The Abraham Accords unlocked one of the most strategically aligned investment opportunities in the world. At the center of this opportunity sits Israeli tech, a mature and globally recognized innovation engine that matches the economic priorities of the UAE, Bahrain, and other regional partners.

For investors, the Accords created a rare alignment of capital, scale, and technological capability. It is a moment where geopolitical strategy and commercial upside point in the same direction.

“The true nature of the opportunity lies in collaboration. The Gulf serves as a uniquely stable ground positioned between the shifting powers of East and West, making it an ideal platform for growth-oriented companies. This is particularly relevant for Israeli technology, which is globally recognized for its innovation yet often needs scalable markets and international gateways to realize its full potential.

Even in cases where the Gulf itself may not be the ultimate strategic market, it consistently acts as the most effective go-to-market gateway. By combining Israeli tech capabilities with the Gulf’s resources, connectivity, and access to wider MENA and Asian markets, companies can accelerate their expansion, build trust through partnerships, and create new growth pathways that would otherwise remain inaccessible.”

– Nave Shachar, Family Office

A Region Ready for Technological Acceleration

Gulf economies are moving fast toward diversification, with national strategies centered on energy transition, advanced manufacturing, food security, logistics, financial innovation, and AI. These sectors require solutions that can scale quickly and deliver measurable outcomes. The Accords brought new clarity to the practical intersections between Israeli strengths and Gulf priorities. Key areas of alignment include:

- Health: Digital health and medical devices

- Agritech and food systems

- Water tech and climate resilience

- Cybersecurity for finance, energy, and government

- AI infrastructure and industrial automation

- Energy storage and smart grid solutions

- Mobility, logistics, and port optimization

These are long-horizon sectors with strong demand curves and technology barriers that favor experienced R&D ecosystems. Israeli companies offer validated technologies that match the region’s strategic timelines.

Synergies Between Ecosystems: Israel and the UAE

The Israeli and UAE tech ecosystems are naturally complementary, which is why collaboration accelerated so quickly after the Accords. Israel brings depth in R&D, strong early-stage innovation, and proven expertise in sectors such as cybersecurity, health tech, agrifood, climate solutions, and AI. The UAE brings scale, capital, advanced manufacturing capacity, and a national mandate to lead in frontier technologies, including artificial intelligence and next-generation digital infrastructure. For Israeli AI companies, the UAE offers access to large datasets, enterprise partners, and government-backed platforms that can support rapid deployment. For the UAE, Israel provides a pipeline of AI talent, applied research, and technologies that strengthen its push to build an AI-driven economy. Together, the two ecosystems create a balanced model that blends Israel’s problem-solving urgency with the UAE’s ability to scale and globalize technology, creating strong opportunities for investors focused on long-term, strategic innovation.

This synergy is already reflected in a range of publicly reported investments and partnerships across the region. Emirati funds have participated in rounds for Israeli cybersecurity, fintech, and enterprise software companies, and Israeli technologies have been deployed in sectors such as agrifood systems, water optimization, and industrial automation across the Gulf. Joint R&D projects, accelerator programs, and venture partnerships between Israeli startups and UAE-based corporates have also expanded, especially around AI, climate tech, and advanced manufacturing. Together, the two ecosystems create a model that blends Israel’s problem-solving urgency with the UAE’s ability to scale and globalize technology, opening strong opportunities for investors focused on long-term strategic innovation.

Why Investors Should Pay Attention Now

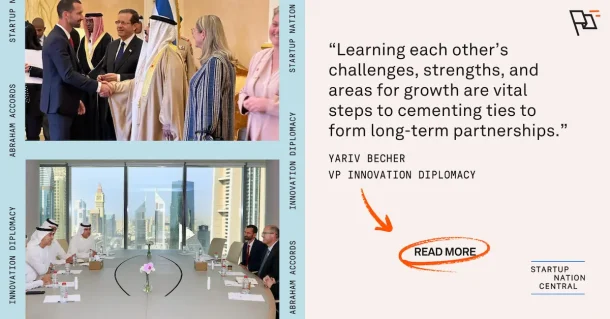

Capital flows into the region are becoming more intentional. Sovereign wealth funds, corporate investors, and family offices are increasingly seeking innovation partnerships that blend regional scale with Israeli technology depth. The result is a new model of cross-border collaboration that supports both economic diversification and portfolio performance.

Several forces make this a timely investment window:

- Strategic national budgets in the Gulf for AI, food security, and clean energy

- A growing appetite for co-developed technology and shared R&D

- Regional demand for defensible IP and solutions with economic and security relevance

- An emerging preference for long-term partnerships over one-off deals

For investors, the Accords are diplomatic signals, but they are also market signals. According to Startup Nation Finder Data, we have seen a strong rebound and acceleration in private funding activity across Abraham Accords countries. Private funding surged to $186M in 2025, up from $35M in 2024, representing a ~5.3x increase (~431% growth) year-over-year. This marks the highest funding level since the 2021 peak ($219M), signaling renewed investor confidence.

Deal activity also increased in 2025, led by investments in the Agriculture & Food Tech sector. Investor participation shows expansion, with the UAE leading in investor count alongside growing activity from Bahrain and Morocco, reinforcing the depth and diversification of the capital base in 2025. Importantly, reported figures likely understate actual activity, as many early-stage, family office, corporate, and cross-border deals remain under the radar and difficult to track, suggesting real investor engagement across Abraham Accords markets is meaningfully higher than headline data indicates.

Shirley Shahar at the last World Agri-Tech

Summit in Dubai

“What we’re seeing across the region is that investment is becoming as strategic as the challenges we face. Capital is flowing toward technologies that can withstand heat, drought, and climate volatility and toward partnerships that build real capability on the ground.

It’s clear that investors today aren’t simply looking for exposure to innovation; they’re seeking co-development, shared IP, and solutions that strengthen regional food and climate resilience. When governments, corporates, and family offices align around climate-resilient, agri-food systems, they’re not only backing technology they’re shaping the region’s long-term stability and shared prosperity.”.”

– Shirley Shahar, General Partner, DesertTech Ventures

From Bilateral Deals to a Regional Innovation Network

The next phase of investment will benefit from structures that are already forming, including:

- Joint venture models connecting Israeli tech with Gulf scale

- Cross-border accelerators and R&D centers

- Bilateral investment funds focused on climate tech, health tech, and infrastructure

- Co-developed manufacturing and deployment hubs

- AI and advanced computing collaborations

These frameworks reduce risk and improve market access for the companies involved. They also support investors by providing clearer pathways to scale and exit.

“The demand is unequivocal, and so is the desire. The value proposition for building real relationships has never been clearer. People are talking; people to people connections. Israeli technology works, and there is tremendous interest across the region in leveraging it. What we hear consistently is a desire not just to use innovation, but to own IP, to co-develop, to build expertise together.

When you combine the ingenuity and brainpower coming out of Israel with partners across the region, you create solutions, you create shared value and you create partnerships that last. And those who truly know the ecosystem and have earned the trust of all sides aren’t just succeeding; they’re helping deepen regional peace and build the future together.”

– Isaac Applbaum, Chairman, Kinetica Ventures

A Strategic Bet on Regional Stability and Long-Term Value

The Abraham Accords opened a corridor where geopolitical alignment supports commercial investment, not the other way around. Israeli technology provides the innovation stack needed for regional resilience. Gulf economies provide the scale and capital required to deploy solutions at national and cross-border levels.

For investors, this adds up to a compelling thesis: the Accords created a durable platform where innovation, capital, and long-term strategy reinforce each other.

Israel’s tech ecosystem is positioned to remain a core driver of this momentum. Its ability to translate research into real-world systems fits directly into the region’s priorities in energy, food, healthcare, digital infrastructure, and climate adaptation.

This is a diplomatic breakthrough and the starting point for the creation of a new regional innovation economy. Investors who understand this shift early will be best positioned to benefit from the opportunities now emerging across the Middle East.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle