Israeli biotech refers to the country’s research-driven life sciences sector that fuses biology, data science, engineering, and AI to create therapeutics, diagnostics, medical devices, and computational biology solutions. This article explains Israel’s biotech momentum by outlining the ecosystem’s structure, investment trends, key sub-sectors, funding pathways, and the country’s outlook for 2026–2030.

Israel’s Biotech Boom

With private health tech funding reaching 1.2 billion dollars in 2024, Israel’s biotech sector is entering a new phase of global relevance. Long known for its leadership in cybersecurity and software, the country is now channeling its technical strengths, research culture, and entrepreneurial mindset into life sciences. The shift is driven by advances in AI, computational biology, and digital tools that reduce the time and cost of scientific discovery. These technologies fit naturally with Israel’s multidisciplinary talent base and its ability to move quickly from research to real-world validation.

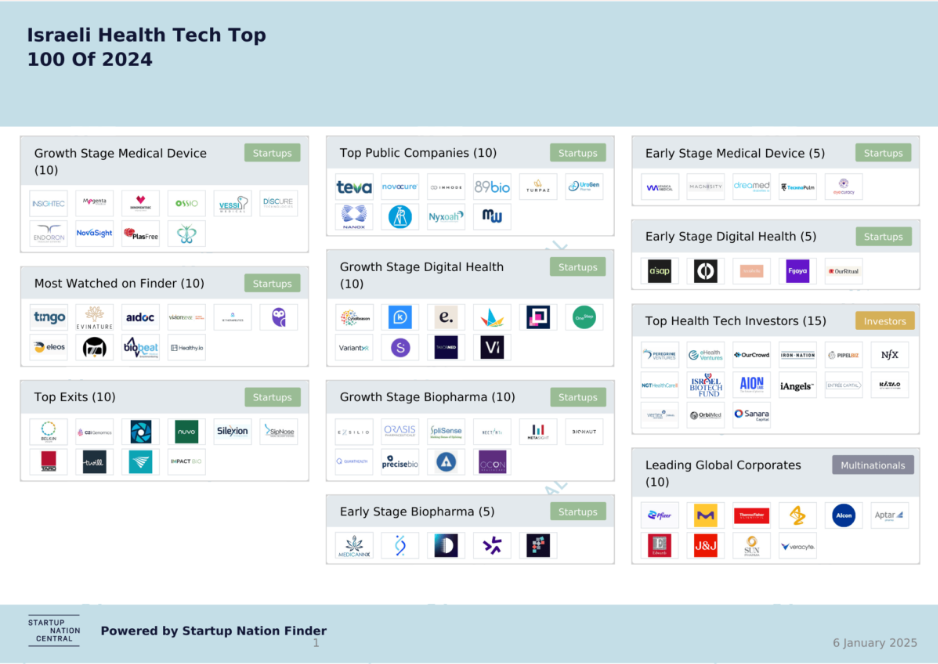

The life sciences sector is already the largest in Israel’s innovation ecosystem with about 1,600 companies. This includes approximately 450 Israeli pharmaceutical companies, 650 medical device companies, and 700 digital health companies. These numbers indicate a substantial foundation built on decades of research, medical excellence, and technical ingenuity. Israeli biotech companies merge biology, engineering, and data science, creating an environment where innovation grows faster, scales more efficiently, and reaches global markets early in the company lifecycle.

Investors are taking notice. Despite global economic uncertainty in 2024, the average deal size in Israel climbed to 4.6 million dollars. Digital health drew 545 million dollars, medical devices brought in 380 million dollars, and pharma and biotech attracted 262 million dollars. Israeli companies continued to deliver high-value rounds, notable exits, and partnerships with leading multinational pharmaceutical companies. These signals show a sector that moves with purpose and attracts investors who value both scientific depth and technical strength.

Why global investors are turning to Israeli biotech

Investors today look for ecosystems that combine solid research, strong data assets, and a clear path to commercialization. Israel delivers on all three. Its healthcare system has more than 25 years of digitized population-level data, four HMOs that serve as validation partners, and clinical institutions that welcome collaboration with startups. Academic and medical centers are tightly linked to industry. The result is a fast route from lab insights to pilot studies and clinical trials.

Digital health, diagnostics, computational biology, and genomics form a natural fit with Israel’s established leadership in AI and machine learning. AI-enabled health companies accounted for a large share of digital health activity in 2024. These companies focus on provider support, R&D enablement, and advanced clinical decision tools. As a result, global healthcare systems and pharmaceutical companies increasingly view Israel as a partner for solving urgent challenges in drug discovery, precision medicine, and patient monitoring.

The rise of biotech innovation in Israel

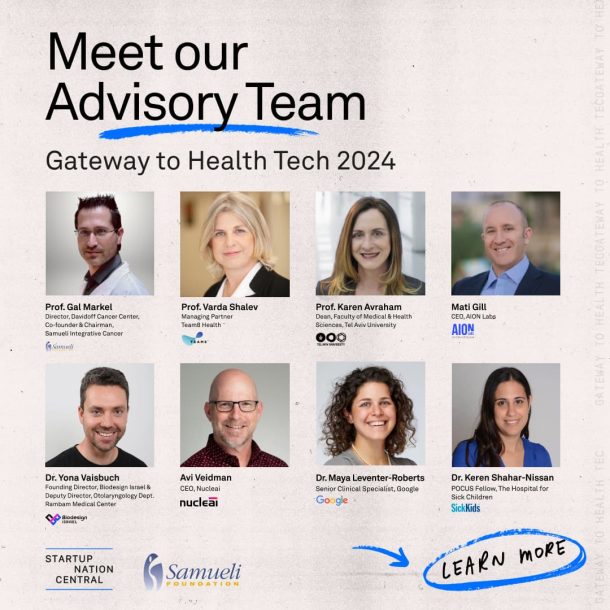

As computational biology becomes central to biotech innovation, Israel’s AI strength positions the country for leadership. According to AION Labs CEO Mati Gill, AI has shifted global biotech priorities. Drug discovery now depends on machine learning, advanced simulation, and data-driven target identification. Israel’s expertise in these fields gives it an advantage in this new biotech era.

Multinational companies like GSK, Verily, Pfizer, and AstraZeneca have expanded R&D activity in Israel to access local computational talent and collaborate with startups working on AI-based therapeutic development. Companies such as Quris-AI and CytoReason exemplify this model. Their partnerships with major pharma companies show how Israel’s computational-first approach is becoming embedded in global drug development processes.

Academic researchers are also moving more actively into company building. This shift brings cutting-edge science into commercial settings earlier, improves the quality of translational research, and strengthens the innovation pipeline.

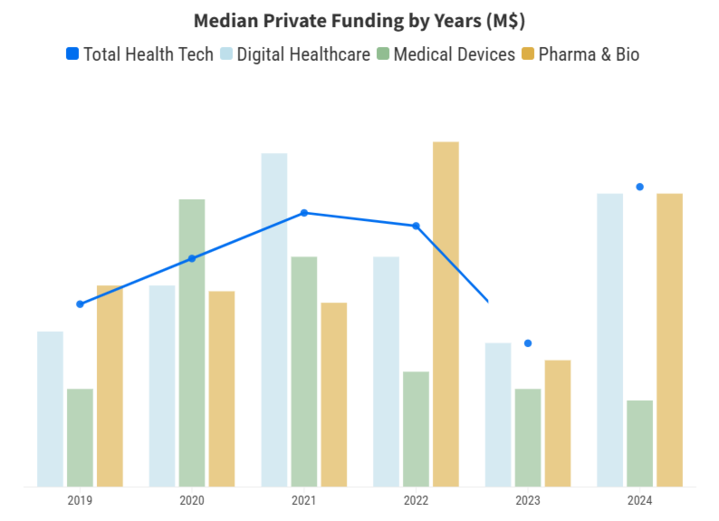

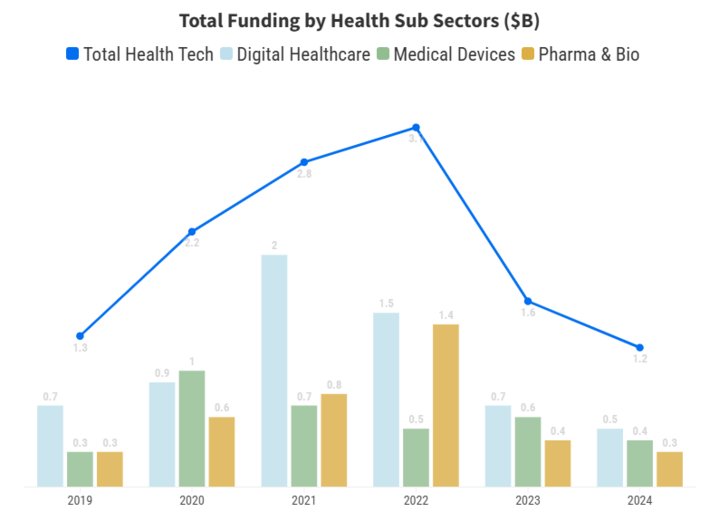

Overview of Israeli biotech investment growth trends

The life sciences and health tech sector holds a consistent share of Israel’s innovation activity, as highlighted by several key metrics:

- 1.2 billion dollars in private funding for health tech in 2024

- 545 million dollars invested in digital health

- 380 million dollars invested in medical devices

- 262 million dollars invested in pharma and biotech

- Average deal size of 4.6 million dollars

- Significant rounds, including 150 million dollars raised by Insightec, 111 million dollars raised by VI Labs, 105 million dollars raised by Magenta Medical, and an 82 million dollar Series A round by Exsilio Therapeutics

These patterns continued into 2025. In H1 2025, total private funding rose to 9.5 billion dollars across 367 rounds. By Q3 2025, the ecosystem showed fewer but larger rounds with a median round size of 10.5 million dollars. Funding was most concentrated in business software, cybersecurity, industrial tech, and health tech.

In health tech specifically, companies such as Aidoc raised large rounds, including 110 million dollars. These signals point to a biotech landscape that is maturing as capital flows toward companies with validated technologies and clear scale potential. For investors, this translates to significant biotech investment opportunities in 2026.

Understanding Israel’s Biotech Ecosystem

Biotech in Israel is shaped by the interplay between academia, medical institutions, startups, investors, and multinational companies. Each part of the ecosystem contributes capabilities that strengthen the whole and create an environment where scientific ideas can scale.

Key players shaping the ecosystem

Israel’s biotech ecosystem is driven by research universities, government support, more than 75 innovation hubs, and growing multinational pharma partnerships, creating a connected pipeline from academia to commercialization.

Research universities and medical institutions

Israel’s academic institutions are global leaders in biology, chemistry, computer science, and engineering. The Weizmann Institute, Technion, Hebrew University, Tel Aviv University, and Ben-Gurion University produce a continuous supply of scientific and technical talent. These universities also collaborate closely with hospitals such as Sheba Medical Center, Hadassah Medical Center, Ichilov Hospital, and Rambam Health Care Campus.

This alignment accelerates translational research, increases opportunities for clinical validation, and provides startups with access to world-class medical data sets.

Government agencies and public funding bodies

Government programs are essential for early-stage biotech. The Israel Innovation Authority supports R&D grants, consortia, incubator programs, and foreign investor matching. These mechanisms reduce early risk and give Israeli biotech startups longer runways in science-heavy fields where development cycles are longer.

Israel’s national health insurance model creates additional advantages. With four HMOs that cover the entire population, companies can secure partnerships for pilots, data access, and clinical feedback.

Private sector innovation hubs and incubators

More than 75 hubs and incubators operate within the health tech and life sciences ecosystem. These include industry-specific accelerators, corporate innovation centers, and early-stage incubators supported by the Israel Innovation Authority. Many hubs specialize in digital health, diagnostics, medical devices, or biotech R&D.

AION Labs stands out for its co-development model that pairs startups with global pharma partners. This approach gives startups early access to industry expertise, proprietary datasets, and commercial frameworks.

Multinational pharmaceutical partnerships in Israel

The presence of more than 400 multinational R&D and innovation centers in Israel strengthens the biotech ecosystem. Israeli pharmaceutical companies tap into local AI and data science talent to support computational biology programs and digital clinical tools.

Partnerships such as Quris-AI with Merck KGaA and the CytoReason collaborations backed by Pfizer and NVIDIA show how global pharma companies rely on Israeli startups for next-generation discovery tools.

The role of Israeli academia and R&D excellence

Israeli academia supports biotech with deep scientific expertise and a culture of inquiry. Researchers often work across disciplines, combining computational modeling with wet lab experiments and clinical insights. This multidisciplinary training produces founders who can navigate complex biotech challenges.

Academic leaders increasingly take part in commercialization by launching companies, advising startups, or licensing technology through tech transfer offices. This shift signals a maturing ecosystem where scientific discoveries move into industry faster.

How tech transfer offices support commercialization

Tech transfer offices such as Yeda (Weizmann), Ramot (Tel Aviv University), Yissum (Hebrew University), BGN Technologies (Ben-Gurion University), and T3 (Technion) play a critical role in bridging academia and industry. Their support includes patent protection, licensing deals, venture creation, and corporate partnerships.

In biotech, where intellectual property and regulatory pathways are complex, TTOs help companies secure strong IP positions and build commercial plans that support global scale.

Startup Nation meets Life Sciences, Convergence of tech and biotech

Israel’s biotech sector thrives on convergence. Engineers build medical devices that integrate software and sensors, data scientists collaborate with clinicians to build diagnostic tools, and AI teams model biological pathways and design molecules. These collaborations are supported by an entrepreneurial culture that values experimentation, iteration, and practical impact.

This cross-sector environment is essential for next-generation biotech solutions, especially in computational biology, digital therapeutics, and AI-enabled drug development.

Why Invest in Israeli Biotech

Israel’s biotech strength comes from early clinical access enabled by digitized health data, strong exits and acquisitions, supportive government programs, and advanced integration of AI and data science across development.

Strong innovation-to-market pipeline

Israel’s integrated healthcare system gives startups a fast route to validation. Access to digitized population data, a responsive clinical ecosystem, and strong medical institutions allows companies to test technologies earlier and move toward market readiness faster.

Proven track record of global biotech exits and IPOs

Over the last couple of years, Israeli health innovation produced notable growth stories:

- Insightec raised 150 million dollars

- VI Labs raised 111 million dollars

- Magenta Medical raised 105 million dollars

- Exsilio Therapeutics raised 82 million dollars

- BELKIN Vision was acquired by Alcon

- C2i Genomics was acquired by Veracyte

These successes reflect a pattern of strong scientific assets combined with commercially relevant applications.

Supportive government policies and tax incentives

Government support mechanisms help derisk biotech investments. Benefits include tax incentives, R&D grants, foreign investor matching, and support for incubators. These programs help bridge early gaps in capital-intensive biotech development.

Cross-sector innovation, AI, data science, and biotech integration

AI is becoming central to biotech, and Israel has a well-established advantage. The ecosystem includes hundreds of AI-enabled digital health companies, a large data science workforce, and strong experience with algorithm-driven industries. This creates opportunities for biotech companies that depend on computational biology, predictive diagnostics, and digital clinical workflows.

Biotech Investment Landscape in Israel

Israel’s 1600+ company strong biotech and health sciences landscape covers several major categories, providing investment opportunities in 2026 and beyond.

Overview of sub-sectors

Israel’s biotech landscape spans multiple sub-sectors and regions, each contributing distinct scientific strengths, investment patterns, and commercialization pathways.

- Pharmaceuticals and therapeutics

Companies integrate AI and computational biology to improve target discovery, drug design, and preclinical predictions. Genomic and protein engineering companies form a growing segment within the market.

- Medical devices

With about 650 companies, medical devices form one of Israel’s most mature sectors. Innovation includes minimally invasive tools, imaging devices, ultrasound platforms, and therapeutic systems.

- Diagnostics and digital health

Digital health includes approximately 700 companies focused on AI diagnostics, remote patient monitoring, clinical support tools, and digital therapeutics. Digital health attracted the largest share of funding in 2024.

- Agritech and food biotech

Israel applies biotech approaches to agriculture and food systems to address climate resilience, food safety, and sustainable production. These areas benefit from overlapping expertise in biology, engineering, and environmental science.

- Industrial and environmental biotech

Companies develop bio-based materials, sustainable manufacturing processes, and environmental remediation technologies.

Funding stages and capital sources

Biotech investments in Israel span a broad range:

- Early stage includes angel investors, micro-funds, and government-backed incubators

- Venture capital supports seed to growth stages

- Global investors take part in later-stage deals

- Public markets include both TASE and NASDAQ listings

Regional biotech clusters and hubs

Jerusalem

Home to Hebrew University and Hadassah Medical Center, Jerusalem specializes in medtech, immunology, and genomics.

Tel Aviv

A leading hub for digital health, AI, and computational biology, supported by strong investor and corporate presence.

Haifa and the North

Built around Technion and Rambam Health Care Campus with strengths in engineering-driven medical devices.

The Negev

Ben-Gurion University anchors activity in environmental biotech, desert agriculture, and water innovation.

How to Invest in Israeli Biotech

Investors can access Israeli biotech through several clear pathways that match different risk levels, stages, and strategic goals.

- Direct investment in startups

Investors can join early rounds, often alongside experienced local and global venture firms. - Participating in venture capital funds

More than 250 investors operate in the health tech and life sciences ecosystem with several funds specializing in Israeli biotech companies and digital health. - Partnering with accelerators and incubators

Incubators like AION Labs offer access to early biotech investment opportunities built with multinational partners. - Investing via public markets

Israeli companies listed on NASDAQ and TASE offer exposure to biotech and health tech segments. - Joint ventures and strategic partnerships

Corporates and investors use joint ventures to support the development of platform technologies, computational biology programs, and clinical solutions.

Future Outlook for Israeli Biotech Investment

Between 2025 and 2030, Israel’s biotech sector is expected to expand through a combination of computational biology, digital health, and advanced therapeutic development.

Several forces will shape the coming years:

- Continued growth in AI-driven biotech

- Increased collaboration with multinational pharmaceutical partners

- Stronger integration of clinical data and predictive modeling

- Growth in genomic medicine and protein engineering

- Rising investor interest in deep-tech platforms

Data from recent years shows that fewer but larger rounds are becoming the norm. Median round sizes are increasing, investor participation is rising, and the ecosystem is moving into a scale-up phase. Health tech remains a large sector by company count, and digital health continues to demonstrate strong resilience and growth potential.Taken together, the ecosystem offers significant biotech investment opportunities.

Key Takeaways

- Israel’s biotech segment sits within a broader life sciences ecosystem of approximately 1,600 companies, including Israeli pharmaceuticals companies and many diagnostics and computational biology startups.

- Private health tech funding reached 1.2 billion dollars in 2024, and 2025 data shows fewer but larger rounds as the ecosystem moves toward scale-up maturity.

- More than 25 years of digitized health data and collaboration across four HMOs give biotech startups strong pathways for clinical validation.

- Major rounds and acquisitions involving Insightec, VI Labs, Magenta Medical, Exsilio Therapeutics, BELKIN Vision, and C2i Genomics highlight strong commercial performance.

- Research universities, incubators, and multinational pharma partnerships create a connected pipeline from scientific discovery to commercialization.

- AI, computational biology, and data science are driving the next phase of Israeli biotech innovation and shaping growth through 2030.

FAQs About Investing in Israeli Biotech Companies

This section answers common investor questions about safety, capital requirements, sector opportunities, engagement channels, and foreign investment conditions in Israeli biotech.

Is Israel a safe market for biotech investment?

Israel’s biotech market is stable, with consistent funding, notable exits, and active multinational participation, creating a dependable environment for investors seeking strong fundamentals and measurable performance.

What are the minimum investment requirements?

Investment amounts depend on company stage, from smaller early rounds to larger growth commitments. Investors can initiate their investment journey through Startup Nation Central’s research resources and curated deal flow.

How do I connect with Israeli biotech startups?

Startup Nation Central’s Finder platform offers investor access through company profiles, sector insights, deal flow tools, innovation maps, and direct connections to founders and partners.

Which biotech fields are most promising in Israel?

High-potential fields include computational biology, AI diagnostics, genomic medicine, minimally invasive medical devices, and industrial biotech focused on advanced materials and sustainable production.

Are there any government restrictions for foreign investors?

Foreign investment is welcomed, supported by R&D grants, tax incentives, and matching programs that help reduce early-stage risk and strengthen long-term engagement in Israeli biotech.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle