Despite the proposed judicial reform turmoil and the Oct 7 war, Israeli tech remained robust in 2023: Private funding for Israeli tech is expected to reach nearly $10 billion, according to Startup Nation Central

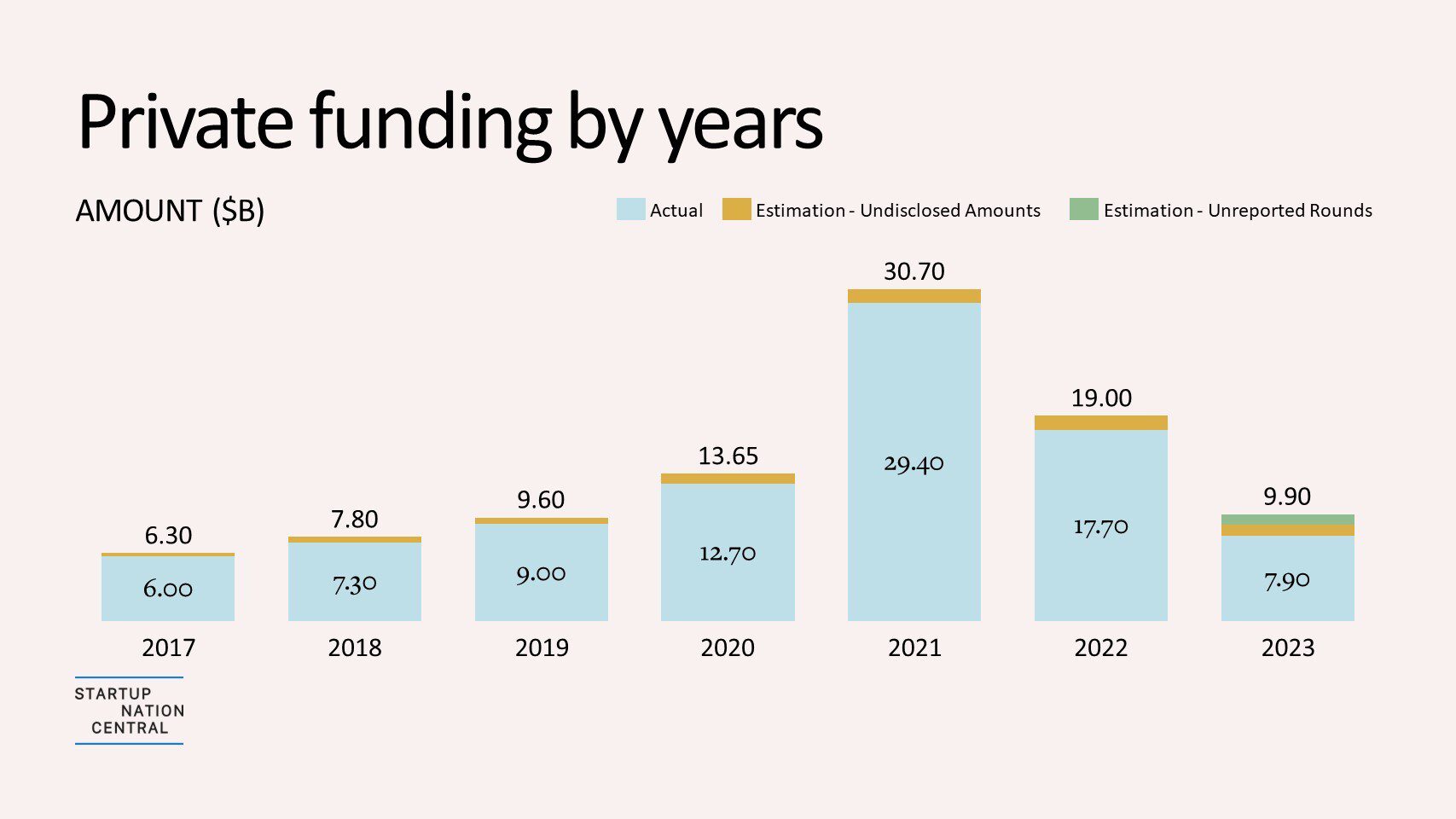

Tel Aviv, January 15, 2024: According to an annual report highlighting activity in Israel’s technology sector released by Startup Nation Central, a non-profit connecting global solution seekers with Israel’s innovators, the Israeli tech sector remained robust despite many disruptions in 2023. The year included the proposed judicial reform and civil unrest, Hamas’ heinous terrorist attack on October 7 and the still-raging war, as well as global macroeconomic challenges. The report found that the country’s dynamic startup culture, coupled with the steadfast engagement of global players, maintained resilience, and remains the economic anchor of Israel. The report, based on data and insights from its ecosystem business-engagement platform, Finder, anticipates that private funding for Israeli tech in 2023 will reach nearly $10 billion, factoring in undisclosed rounds and historical patterns of delays in publishing rounds. The disclosed funding currently stands at $7.9 billion.

The report includes sector overviews, private and public funding activity, investor landscape, global comparison, sector analysis, M&As, and the results of surveys reflecting the sentiment of the ecosystem, investors, and MNCs doing business in Israel. The report also includes commentary from leading figures in the investment community, including Alan Feld, founder and managing partner, Vintage Investments; Nadav Zafrir, co-founder and managing partner at Team8; Rona Segev, general partner TLV Partners; and Shlomo Dovrat, co-founder and general partner of Viola.

Start-Up Nation Central CEO, Avi Hasson: “Looking to 2024, the outlook is cautious but optimistic. We hope the ecosystem’s bedrock of innovation, global partnership, and proven resilience will steer it through uncertainty toward a continued growth trajectory. With investments in Israel leveled down to 2019 numbers, the main challenge is attracting investment to the Israeli tech ecosystem and preserving human capital – Israel’s most significant asset. At Startup Nation Central we foster investment opportunities while supporting local companies and promoting the efforts of multinational companies in Israel.”

VP of Digital Products and Data, at Startup Nation Central, Yariv Lotan: “Private funding in 2023 declined from the 2021 peak, reaching $7.9B to date. The estimated total private funding, including unknown rounds, will amount to nearly $10B, similar to 2019 levels. In 2024, 88% of MNCs plan to either sustain or grow their presence in Israel, indicating continued confidence in the ecosystem. However, there is a split in investor sentiment, with 52% predicting a downturn in investments for 2024. Despite this, AI, cybersecurity, and defense tech—are predicted to continue their upward trend.”

Key findings from the report:

Private funding core resilience, despite exogenous circumstances: Amid broader economic uncertainties, the ecosystem’s private funding levels have demonstrated notable resilience, comparable to that of the US. Despite an overall decline from the previous year, 2023’s private funding is estimated to approach $10 billion, factoring in undisclosed rounds, with disclosed funding totaling $7.9 billion. This resilience is further emphasized as funding levels stabilize to 2019 levels, albeit with fewer rounds, indicating a more discerning yet strong investment environment.

Seed stage relative tenacity: In notable contrast to the broader market, seed stage rounds were significantly less impacted by the funding decline that significantly affected A and B rounds. This resilience underscores a keen investor interest in fostering nascent technologies and innovations, ensuring a continuous stream of fresh ventures.

Public funding steadfastness: With $1.9 billion, public funding has contracted yet remained robust, indicating enduring investor confidence and a market capable of weathering financial ebbs and flows. Health Tech’s doubling in public funding compared to the previous year is a highlight, showcasing the sector’s strong recovery and investor interest.

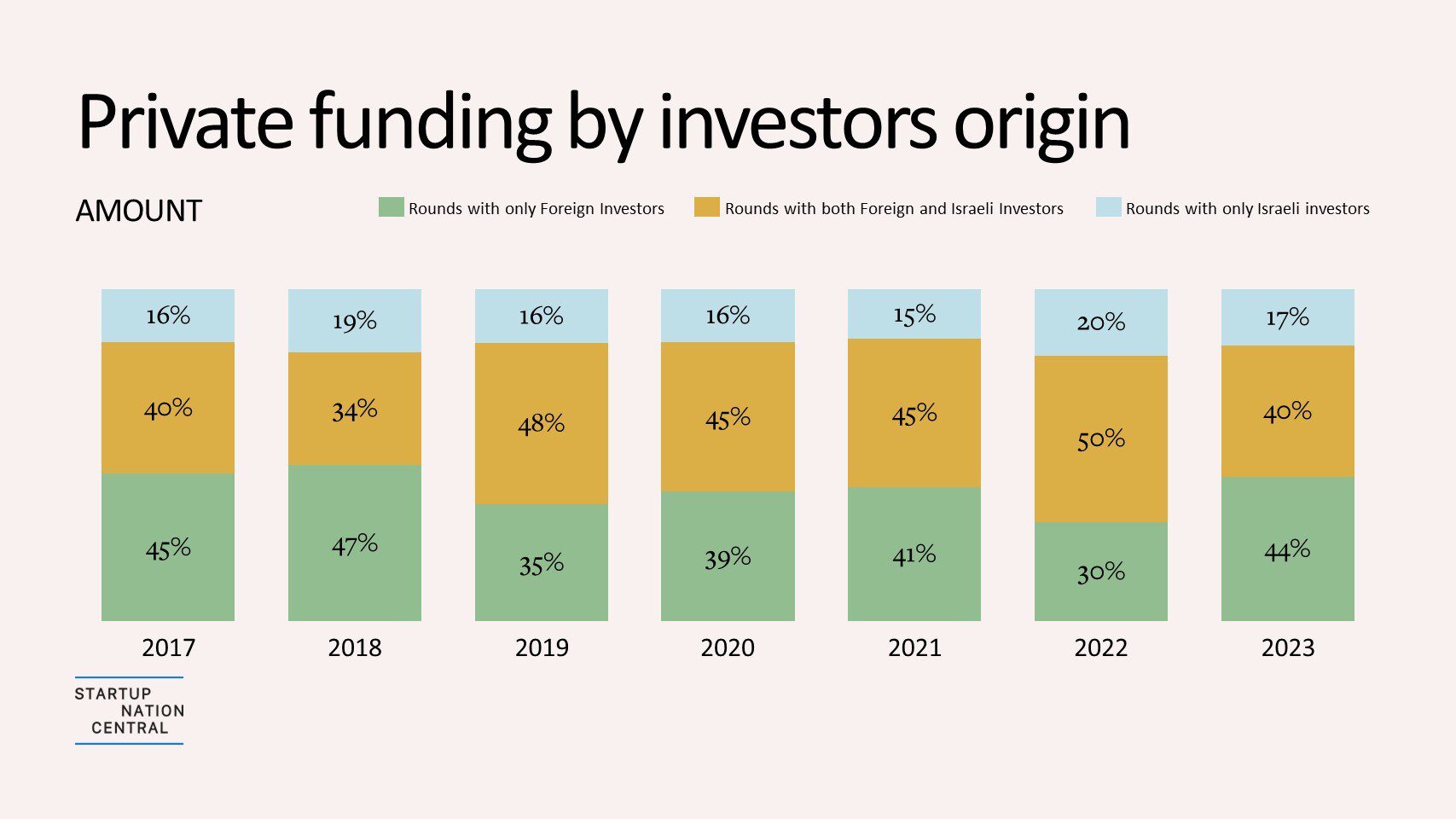

Foreign investor confidence: Foreign investors have reinforced their role as pivotal contributors to the ecosystem, with their participation in funding rounds rising significantly. Their sustained investments signify a robust vote of confidence in the long-term prospects of Israel’s tech sector.

M&A activity – signs of rebound: Mergers and acquisitions have declined by 25% in value from the previous year; however, an end-of-year rebound where the M&A exits reached $1 billion in Q4 indicates resilience and potential for growth. Cybersecurity stands out with M&A exits surging to $2.8 billion, hinting at a sector ripe for investment and innovation.

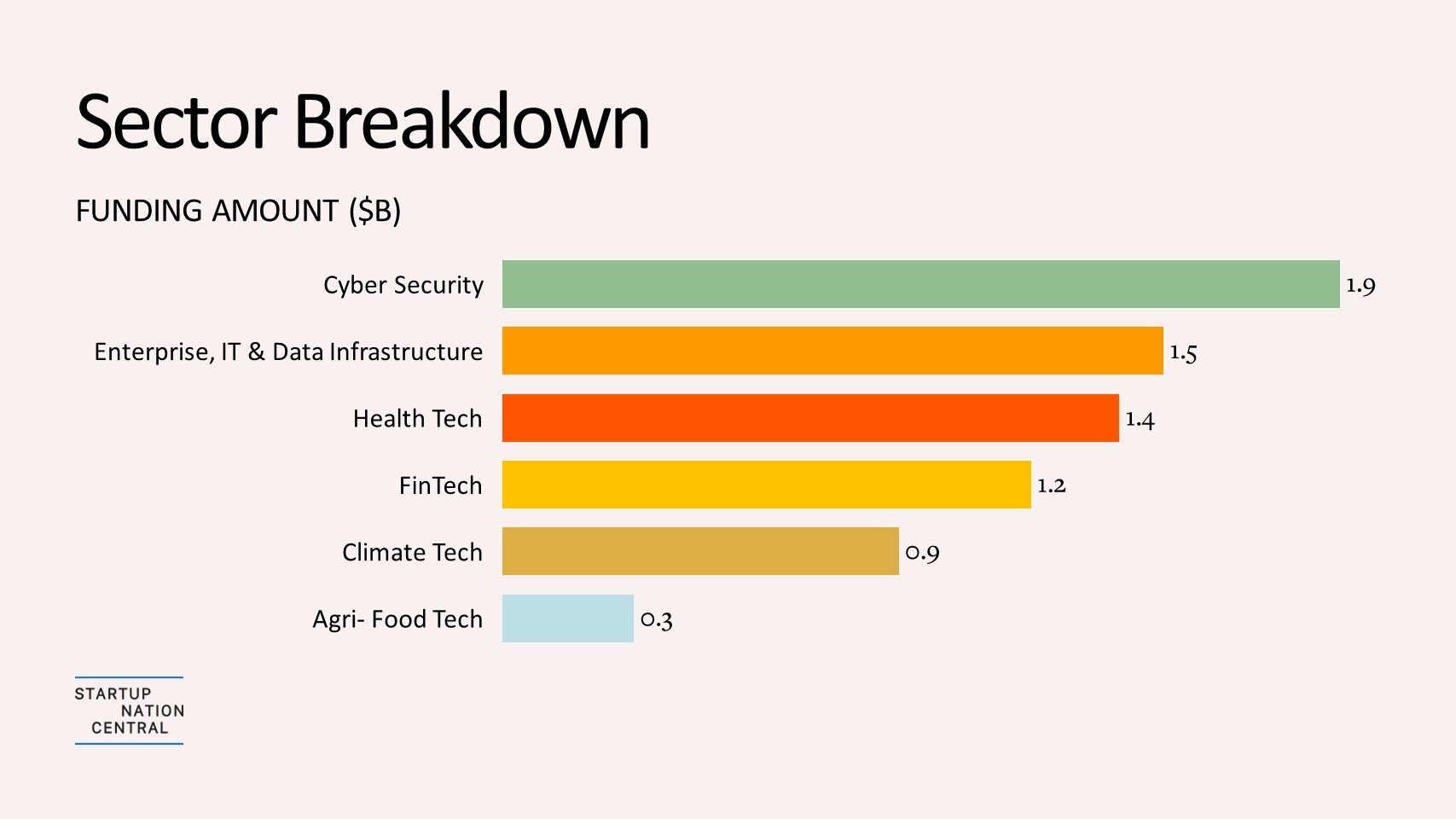

Cybersecurity: The Israeli cybersecurity industry remains robust, securing the highest sector private funding at $1.9 billion and an average round amount of $27 million this year. The 2023 decrease of 45% is lower than the broader ecosystem’s 55% decline. Comparing H2 this year to H2 last year, the decrease is only 12.5%, with no change in the average round amount. The sector has been stable since Q3 2022. There were 2 very large mega-rounds – Wiz raising $300 million in round D and Cato Networks securing $238 million in round G.

Health Tech: The health tech sector, with over 1600 companies (22% of the ecosystem including ~150 mental health and rehabilitation startups), saw a 53% decrease in private investments to $1.4 billion, in line with the broader ecosystem’s 55% decline. While the sector demonstrated resilience in the first three quarters of 2023, Q4 experienced a drop in investments.

Climate Tech and Agri-Food Tech: Despite a 60% decrease in private funding for the Climate tech and Agri-Food tech sectors compared to last year, mainly due to a particularly strong Q1 2022 and a weaker Q4 2023, there has been a period of stability in investments from Q2 2022 through Q3 2023.

These sectors show stability and promise, with Israel leading in sustainable water solutions, alternative proteins, and renewable energies while attracting new accelerators, innovation centers, and incubators for venture cultivation to address climate challenges.

2024 Expectations:

Startup Nation Central conducted a survey of investment firms and MNC leaders active in the Israeli tech ecosystem to understand the industry’s expectations for 2024 following a turbulent 2023. Key findings include:

- Optimism regarding Israel’s resilience and ability to overcome challenges.

- MNCs with a presence in Israel are confident in Israel’s tech ecosystem with 88% planning to maintain or expand activity in Israel.

- Investors are not as confident with 52% indicating investments will decrease in 2024.

- Investors did show optimism regarding M&A and IPO activity, with 60% and 54% expecting M&As and IPOs respectively to increase or remain stable in 2024.

- AI and Cyber tech sectors will continue to lead in 2024 with defense tech gaining in prominence.

About Startup Nation Central: Startup Nation Central helps global solution seekers tackle complex challenges by giving them frictionless access to the expertise and solutions of Israel’s problem solvers – and their bold and determined approach to innovation. We call this Impatient Innovation.

Our free business engagement platform, Finder, grants unrestricted access to real-time, updated information and deep business insights into the Israeli tech ecosystem, explore potential opportunities, and forge valuable business connections.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers