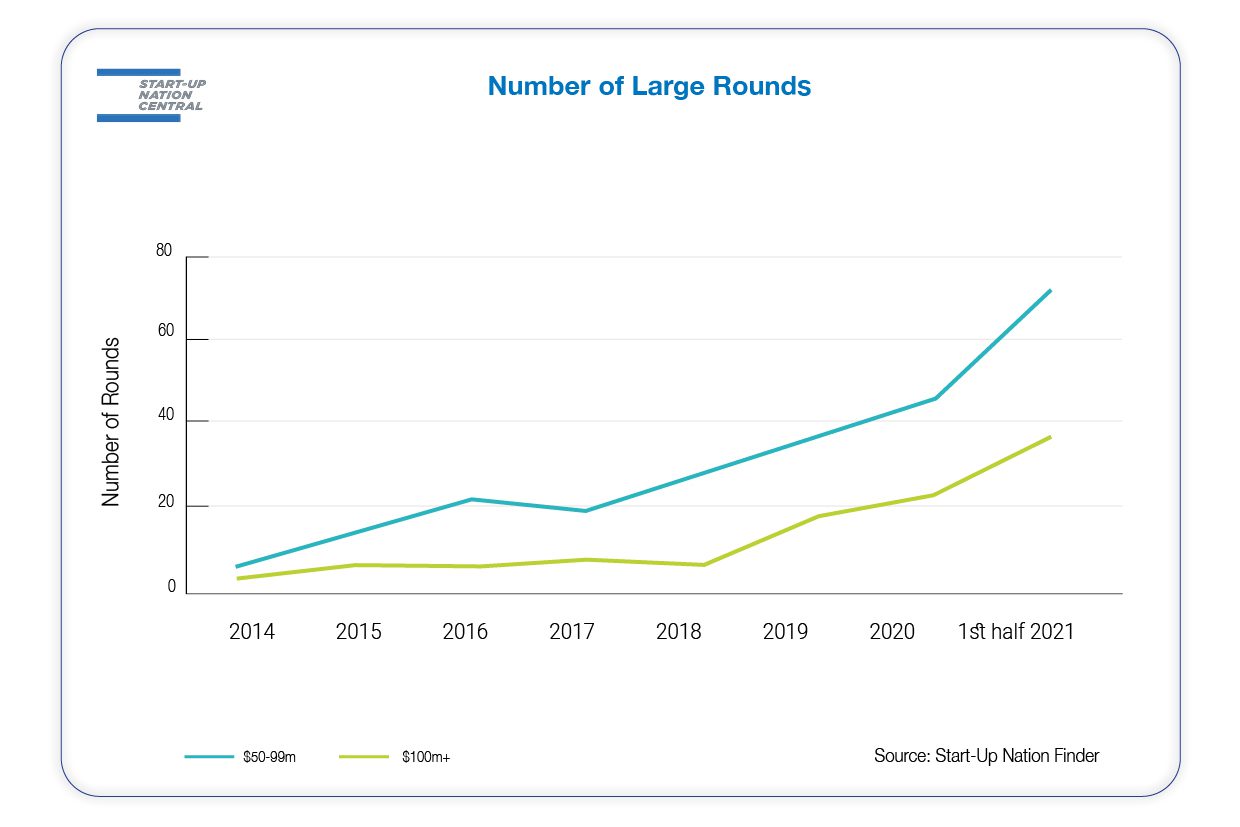

For rounds above $30M, the increase has gone from 25% participation in 2018 to over 43% in 2021 while for rounds over $100M (mega-rounds), they have gone from 25% participation in 2018 to 69% in 2021. The influence of these giants was even greater in the largest rounds. In H1 2021, they led seven out of the 10 largest rounds and participated in nine of them.

The graph above shows that the average size of rounds that this group of 10 Giants have participated in has been far larger than those they were not involved in. Even in 2018, the average size of C+ rounds in which they participated was $57M vs $28M for those in which they did not participate and by 2021, the average size of C+ rounds in which they participated was $153M, while C+ rounds in which they did not participate averaged $57M. Their round sizes were at least double across all other investment stages as well.

We can see their rising influence most clearly from the following graphs. These show the total amount raised on the y axis versus the size of rounds on the x-axis. In 2018, they made a modest, albeit disproportionate contribution to total capital raised. In 2021 so far, they have become even more dominant, participating in rounds accounting for more than half the capital raised and in all rounds that raised more than $210M.

Large rounds are the hallmark of large global investors who use their considerable dry powder to provide strong backing to their portfolio companies and ensure they have enough capital to take on their competitors and dominate their market. As can be seen in the graph below, the number of rounds above $50M has been on a strong upward trend after 2017 while the number of rounds above $100M took off after 2018. In H1 2021, mega-rounds of $100M+ accounted for 54% of all capital raised vs just 33% in 2020.

Most Active Investors in Israel

We can see the impact this is having on the Israeli market by looking at the most active investors in recent years. As recently as 2018, 13 out of the 15 most active investors were Israeli and only one was not primarily early stage. By the first half of 2021, this had changed considerably. There are seven foreign investors among the most active investors and only five are primarily early stage. In addition, the most active investor (Insight Partners) invested more times in half a year than the most active investor in any previous full year.

Of the group of 10 Giant investors, five were in the top 15 of most active investors: Insight Partners (26 investments), Bessemer (14), Sequoia (9), Tiger Global (9), and Battery Ventures (8). Other investors from that group that were very active in H1 2021 include Lightspeed (7), and Accel (6).

Developments in the Israeli Ecosystem Have Encouraged Larger Round Sizes

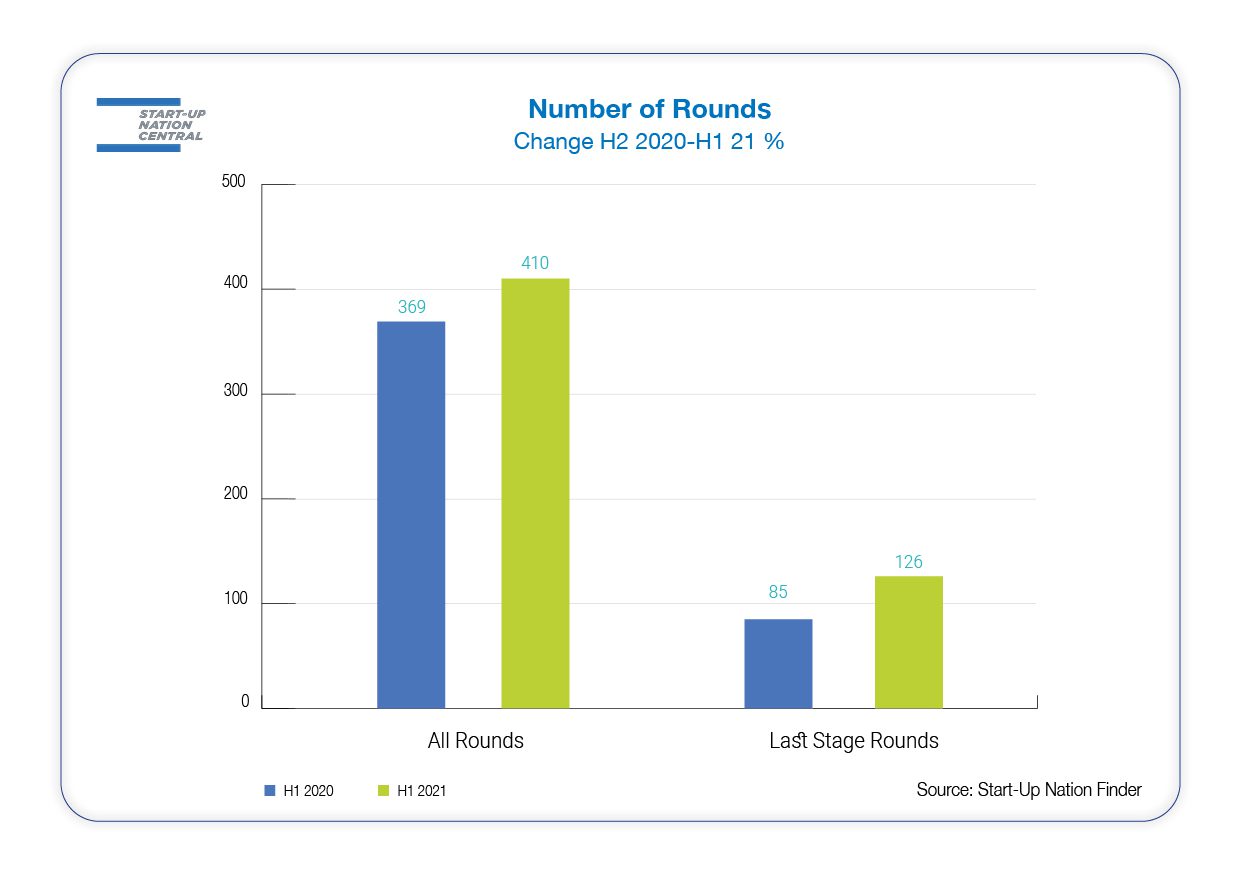

The total number of rounds rose modestly from H1 2020 to H2 2021 and while the number of late- stage rounds increased more rapidly, this was still less than 50%.

The greater increase was in the size of rounds, with the median round size doubling from $6.5M to $13.8M. This is a massive increase over such a short time span and far exceeds other regions. In the US, for example, the increase was just over 50%.

This increase is partially due to a maturing ecosystem that offers a larger number of late-stage companies that have reached important milestones in terms of development. But more than this, the doubling in round sizes reflects the increasing contribution of the giant global investors over the past three years.

Their involvement was further boosted by the COVID-19 pandemic and the rise of remote investing. While some of these investors do have a physical presence in Israel, once all deals transitioned to being completed remotely, it made little difference where the startup was physically located.

Investors became just as willing to look at targets in Israel as in their home market. This has resulted in many more competitive rounds as the largest investors became more active participants and subsequently drove up deal sizes. With geography less of an impediment for investors, regional differences in deal sizes and valuations have been reduced.

2021 has also seen a record number of Israeli companies take on unicorn status, taking the total to 47, far higher than any other single European country. Several of these unicorns have reached multibillion-dollar valuations and have gone public this year. Perhaps the prime example is cybersecurity company SentinelOne which raised $1.2B with a valuation of almost $9B. In total, Israeli companies raised $3.3B in proceeds from IPOs in the first half of the year, exceeding any previous full year total. This has helped convince investors that many Israeli companies can reach the same kinds of return multiples seen in some other markets.

The Composition of Israel’s Ecosystem

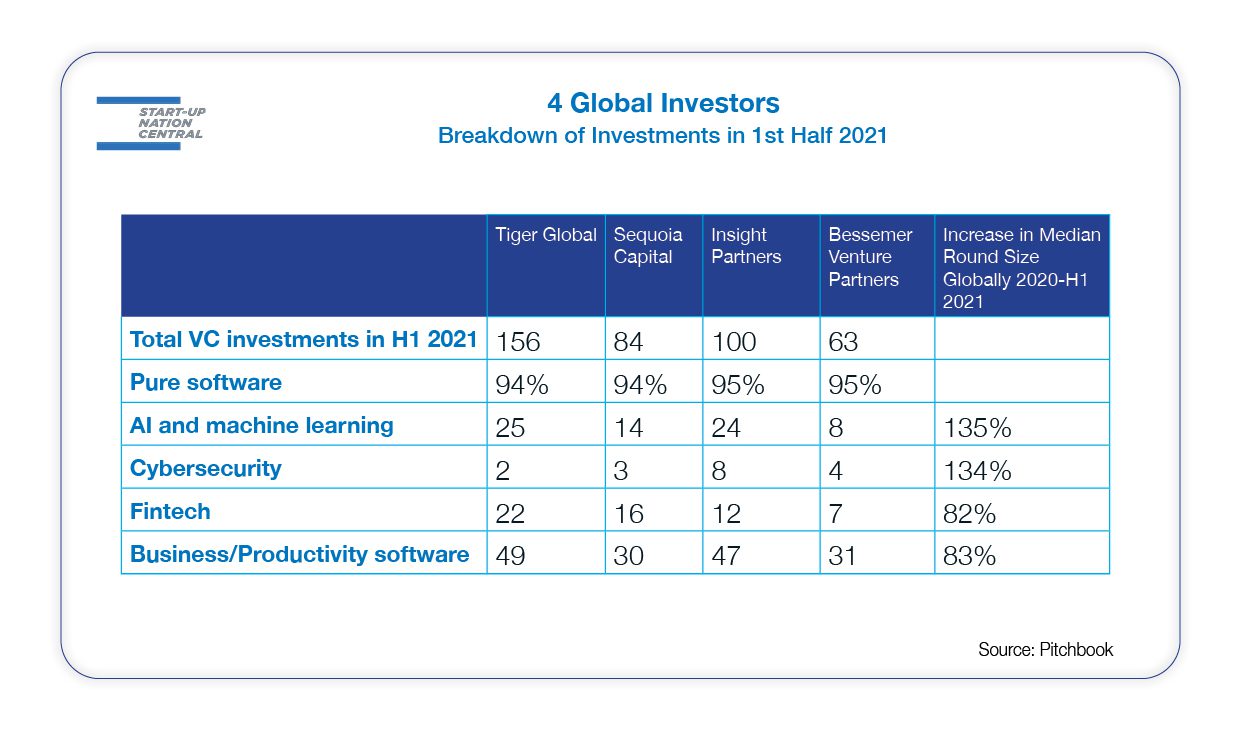

An additional, perhaps complementary, explanation is that the strengths of Israel’s software-driven ecosystem happen to correspond with the types of companies that large global investors are looking to invest in. VC investors currently have a strong preference for pure software companies. In 2021, 34% of VC capital was invested into software companies, up from 22.5% in 2006. This preference is even stronger amongst the Giants. Examining investments made globally in 2021 by the largest investors who are also among the most active in Israel, we see that Tiger Global, Sequoia, Insight, and Bessemer have invested in pure software companies over 90% of the time.

Another feature of the Israeli ecosystem is the dominance of B2B over B2C solutions. While this has sometimes been seen as holding back the development of very large companies which are more often B2C oriented, this changed during the pandemic when B2B companies saw a surge in demand for their products as businesses adapted to remote work and other changes while many B2C companies saw demand drop as consumers held back on spending. Global investors have shown a strong preference for B2B investments in the last year or so as many of those sectors have seen soaring growth.

Strongest Sectors in Israel

Some of the sectors that have been most popular among global investors are also areas that Israel has traditionally excelled in. The table above shows some of the most popular industries that the larger global investors have targeted this year. As can be seen, AI and machine learning along with cybersecurity have all seen investments from all these investors and their median round size has more than doubled. Other industries where Israel is strong, such as FinTech and business/productivity software have seen their round sizes almost double.

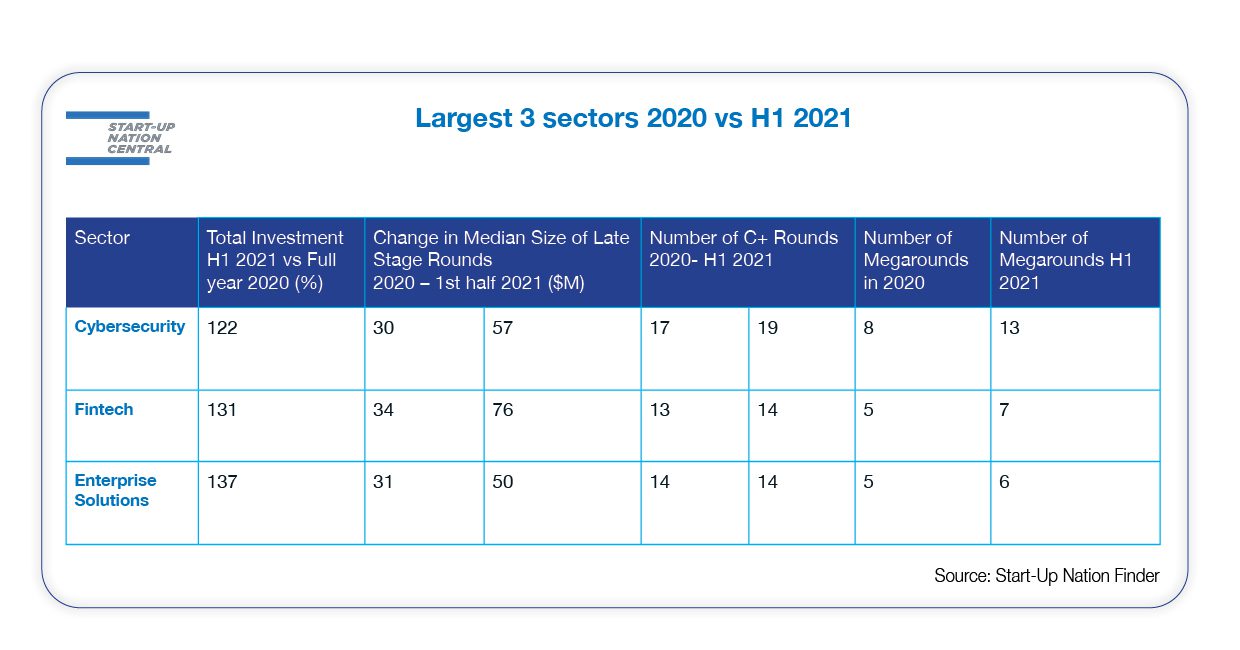

While the classifications in Start-Up Nation Central’s Finder database do not precisely match these sectors, Cyber, FinTech and Enterprise Solutions are the leading sectors in Israel when it comes to capital raised in 2021 and for the last few years. Increasing deal sizes mean that these sectors have all already far surpassed their totals raised in 2020 by the middle of 2021.

The table below shows that all of them experienced similar investment trends in 2021. These include above-average increases in investment in H1 2021 vs 2020, high and increasing median round sizes at later stages, an increasing number of rounds at stage C or later, and a large number of mega-rounds.

In total, these three sectors accounted for almost 62% of all money raised in H1 2021 and can be considered the engines of the ecosystem.

Conclusion

The huge increase in investments that we saw in Israeli high-tech in 2021 did not come out of nowhere but was a result of a process that has been taking place over the past few years. The increase in assets raised by the largest global investors and their increased involvement in Israel has been the primary driving force behind the massive rise in investments which explains the dramatic increase in large size rounds we have witnessed since 2019. The effects of the pandemic along with the composition of Israel’s ecosystem have accelerated this trend even further in 2021. This trend may have even further to run as many of the largest global investors are still barely active in Israel and this may change as they look to deploy their high levels of dry powder.

* All Israel-specific data is from Start-Up Nation Finder as of 4 July, 2021. All global data is from Pitchbook unless otherwise stated, as of 4 July, 2021.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers