Israel’s mental health tech sector is fundamentally redefining what investable mental health innovation looks like. In 2025, the sector raised $352 million, a 150% increase from the previous year, with three of Israel’s five largest health tech funding rounds going to mental health companies. But the real story isn’t the capital. It’s what that capital is funding: clinically validated, system-integrated solutions built under the most demanding real-world conditions imaginable.

The aftermath of the October 7 attacks created a space in Israel’s tech scene for a whole new concept known as “traumatech.” While people in Israel still heal from the collective traumas, a quiet transformation has taken place within one of its most human-centred sectors – the mental health technology.

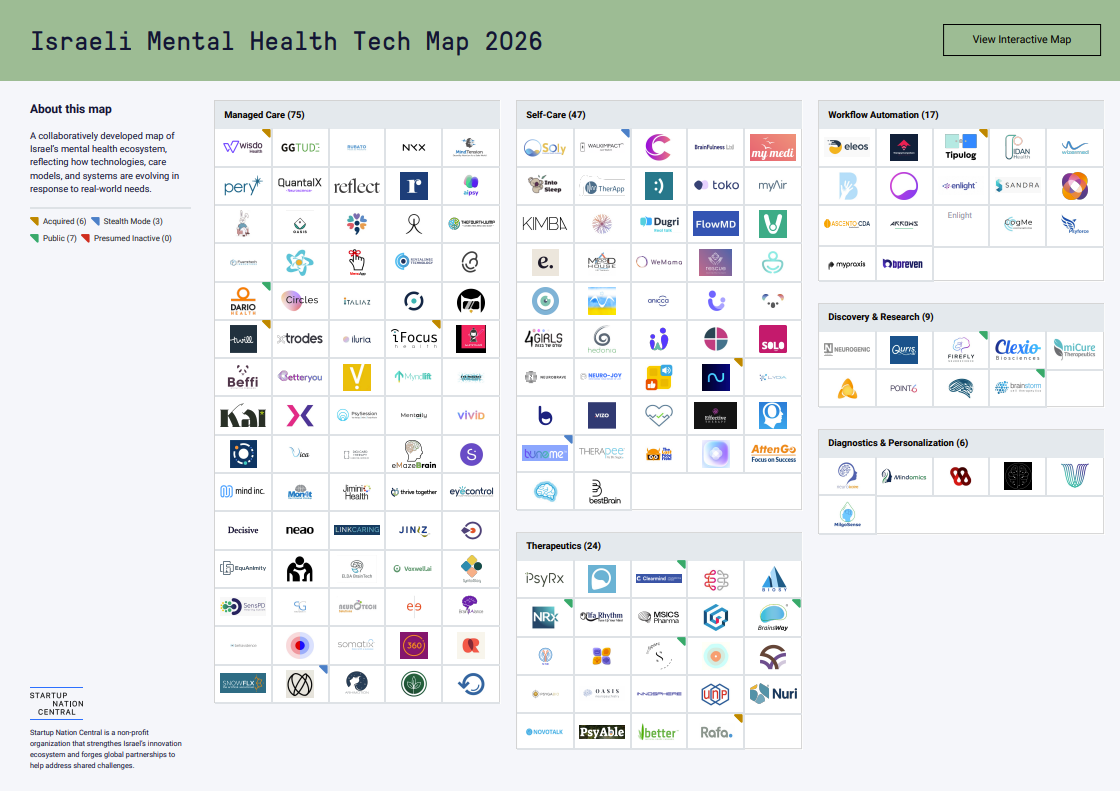

A total of 178 companies were active this year in Israel’s mental health technology sector, as shown by our map, which is a 150% surge compared to previous years. These numbers show that Israel is focused on developing a strong mental health technology ecosystem to support trauma recovery and expand mental health care for everyone.

Why Israel’s Mental Health Tech Scene Matters for Investors?

Three factors make Israel’s mental health tech sector uniquely positioned for investor returns:

- Clinical Validation at Speed: Where most mental health startups spend years proving efficacy, Israeli companies are validating in months through partnerships with military mental health units, national healthcare systems, and academic institutions operating under crisis conditions. This compressed timeline to proof-of-concept reduces investor risk substantially.

- Built for Institutional Buyers: Unlike consumer wellness apps that struggle with retention and monetization, Israeli mental health tech is designed from day one for B2B and B2G contracts with employers, insurers, hospitals, and governments. These are larger deals, longer contracts, and more predictable revenue than consumer subscriptions.

- Global Tailwinds: The problems Israel is solving, mass trauma, workforce burnout, and overwhelmed healthcare systems, aren’t regional. They’re universal. Every developed market faces some version of these pressures, meaning solutions validated in Israel’s complex environment are immediately relevant to international buyers willing to pay premium prices for proven technology.

The 150% Surge: What the Numbers Actually Signal

According to the numbers, Israeli mental health technology defied expectations in 2025. Total investment reached $352 million, representing a 150% increase from the $138 million raised in 2024. This figure is striking, but the underlying dynamics are even more revealing.

Rather than a huge deal volume, the market saw capital concentration. Fewer rounds were closed, yet average deal sizes increased, showing that investors are backing solutions with clinical validation, scalable business models, and system-level relevance.

The sector’s growth within Israel’s broader tech scene is also notable. Three of the five largest health tech funding rounds in 2025 were in mental health, showing that it’s a central focus, not a preference.

Perhaps most compelling is what lies ahead. Of the 178 active mental health startups currently operating in Israel, 80% remain at early stages of development. This signals not fragility, but depth: a robust innovation pipeline positioned for growth as regulatory clarity, reimbursement pathways, and global demand align.

Traumatech as a Structural Shift

The concept of traumatech arose from local necessity rather than market demand. Israel’s citizens faced trauma at population scale, from civilians and families to reservists and medical professionals. The standard care became insufficient, creating a demand for technologies to function under urgency and uncertainty.

As a result, mental health innovation in Israel moved rapidly from adjacent to healthcare systems to embedded within them.

Israel’s Tech Scene: From Wellbeing to Clinical Infrastructure

The 2026 Mental Health Tech Landscape Map captures a clear evolution in how mental health innovation is implemented.

The most notable change is the Managed Care, now the largest segment on the map with 75 companies. These startups are built to integrate directly into healthcare systems, insurers, employers, and public institutions. Their value lies in outcomes, care continuity, and operational scalability.

This system is focused on these three complementary stages:

- Discovery and Research: Understanding the trauma, stress, and neurological response

- Diagnostics and Personalization: Powered by AI and data analytics to deliver early detection and precision care

- Therapeutics: Including digital therapeutics (DTx) and hybrid clinical solutions validated for real-world use

This way, Israeli companies address national trauma with clinically credible solutions.

Innovation Categories

The sector is organized around four main areas:

- Managed Care: Platforms connecting patients with therapists through hybrid digital solutions

- Self-Care: Digital tools for proactive mental health management, including AI-powered platforms like Kai.ai, which uses cognitive behavioral therapy principles

- Workflow Automation: AI solutions reducing administrative burdens for clinicians

- Mental Health Research: Early diagnosis tools and personalized treatment approaches

The Concept of Impatient Innovation

“Following the war, Israel has become an unprecedented real-world environment for mental health innovation, with a rapidly growing need for solutions that deliver fast, precise, and scalable care,” says Adi Ostry Matalon, Mental Health Tech Ecosystem Leader & Investor.

The 7 October created conditions of acute national need, rapid regulatory flexibility, and immediate collaboration across sectors. Military mental health units, academic researchers, hospitals, startups, and policymakers began working in parallel, compressing what would normally be a decade of tech ecosystem alignment into months.

This phenomenon has been described as “impatient innovation”: a refusal to wait for ideal conditions, driven by the urgency of human need.

Still, these tools and approaches apply worldwide, not only to Israeli users. They’re built with global scalability in mind, addressing post-conflict recovery, mass trauma, workforce burnout, and overstretched healthcare systems.

Is 2026 the Year Mental Health Becomes a Critical Business Asset?

By 2026, mental health support won’t be a soft benefit, but fully integrated into companies’ core. Israel’s mental health tech ecosystem reflects this shift. Many startups no longer sell to individuals, but to employers, insurers, and public institutions, positioning mental health as a form of organizational resilience.

For investors, this reframes the category entirely. Mental health is not a discretionary expense—it is becoming a strategic business asset, embedded into how organizations sustain performance under pressure.

How Does Data Transform Trauma into Measurable Recovery?

Another shift is moving from subjective experience to measurable recovery pathways. Trauma is difficult to quantify, as it depends on clinical observation and self-awareness. Israeli startups apply AI and behavioral analytics to collect data, ensuring early intervention, personal treatment plans, and continuous monitoring.

In the context of mass trauma, as October 7 is, this approach is transformative. Companies can allocate resources and scale as needed, switching from emotional overwhelm to resolving system problems.

From Local Crisis to Global Export: Can Israel’s Blueprint Scale Internationally?

Israel’s mental health innovation surge was catalyzed by a local crisis, but its relevance is global. Societies around the world face pressures: geopolitical instability, economic uncertainty, workforce exhaustion, and strained healthcare systems. The conditions that forced Israel to innovate quickly are not unique – they are simply more compressed.

Unlike Silicon Valley’s consumer-focused mental health apps or Europe’s regulatory-first approach to digital therapeutics, Israel’s mental health tech ecosystem emerged from clinical necessity rather than market opportunity. Where Western startups often optimize for user engagement metrics, Israeli companies build for institutional integration and measurable clinical outcomes, a distinction that positions them for B2B and government contracts rather than direct-to-consumer competition.

What makes Israel’s blueprint exportable is not the trauma itself, but the infrastructure built in response to it. Solutions designed for national-scale deployment, regulatory complexity, and institutional integration fit every international market. The question is no longer whether this model can scale internationally. It is how quickly global systems are ready to adopt it.

The Path Forward: From Innovation to Scale

The question is not whether a world-class mental health technology is built, but how to scale it both inside Israel and worldwide. The Israeli Ministry of Health established a Digital Therapeutics framework, creating structured pathways for validation, adoption, and reimbursement.

For global investors, healthcare providers, and insurers, this opportunity is difficult to ignore. Israel is developing exportable mental health infrastructure under complex conditions in a modern society. These technologies shape how mental health care is delivered, measured, and financed in the years ahead.

Explore Israel’s Mental Health Tech Landscape Map to see how these companies are structured across care, diagnostics, and therapeutics

Tech Ecosystem

Tech Ecosystem Human Capital

Human Capital Focus Sector

Focus Sector The Health Network

The Health Network

Business Opportunities

Business Opportunities Investment in Israel

Investment in Israel Innovation Diplomacy

Innovation Diplomacy Leadership Circle

Leadership Circle