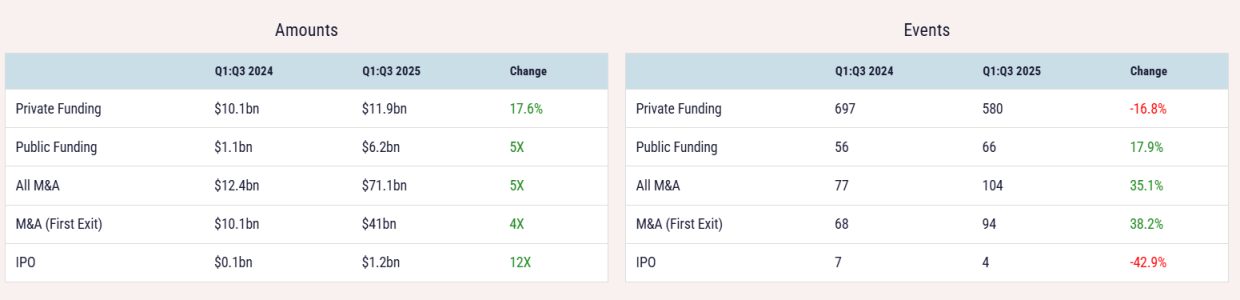

Attracting global investors is about raising capital, but even more so about building partnerships that can accelerate growth and create long-term value. Israeli startups have a proven record of turning innovation into global impact, and 2025 has reinforced that reputation. In the first three quarters of the year, Israeli tech companies raised 11.9 billion dollars across 580 private rounds and recorded 71 billion dollars in mergers and acquisitions.

These numbers reflect a clear message: Israel’s tech ecosystem has entered a new phase of maturity. The country is no longer just the Startup Nation, it is a Scale-Up Nation. Investors from around the world are drawn to its ability to deliver scalable technology, resilience in uncertain times, and a culture that rewards execution.

For founders, this environment creates both opportunity and responsibility. The bar is higher, but so is the potential. Global investors are ready to engage, and the steps you take now will shape how fundable your startup looks in this new phase of Israel entrepreneurship.

Israel’s Position as the Startup Nation

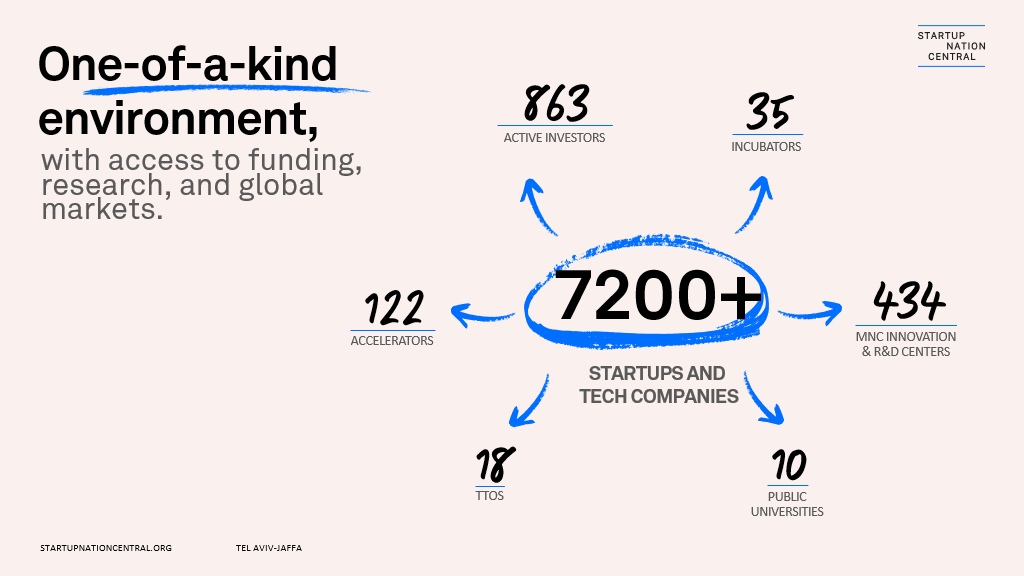

Israel remains one of the most productive innovation ecosystems in the world. With over 7,000 active tech companies, 517 venture capital funds, and 400+ multinational R&D centers, the country continues to set global standards for entrepreneurship. The innovation sector contributes roughly 20% of national GDP and over half of all exports, making technology a cornerstone of Israel’s economy.

In 2025, this ecosystem demonstrated remarkable strength. While the number of deals dropped by 17% compared to 2024, total capital raised increased by 18%. The median deal size reached a record 10.5 million dollars. This growth shows that global investors are concentrating their capital on fewer, stronger companies that can scale efficiently and compete internationally.

Israel’s evolution from startup hub to scale-up powerhouse is not accidental. It is supported by academic excellence, cross-sector collaboration, and a strong innovation infrastructure that encourages risk-taking and rewards results. Learn more about these trends in Startup Nation Central’s analysis of record-breaking M&A activity in 2025.

What Global Investors Look for in Startups

Global investors evaluating an Israeli startup look for three core qualities: scalability, strong fundamentals, and clear differentiation. When founders show these through clear signals and measurable results, it becomes easier to attract capital from abroad.

Scalable Business Models

Scalability is a top priority for any global investor because it shows the potential for long-term growth. Israeli startups often design for global markets from the start because the local market is small.

Signals of scalability include

- Repeatable sales patterns across more than one geography

- Unit economics that improve as revenue grows

- A product or infrastructure that supports global use, such as cloud deployment or multilingual capability

Safe Superintelligence, which raised 2 billion dollars in 2025, built its platform for multinational adoption. Mid-stage companies offer useful examples as well. Aidoc expanded its healthtech platform into multiple hospital networks, and Capitolis entered new financial markets early. These companies showed that scalability does not depend on size, it depends on clarity of execution.

Product-Market Fit and Traction

Investors need to see evidence that customers value your product. Product-market fit can be demonstrated long before a startup hits major revenue milestones.

Signals of traction include:

- Three to five recurring enterprise customers or steady user growth

- Customer retention above 80 percent

- Signed pilot agreements, paid trials, or letters of intent

These signals help de-risk investment decisions. Even early-stage founders can demonstrate momentum through pilot results, engagement metrics, or strong customer feedback.

Strong, Balanced Founding Teams

Founders are one of the first things investors evaluate. Teams that combine technical depth with commercial and operational leadership stand out.

Signals of a balanced team include:

- A technical founder responsible for product development

- A commercial or operations leader focused on customers and revenue

- Advisors or mentors who bring knowledge in finance, regulation, or international expansion

Mid-stage companies like Noma Security and Exodigo attracted investment early because they combined engineering talent with experienced go-to-market leadership.

Clear Exit Potential

Exit strategy is a critical factor in investor evaluation. Israel saw major exits in 2025, including Google acquiring Wiz for 32 billion dollars and Munich Re acquiring Next Insurance for 2.6 billion dollars. These deals confirm that Israeli startups can deliver strong returns.

Early-stage founders can learn from these outcomes; you do not need to be a late-stage company to show exit potential. Signals that matter include:

- Clean financial records and organized cap tables

- Clear ownership and documentation of intellectual property

- Awareness of potential strategic acquirers and their priorities

These steps help investors understand how value will eventually be realized.

Preparing Your Israeli Startup for Global Investment

Preparing for international investment requires structure, focus, and readiness. Global investors look for startups that can show maturity in both technology and business operations. Founders who take deliberate steps in these areas position their companies for stronger investor engagement.

Build a Solid Foundation

Sound corporate governance, clear ownership structures, and transparent financial practices build investor confidence. Companies should ensure intellectual property is protected, compliance standards are met, and internal reporting is consistent.

What to do this quarter

- Update your cap table and make sure all agreements are signed and organized

- Conduct an IP audit to confirm ownership, filings, and inventor assignments

- Create a basic data room with financial statements, contracts, and product documentation

- Review compliance requirements for your sector and close any gaps

Strengthen Your Market Readiness

Investors expect proof that a startup’s product has real market demand. Conduct pilot programs, gather feedback, and secure paying clients before entering fundraising. The Israeli market rewards companies that validate early and scale strategically.

What to do this quarter:

- Run at least one paid pilot or structured proof of concept

- Collect customer feedback and turn it into measurable product improvements

- Build a simple dashboard to track usage, retention, or revenue indicators

- Identify two or three reference customers who can speak with investors

Optimize Your Pitch and Storytelling

A clear, evidence-based story can make the difference between a meeting and a deal. Investors want to know how your product solves a global problem and why you are best positioned to deliver that solution. Learn more about how tech innovation can generate alpha and communicate this message and measurable results.

What to do this quarter:

- Rewrite your pitch deck to focus on data, not assumptions

- Build a one-page narrative that explains your problem, solution, and traction

- Prepare a short customer case study with quantifiable impact

- Practice a 3-minute verbal pitch that works for investor introductions

Crafting a Winning Investment Strategy

A successful fundraising strategy depends on precision and preparation. Founders who identify the right investors and build relationships early gain a significant advantage.

Identifying the Right Type of Investor

Not all investors fit every startup. Match your stage of growth and sector focus to the right partners.

- Stage alignment: Early-stage investors look for vision and product potential, while growth funds prioritize revenue and market expansion.

- Sector alignment: Israel’s leading sectors for international investment in 2025 included cybersecurity, fintech, AI, and healthtech.

Building an Investor Pipeline

A strong pipeline helps you stay organized and focused, giving you a clear view of which investors to approach, when to engage them, and how to move each relationship forward.

- Use reliable data sources: Startup Nation Central Finder provides real-time access to information about investors, startups, and deal trends.

- Leverage networks: Introductions through trusted advisors, mentors, and ecosystem leaders remain the strongest path to investor engagement.

- Track global activity: Leading funds such as Insight Partners, Lightspeed, and Bessemer Venture Partners continue to invest heavily in Israeli startups.

Building Relationships Before Asking for Capital

Investors fund people they know and trust. Engage early by participating in international conferences, publishing insights, and sharing company updates. Consistent communication builds credibility. Joining communities like the Leadership Circle can help expand your reach among global investors.

How to leverage Israel’s Ecosystem for Investor Access

Israel’s innovation ecosystem is built to connect local startups with global partners. Founders can take advantage of public initiatives, non-profit programs, and collaborative networks that make investor access more efficient.

Role of Startup Nation Central and National Innovation Agencies

Startup Nation Central acts as a bridge between Israeli innovators and global investors. The organization’s Finder platform gives investors direct access to more than 7,000 startups and detailed insights on sectors, funding trends, and partnerships. It also supports cross-border collaboration through strategic matching programs and ecosystem research.

For example, explore how our grant matching platform helps companies align with potential investors and partners for optimal results and mutual benefit.

Government Incentives and Grants for Foreign Partnerships

The Israel Innovation Authority offers R&D grants, support for joint commercial pilots, and incentives for foreign partnerships. These tools help founders lower early technical risk, test products with international partners, and present a stronger funding case to global investors.

Collaborating with Israeli Accelerators and Innovation Hubs

With over 120 accelerators and 35 incubators, Israel’s innovation infrastructure creates a continuous flow of new opportunities. Many of these programs work with global corporations, giving startups access to mentorship, investment, and pilot projects in international markets.

Common Challenges Israeli Startups Face

Even with its strong reputation, Israel’s ecosystem faces several challenges that founders must understand.

- Longer fundraising cycles: The average time from seed to series A reached 35 months in 2025. Investors expect stronger proof points and operational discipline before advancing to the next round.

- Capital concentration: Half of all funding in 2025 went to cybersecurity and business software, leaving emerging sectors such as healthtech and climate tech relatively underfunded. Healthtech, despite having the most active companies, received only about seven% of total investment.

- AI competitiveness: Israel ranks 32nd globally in AI policy and infrastructure investment, while countries like France and Saudi Arabia are investing tens of billions of dollars in national AI programs. Expanding Israel’s AI strategy and funding will be key to maintaining global leadership.

These challenges also highlight opportunities. Investors increasingly value ecosystems that evolve under pressure. Israel’s response to market shifts has been to innovate faster and with sharper focus, an attitude that continues to attract long-term capital.

What founders should do in response:

- Strengthen your runway planning and prepare for longer time between rounds; build clear, data-backed milestones for each stage.

- Position your startup clearly within a defined niche and show how you outperform competitors, especially if you operate in an underfunded sector.

Integrate AI readiness into your strategy, whether through product features, data infrastructure, or partnerships that help you stay competitive.

Success Stories and Lessons from Israeli Startups

The best proof of investor confidence lies in real success stories.

In Q3 2025, healthtech company Aidoc raised 110 million dollars to expand its AI-based medical imaging platform. Cybersecurity startups Noma Security and Decart AI each closed 100 million dollar rounds. Quantum Machines raised 170 million dollars to advance quantum computing infrastructure, and Cyera secured 500 million dollars to accelerate AI-driven data security. Together, these examples highlight concentrated investment in advanced, scale-ready technologies.

What they all did right

- Built a deep understanding of their market and aligned their product with a clear global need

- Designed technology that could scale across borders and support different types of customers

- Operated with strong execution discipline, demonstrating reliability through customers, pilots, and measurable performance

These examples demonstrate that global investors are not simply buying technology. They are investing in the combination of resilience, execution, and strategic thinking that defines Israeli entrepreneurship.

Final Thoughts

Israel’s innovation ecosystem has reached a point of global maturity. It continues to attract investors not because it is large, but because it is focused, fast-moving, and fearless in solving complex problems.

For founders, the path to global investment is clear. Build solid foundations. Validate your market. Communicate with clarity. Engage with investors before you need capital. Leverage the strength of Israel’s ecosystem and platforms like Startup Nation Central to build meaningful, long-term partnerships.

In a global market defined by uncertainty, Israeli startups continue to prove one constant truth: disciplined innovation always finds investment.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle