After a year and a half of war, Israel now faces an eighth strategic front.

In recent days, Israel carried out a preemptive strike on Iran to halt the advance of its nuclear ambitions. This was powered by proven, operational defense technologies developed through decades of urgency and necessity.

The response began with a precision military operation that felt pulled from an intelligence thriller. It brought together advanced capabilities from the Israeli Air Force, Mossad, and deep-tech solutions developed across Israel’s ecosystem. It was fast, focused, and deliberate.

This is Impatient Innovation in action.

Israeli Defense Innovation in Action

Iran launched a barrage of missiles designed to overwhelm Israeli defenses. The majority were intercepted by a layered air defense network that represents one of the most sophisticated systems of its kind.

Israel’s three-tier air defense system combines speed, flexibility, and resilience:

- Iron Dome is the frontline defense against short-range rockets and mortars. It uses radar-guided interceptors to stop threats aimed at populated areas, with a success rate consistently above 85%.

- David’s Sling fills the middle layer. It counters cruise missiles and medium-range ballistic threats that fall outside Iron Dome’s range. Developed with the United States, it achieved its first live interception in May 2023.

- Arrow 3 protects against long-range ballistic missiles, including those with the potential for nuclear payloads. Operating outside Earth’s atmosphere, Arrow 3 is a deterrent backed by international demand and strategic alliances.

Together, these systems form a defense stack built on real-world need, technical expertise, and years of rapid iteration under pressure.

Even with this level of capability, some attacks made it through. Missiles struck civilian areas, damaging infrastructure and disrupting daily life. People were killed and injured. Homes were destroyed. Emergency systems operated beyond capacity. Communities are grieving and rebuilding while the threat continues.

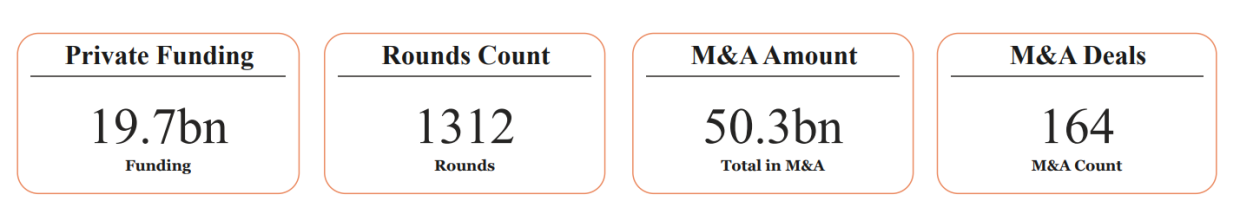

Still, the broader picture is clear. Israeli tech companies raised over $12 billion in 2024, a 27% year-over-year increase, with 15 mega-rounds totaling $4 billion, or 41% of total funding, compared to 9 rounds and $2 billion (22%) in 2023.

In Q1 2025 alone, Israel attracted $3.2 billion in private tech funding, up 12% from the previous quarter. 81% of rounds involved global investors, demonstrating confidence in Israel’s innovation, even during sustained conflict. Much of this momentum is concentrated in sectors directly tied to defense and resilience. $35.7 billion in M&A activity, led by Google’s $32 billion acquisition of Wiz, signals international demand for solutions forged under fire.

TOTAL FUNDING FROM OCTOBER 2023-JUNE 2025

Security Context

This conflict is playing out across air, cyber, and physical domains. The battlefield is complex and fast-moving. Israel’s innovation ecosystem is built to respond not in months, but in days. It is structured for execution under pressure.

Traditional preparedness is not enough. The ability to adapt, update, and deploy technology quickly is essential. Israeli defense tech thrives in this exact scenario. Urgency fuels development. Complexity sharpens focus.

Israel’s strategy integrates real-time intelligence, surveillance powered by AI, and adaptive operational platforms. Secure communications support rapid coordination. Engineers adjust on the move. Systems evolve mid-conflict.

Strategic Response

This speed and depth reflect the strength of the country’s innovation infrastructure. Today, over 312 companies are active in aerospace, defense, and homeland security. Many emerged from earlier conflicts. Others grew from military intelligence units or dual-use research programs. All operate with mission focus.

Technology in Defense

Israel’s defense sector spans multiple fields:

- Air Defense Systems: Iron Dome, David’s Sling, and Arrow 3 cover short, medium, and long-range threats. These systems provide real-time protection and are built for operational agility.

- Unmanned Systems: Autonomous and remote-controlled platforms powered by AI and advanced sensors.

- C4I and Defense Electronics: Integrated systems for command, control, communication, and battlefield visibility.

- Aircraft and Avionics: Enhanced performance, sensor integration, and aerial coordination.

- Security and Surveillance Integration: Smart platforms that combine data for rapid response.

- Simulations and Training: Tools that enhance decision-making and combat readiness in real-world scenarios.

About 42% of these companies are early-stage, continually feeding the sector with new ideas. Many develop dual-use technologies that support both military and civilian needs from smart city security to critical infrastructure protection.

Cybersecurity, a vital layer of national defense, led all sectors with $3.8 billion in funding in 2024. This shows how blurred the line between digital and physical defense has become, and how investors are backing technologies that can secure both.

Israel is also developing the next frontier: Iron Beam, a high-energy laser system designed to intercept short-range threats like drones and mortars at the speed of light. It offers low cost per use, no debris, and rapid engagement. While still in development, it is expected to complement existing systems and redefine interception standards.

In 2024, defense exports reached $14.8 billion, with over half going to Europe. Industry leaders like IAI, Rafael, and Elbit are recognized globally. But the future of defense tech depends on deeper integration: between legacy primes, bold startups, state-backed partners like MAFAT and the Israel Innovation Authority, and a financial infrastructure increasingly backed by foreign capital.

Global Scalability

Defense tech can become the next cyber for Israel: a strategic engine that drives exports, attracts global investment, and strengthens the economy.

The ecosystem is already active:

- Talent trained in elite military units

- Dual-use tech proven in live operations

- 300+ startups in AI, aerospace, and advanced manufacturing

- Public backing from Directorate of Defense Research & Development (MAFAT) and the Israel Innovation Authority (IAI)

- Growing interest from global VCs and defense investors

Startups are flying missions, securing networks, and analyzing data in real time. But without a national push, progress risks fragmentation. Furthermore, global capital is watching. Andreessen Horowitz has launched a $600 million defense fund and Sequoia is still betting on Israel, acquisitions are accelerating, and growth stage companies are gaining traction.

Human Impact

Innovation operates within the reality of human cost. Technology alone does not erase what happens on the ground: people have been killed and injured, families have been displaced, and emergency infrastructure has been stretched to its limits.

This is where innovation is stress-tested. These are the moments that separate ideas from impact. Israeli defense companies are focused on speed, clarity, and outcome – namely delivering protection.

A Broader Innovation Pattern

Periods of crisis have consistently led to new growth across Israel’s tech ecosystem. After conflict comes recalibration:

- Startups emerge with sharper missions.

- Investment shifts toward high-impact solutions.

- Product cycles compress.

- Dual-use applications find new relevance.

That pattern is visible again. Defense innovation is creating ripple effects across AI, sensing, edge computing, and cybersecurity. Investors are tracking technologies that are tested, deployed, and market-ready:

Mellanox, now NVIDIA’s networking division, is a case in point. The Israeli team leads the development of Spectrum-X and NVLink systems powering global AI infrastructure, including NVIDIA’s Israel-1 and Elon Musk’s Colossus at xAI. Revenue from the division reached $5 billion last quarter.

Apple is also doubling down. The company recently expanded its presence in Jerusalem, recruiting directly from Hebrew University’s elite tech programs. Its Israeli engineers are responsible for key components across chipsets, memory, and vision systems.

Still Delivering, No Matter What

Israel’s national resilience is matched by its innovation output. The result is a defense tech ecosystem that performs in real time, scales globally, and creates value beyond the battlefield. Every layer, from Iron Dome to Arrow 3, is the product of necessity, execution, and precision.

Our thoughts are always with the soldiers serving across multiple fronts and the hostages who have not yet come home.

This is where resilience becomes infrastructure.

This is where innovation performs, no matter what.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle