Israel’s reclassification by MSCI is a boon to the country and tech investors

Tech Innovation

Background

For the last couple of decades, Israel has been on a continuous journey, transitioning from a developing economy into a developed one. Led by a thriving high-tech industry, which earned its branding as “Start-Up Nation,” Israel is a country that every investor should have some exposure to. With 54 tech unicorns and attracting $25.6b of investment in high-tech, Israel clearly punches above its weight.

As part of this journey, in 2010, American finance company, Morgan Stanley Capital International, Inc. (MSCI), changed Israel’s classification to a developed market (DM). By way of geographical classification, MSCI considers Israel as part of the Middle East region, and thus, Israel is currently the only developed market in this region.

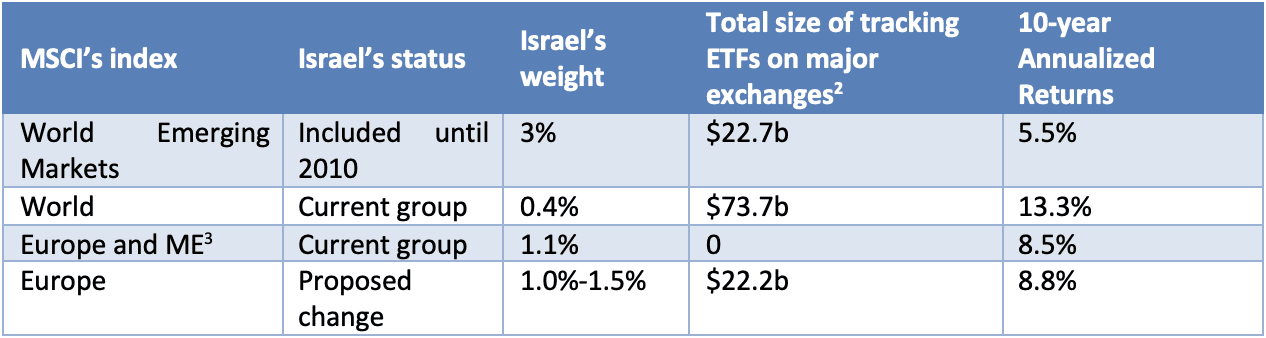

Before this change, Israel was included in the MSCI World Emerging Markets index and comprised around 3% of that index. Currently, it is only 0.4% of MSCI World (which is an index of DMs). Additionally, as a result of this change, Israel is not included in any of MSCI’s major regional indices. Thus, the “upgrade” in 2010 actually resulted in a large decrease in the involvement of foreign ETFs and mutual funds in the Israeli stock market (see table below for comparison).

Israel is included in the MSCI Europe and Middle East index, where its weight is 1.1%. However, this index is a rather obscure one that very few ETFs or mutual funds track. In contrast, the far more popular MSCI Europe index is tracked by funds worth more than $170b.[1]

Table 1: Comparison of Israel’s inclusion in different MSCI indexes

Expected Effect of Reclassifying Israel to the European Region

Changing Israel’s regional classification to Europe as is now proposed would essentially make the modified MSCI Europe and existing MSCI Europe & Middle East one and the same. Israel’s weight in that new index is expected to fluctuate around 1.0%-1.5%. Therefore, based on the amount of capital tracking this index, we expect to see an additional flow of at least $2b into the Tel Aviv Stock Exchange.

Beyond the main regional index, this will also affect Israel’s participation in regional-sectorial indices. In particular, Israeli tech companies are likely to constitute a substantial share of the MSCI Europe Information Technology index. It is estimated that some 100 Israeli companies would be included in at least one sectorial index as a result of this change.

The large capital inflow is set to benefit the entire financial system by largely improving the liquidity in the market (which is a constant concern), making it easier for Israeli companies to go public, and by incentivizing Israeli companies that are listed abroad to consider dual listing. Overall, this will enhance the performance of the Israeli capital market, and, we believe, promote growth.

Appreciation Concerns

A caveat to the above statement revolves around the timing of Israel’s inclusion. At the end of 2021, the USD/ILS exchange rate reached an all-time low of 3.10, and the Shekel is expected to remain exceptionally strong for the near future. This sharp appreciation has the potential to severely hinder exports, which make up roughly a third of GDP, posing a reason for concern.

Naturally, a sudden inflow of billions of dollars would only add to the appreciative pressures and pose a challenge for the Bank of Israel. However, the Bank of Israel has been dealing with this issue since 2008 and has managed to use a combination of standard monetary policy coupled with USD purchases in order to absorb some of the capital inflows, and lean against the wind.

Now may not be the ideal moment to make this change, but since we strongly believe that this move would bolster Israel’s future prosperity, we embrace changing Israel’s regional classification.

Benefits to Investors

The inclusion of Israel into the MSCI Europe Index would benefit investors. The Israeli market is typically not exposed to the same geopolitical events that European countries are. Therefore, the addition of Israel to the index could improve its diversification, increasing returns and decreasing risk. In addition, the inclusion of Israel will increase exposure to the high-tech sector, further providing sector diversification. Moreover, while successful Israeli high-tech firms tend to go public abroad, the Israeli exchange does offer the option to be dually traded. As a result, investors could benefit from higher exposure to leading tech companies through the Israeli exchange. Overall, we believe that the Israeli market inclusion in the index is of value to investors as it will increase diversification and returns.

Efforts to Support the Reclassification

The relevant Israeli authorities all support the efforts to reassign Israel to the European region. The Israel Securities Authority (ISA) has been actively promoting and campaigning for this change for more than two years, along with other government agencies.

There was already an attempt at reclassification in 2013 that failed. At the time, MSCI explained that “the majority of international institutional investors that participated in the consultation do not consider the MSCI Israel index to be part of their European investment opportunity set and hence, are not supportive of an inclusion of the MSCI Israel Index in the MSCI Europe index.”

We hope that this time international investors will see the benefits of exposure to Israel as part of the MSCI Europe and related indices and that the current attempt will prove successful.

[1] Based on the calculations of the ISA.

[2] We calculated the total size of ETFs tracking these MSCI indices based on data from TrackingDifferences.com. These figures can be seen as a proxy for the relative importance of these indices. Note that there are many other types of investing products tracking these indices which are not included. For a more complete list of exchange traded products based on MSCI indexes, see here.

[3] This is currently a very obscure index that does not have any notable tracking.

Start-Up Nation Policy Institute (SNPI) is an independent think-tank from the Start-Up Nation Central group focusing on Israeli Innovation policy. it is a nonprofit organization, SNPI’s mission is to strengthen Israeli innovation economy while maximizing the socio-economic value captured in Israel. It employs data-backed research that serves as the foundation for policy recommendations while working to stimulate open discourse on innovation-related issues.

Follow SNPI via Linkedin.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers