Innovation Ecosystem Survey: Examining the economic impact of the judicial reform process

Tech Innovation

Tel-Aviv, July 23, 2023: Start-Up Nation Central, conducted a follow-on survey of leaders of the Israeli tech ecosystem (founders and CEOs of startups and managing directors of VC funds) from July 18-19. The purpose of the survey was to understand implications thus far in 2023 and the industry’s expectations into the future, in light of the judicial reform legislation and civil unrest that has now plagued Israel for the last six months.

The survey questionnaire was completed by 734 professionals, representing 521 companies , according to the following breakdown:

• Startup/tech companies – 615 respondents

• Investors – 119 respondents

Although the survey focuses on the local risks posed by the judicial reform process, it is important to note the difficulty in isolating these risk and actions of investors and high-tech companies from global economic trends, especially regarding the difficulty in raising funds and laying off workers. We therefore sought to gauge the Israeli tech sector’s expectations for recovery in the venture space compared with the US technology and VC market.

Key Highlights

Here are the key findings from our July survey:

• 68% of Israeli startup companies have begun taking active legal and financial steps, like withdrawing cash reserves, changing HQ location outside Israel, relocation of employees and conducting layoffs.

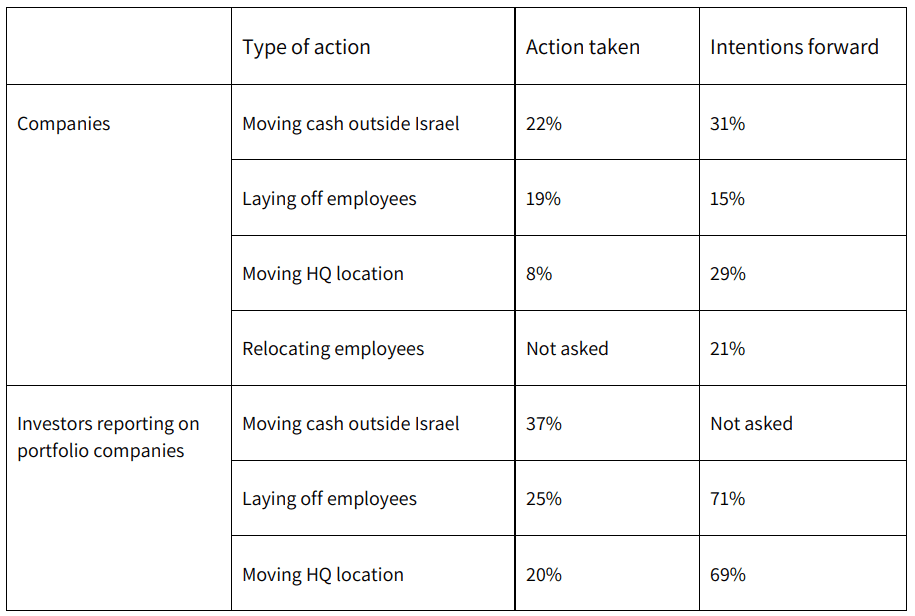

• 22% of companies report that they have diversified cash reserves outside Israel and 37% of investors say companies in their portfolios have withdrawn some of their cash reserves and moved them abroad.

• 8% of companies report that they have already begun the process of changing HQ locations, and 29% reported their intention to do so in the near future. 20% of investors note that companies in their portfolios have begun changing HQ location and 69% of investors noted that companies in their portfolios intend to do this in the future.

• 67% of investors are investing or are considering to invest in foreign companies – investments outside Israel are growing as a component in Israeli VC investment strategy.

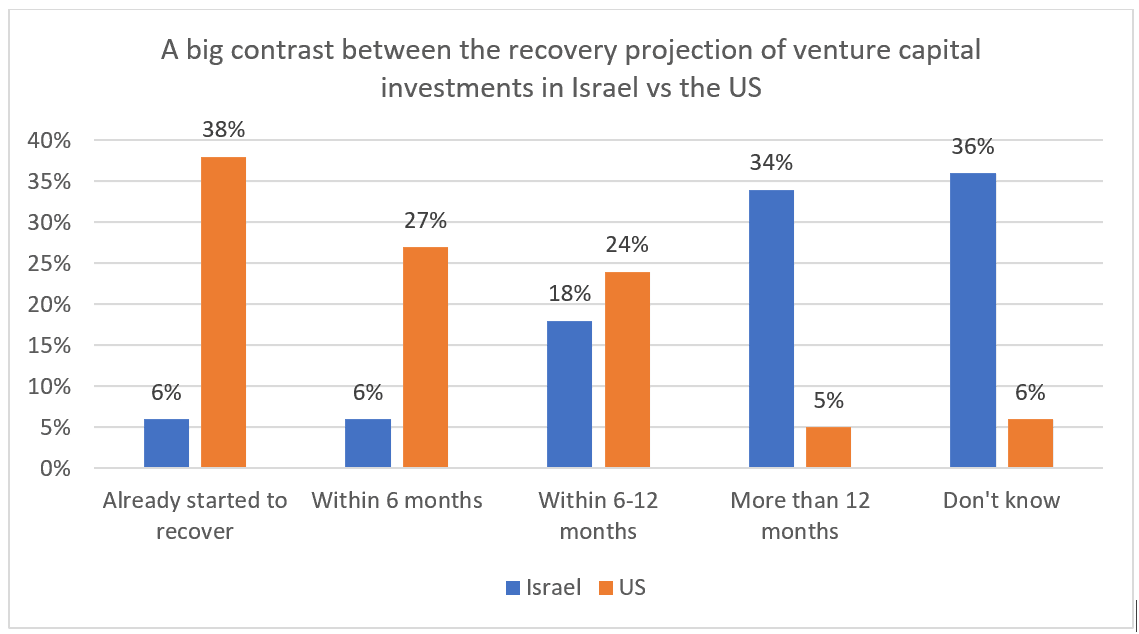

• 65% of investors already see signs of recovery in the US venture capital market or believe they will see them in the coming six months, compared with only 12% in Israel.

Start-Up Nation Central CEO Avi Hasson: “Companies and investors are taking active steps to move activity away from Israel and this behavior has increased significantly over the past three months. Concerning trends like registering a company abroad or launching new start-ups outside Israel will be hard to reverse. As an organization with a mission to strengthen the technology industry in Israel, it is our duty to share this data with decision makers in Israel and provide an up-to-date picture of the situation as it unfolds.”

Survey findings:

1. The ecosystem is currently experiencing headwinds and there is uncertainty about the future of VC investments in Israel. This concern is more noticeable when comparing expectations for Israel with the US market.

1.1. 65% of investors think the US is already seeing signs of recovery or will see them within six months compared to only 12% in Israel.

1.2. There is significant lack of clarity regarding the expected horizon of recovery in Israel. 36% of investors say they cannot assess when a recovery will begin in Israel, compared to only 6% who said they cannot predict the same for the US.

2. Investors observe that the judicial reform is already affecting their investment strategy in a way that will harm Israeli companies’ ability to get investments.

2.1. 72% of investors say there will be a negative influence on investment in new companies, compared to 68% who said so in the previous survey. In the recent survey, 28% said the influence will be very negative, compared to 18% who said the same in the previous survey.

2.2. Investment outside Israel is gaining more weight in investors’ strategies: 67% of investors are investing or considering investing in foreign companies – 39% have already invested in foreign companies in the past, 5% started investing recently, and an additional 23% are considering beginning to invest in foreign companies.

3. In light of the uncertainty created by the judicial reform, the survey shows that most company executives have already begun taking substantial steps to reduce costs and / or make financial and legal changes.

3.1. 68% of companies are taking active steps (including: withdrawing cash reserves, registering companies overseas, relocating employees and conducting layoffs).

3.2. 22% of companies report that they have moved cash reserves outside Israel, and of these, 53% said they moved abroad more than 30% of their cash reserves.

37% of investors said their portfolio companies moved some of their cash reserves abroad, and of them, 68% said more than 30% of the funds were transferred.

3.3. 19% of companies say they laid off employees and of these companies, 46% said they laid off 10-30% of the workforce, and 28% said they laid off more than 30% of the workforce.

25% of investors reported layoffs in their portfolio companies

3.4. 8% of companies said their headquarters are now registered elsewhere.

20% of investors said companies in their portfolios began the process of registering outside Israel.

4. A vast majority of startup companies intend to take actions to transform and contract in the coming future. These actions include withdrawing remaining cash, changing location (away from Israel), employee relocation and layoffs.

4.1. 76% of the companies intend to take active measures in light of the judicial reform and its implications.

4.2. 31% of companies intend to remove funds from Israel.

4.3. 29% of companies intend to relocate their headquarters. Of these, 70% say they already took active steps to examine the legal and financial ramifications of such a move. 69% of investors believe companies in their portfolios will relocate their HQs and register in a different country.

4.4. 21% of companies intend to relocate employees.

4.5. 15% of companies intend to lay off employees. 54% of these companies estimate they will lay off 10%-30% of the employees, and another 31% estimate they will lay off more than 30% of their workforce.

71% of investors expect layoffs in their portfolio companies, of which 64% expect 10%-30% layoffs and 20% expect more than 30% layoffs.

A table summarizing the comparisons detailed in clauses 3 (actions already taken) and 4 (actions intended to be taken)

5. Investors and company leaders report that the judicial reform legislation’s progress has a negative impact on their companies, similar to the survey results conducted in March 2023.

5.1. 78% of company executives reported that the judicial reform is negatively impacting the activity of their companies.

5.2. 84% of investors said the judicial reform has a negative influence on their portfolio companies.

5.3. 80% of investors believe that any deterioration of relations between Israel and the United States will have negative influence on the tech industry in Israel.

6. A large majority of company executives and investors believe halting the legislation or passing a bill arrived at by wide consensus are necessary to improve the outlook of the Israeli tech industry.

6.1. Among the investors, 43% think stopping legislation is the correct remedy, while 40% believe legislation based on a wide consensus (like the president’s proposal) will improve the situation.

6.2. Among company executives, 44% think stopping legislation is the correct remedy, whereas 31% believe legislation based on wide consensus will improve the situation.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers