Israeli Tech Ecosystem Resilience Analysis of the IL tech ecosystem following Operation Protective Edge (Tzuk Eitan) 2014 conflict

Finder

Tel Aviv, November 1, 2023: Start-Up Nation Central, a non-profit that promotes the Israeli innovation ecosystem around the world, publishes an analysis of the IL tech ecosystem following Operation Protective Edge (Tzuk Eitan) conflict during the summer of 2014. Leveraging data before, during, and after the Operation Protective Edge conflict from its comprehensive information platform Finder.

Historically, during and following regional conflicts, the Israeli economy shows resilience. The same applies to the Israeli tech ecosystem. The main finding was that the tech ecosystem not only showed resilience during the conflict but also continued to grow after it. Moreover, companies that raised funds during the conflict demonstrated successful and a solid investment.

Main findings

Macro parameters:

- The average growth rate in GDP was higher than other OECD countries. In 2014, during Operation Protective Edge, Israel’s GDP growth was double the OECD average – 4% compared to 2%.

- The public market, TASE, has repeatedly generated returns for investors after conflicts including Operation Protective Edge

Raising funds:

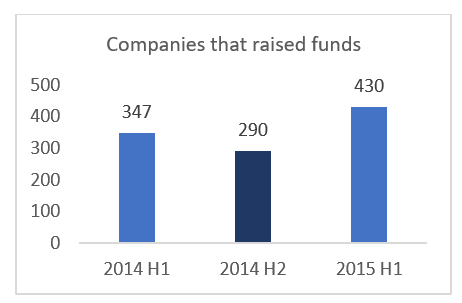

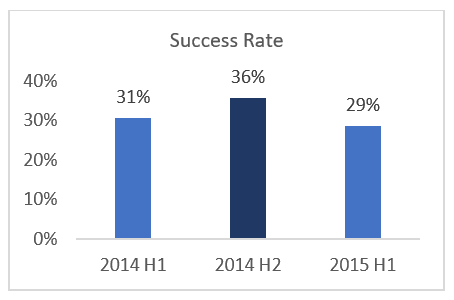

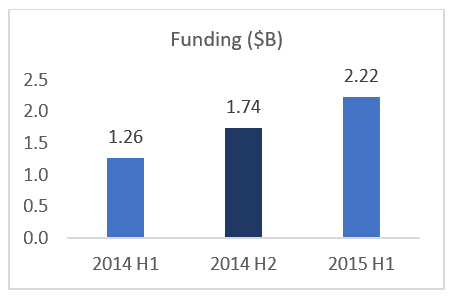

- ~290 companies raised funds during H2 2014, 36% of these companies were later acquired, executed an IPO, or achieved unicorn valuation, compared to ~30% of the companies who raised funds in the halves before and after the conflict. Total funding was $1.74 billion, a 38% increase compared to half before the conflict.

- Among the companies that raised funds during (and right after) Operation Protective Edge: JFrog, ironSource, Fiverr, HoneyBook, Payoneer, Datorama, Argus Cyber Security, Augury, Tipalti, Forter, eToro, SimilarWeb, Trax Retail – most of them are still strong and growing today.

Founding companies:

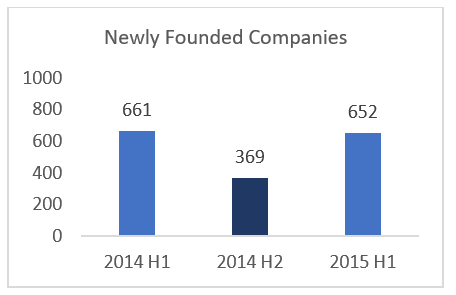

- ~370 companies were established during H2 2014. This is lower than H1 2014, however, these companies raised double the funds compared to companies founded before H1 2014.

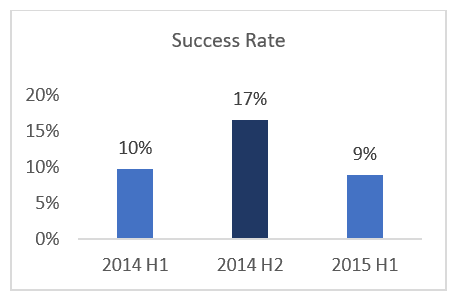

- ~17% of the companies established in H2 2014 were acquired, went public, or became unicorns, compared to ~10% of the companies that were established before and after.

- Some of the companies that were established during (and right after) Operation Protective Edge include: Claroty, Prospera Technologies, Avanan, Transmit Security, RapidAPI, PereimeterX.

Raising Funds

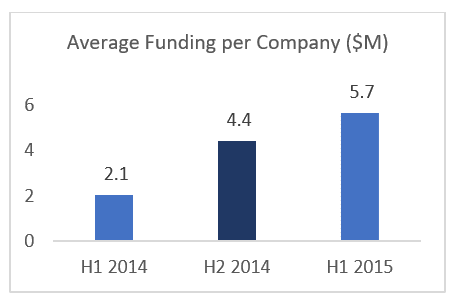

Although fewer companies raised funds during the conflict, funding amounts continued to grow (38% higher than previous half) and their success rate was higher than companies who raised funds during the previous or successive 6 months.

Charts 1-3:

Notes for charts 1-3

- Population – private companies that raised funds during H12014, H2 2014 and H2 2015

- H2 2014 is marked dark blue indicating when Operation Protective Edge occurred (July – August 2014)

- Success rate is defined as the rate of companies that eventually went public, were acquired, or became a unicorn.

There are some notably successful companies that raised funds during the conflict and the months following (H2 2014), including: JFrog, ironSource, Simply, Fiverr, OpenWeb, HoneyBook, Payoneer Global, Datorama, Argus Cyber Security, Augury, Tipalti, Autotalks, Hello Heart, Forter, eToro, SimilarWeb, Trax Retail

Founding New Companies

During the conflict period (H2 2014), fewer companies were established. However, these companies raised more funds over the next 5 years than companies founded prior to the conflict. In addition, their success rate was higher than for companies founded in the previous or successive periods.

Charts 4-6:

Notes for charts 4-6

- Population – companies that were founded during H1 2014, H2 2014 and H2 2015

- H2 2014 is marked dark blue indicating the half during which Operation Protective Edge occurred (8 July – 26 August 2014)

- Average Funding per Company is based on a 5-year period following the quarter when the company was founded.

- Success rate is defined as the rate of companies that eventually went public, were acquired, or became a unicorn.

There are some notably successful companies founded during the conflict and the months following (H2 2014). These include: Claroty, Prospera Technologies, Avanan, Transmit Security, RapidAPI, PereimeterX.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers