2021 was the Best Ever Year for Israeli Tech: $25 Billion Raised and a Record Number of Unicorns and Mega Rounds

Finder

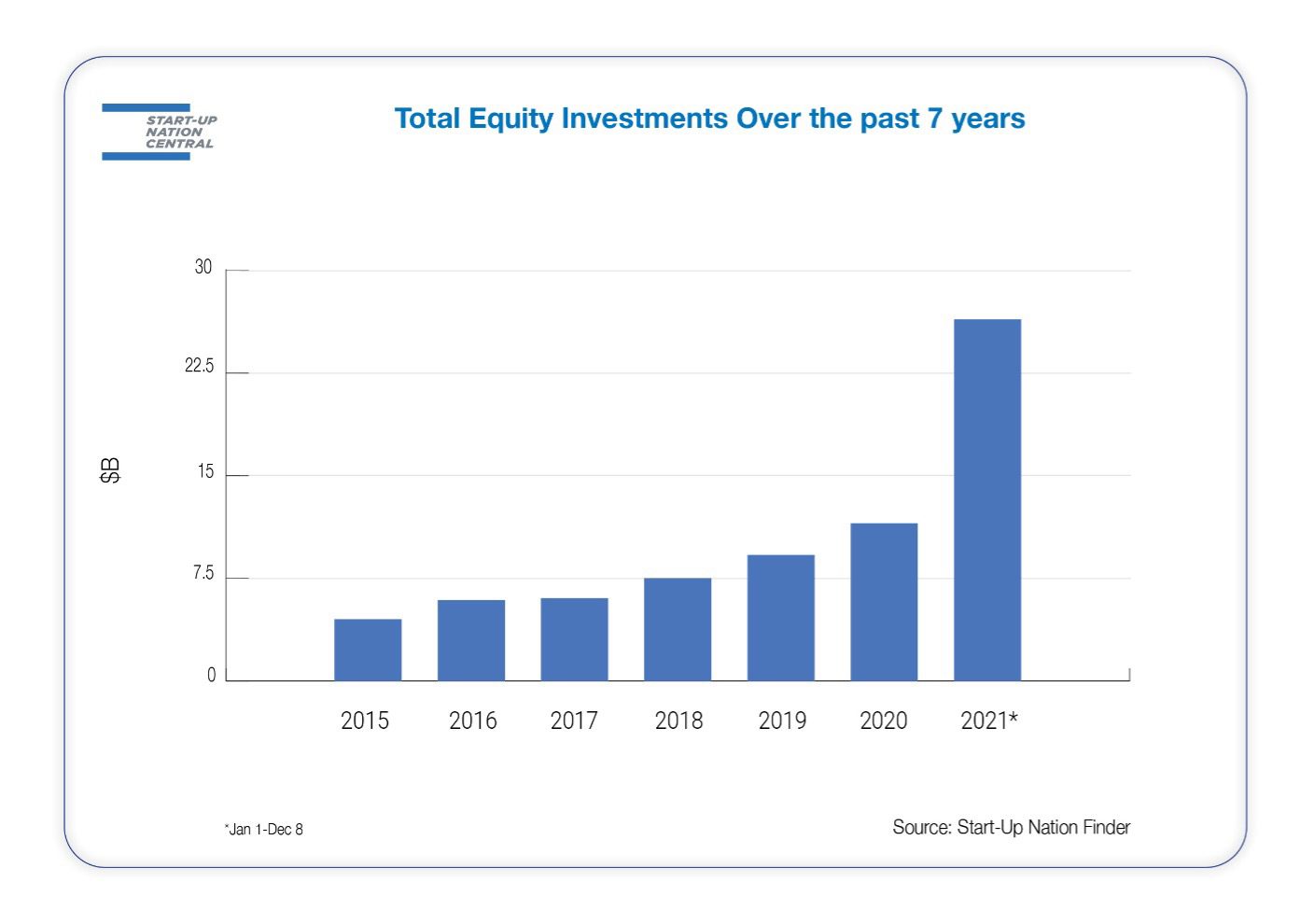

‘- With $25.4 billion raised so far in 2021, representing 136% growth in equity investments over 2020, Israel surpassed the average global increase (71%) and that of the US (78%).

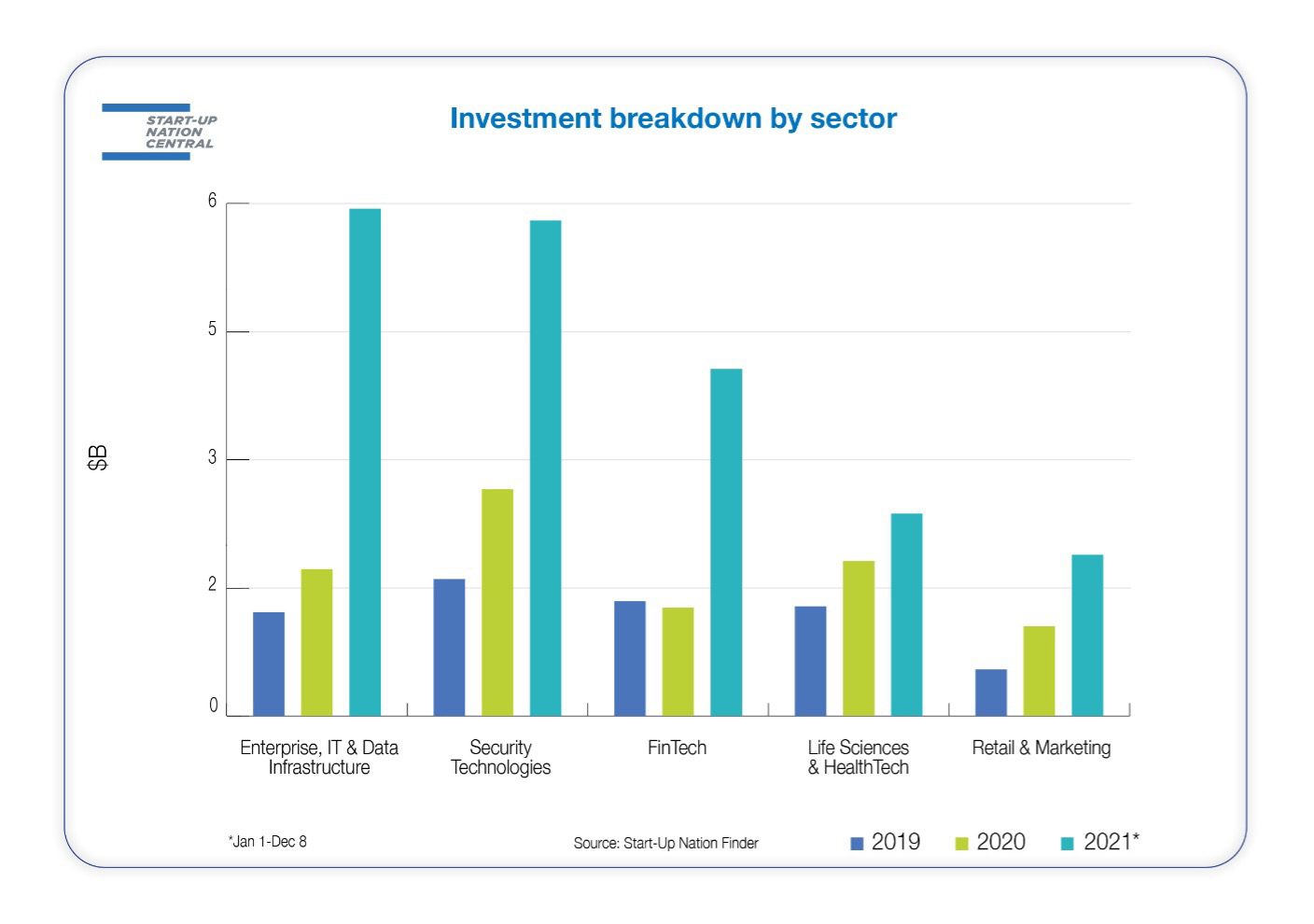

– FinTech, Enterprise IT & Data Infrastructure, and Security Technologies are the three largest sectors in terms of funding, each doubling last year’s total and emerging as the ecosystem’s main drivers.

– The number of mega-rounds climbed from 22 in 2020 to 74 in 2021, hitting $14.77 billion — 310% more than last year — and making up more than half of the funding total.

– 2021 saw 33 privately held technology companies join the billion-dollar club, reaching a total of 53 Israeli unicorns.

– The number of IPOs shot up from 22 in 2020 to 57 in 2021, raising an accumulated $4 billion. Although the trend made many headlines this year, only 10 companies carried out SPAC mergers, raising an accumulated $4.9 billion.

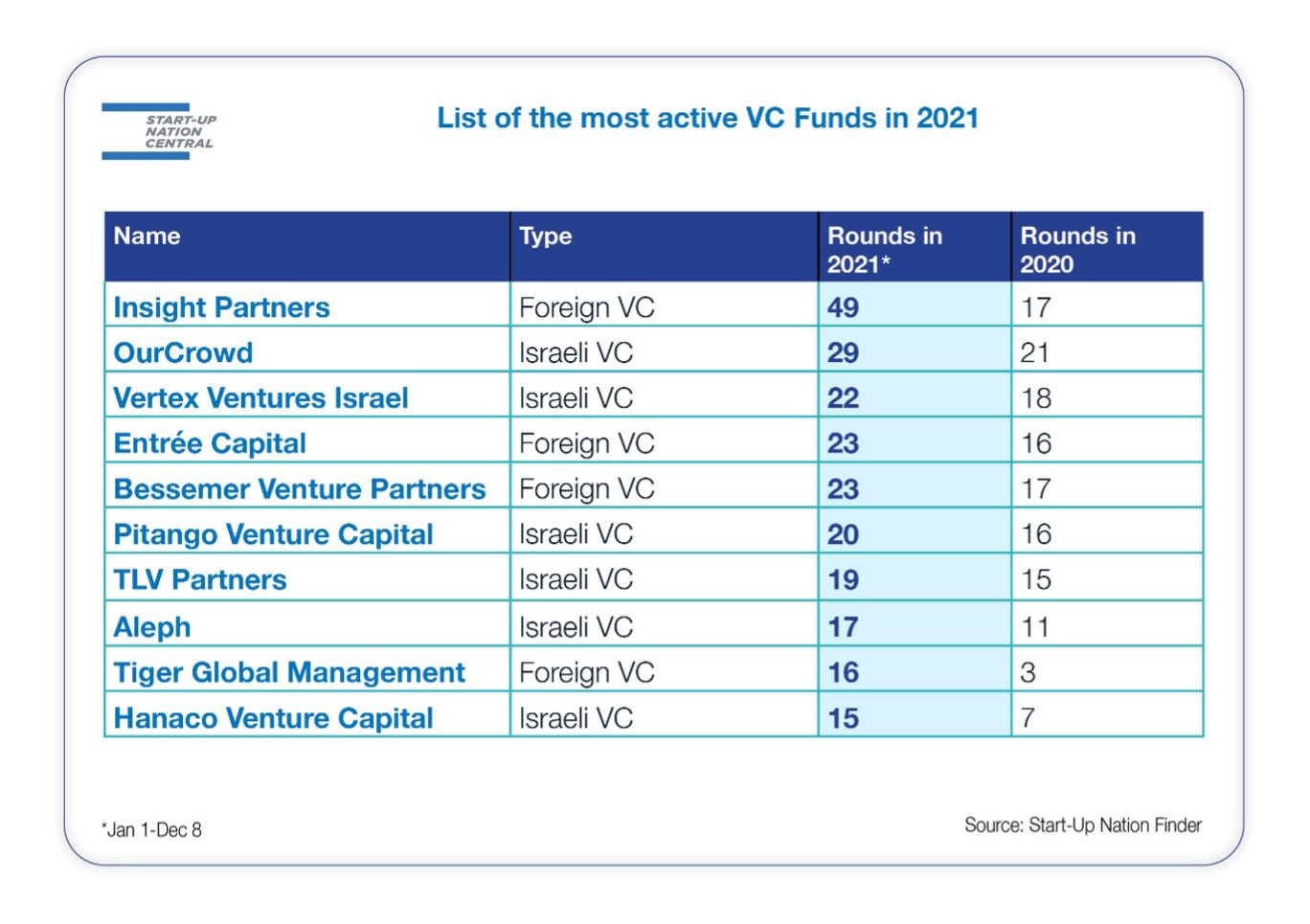

– Some of the most active investors in 2021 were foreign-based VCs that are among the world’s largest tech investors, including Insight Partners (participated in 49 rounds), Bessemer Venture Partners (23), and Tiger Global Partners (16). This illustrates the level of attractiveness Israeli companies hold for foreign investors and their growing influence on the market.

TEL AVIV Dec. 13, 2021 — Start-Up Nation Central released today an end-of-year summary highlighting the blistering growth of Israel’s technology sector. The sector raised a record total of $25.4 billion in 2021, according to Start-Up Nation Finder. The unprecedented figure represents a 136% increase over last year, which concluded with a full-year total of $10.8 billion raised.

Although investment in technology companies has grown considerably across the world, the rate of increase of funding for Israeli companies far surpasses the global average of 71%, as well as those of other tech centers, including the US (78%), the UK (105%), and Singapore (95%), according to comparative data on compiled from PitchBook on Dec. 1.

FinTech, Security Technologies, and Enterprise IT & Data Infrastructure – Israel’s Big 3 Tech Sectors

The three sectors that dominated investments in Israel were FinTech, Enterprise IT & Data Infrastructure, and Security Technologies (predominantly Cybersecurity), all three more than doubling FY2020 figures. The leading three sectors made up 65% of total funds raised, compared to 52% of the total raised by the same sectors throughout all of 2020. These sectors emerged as the “Big 3” of the Israeli ecosystem due to the fact that they are comprised primarily of pure software companies capable of delivering rapid solutions and are generally unaffected by distance from market.

2021 Sees a 310% increase in Mega-Rounds

An indication of the hunger for investment in Israeli tech companies was the number of mega-rounds over 2021. Since the start of the year, there have been 74 funding rounds that raised more than $100 million, more than double the number of rounds raised last year. Those rounds raised an accumulated $14.77 billion – up 310% from $3.6 billion last year – and made up more than half the total amount raised in 2021. In addition, the median round size rose from $6 million to $14 million.

33 Companies Join Israel’s Unicorn Club

More than $11 billion – a little under half of the total funding raised this year – went to what has come to be known as Israel’s unicorn assembly line. Thirty-three unicorns (privately held companies valued at over $1 billion) were born this year, more than doubling Israel’s total, which now stands at 53. Like the market as a whole, Israel’s unicorn club is dominated by companies that belong to the FinTech (11), Security Technologies (12), and Enterprise IT & Data Infrastructure (10) sectors.

A Record Year for IPOs and Acquisitions

2021 was also a phenomenal year for IPOs and acquisitions. Fifty-seven companies went public this year, having raised an accumulated $4 billion, nearly tripling the 22 IPOs completed in 2020, which raised an accumulated $1.7 billion. Despite the hype they received this year, so far, only 10 SPAC mergers have closed, raising a total of $4.9 billion. Although the rise in the number of acquisitions may have been more modest (119 up from 91 in 2020), their accumulated value nearly doubled from roughly $4 billion to $7.6 billion. One trend that stood out this year was the increase in the number of Israeli startups acquired by Israel-based companies. There were 39 such deals carried out in 2021, the highest number on record, up from 21 in 2020, another indication that the Israeli innovation ecosystem is maturing.

Foreign Funds Dominate Investments

The massive increase in equity investments in 2021 came with a big shift in the identity of the leading investors in Israel and how much they invest. According to data compiled by Start-Up Nation Central, top investors are participating in many more rounds than in previous years (see Fig. 3).

While Israel used to be somewhat of a niche market for investors, trends over the last two years – which became even more pronounced in 2021 – show that it is now a go-to source of solutions for the biggest names in the industry. As the following chart indicates, many of the world’s leading tech investment funds substantially increased the number of investments in Israeli companies. Another trend that emerged over the past year is the strong presence of foreign VC funds, which currently make up 7 of the top 20 most active funds and 4 of the top 10. This illustrates the level of attractiveness that Israeli companies hold for foreign investors and their growing influence on the market.

Seed Investments Climb, But at a Lower Pace

The one segment of the ecosystem that could be described as underperforming is early-stage companies. Although investments in seed rounds increased in absolute numbers, from $670 million to $794 million, the increase was less than in later stages. The number of seed rounds also continued to decline, from a peak of 361 rounds in 2018 to the current total of 188. The average seed round currently stands at $510,000. It should be noted that there is a time lag in the reporting of seed rounds, which means that the final totals for recent years will likely be higher.

Start-Up Nation Central CEO Avi Hasson: “Two years into the COVID-19 pandemic, the Israeli tech ecosystem is stronger than ever. In a world in which digital has become the default, the Israeli tech ecosystem is a world-class source of solutions to global challenges. Israeli companies in the most sought-after areas, like FinTech, and Security Technologies, have been able to supply their solutions to many more customers with a corresponding jump in valuations. The Israeli tech ecosystem is generally in excellent shape in terms of capital raised, foreign interest in our innovation, and the major buzz surrounding our ability to produce unicorns. This raises the question of whether Israel has made the transition from being the Start-Up Nation to the Scale-Up Nation.”

Hasson adds, “However, some of the challenges are reaching critical levels. Companies are struggling to find sufficient employees, with the Israeli tech sector suffering a chronic shortage of tens of thousands of skilled employees. One of the ways that Start-Up Nation Central helps the tech community is through a range of career training and placement programs created by our daughter organization Scale-Up Velocity. The programs — developed in partnership with government and industry leaders — are geared to helping companies achieve greater scale and overcome the human capital shortage by increasing the human capital pool that the tech ecosystem can draw from with candidates from a range of previously untapped sources.”

About Start-Up Nation Central:

Start-Up Nation Central is the address for corporations, governments, and investors to connect with the Israeli tech ecosystem. Start-Up Nation Central catalyzes growth opportunities by bringing Israeli tech innovation to global business and societal challenges. Established in 2013 and headquartered in Tel Aviv, Israel, Start-Up Nation Central is a not-for-profit organization funded by philanthropy.

Start-Up Nation Finder is a free online platform for identifying and engaging Israeli tech organizations based on customers’ specific interests. This innovation business platform is a comprehensive knowledge hub on Israeli startups, investors, acceleration hubs, multinational corporations, and technology-based innovation associated with academic research. The open-source platform provides up-to-date information and insights on thousands of active Israeli tech companies.

Graphics: (Credit: Start-Up Nation Central)

For more details contact:

Estie Rosen, Director Global PR at Start-Up Nation Central – 052-4677010, [email protected]

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers