At the Height of the COVID-19 Pandemic, January Sees Record Number of Investments in Israeli Startups

Finder

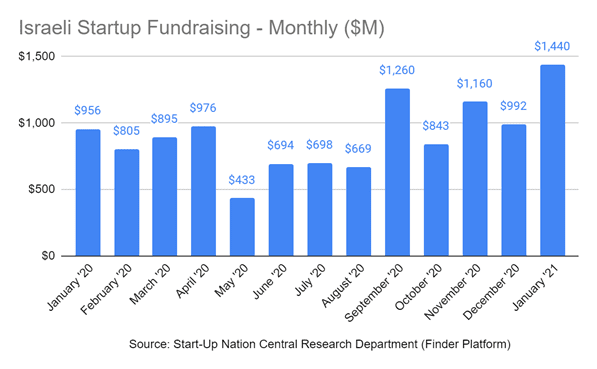

Analysis by Start-Up Nation Central has revealed that January 2021 saw record investments in Israel during a single month. Six startups raised more than $100 million each (mega-rounds) during the month, accounting for 73% of the total, record-breaking $1.44 billion raised by Israeli firms in January. Furthermore, the mega-rounds in January 2021 alone, equal close to 30% of the total number of mega-rounds in the entire year of 2020 (21 in total). January 2021 comes on the heels of a record year; 2020 saw investments surpass $10 billion.

All of the aforementioned reflects a strong vote of investor confidence in Israel’s innovation ecosystem during the COVID-19 pandemic.

The six mega-rounds announced during January 2021 were raised by the following companies: Rapyd Financial Network (FinTech), $300M, D Round; Drivenets (Network Infrastructure), $208M, B Round; OwnBackup (Enterprise solutions), $167.5M, D Round; K Health (Digital health), $132M, E Round; Resident Home (Ecommerce), $130M, B Round; and Melio (FinTech), $110M, D Round.

It is the highest number of both mega-rounds and general investments made during a single month in Israeli startups. The year 2020 witnessed 21 ‘mega-round’ investments during the whole of 2020, equivalent to 33% of the capital raised. As a monthly comparison, there were three ‘mega-rounds’ in January 2020, none in January 2019 or January 2018. The mega-rounds in January were led by US investors.

FinTech was the dominant sector during January with two ‘mega-rounds’ and $413M raised (29% of the total fundraising in January). It is a continuation of Fintech’s strong performance since September 2020 with $1.4B in investments compared to only $340M raised in the first eight months of 2020.

According to Meir Valman, Director of Research at Start-Up Nation Central, “the record level of fundraising in recent months is driven by two effects. One is the increasing maturity of the Israeli tech ecosystem, when rapidly growing startups are able to raise much larger rounds. The other is the effect of COVID-19 on Israeli companies, which pivot rapidly to address the challenges of the pandemic, but that will also stay relevant long after it is gone.”

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers