Just hours into his first visit to Israel, Alex Moore of 8VC shared a sharp and strategic take on what it takes to build next-generation defense tech startups. His remarks reflect the growing partnership between 8VC and Israeli VC Kinetica, both committed to launching transformative companies at the intersection of deep tech, national security, and US-Israel innovation.

Moore’s insights shed light on the complexity, opportunity, and urgency of developing new defense platforms that integrate software, hardware, and government relations while also reinforcing the global and cross-border relevance of these efforts. Below is a full breakdown of his remarks.

The “Big Four” for Early-Stage Defense Startups

- Platform Thinking Over Contracts

Moore urged founders to think beyond single defense contracts and take a platform-first approach. Tactical wins may look appealing, but real value lies in long-term systems integration and scalable capability development.

- The Triple Challenge: Hardware, Software, and D.C. Relations

Defense startups are essentially building three companies at once:

- Hardware manufacturing

- Software and systems integration

- Government relations and policy navigation in Washington, D.C.

Each demands a different skill set and execution plan. Startups often stumble when they fail to optimize across all three. With the added complexity of US federal budget cycles, Moore emphasized the need for a deliberate and well-resourced approach.

- The Dual-Use Dilemma

Reflecting on the dilemma of dual-use technologies, Moore thinks that while they can de-risk a business, they rarely evolve the way one expects. Palantir’s commercial division focuses on Fortune 500s, but Moore is personally cautious about opening to commercial use too early, preferring to focus on defense-first.

- Fundamentals Still Matter

Core startup principles like team, product-market fit, and scale still apply. But in defense tech, they come with added layers of geopolitical and technological complexity.

Building a $10B+ company requires:

- Close integration of engineering and manufacturing.

- A clear understanding of the ecosystem (what you replace or integrate into).

- A bold and opinionated market view. For example, “If you’re building seeker heads for missiles, is your next move to build the missile?”

Understanding Capital Geometry

Moore introduced the concept of “capital geometry”, which describes the shape and function of the money you raise.

- Early-stage investors must be highly strategic and bring defense expertise.

- Later-stage investors should be patient capital-think family offices or institutions that aren’t fixated on 5 to 7-year returns.

- Avoid “random VC money” that offers no strategic value.

He also recommended creative financing to avoid unnecessary dilution, especially when scaling infrastructure. Rather than funding factories with equity, founders should explore debt or hybrid structures.

Global Go-to-Market and International Sales

Moore was candid: the biggest barrier in defense innovation is international sales.

- US export and procurement processes are slow.

- Foreign buyers often move faster and fund innovation directly.

- Start international processes early, it can take 2-3 years to gain traction.

He strongly supports reforming allied procurement policies to streamline collaboration across likeminded nations.

What’s Next in Defense Tech: 6 Domains to Watch

Moore is bullish on several emerging areas, including:

- Mission-layer autonomy: e.g., drone swarms that complete missions without human intervention

- Next-gen manufacturing: enabling mass production across defense classes

- Weapons in space: think Iron Dome, but orbital

- Electronic warfare

- Directed energy and lasers (a focus during his Israel visit)

- Quantum defense technologies

Yet his top priority remains: building true autonomous systems that reduce risk to human lives.

The Coming Industry Shift: “Neo-Primes” on the Rise

Moore predicts a wave of industry consolidation. In a few years, the “primes” (Lockheed, Raytheon, etc.) will start acquiring, but it’s likely that neo-primes, younger, tech-native players will lead the charge.

He’s skeptical of forecasts for imminent conflict with China but sees deterrence as vital: “It’s not about fighting a war; it’s about preventing one.”

Tactical Advice for Founders

Moore offered specific, actionable tips for new founders:

- First hire? Move a founder to the U.S.

- Second? Hire a former military operator who can build connections in D.C., lobby Congress, and engage with senior defense generals before building out your engineering team in LA.

Final Thoughts: Israel, Kinetica, and What Comes Next

Moore closed with optimism. He’s bullish on defense tech, not just as an investment opportunity but as a strategic imperative. He sees a future where defense startups reshape the global security landscape, and he reaffirmed his commitment to collaboration with Kinetica and the Israeli innovation ecosystem.

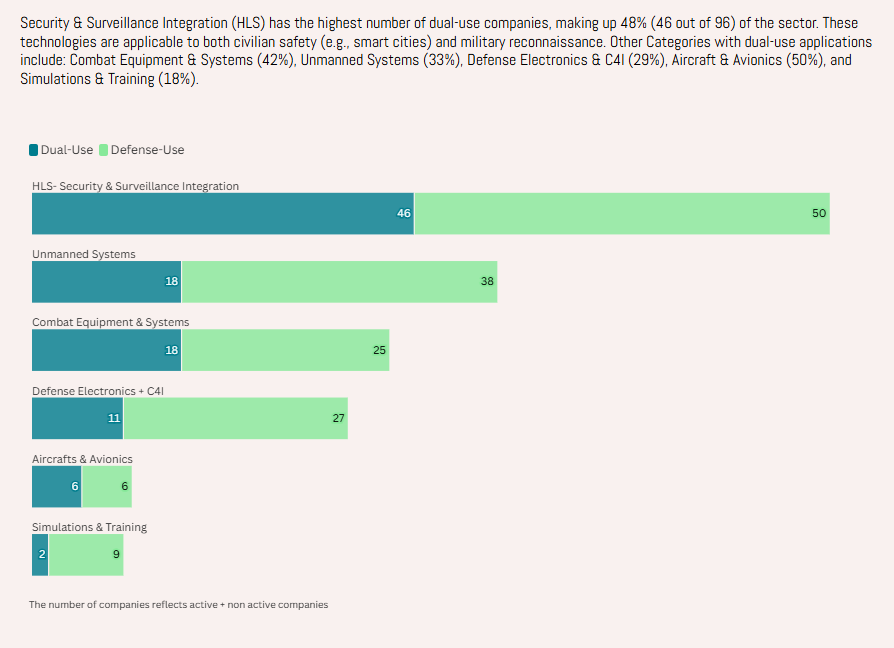

To support investor decision‑making, Startup Nation Central published a comprehensive dataset covering hundreds of Israeli companies in dual‑use, aerospace, defense and homeland‑security sectors. Over 300 startups are active across subsectors such as unmanned systems, cyber defense, avionics and space tech; that capital inflows into Israel’s defense tech sector have increased by 35% year‑on‑year; and that Israeli innovation is now present in 24 countries through global partnerships and R&D hubs. For VCs and strategic investors looking to identify high‑potential entry points, the map offers detailed segmentation, funding trends, and collaboration pipelines.

Read the full report here → 2025 Israeli Aerospace, Defense & HLS Landscape Map

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle