Innovation must serve not only the economy but national priorities: security, stability and resilience.

Israel’s tech sector is more than a growth engine. It is one of the most strategic levers we have for long-term economic resilience, global relevance and national security. This Yom Ha’atzmaut, Israel Independence Day, as Israel turns 77, the innovation economy stands at a critical juncture.

The past year tested the entire ecosystem: infrastructure, capital, talent and trust. Yet even through conflict and uncertainty, Israeli tech continued to perform. In 2024, tech companies raised $10.6 billion. In the first quarter of 2025, private funding reached $3.2 billion, and thanks to the landmark acquisition of Wiz by Google, M&A (mergers and acquisitions) activity soared to $35.9 billion. Despite anticipated contractions in response to U.S. President Donald Trump’s currently delayed proposed tariffs and other macroeconomic factors, Israeli tech is staying the course.

These are not isolated data points. They prove a strong foundation, but the next phase will require more than resilience. It will demand strategic action. It will require scale, talent development, sector diversification and alignment between innovation and national priorities.

Here are the opportunities and challenges that will shape the path ahead for Israeli tech at 77.

Seven Opportunities for Israel at 77

- Cyber and defense tech as a scalable growth engine

Cybersecurity and defense tech attracted $3.8 billion in private funding last year, making it the most capitalized sector. Israeli companies continue to lead the global cybersecurity landscape, with some of the world’s top firms founded by Israelis or maintaining R&D hubs here. Defense tech is emerging as critical to national and economic security as AI, infrastructure and digital systems evolve. Dual-use technologies are in demand, and Israel is well-positioned to lead in platforms that secure digital assets, infrastructure and emerging AI systems, offering a new economic growth engine for the ecosystem. - AI stack leadership with global relevance

Israel operates across the entire AI value chain, from chip design and data infrastructure to applications that fit the global market, attracting strategic AI R&D operations from the world’s largest companies, including Meta, Amazon, Microsoft, Google and more. The Startup Nation Central and NVIDIA joint report highlights Israel’s strength in building commercially viable AI solutions across sectors like health, defense and finance. With global AI spending expected to reach $300 billion by 2026, Israel has a clear opportunity to shape the infrastructure and tools that define how intelligence is developed, deployed and secured. - Regional innovation diplomacy post-conflict

The Abraham Accords opened a new chapter in regional cooperation. But today, the geopolitical environment creates a deeper imperative. For the first time in Middle East history, countries across the region face a shared interest in investing collaboratively in innovation infrastructure. Tech collaboration in areas like water, food and climate can help stabilize the region and create new platforms for economic interdependence. Israel can help lead this transition. - Sustained investor confidence in scale

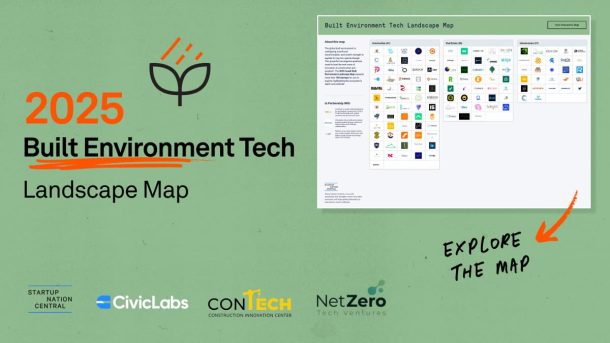

Despite the war, Israeli tech raised over $10 billion in 2024, with 15 mega-rounds totaling $4 billion. In early 2025, investment momentum continued. The first quarter saw 37 M&A deals totaling $3.9 billion, even excluding Google’s $32 billion acquisition of Wiz. Sectors like cybersecurity, fintech and health tech are showing maturity. Global investors, who make up most of the funding in the country, continue to see Israeli companies as relevant and competitive on the world stage. - Health, energy and food tech ready for scale

Israel is gaining recognition in sectors tied to global infrastructure and resilience. Startups in health, energy and food systems are beginning to secure larger rounds and scale internationally. These are high-impact areas where Israeli innovation can offer global solutions and contribute to economic growth at home. - Secure global R&D hub status

With more than 430 multinational R&D centers operating in Israel, including leaders in AI, semiconductors, cloud and enterprise systems, Israel is a trusted destination for innovation. As nations prioritize technological sovereignty and security, the ability to offer a stable and strategic R&D base is a clear advantage. - Foster growth companies and global category leaders

A new wave of Israeli scale-ups is emerging. These companies are not just growing, they are setting the standards and shaping markets. Companies like Wiz are leading the charge as global category creators, turning deep tech into dominant platforms and positioning Israel as a launchpad for industry-defining companies.

Seven Challenges for Israel at 77

- Geopolitical volatility and economic uncertainty

The Hamas-led terrorist attacks in southern Israel on Oct. 7, 2023, changed the operating environment for many Israeli companies. At the same time, global shifts and geopolitical tensions are impacting macroeconomic conditions and reshaping international supply chains. These developments increase production costs, introduce logistical risk and force Israeli companies to reassess global strategies. - Talent bottlenecks and workforce gaps

Startup Nation Central’s Q1 2025 Ecosystem Report shows that Israel’s tech workforce shrank by 1.2% in 2024, the first decline in more than a decade. Non-R&D roles like product, data and business operations saw the sharpest drop while R&D hiring grew by 3.6%, signaling a shift toward core innovation roles. To stay competitive, the sector must grow the local talent pool and better integrate women, Arab Israelis and Haredi workers, while curbing brain drain and supporting local talent to remain in Israel. - Need to move from strategy to execution

Israel has the talent and policy infrastructure to lead globally. However, national innovation programs are often not fully executed or coordinated. Strategic alignment between government, the tech ecosystem and capital markets remains a work in progress. Israel’s academic research and investment infrastructure is constrained by overregulation and bureaucracy. Reducing these barriers is key to enabling business growth and creating a more competitive environment. - Overconcentration in a few sectors

Cybersecurity is a strength, but relying too heavily on one pillar limits economic growth. Sector diversification into health, climate, semiconductors and food systems must accelerate. These areas offer strategic value and long-term economic returns and resilience. - Capital flow and global perception

Investors are taking a cautious view of political and economic uncertainty. Judicial reform, policy instability and regional tensions have raised questions in some global markets. Restoring and maintaining investor confidence will require clarity, consistency and sustained high performance from both the government and the ecosystem. - Tech sovereignty under pressure

As AI infrastructure, cloud computing and chips become central to national security, Israel must reduce its dependence on foreign-controlled systems. Strategic partnerships can help, but sovereignty must be maintained in the most critical layers of technological development and deployment. - Applied innovation starts at home

Israel builds world-class tech but lags in using it. Outside defense, most innovative products are launched in foreign markets and not utilized locally. In addition, basic services are slow and not digitalized, from opening a bank account to public-service delivery in the periphery. Closing this gap is critical for competitiveness and quality of life.

Israeli tech has proven its strength. Now, it must prove its strategy. The fundamentals are there. However, scale, talent and global partnerships will determine the next phase. Innovation must serve not only the economy but national priorities: security, stability and resilience.

This moment calls for execution. The decisions we make now will shape Israel’s global standing for decades to come. Startup Nation Central brings together tech leaders, global investors, government stakeholders and multinational partners. This nonpartisan platform is central to aligning policy, capital and innovation toward national priorities and international partnerships in a complex and often divided environment. This will be essential as the country looks toward economic recovery and regional stability.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle