Israeli fintech in 2025 is projected to make an impact with renewed momentum and global relevance. Known for its agility and deep tech expertise, the ecosystem is driving real-world solutions across payments, embedded finance, fraud prevention, and AI-powered infrastructure. While global fintech adjusts to new economic realities, Israeli companies are actively reshaping the future of finance.

A Decade of Growth, a Shift in Focus

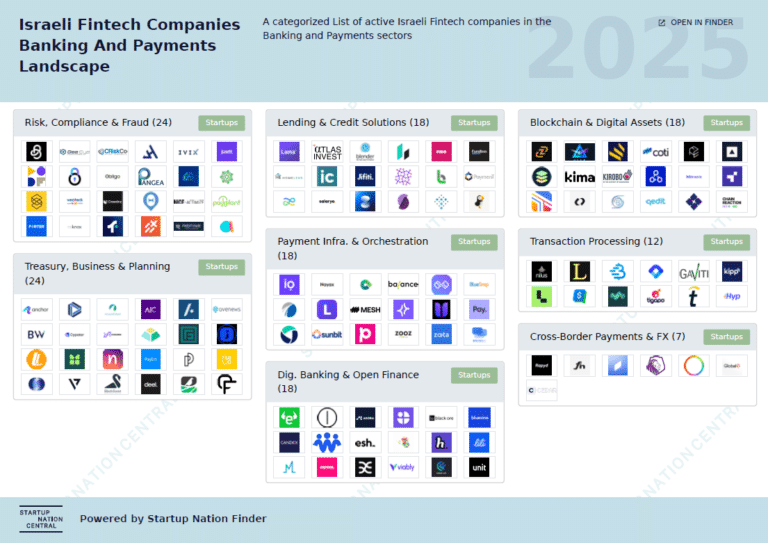

Over the past ten years, Israel’s fintech landscape has evolved dramatically. In 2014, there were just 76 active banking and payment startups. By 2022, that number peaked at 228, before slightly declining to 217 companies in 2024. Despite the dip, this trajectory shows long-term resilience and continued relevance.

Nearly 70% of these companies are still in early stages, indicating a robust pipeline of innovation. Around 72% operate with fewer than 50 employees, highlighting the sector’s startup-driven nature. Yet, a handful of breakout successes, like Payoneer, Melio, and Rapyd, demonstrate Israel’s ability to scale globally.

From Payments to Platforms

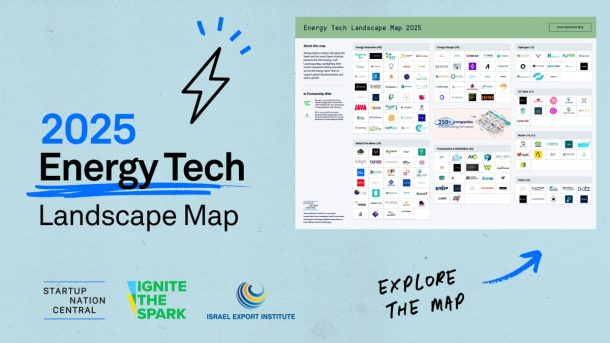

Israel’s fintech strength historically began in core payment infrastructure and orchestration. But the industry is rapidly expanding beyond simple transaction tools.

- Payment orchestration platforms like BridgerPay and Melio are enhancing transaction success rates by automating routing and compliance.

- Transaction processors such as Tipalti and Nilus are enabling real-time approvals, fraud prevention, and global scalability.

- AI-driven risk and fraud platforms like Forter are helping global merchants and banks respond to increasingly complex threats.

The ecosystem is also leaning into open banking, lending, and digital finance infrastructure, with standout players including ONE ZERO Digital Bank, Lama AI, and FundBox.

AI is Redefining Financial Services

Artificial intelligence is fortifying financial infrastructure, with Israeli fintech companies are embedding AI across the value chain:

- Fraud prevention and risk analysis are now predictive, not just reactive.

- Credit scoring is evolving beyond traditional models, using alternative data sources to unlock lending for underbanked populations.

- Corporate finance platforms are leveraging AI for cash flow forecasting, scenario planning, and real-time liquidity management.

As MongoDB’s Luis Pazmino Diaz notes, “AI is streamlining compliance, enhancing security, and delivering personalized financial experiences.” This shift requires strong data infrastructure, an area where Israeli startups are building flexible, scalable API-based solutions designed to integrate with legacy systems worldwide.

Global Reach, Local Adoption Gap

Israeli fintech companies are already serving billions globally. From Payoneer’s cross-border solutions to Rapyd’s embedded finance APIs, Israel is powering the backend of global financial operations.

Yet locally, adoption remains surprisingly low. Shmuel Ben-Tovim of The Israel Fintech Center calls this “a striking gap,” attributing it to regulatory friction and market conservatism. As open banking regulation progresses in Israel, fintech in 2025 could unlock opportunities for homegrown innovation to scale locally as well as globally.

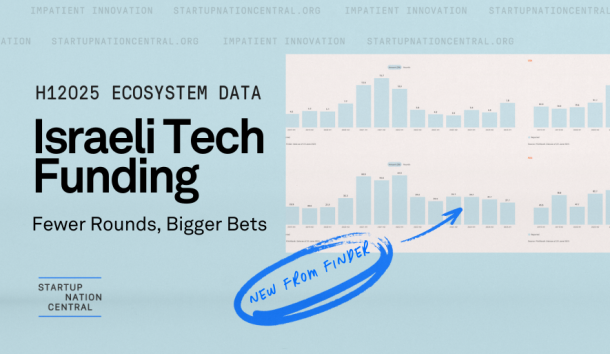

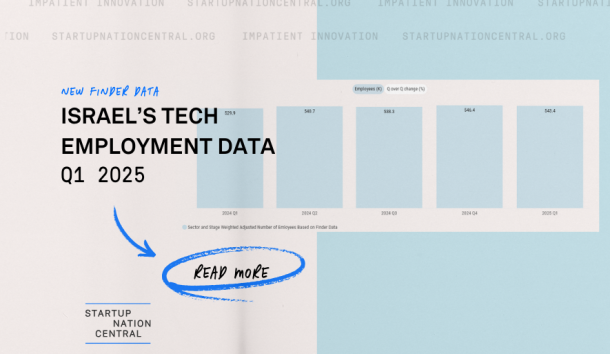

Capital Trends: Realignment and Resilience

Following a post-2021 correction, fintech investment globally slowed, but Israel has weathered the downturn with characteristic adaptability. In the six months after October 7th, 2023, Israeli tech firms raised $3.1B across 220 private rounds, with fintech among the top three sectors for capital raised.

Cross-border payments, though home to just 12 companies, attracted $1.5B in funding, surpassing many larger subsectors. This focus on efficiency and scalability mirrors a global shift: away from blitz-scaling and towards sustainable, infrastructure-first innovation.

What Makes Israel’s Fintech Ecosystem Unique?

1. Second-generation founders

A new wave of fintech startups is emerging, led by veterans of successful exits or scaleups. These founders bring deep domain knowledge, international networks, and operational discipline.

2. Cybersecurity DNA

Thanks to military-grade experience, Israeli fintech integrates security at the core, which is crucial as financial threats grow more sophisticated.

3. Tech-agnostic regulation

While challenges persist, regulators are increasingly open to innovation-first approaches, especially in open finance and digital banking.

4. Connected ecosystem

From 435 MNC innovation centers to over 250 active investors and 75+ accelerators and hubs, Israeli startups have access to everything needed to test, validate, and scale quickly.

Fintech in 2025 and Beyond

As embedded finance, AI, and real-time payments become global standards, Israel’s fintech ecosystem is well positioned to lead:

- From niche tools to financial platforms

Startups are transitioning from narrow services to comprehensive, interoperable financial ecosystems. - International-first, local-ready

With product-market fit abroad and regulatory shifts at home, Israeli fintech is poised to scale in both directions. - Strategic M&A and local consolidation

Large-scale players like Rapyd and Payoneer are becoming acquirers and channel partners, giving early-stage startups a growth path that doesn’t rely solely on overseas expansion.

Israel is Building the Future of Finance

In a world where financial systems are increasingly digital, AI-powered, and decentralized, Israel offers a blueprint. Israeli fintech is no longer just a startup scene; it’s a strategic asset in the global financial architecture.

Want to explore Israel’s fintech ecosystem?

Get access to real-time data and company insights through Startup Nation Finder and connect with the innovators building the future of finance.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle