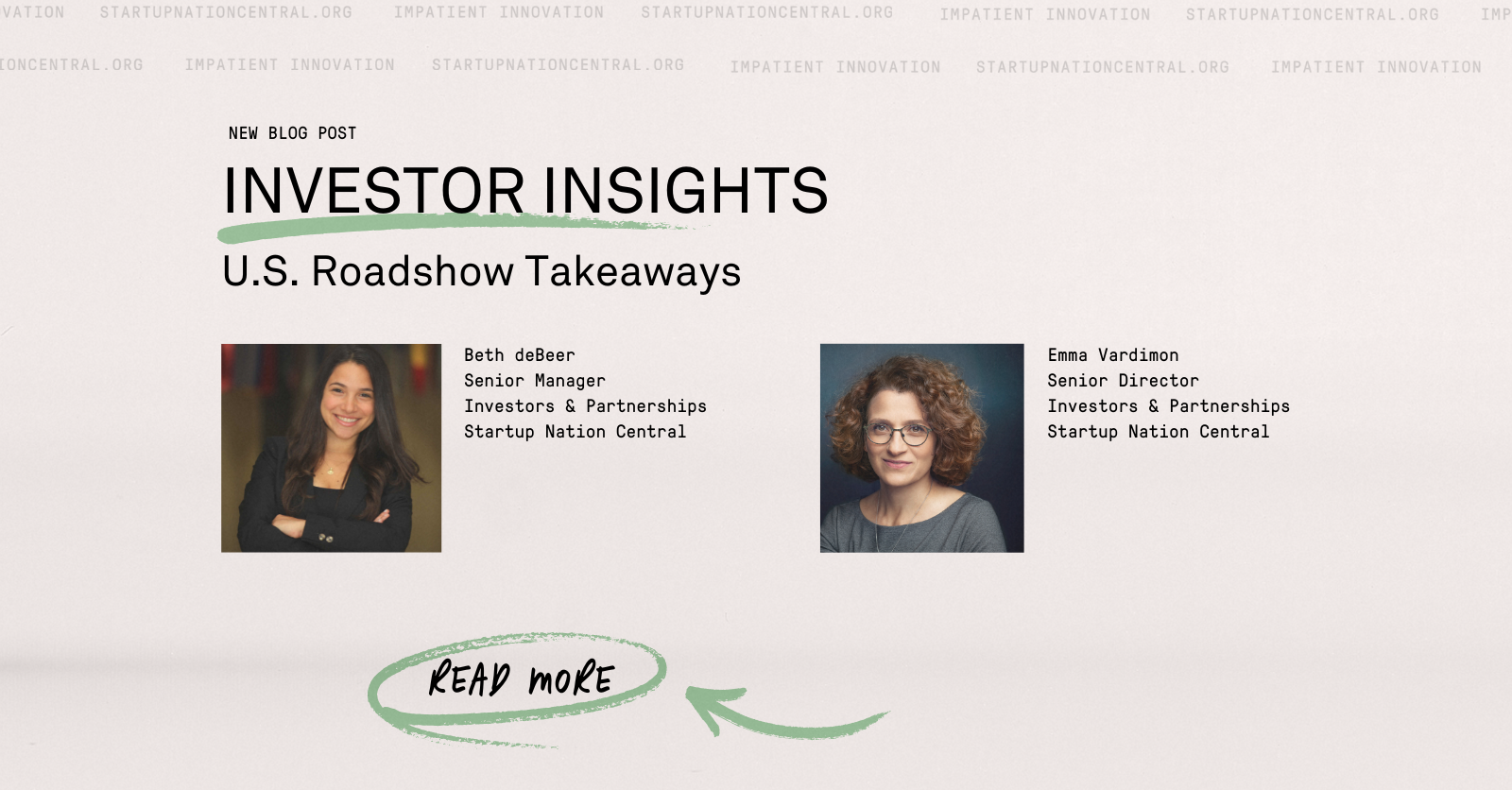

By Beth deBeer & Emma Vardimon

Startup Nation Central’s recent investor roadshow across Miami, Boston, Chicago, and New York demonstrated how Israeli innovation continues to attract global investment, even in the face of economic and geopolitical uncertainty. In a moment where markets are recalibrating and investor sentiment is cautious, Israeli tech stands out as a source of resilience and long-term value.

At each stop on the roadshow, we saw investors actively rethinking how they assess risk, opportunity, and returns. Every city brought its own lens, but the message was consistent: Israeli startups remain among the most adaptable, focused, and investable players in today’s global tech landscape.

“Israeli tech is gaining momentum, driven by resilient founders who continue to innovate and build. Since October 7th, we’ve witnessed firsthand how adversity can spark opportunity. This resilience underscores the critical role of collaboration and adaptability in driving innovation forward. As U.S. interest in Israeli innovation deepens, more investors are recognizing the strength of its founders and the track record of successful startups. The next step is clear, pairing capital with strategic partnerships that unlock long-term growth.”

– Kerry Miller, Ida Ventures

Miami is quickly establishing itself as a major tech hub, with a strong emphasis on fintech and financial innovation. Investors at the roadshow recognized the city’s role as a gateway to Latin America, making it a prime location for Israeli startups looking to expand into new markets. The city’s open regulatory environment, growing investor base, and increasing number of tech companies make it an attractive destination for Israeli fintech innovators.

Boston and Israel share a deep focus on life sciences and healthcare, making them natural partners. Like Israel, Boston is home to leading research institutions and a strong biotech and med-tech sector. Investors at the roadshow highlighted their interest in Israeli companies working on AI-driven diagnostics, biotech breakthroughs, and medical devices. With U.S. multinationals heavily invested in Israeli health tech, Boston remains a key destination for partnerships and funding.

In Chicago, investors emphasized that 2025 is the time to invest and took a pragmatic and forward-looking tone to the roadshow. Investors here focused less on hype and more on timing, and many concluded that now is the right time to invest. There was a strong emphasis on fundamentals: founder quality, product-market fit, and resilience. Chicago investors saw Israeli innovation as both an economic opportunity and a hedge against volatility, recognizing the ecosystem’s history of building through adversity, not around it.

“The Wiz deal is a bright spot in a challenging global market and an important reminder of the resilience of Israeli tech. This country was born out of crisis and our tech ecosystem has always found ways to adapt, build and lead regardless of the economic or political climate. While uncertainty remains, Israeli innovation continues to move forward as it always has, with focus and consistency.”

– Ido Fishler, Good Company

In New York, investor sentiment was shaped by a mix of caution and curiosity. Economic headwinds and the ongoing consolidation of the U.S. venture landscape have prompted a more measured approach to deploying capital. Still, discussions throughout the roadshow highlighted a key takeaway: Israeli tech has a proven track record of thriving through uncertainty. Investors recognized the adaptability of Israeli entrepreneurs, founders who know how to pivot, execute, and scale even in the most challenging conditions.

Artificial intelligence stood out as a focal point. AI is increasingly seen as a foundational layer across sectors, from enterprise tools to vertical-specific platforms and generative technologies. Israeli startups, many of which are already operating at the intersection of AI, cybersecurity, and enterprise software, are well-positioned to lead. Their early adoption of AI, combined with a strong talent base, gave New York investors’ confidence that Israeli companies aren’t just part of the AI movement, they are helping to define it.

“We all are witnessing that this is a transitional tipping point in world affairs. If played correctly, Israel is well positioned to pioneer advancements in AI and quantum computing which will affect humans around the world and make their lives more productive, healthier and promote overall geo-political stability. The Israeli tech pioneers are ready, willing and able to bounce back and be the driver behind this new wave of uber innovation which we are just at the start of.”

– Yaron Carni, Maverick Ventures Israel

With less noise in the market and more grounded valuations, investors saw an opportunity to make smart, strategic bets. The consistency of Israeli founders, their global market mindset, and their ability to execute under pressure stood out as key advantages in a venture environment still recalibrating.

“It is a great time to be investing in technology both because there has been a pull back in the venture capital ecosystem (globally) which has made funding harder to come by for many start-ups. That has driven prices down, created less noise with customers, yet the pace of innovation and quality companies has remained constant. That has led to a great opportunity for those investors with dry powder to greatly benefit. In Israel more specifically, this same dynamic is at play with the added resiliency shown by Israeli entrepreneurs during a very tough period. We remain bullish on the Israeli ecosystem.”

– Daniel Frankenstein, Joule Ventures

The U.S. remains the largest source of investment in Israeli startups, with major venture capital firms, corporate investors, and institutional funds continuing to back Israeli innovation. The roadshow reaffirmed that Israeli tech remains a global force, attracting strong investor interest despite broader economic challenges.

For investors seeking high-growth, innovation-driven opportunities, now is the time to act. With over 7,000 startups and tech companies, 517 venture capital funds, and nearly 450 MNCs with innovation activity in Israel, the ecosystem is as dynamic and resilient as ever.

As your partner on the ground, Startup Nation Central is available to help new investors to Israel navigate and access these opportunities.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle