FINDER SPOTLIGHT: Six Months of Israeli Innovation in War

Tech Innovation

Since October 7, the current conflict has posed significant challenges to the Israeli tech economy, particularly its tech sector, a vital component of the nation’s economic fabric.

Despite these hurdles, recent findings reveal a picture of resilience and continued growth within the tech sector.

The Israeli Tech Economy Since October 7

The high-tech sector fuels 14% of Israel’s GDP, contributes 30% to tax revenues, and constitutes 48% of exports. Plus, with the active presence of 450 world-leading multinationals, Israel’s impatient innovators are a main vector of the nation’s economy.

Following October 7th, the Israeli tech sector faced immediate challenges, including a reduction in workforce availability due to approximately 15% of the workforce being drafted into the war. Short-term funding gaps emerged, particularly affecting smaller startups with limited financial runways.

Despite these obstacles, the sector has demonstrated remarkable resilience, continuing to attract significant investor interest and venture capital activity. Here is how things have been in the first six months of the war…

Private Investment Rounds

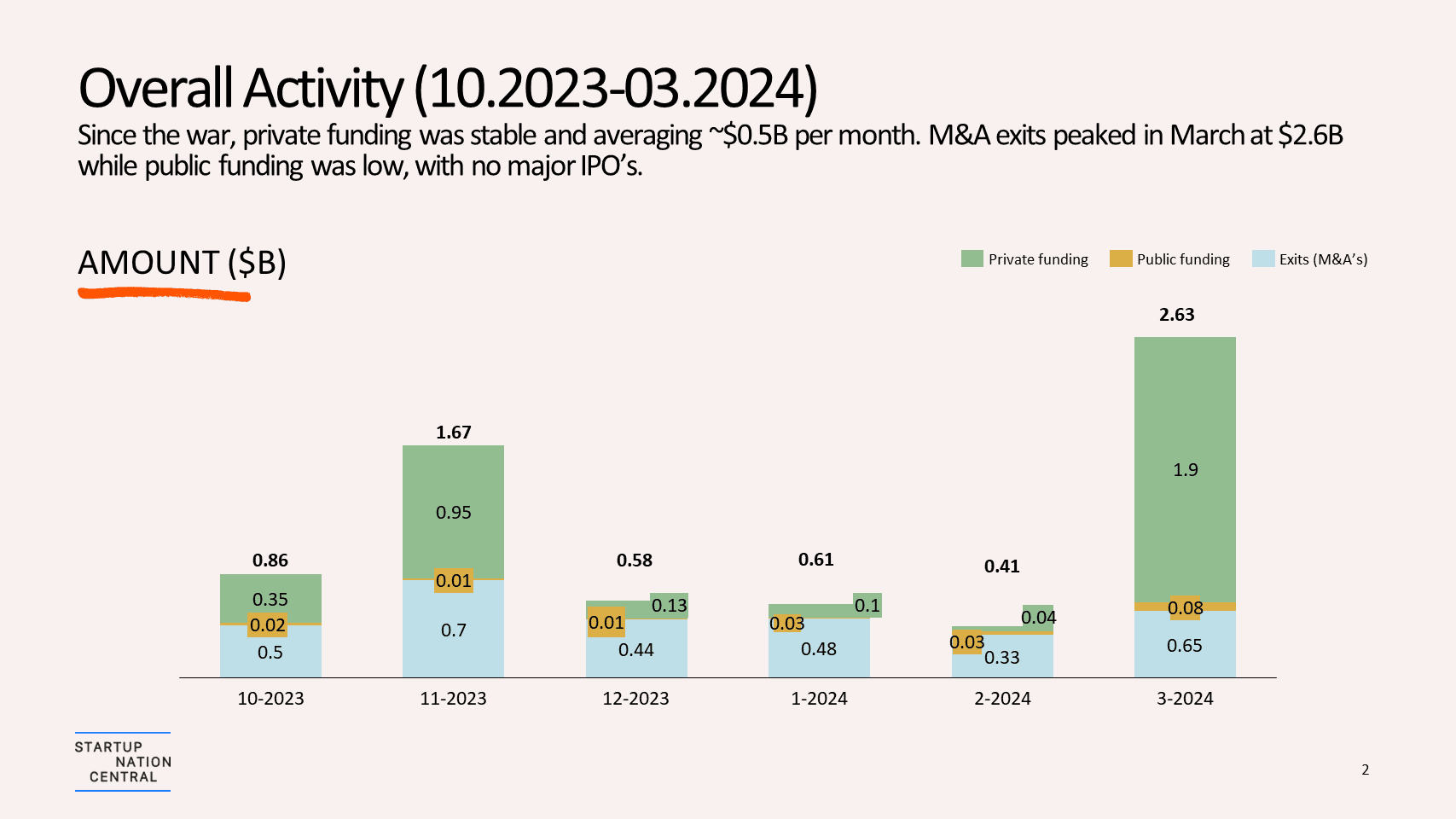

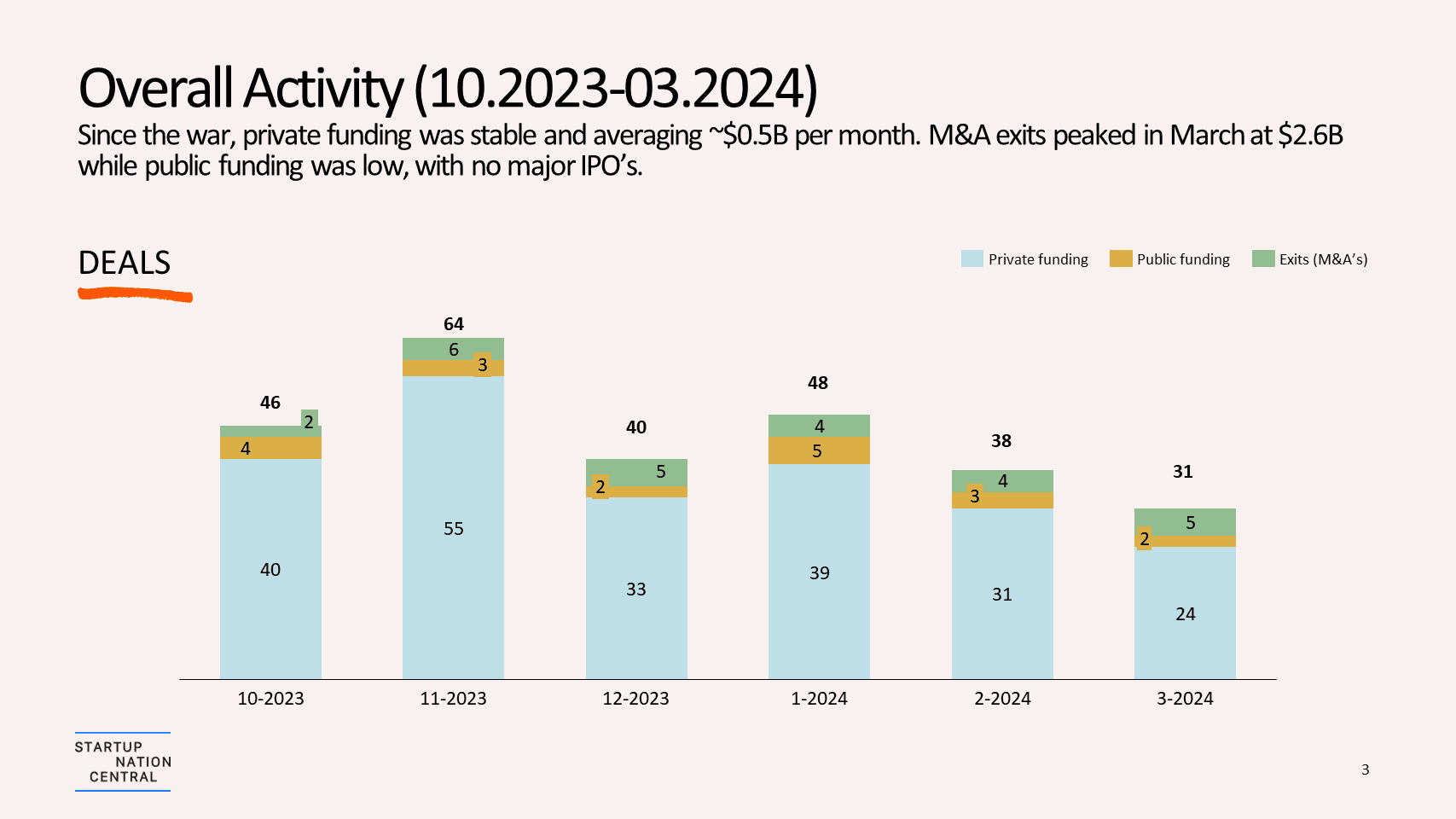

Since October 7th, the Israeli tech ecosystem has seen 220 private investment rounds, with an estimated $3.1 billion raised.

The average investment amount during this period was $19 million. A standout investment was the $265 million raised by Next Insurance, backed by two foreign venture capital firms. Regarding sector activity, health tech led with 47 rounds, followed by enterprise software solutions at 42 deals, and security technologies at 39.

Security technology emerged as the leading sector in funds raised, securing nearly $1.1 billion, while fintech and enterprise software solutions each raised almost $0.5 billion.

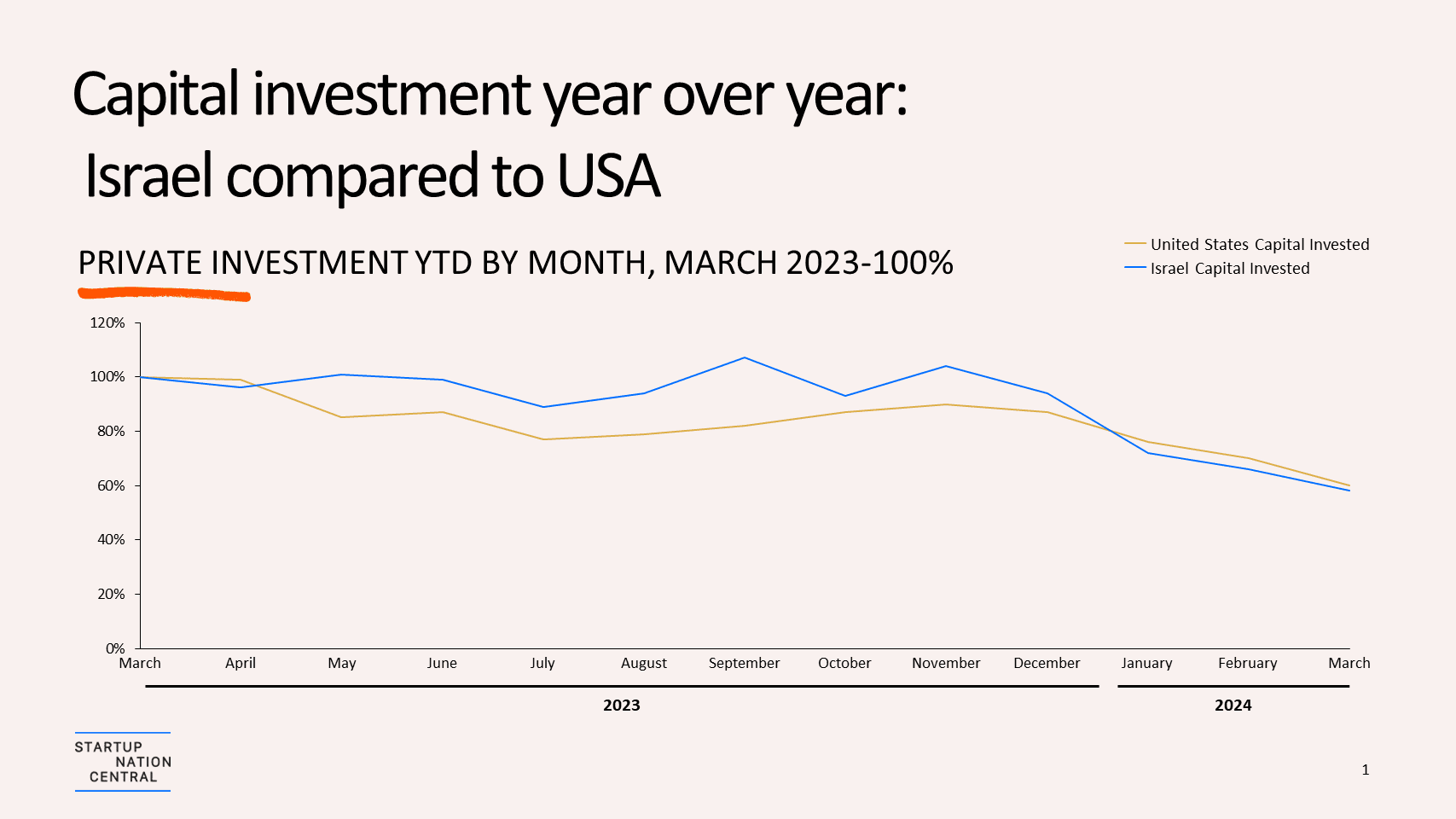

This investment trend in Israel mirrors the downward trend observed in the US, indicating a global adjustment in tech sector investments.

Mergers and Acquisitions (M&As)

The sum of M&A transactions since October 7th reached $3.7 billion.

Two significant M&A deals were finalized, with total acquisition amounts nearing $1 billion. Additionally, nine acquisition deals exceeding $100 million were completed, six of which were in the security technology sector.

These include acquiring Talon Cyber Security for $625 million, Dig Security, Avalor, and Gem each for $350 million, and Flow Security and Spera Security for $200 million and $130 million, respectively.

Health tech also saw significant activity, with CartiHeal being acquired for $330 million, contributing to a total M&A value of $425 million in the sector. Enterprise Software Solutions M&As accounted for $240 million.

New Funds Established

In response to the war’s impact and to bolster confidence in the Israeli tech ecosystem, over 20 new funds were established, raising $1.7 billion.

Eleven funds were created to address the urgent funding needs of startups affected by the conflict. Notable new funds include Iron Nation; 1948 Ventures; OurCrowd – Israel Resilience Fund; SYN Ventures – Cybersecurity Seed; Trendlines – Startup Shield SPV; TechShield; and the Google Support Fund.

Looking Forward: Is Israel Keeping Up?

Since October 7, the Israeli economy has responded to the challenges posed by the conflict with Hamas. This is a testament to its inherent resilience and global confidence in its continued growth and innovation.

Despite immediate setbacks, the sector has shown signs of robust activity in private investment rounds, M&A deals, and the establishment of new funds supporting startups during these turbulent times.

Compared to global trends, especially in the US, Israel’s tech investment landscape shows similar growth and contraction, demonstrating resilience and dynamism. This parallel reinforces Israel’s strong position in the global tech scene, even during geopolitical tensions.

The Israeli economy’s resilience since October 7 is more than a survival mechanism; it’s a vibrant and dynamic force that continues to drive Israel’s economic success and global tech leadership.

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle Our Story

Our Story Management Team

Management Team Careers

Careers