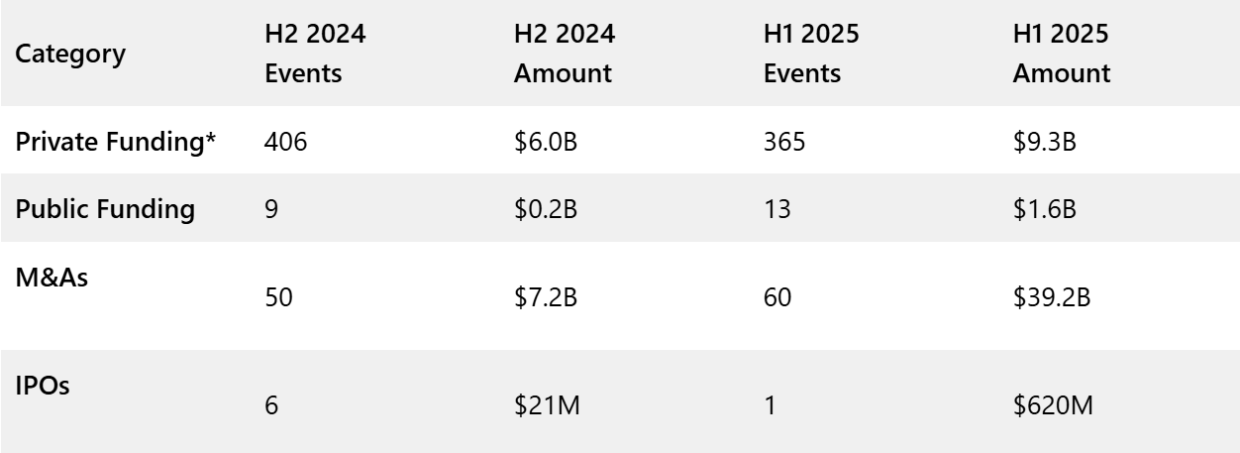

TEL AVIV, June 29, 2025: Startup Nation Central, a nonprofit promoting the Israeli innovation ecosystem globally, has released a mid-year analysis based on data from the Finder business platform, revealing that the first half of 2025 marked the strongest six-month period for Israeli tech funding in three years. Private capital raised reached an estimated $9.3 billion, a 54% jump compared to the second half of 2024. This recovery, which began in late 2024, accelerated in Q2 2025, with funding rising from $3.3 billion in Q1 to $6 billion in Q2, despite a decrease in the number of rounds from 214 to 151.

Larger rounds are becoming more common. The number of rounds exceeding $50 million rose from 20 to 32. Among them was the $2 billion Series B round by Safe Superintelligence (SSI), one of the largest in Israel’s history.

Enterprise software led all sectors with $3.19 billion across 71 rounds. Cybersecurity followed with $1.98 billion across 56 deals. Without the Safe Superintelligence megadeal, cyber would have led the category. Fintech was third, with $751 million across 29 rounds, including a $500 million raise by Rapyd. Health tech had the highest number of rounds (69) but a lower total of $623 million, mostly early-stage.

Early-stage recovery is evident, with pre-seed and seed funding up 50% to $607 million. There was also a 60% increase in Series B and C funding, not including the SSI raise. The overall number of deals decreased by 10% compared to the second half of 2024, however, the median round size grew by 28% to $9 million, demonstrating rising investor confidence in mature startups.

Landscape

* Private funding includes estimation of the amount raised in rounds with an undisclosed amount and also accounts for yet to be reported rounds.

Avi Hasson, CEO of Startup Nation Central, said:

“The data from the first half of 2025 proves that the market continues to price in long-term confidence in Israeli tech, even amid a complex security reality. Just last month, during the lead-up to and throughout the campaign against Iran, we saw 31 funding rounds, providing clear evidence that entrepreneurs are still building and investors still remain confident. The strength of the shekel, positive market trends, and the strong presence of global players, both in VC and strategic acquisitions, all reflect the market’s view of Israel’s medium and long-term economic potential. This is yet another sign that Israeli technology, with its unique characteristics and capabilities, remains a valuable force in the global market.”

M&A activity reached a record $39.2 billion in the first half of 2025, driven by Google’s $32 billion acquisition of Wiz. Other notable deals included Next Insurance ($2.6 billion) and Melio ($2.5 billion). Even without the Wiz deal, M&A value stayed consistent at $7.2 billion. There were 60 first-time acquisitions, the most since the first half of 2022, with 51% led by global strategic buyers and 42% by local acquirers.

Public funding also showed momentum. There were 13 transactions totaling $1.6 billion, up from $200 million in the second half of 2024. eToro’s IPO on Nasdaq, the first significant Israeli tech IPO in years, was well received, with shares jumping over 30%.

A total of 447 investors have invested in Israel in the first half of 2025, representing a 12% decrease from the previous six months. Despite the ongoing regional conflict, global investors continued to dominate with a share of 62%. The share of rounds with global investor participation increased eight percentage points from 61% in H2 2024 to 69%. iAngels and Pitango were the most active Israeli investors with 15 each.

Yariv Lotan, VP of Digital Products and Data at Startup Nation Central, said:

“The quantity-to-quality trend we’ve been tracking is only getting stronger, with fewer deals, but each round is larger and more focused. While it’s taking longer for rounds to close, the capital being raised is giving companies more breathing room. Even at the early stages, there’s a recovery: pre-seed and seed investments rose 50%, from $406 million to $607 million, along with a 60% increase in mid-stage rounds. These, along with active dealmaking in stealth-stage companies, reinforce the ‘startup baby boom’ trend we pointed to at the end of 2023 and mark a standout investment opportunity in Israel’s tech ecosystem.”

The full report will be released in mid-July and will include deeper sector trends, international comparisons, and perspectives from across Israel’s tech ecosystem.

About Startup Nation Central: Startup Nation Central helps global solution seekers tackle complex challenges by giving them frictionless access to the expertise and solutions of Israel’s problem solvers – and their bold and determined approach to innovation. We call this Impatient Innovation. Our free business engagement platform, Finder, grants unrestricted access to real-time, updated information and deep business insights into the Israeli tech ecosystem, explore potential opportunities, and forge valuable business connections.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle