Snapshot of Israel’s Economic Trajectory

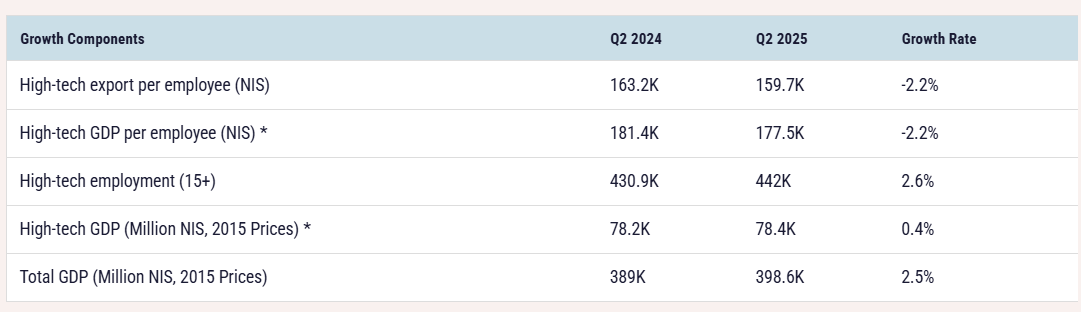

Israel’s economy in 2025 continues to demonstrate resilience and adaptability. Despite regional uncertainty and global market shifts, growth is steady and innovation-driven. According to Startup Nation Central’s Q3 2025 Israeli Tech Ecosystem Report, total GDP grew by 2.5% year over year in Q2 2025. The high-tech sector remains central to this performance, accounting for roughly 20% of Israel’s GDP and over 50% of exports.

Employment in high tech reached a record 442,000 people, up 2.6% from the previous year. Output grew modestly by 0.4%, while services exports rose 8% and goods exports fell 11%. Overall, high-tech exports decreased by just 2.8%, showing resilience even amid global slowdowns. These results highlight the strength of Israel’s innovation economy, where talent, technology, and adaptability continue to drive national growth.

For a deeper look at the foundations of this innovation-led performance, see Understanding the Innovation Economy and Israel’s Leading Role.

High-Tech and Innovation as Core GDP Drivers

Israel’s high-tech sector is not only the largest engine of economic growth but also the foundation for future competitiveness. Data from Q3 2025 highlight how private capital, public markets, and global M&A are combining to sustain momentum in the innovation economy.

Share of GDP and Exports

High tech is the cornerstone of Israel’s economic model. Its contribution to GDP and exports continues to rise as other sectors integrate more technology and digital tools. In Q3 2025 alone, Israeli tech companies raised $2.5 billion across 155 private funding rounds, contributing to a cumulative $11.9 billion raised over the first three quarters of the year, an 18% increase from the same period in 2024. The median round size reached $10.5 million, the highest on record and a sign of a maturing ecosystem focused on scalability and capital efficiency.

At the same time, M&A activity reached a historic $31.8 billion, marking one of Israel’s strongest quarters ever. The landmark $25 billion acquisition of CyberArk by Palo Alto Networks represented more than half of the total exit value, reinforcing the global leadership of Israel’s cybersecurity sector.

Public markets also played a growing role, contributing $6.2 billion through IPOs, convertible bonds, and PIPE transactions. Together, these funding channels illustrate how deeply innovation is embedded across Israel’s financial and industrial systems.

Key Sub-Sectors Driving Innovation

Several core sectors are propelling Israel’s innovation-led GDP growth. Cybersecurity remains the dominant force, attracting $0.8 billion in private funding during Q3 2025, about one-third of all private capital raised. Health tech followed, led by Aidoc’s $110 million round. Industrial technologies and business software recorded strong activity with $337 million and $330 million respectively, while fintech added $210 million, the highest median deal size at $21 million.

These industries exemplify Israel’s economic DNA: applied innovation, global scalability, and capital efficiency. AI, automation, and data infrastructure underpin much of this growth, positioning Israel at the forefront of emerging global technology cycles.

For more insights on how innovation drives growth, explore The Knowledge Economy: Ideas, Talent, and Innovation.

Productivity, Wages and Employment

Behind the data is a workforce powering Israel’s success. Q3 2025 marked another high in employment, though the composition of roles shifted. R&D positions declined by 10.5%, while product, data, and QA roles grew by 36.8%. Business and administrative roles remained stable. This reflects an economy focused on scaling products and operations rather than pure invention.

Israel continues to lead globally in R&D intensity, investing over 5% of GDP in research and development. Startup Nation Central’s Global Employment Indicator recorded 616,000 employees across Israeli-founded companies worldwide in Q3 2025. This steady employment level, even after a period of global correction, demonstrates the ecosystem’s adaptability and expanding global reach.

Read more on historical employment trends in Israel’s Tech Employment Data Signals Economic Strength and Resilience.

Innovation Ecosystem and R&D

Israel’s commitment to research and development continues to define its competitive advantage. R&D spending remains among the highest in the OECD relative to GDP, driven by both public policy and private sector investment. Corporate innovation hubs, university research partnerships, and government-backed programs are accelerating deep-tech fields like AI, semiconductors, and quantum computing.

This R&D intensity not only supports growth in high-value sectors but also fuels continuous knowledge transfer across industries, strengthening Israel’s reputation as a global innovation hub.

Beyond Tech: Other Growth Drivers and Supporting Pillars

Israel’s economy is diverse, supported by strong human capital, global trade connections, and sound policy frameworks that sustain long-term competitiveness.

Human Capital, Education and Talent

Human capital remains the foundation of Israel’s innovation economy. The country’s unique combination of military technology training, top-tier universities, and startup experience has produced a steady flow of skilled professionals. As demand rises for expertise in AI, cybersecurity, and semiconductors, talent development has become a national priority.

Expanding training programs, upskilling mid-career professionals, and increasing participation among underrepresented groups will be key to maintaining Israel’s edge in global innovation.

Exports, Trade and Global Integration

High-tech exports continue to drive economic stability. Even as goods exports declined in 2025, digital services rose sharply, mitigating overall losses. Global M&A activity and cross-border investment are deepening Israel’s integration into international markets. Deals involving companies like Palo Alto Networks, Thoma Bravo, and Advent International highlight how Israel’s innovation is embedded in global value chains.

These transactions strengthen technology transfer, enhance market access, and create durable international partnerships that extend Israel’s economic influence.

For insights into Israel’s global investment appeal, visit Investment in Israel.

Diversification and Non-Tech Sectors

While technology dominates, other sectors are emerging as complementary engines of growth. Industrial technologies are expanding Israel’s footprint in automation and advanced manufacturing. Agri-food, health, and aerospace sectors all recorded significant activity in Q3 2025, adding balance to the broader innovation economy.

These industries extend the benefits of innovation to areas that impact sustainability, food security, and health outcomes, reinforcing Israel’s position as a source of solutions to global challenges.

Policy, Government Support and International Cooperation

Government support remains a strong catalyst for innovation. Policy initiatives encourage R&D investment, promote cross-border partnerships, and fund emerging technologies in AI, semiconductors, and defense. Collaborations with the UAE, India, and Europe are creating new opportunities for co-development and commercialization.

This policy consistency and global cooperation reinforce Israel’s position as a strategic partner for nations and companies seeking cutting-edge technology and innovation capacity.

Structural Factors and Challenges

Even as Israel’s innovation economy thrives, several structural challenges persist. Productivity growth has slowed as the ecosystem adjusts post-crisis. Capital remains concentrated in mature companies, limiting early-stage diversity. Rising labor costs in deep-tech roles and infrastructure bottlenecks in housing and transport are increasing operational pressures.

These are growing pains of a mature economy, and they highlight the need for continued investment in infrastructure, education, and regional inclusion to sustain the next phase of growth.

What the Future Holds and Strategic Implications

As Israel moves into 2026, its economy stands on a strong foundation of innovation, capital efficiency, and global trust. The Q3 2025 data point to an ecosystem entering a new stage of maturity that is more selective, more strategic, and increasingly integrated with global markets.

Opportunities

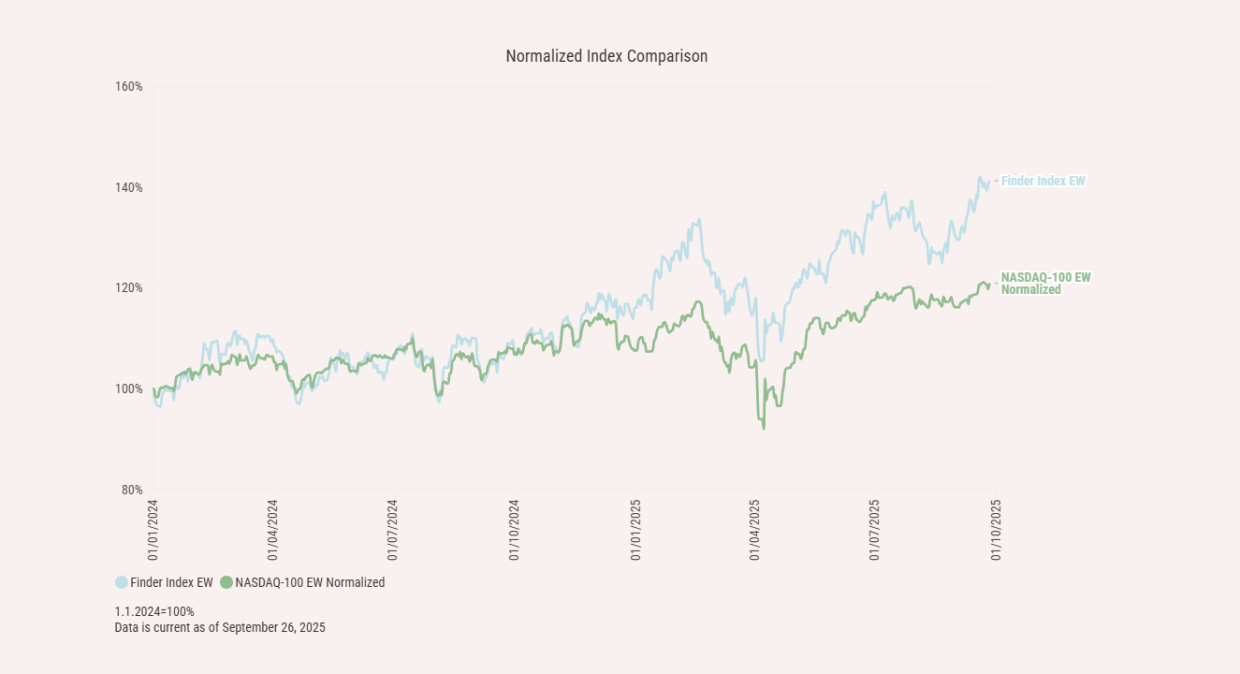

The Finder Index rose nearly 30% in the 12 months ending September 2025, outperforming the NASDAQ-100 Equal Weighted Index, which gained 12%.

This performance indicates strong investor confidence in Israel’s innovation sectors. Key opportunity areas for 2026 include:

- AI and data infrastructure for enterprise transformation.

- Quantum and semiconductor innovation driven by deep R&D.

- Defense and cybersecurity technologies serving global markets.

- Regional partnerships expanding trade and R&D collaboration.

These segments combine strategic and economic value, positioning Israel as a central player in shaping the next wave of technological advancement.

Risks and Constraints

Israel’s growth also faces constraints. Heavy reliance on tech makes the economy sensitive to global capital cycles. The investor base is narrowing, and early-stage funding remains tight. Labor shortages in key roles are raising costs, and export dependency on Western markets creates exposure to external shifts. Diversification and balanced capital distribution will be vital to sustaining long-term stability.

Strategic Recommendations for Stakeholders

Investors: Focus on scale-ready companies with strong fundamentals and clear global strategies.

Government: Continue expanding participation in the innovation economy through education, infrastructure, and inclusion.

Founders: Prioritize disciplined growth, global partnerships, and capital efficiency.

Global partners: Use Finder to connect with Israel’s innovation ecosystem and explore collaboration opportunities in emerging technologies.

Conclusion

Israel’s economy is built on innovation, resilience, and adaptability. The Q3 2025 data confirm the country’s ability to maintain growth even in a complex global environment. High tech remains the anchor, but its influence is spreading across manufacturing, health, food, and defense. Sustaining this momentum will depend on how well Israel continues to connect innovation, inclusion, and global collaboration. With its talent, capital, and policy alignment, Israel’s innovation economy will remain a vital driver of global growth.

Read the full Q3 2025 Israeli Tech Ecosystem Report on Finder to explore detailed data, sector trends, and insights shaping Israel’s innovation economy.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle